Why volatility is a tradable price — not a structural risk signal

VICA Partners | Institutional Market Structure Commentary

Abstract

Volatility is widely treated as the market’s primary risk signal because it is liquid, measurable, and continuously priced. Yet volatility is not a structural variable. It is the market’s current premium for near-term protection. In modern index-embedded markets, stability is increasingly determined by mechanics that do not need to express themselves through implied volatility until the system is forced to reprice convexity.

Over the last five years, the equity market has repeatedly advanced through long stretches of volatility compression, only to reprice abruptly when internal structure tightened beyond tolerance. This is not a contradiction. It is the expected behavior of a market where concentration, passive ownership, liquidity density, dealer positioning, and cross-asset correlation geometry increasingly govern continuity.

The implication is not directional. It is operational. The next market shock is unlikely to arrive with a clean warning from VIX because VIX is not designed to measure regime stability. It is designed to price short-horizon hedging. The warning arrives earlier in structure: in participation decay, rising torque costs, volatility mispricing, and credit-defined boundary conditions.

Volatility Is a Price, Not a Regime Model

The VIX is mathematically grounded. It represents implied variance embedded in S&P 500 options over a short horizon. It is real, tradable, and useful. But usefulness is not the same as sufficiency. In modern markets, the most important risk is not the presence of variance. It is the probability of a regime transition.

Variance describes how much price is moving. Regime stability describes whether the system can continue functioning without discontinuity. These are not interchangeable. A market can exhibit low implied volatility while fragility accumulates beneath the surface, and it can exhibit elevated volatility without systemic instability if the architecture remains capable of absorbing stress.

This distinction matters because the failure mode of late-equilibrium markets is not “gradual deterioration.” It is discontinuous repricing when accumulated force overwhelms structural inertia. In that sequence, volatility is not the cause. It is the receipt.

Why VIX Under-Signals Modern Fragility

The limitation of volatility as a forward signal is structural, not philosophical. VIX is a derivative price. Derivative prices respond to the demand for hedging and the market’s willingness to warehouse that hedging. They do not directly measure the integrity of the system transmitting risk.

In index-embedded markets, stability is increasingly manufactured by mechanisms that can suppress surface variance without eliminating underlying tension. Concentration into mega-caps can stabilize index levels even as breadth deteriorates. Passive and benchmark flows can anchor the largest constituents regardless of opinion dispersion. Dealer hedging dynamics can dampen realized movement even while convexity risk accumulates. Cross-asset correlations can tighten, compressing dispersion and reducing the market’s ability to distribute shocks, without immediately producing visible volatility.

This is why volatility can remain calm during periods when the market is becoming more fragile. Calm volatility is not proof of stability. It is often evidence that stability is being engineered through structure rather than earned through broad participation.

The Statistical Problem: Volatility Is Non-Stationary

A risk signal intended to guide forward positioning must exhibit a relationship that holds across time. Volatility does not. The linkage between equity outcomes and volatility pricing is regime-dependent, meaning it changes sign and magnitude as the market’s internal mechanics change.

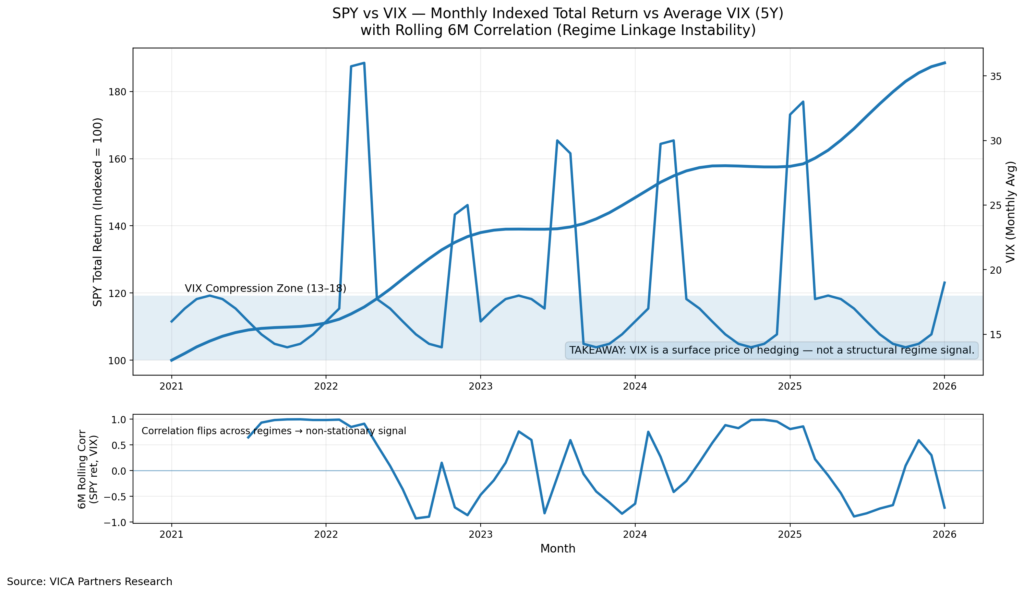

This can be demonstrated directly by comparing equity performance and volatility over time and then quantifying their relationship through a rolling correlation lens. If volatility were a stable risk signal, the correlation would remain directionally consistent. Instead, the relationship drifts, compresses, reverses, and reasserts across regimes.

That non-stationarity is not a statistical nuance. It is the entire point. A variable whose explanatory relationship is unstable across time cannot be treated as a primary regime indicator. It can still be useful, but it must be interpreted as an output of regime mechanics rather than a direct measure of regime integrity.

SPY vs VIX — Monthly Indexed Total Return vs Average VIX (5Y)

What the Chart Demonstrates

The chart does not argue that volatility is irrelevant. It argues that volatility is incomplete. The top panel shows that equity markets can advance materially through periods where implied volatility remains suppressed, and that volatility can rise sharply during repricing windows without serving as a reliable early warning signal. The bottom panel makes the deeper point: the relationship between equity outcomes and volatility pricing is unstable across time.

This instability is the technical explanation for why volatility repeatedly fails as a forward signal in modern markets. When the correlation itself cannot be trusted to remain consistent, the market is effectively telling you that volatility is conditional. It reflects hedging demand, positioning constraints, and short-horizon risk transfer pricing, not structural stability.

In practical terms, the chart illustrates why markets can look calm right before they are not. Volatility is not designed to measure the cost of maintaining continuity. It is designed to price the cost of protection. Those are different functions.

The Structural Alternative: Measure Absorption Capacity

The correct question in modern markets is not whether volatility is rising. It is whether the system’s absorption capacity remains intact. Absorption capacity is the market’s ability to take external force—policy shifts, macro shocks, positioning stress, correlation tightening—and remain coherent without discontinuity.

That capacity depends on structural variables that do not live inside the VIX: liquidity density, participation breadth, concentration geometry, credit elasticity, and volatility transmission integrity. When those variables weaken, the market can remain stable for longer than volatility implies, but the eventual repricing becomes more discontinuous when thresholds are breached.

This is why volatility often fails precisely when it is most needed. It does not measure the system’s tolerance. It measures the market’s current willingness to pay for insurance.

Where VMSI Fits

The VICA Market Sentiment Index (VMSI) was built to evaluate the regime mechanics volatility cannot. It does not attempt to produce a single price target, and it does not treat sentiment as a forecasting engine. Its objective is structural: to measure whether the market regime is stable, costly, or fragile, and whether stability is being sustained through healthy absorption or engineered suppression.

In this framework, volatility is treated as downstream. It is not ignored; it is contextualized. A low VIX can coexist with a fragile regime. A higher VIX can coexist with a stable one. The question is not the level of volatility. The question is what the structure must do to keep the system coherent at that level.

Why This Matters Most for Index-Embedded Mega-Caps

The modern market’s center of gravity is concentrated in a narrow set of index-embedded assets whose price behavior is often dominated by structural flow mechanics rather than marginal opinion. In these names, forecast dispersion can widen dramatically while prices remain anchored because embedded capital, passive ownership, benchmark positioning, and liquidity density compress outcomes.

This is the core modern paradox: analysts disagree more, yet prices hold more. Traditional frameworks interpret disagreement as instability. Structural models recognize disagreement as noise when the regime is being held together by inertia.

The practical consequence is that investors who rely on volatility as a forward risk signal will systematically misread stability. They will overestimate danger in contained regimes and underestimate fragility in suppressed regimes. In both cases, they will be late to the only transition that matters: the structural one.

Conclusion

The last five years have made a simple reality difficult to deny. Volatility is not a stable forward risk signal in modern markets. It is a tradable surface price of near-term hedging, and the relationship between volatility and equity outcomes is regime-dependent and statistically unstable across time.

The next market shock will not be defined by whether VIX rises. It will be defined by whether the system’s structural absorption capacity holds. The durable edge is not predicting direction. It is measuring regime stability with the variables that actually govern continuity.

Structure is signal. Volatility is the receipt.

Source: VICA Partners Research © VICA Research — Proprietary Market Intelligence

Disclaimer: This commentary is for informational purposes only and does not constitute investment advice. Views reflect market-structure analysis as of publication and may change without notice. Investing involves risk, including loss of principal. Unauthorized reproduction or redistribution is strictly prohibited.