The Federal Reserve as of August 2023 was no longer predicting Recession: To quote Investor Jeremy Grantham “the Federal Reserve record on predicting recessionary cycles is guaranteed to be wrong!

So why don’t we support the soft-landing scenario…

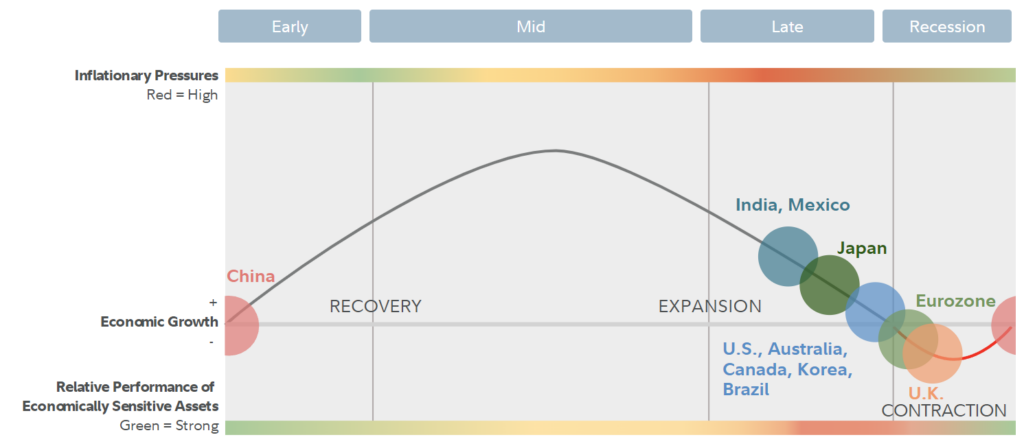

- Vica forecasts that the US will have a Recession, starting as early as Q4 ’23 and deep into ’24: the combination to date of Fed tightening, surging oil prices, stock market overvaluations and a strong dollar will shortly give us our bottom.

- Market bottoms are made on bad news and with deflationary signals: economic reports are mixed and arguably too much focus placed on product prices and weekly jobs. Our biggest concerns are rising interest rates and the depressing slow-moving effect it has on the Real Estate market and revolving consumer debt.

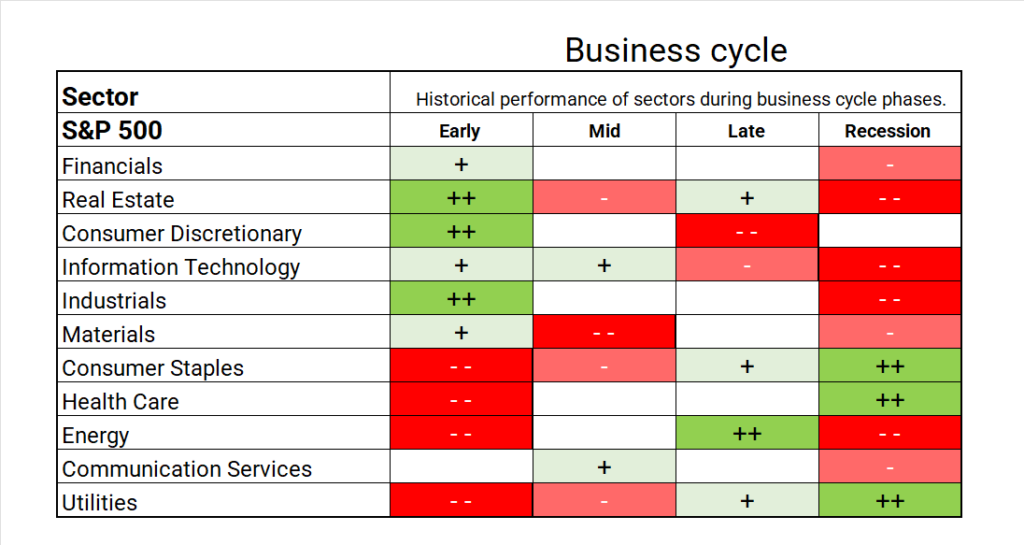

- Current S&P 500 Sector Metrics support contraction: strong trends in the Energy sector indicate a Late Business cycle followed by defensives Health Care and Utilities that will shortly take the lead (see chart below).

- Look for a correction in excessive market asset valuations: the current shift Growth to Value stocks and Information Technology sector pullback is underway.

Pundits can all agree that the Fed has never called any recession in-kind.

Realignment is needed …

- The Federal Reserve has limited power in controlling inflation: old school economic principles are ineffective in a highly automated and expanding global economy. By simply raising rates to counter jobs (1.6 jobs available for every job seeker) will NOT moderate on demands.

- A 2% inflation target is not realistic today: perhaps a >3% base rate could help fund a) appropriated wages for skilled workers and training b) an executable and efficient energy transition c) improving operational efficiencies across the economy d) and most importantly protection from deflation!