Beneath the surface of market activity, institutional capital is quietly realigning — and only the technically proficient will recognize the signals.

VICA Brief | Executive Insight

Institutional rotation has begun. Beneath the resilience of headline indices lies a reallocation into sectors aligned with fiscal durability, sovereign security, and structural pricing power. This report maps the signals — for those positioned to lead, not react.

Opening Statement

The noise of daily price action often conceals the deeper mechanics of capital movement. While headline narratives linger on AI cycles and mega-cap momentum, a subtler, more deliberate rotation is taking shape. This is not speculation. It is the unfolding of disciplined capital deployment by institutional actors operating on signal, not sentiment.

SIGNAL 01 | INDEX MASKING & SECTOR DISPARITY

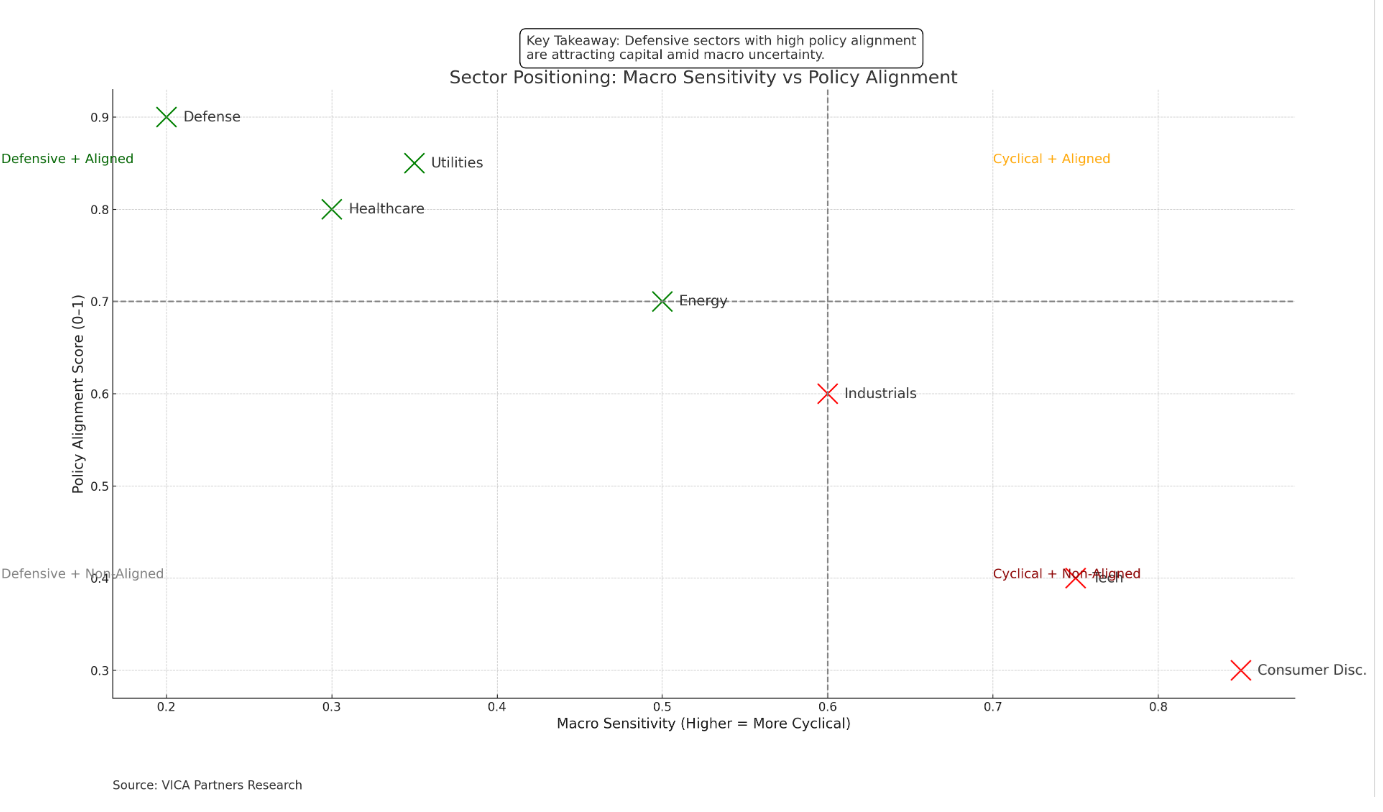

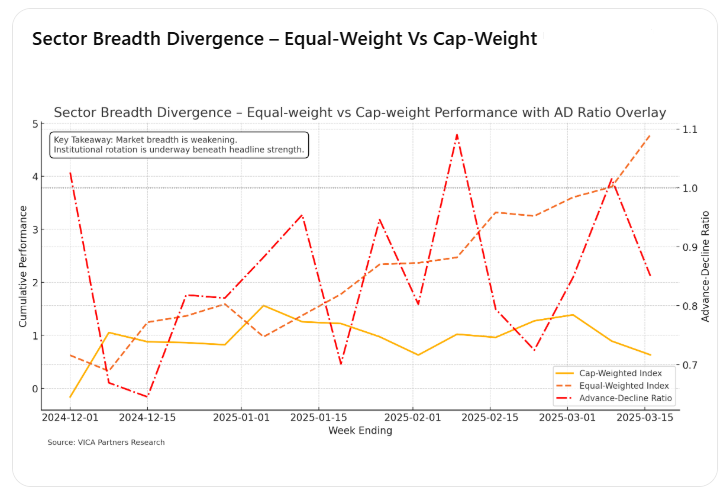

Broad equity indices, particularly market-cap weighted benchmarks like the S&P 500, are currently skewed by narrow leadership. A deeper inspection reveals weakening breadth and rising dispersion.

- Advance-Decline Ratios have deteriorated.

- Equal-weighted indices are diverging from their cap-weighted counterparts.

- Rolling correlation data shows increased segmentation between defensive sectors (utilities, healthcare) and high-beta tech.

Sector Breadth Divergence – Equal-weight vs Cap-weight Performance with AD Ratio overlay

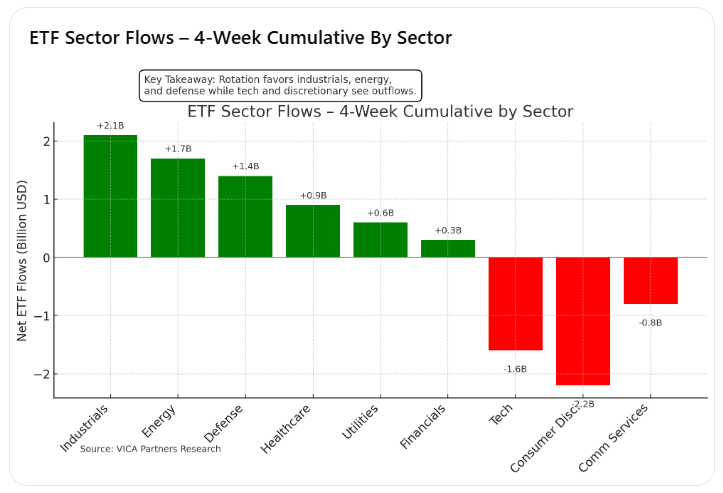

SIGNAL 02 | FLOW DATA & POSITIONING SIGNALS

Rotation is being expressed through a variety of technical footprints:

- ETF Sector Flows: Industrials, energy, and defense ETFs have attracted $4.2B in net inflows over three weeks. Tech and discretionary sectors are seeing capital outflows.

- Options Market Positioning: Elevated put-call ratios indicate hedging activity, not growth exposure.

- Dealer Gamma Exposure: Increased market sensitivity to downside volatility in tech, with positioning stability in cyclicals and value.

ETF Sector Flows – 4-Week Cumulative by Sector

Options Skew & Gamma Exposure – Semis vs Industrials

SIGNAL 03 | LIQUIDITY AND NON-CORRELATED ALLOCATIONS

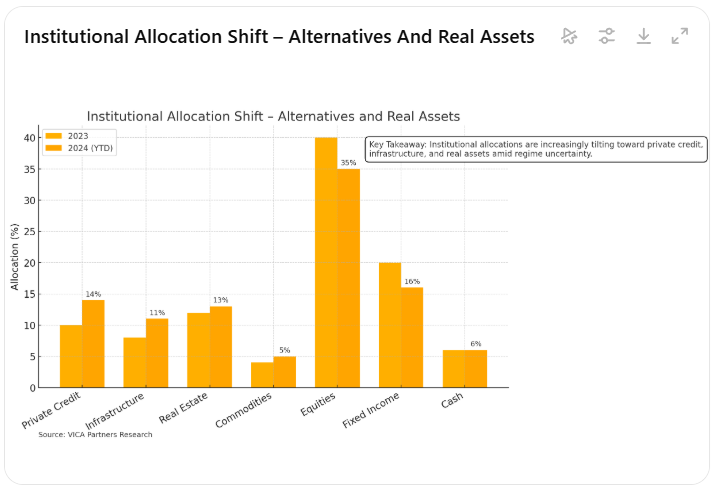

Institutional capital isn’t disappearing — it’s rotating:

- Market-neutral strategies are gaining flows.

- Infrastructure and real asset plays are benefiting from fiscal tailwinds.

- Sovereign wealth and pensions are shifting into long-duration, pricing-power aligned exposures.

Institutional Allocation Shift – Alternatives and Real Assets

SIGNAL 04 | FORWARD-LOOKING CAPITAL ALIGNMENT

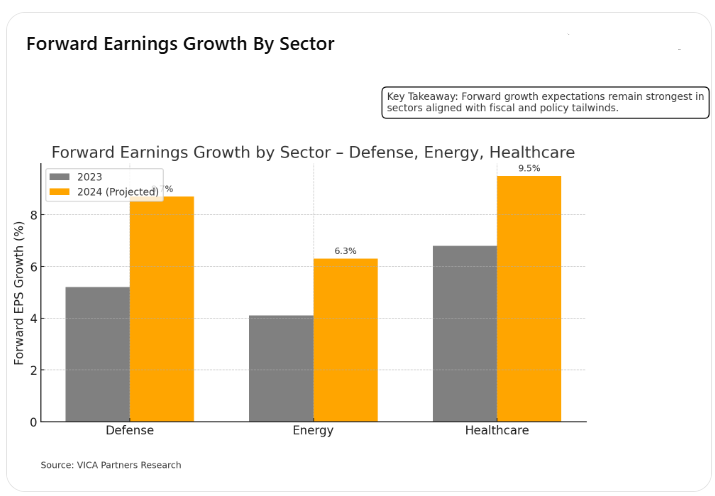

Positioning is now driven by future cash flow visibility, supply-chain control, and national policy alignment:

- Defense Contractors: Multi-year procurement visibility.

- Energy Infrastructure: Sovereign energy security alignment.

- Healthcare & Biotech: Cash-rich innovators in defensible sectors.

Forward Earnings Growth by Sector – Defense, Energy, Healthcare

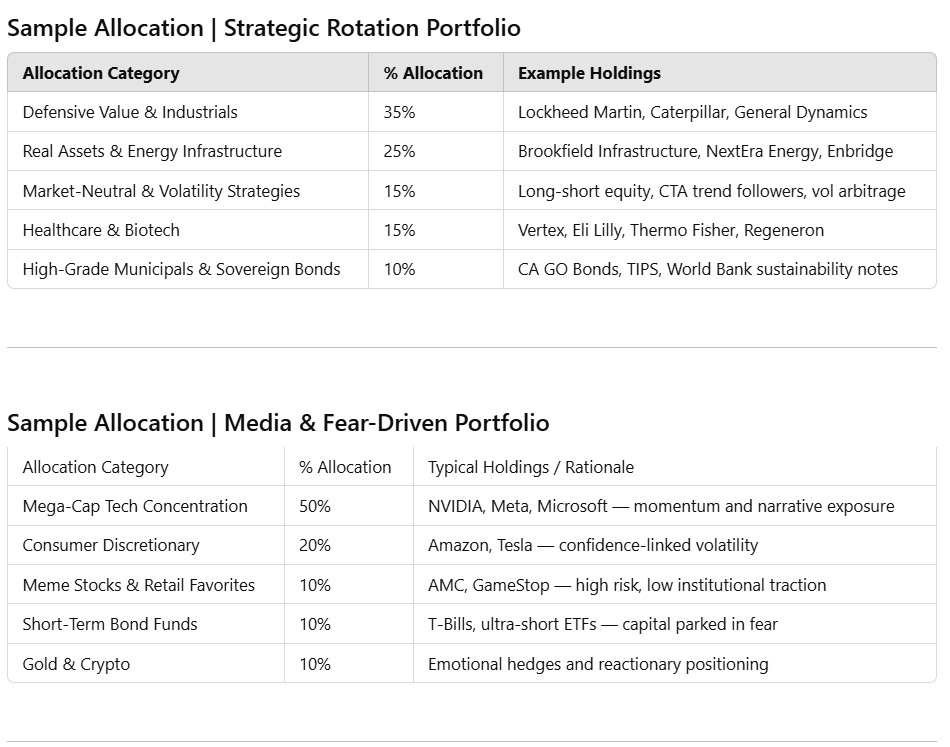

Sample Allocations

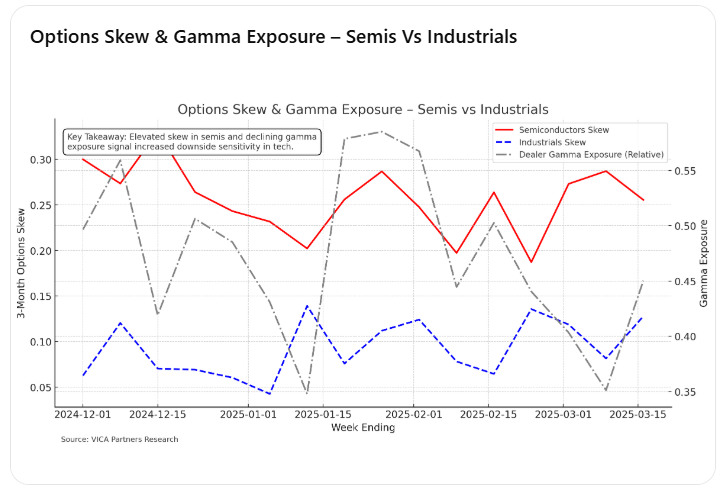

SIGNAL 05 | TECHNICAL MARKET CLUES

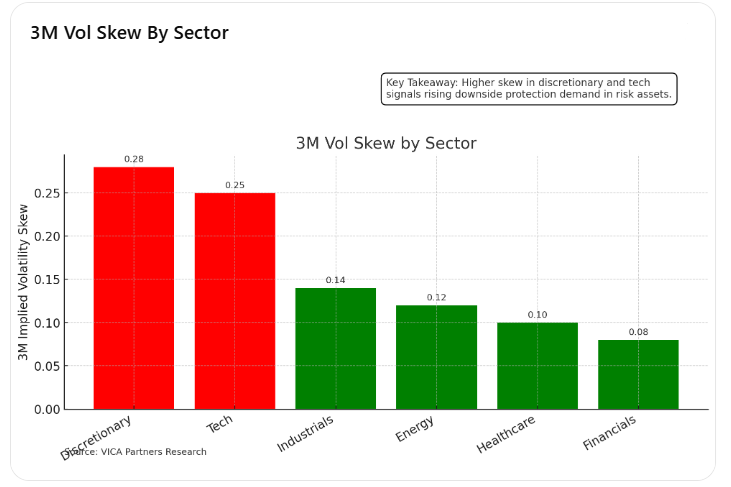

Sophisticated reallocation leaves structure-based signals, not headlines:

- Block Trade Timing during low volume windows.

- 3-Month Volatility Skew shifts before spot price.

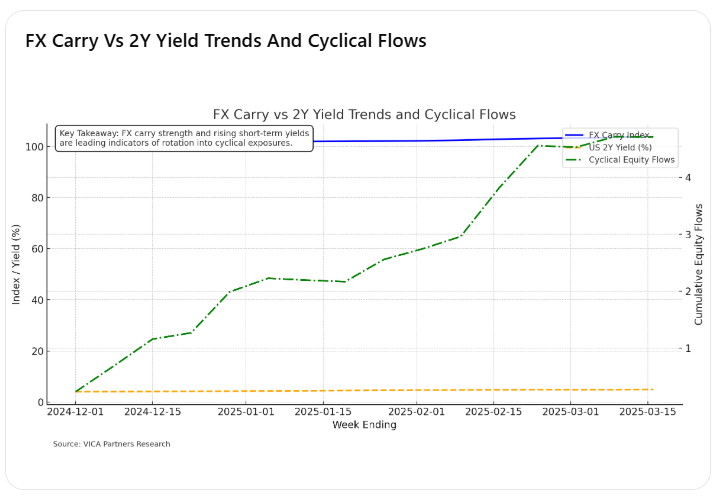

- FX Carry and Short-Term Rate Signals leading cross-asset rotation.

3M Vol Skew by Sector

FX Carry vs 2Y Yield Trends and Cyclical Flows

VICA PERSPECTIVE | THIS ROTATION IS STRUCTURAL, NOT HEADLINE-DRIVEN

We invite you to quietly circulate this perspective among peers who operate with similar discipline.

— End of VICA Internal Market Signal — Informed alignment is rare — and increasingly valuable.

On Deck from VICA Partners:

Inside the Discipline of Silent Alpha: How Technicians Use Structure, Flow, and Volatility as Their Primary Tools.