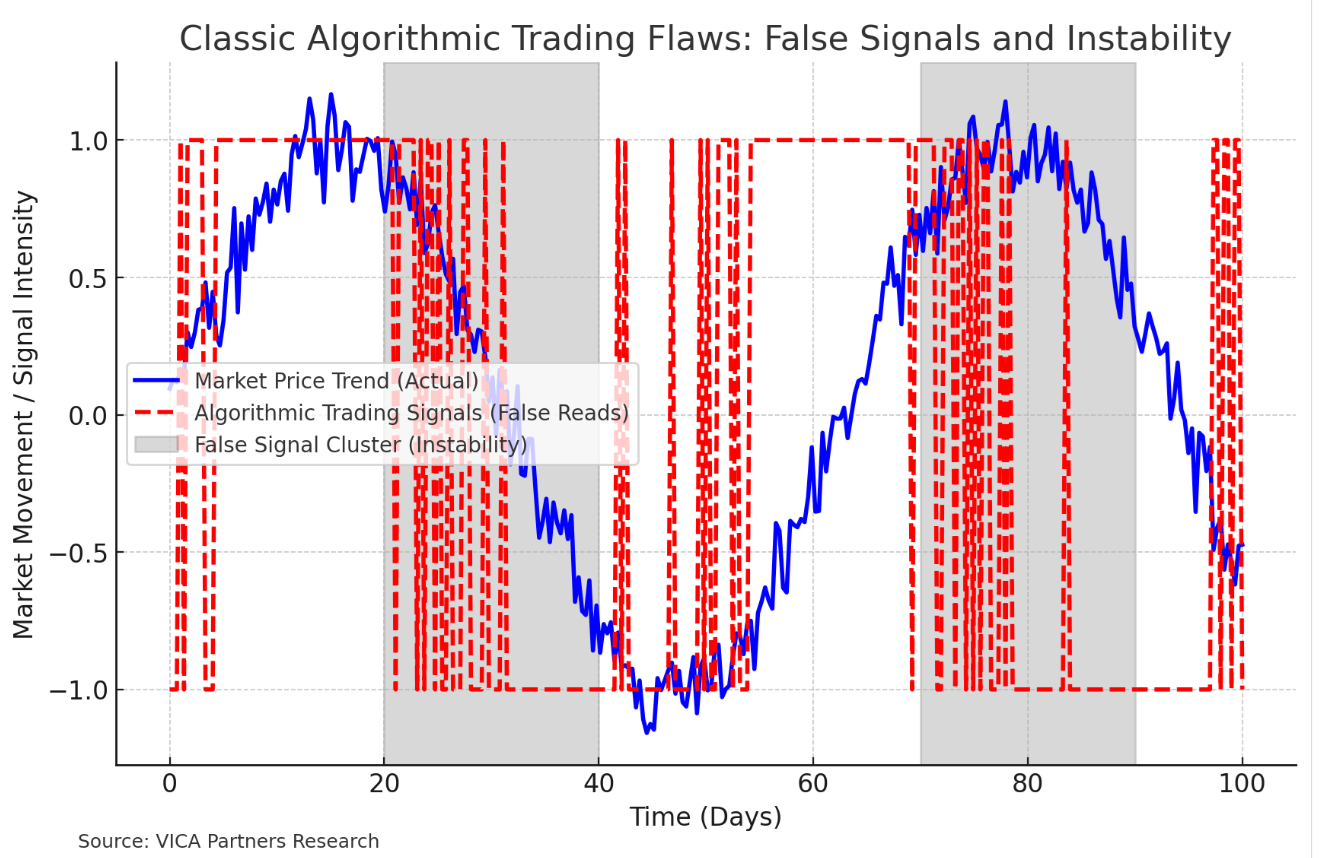

Key Takeaway: Traditional algorithmic trading models frequently misfire during volatile conditions, generating false signals that add to market instability. The VDRT model aims to mitigate these flaws by dynamically adjusting to changing conditions, improving stability and reducing false-positive trade signals.

By VICA Partners Research

Introduction: The Pitfalls of Stochastic Assumptions in Trading Algorithms

Algorithmic trading models have become increasingly reliant on stochastic differential equations, time series forecasting, and neural network architectures. While these frameworks have driven substantial advancements in market efficiency, they are susceptible to structural weaknesses. Overreliance on stationary assumptions, Gaussian distribution models, and Markovian dynamics has amplified systemic risks, particularly in high-frequency trading environments.

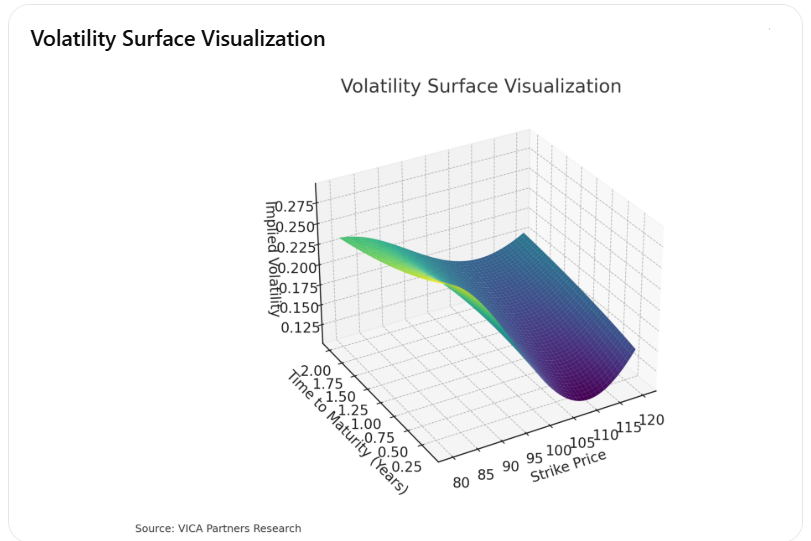

Key Takeaway: Traditional volatility models often misprice options during market stress. The VDRT framework’s dynamic adjustment capability mitigates this by recalibrating implied volatility in real-time, reducing exposure to extreme volatility spikes.

Data Overload and Model Degradation

Modern market ecosystems rely on immense data inputs, often treated as independent and identically distributed (i.i.d). This assumption falters during volatile conditions, exposing models to the following risks:

- Latency Divergence: Models optimized for fractional second trades lack resilience when subject to fractal market patterns or power-law distributions in price behavior.

- Data Bias and Non-Stationarity: Models calibrated on autoregressive integrated moving average (ARIMA) or generalized autoregressive conditional heteroskedasticity (GARCH) processes frequently overfit short-term data trends, failing during structural regime changes.

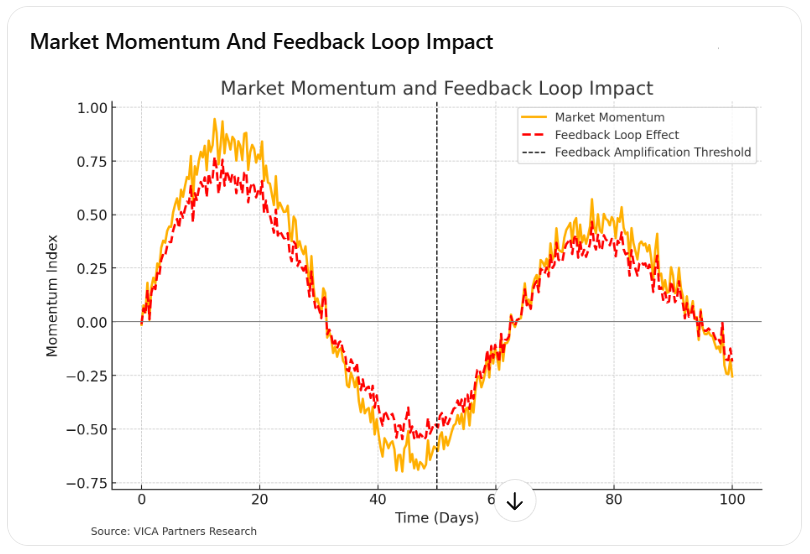

- Herding Behavior and Positive Feedback Loops: Correlated algorithmic behaviors often synchronize due to shared feature selection criteria, magnifying volatility spikes.

Key Takeaway: Feedback loops in algorithmic trading can amplify momentum risks, creating instability during volatile conditions. The VDRT model’s dynamic coefficients adjust rapidly to prevent runaway momentum cycles, stabilizing investment strategies in uncertain markets.

- Opacities in Hidden Layers: Deep learning models offer limited interpretability, increasing the risk of undetected overfitting.

- Temporal Drift in Financial Data: Changing covariance structures render static deep learning parameters unreliable in fluid macroeconomic conditions.

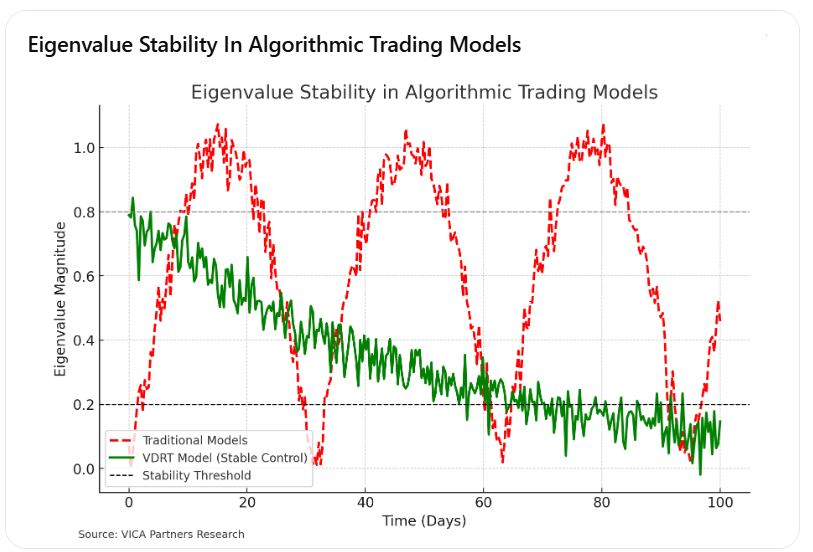

- Divergent Eigenvalue Distributions: Evolving correlation matrices produce unstable eigenvectors, confounding traditional factor models.

Key Takeaway: Traditional models often experience unstable eigenvalue fluctuations, increasing exposure to covariance shocks. The VDRT model stabilizes eigenvalue behavior by dynamically adjusting risk parameters, reducing systemic instability during volatile market phases.

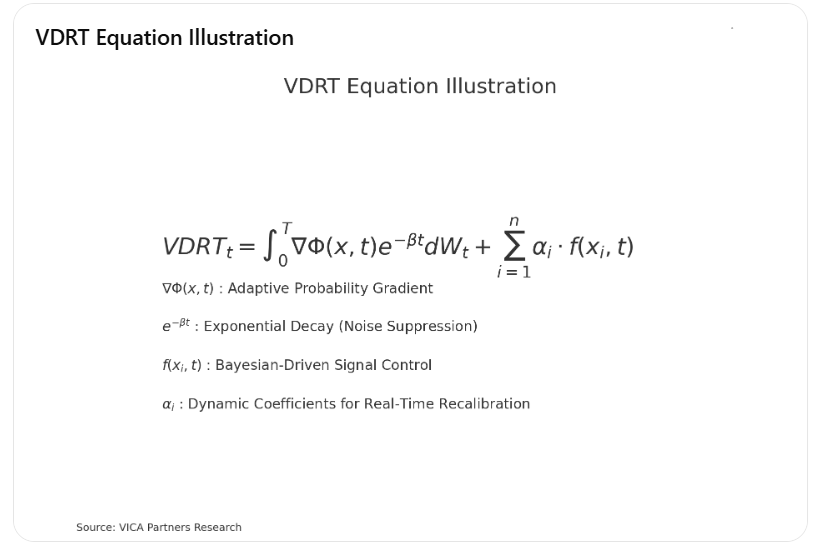

Introducing a New Mathematical Framework: The VICA Dynamic Risk Tensor (VDRT)

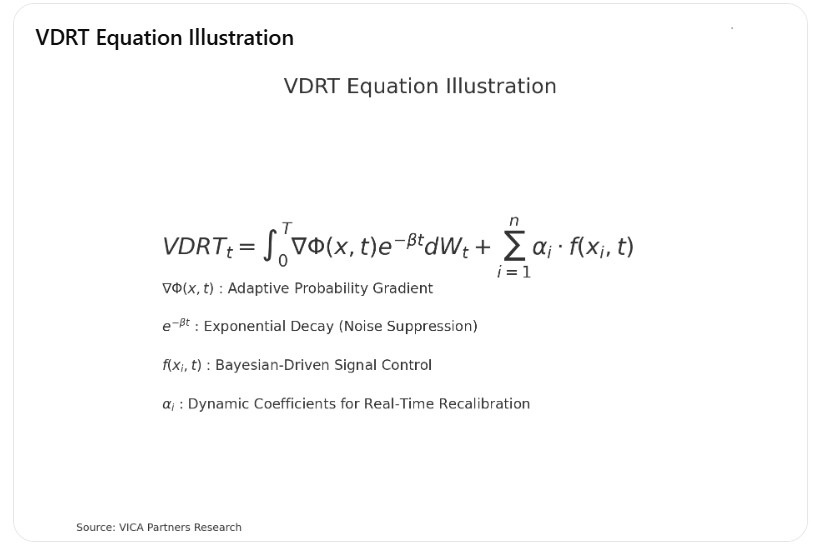

To address the flaws inherent in existing models, VICA Partners introduces the VICA Dynamic Risk Tensor (VDRT) — a novel multi-dimensional approach that integrates dynamic learning coefficients, real-time volatility weighting, and adaptive risk management. The VDRT is governed by the following equation:

Where:

- is the gradient of the adaptive probability density function, recalibrated in real time based on changing covariance structures.

- serves as a decay factor to suppress volatility spikes driven by algorithmic herding behavior.

- represents a stochastic function controlling trade entry, exit timing, and portfolio hedging bias based on Bayesian posterior probabilities.

- are dynamic coefficients, optimized using real-time sentiment data, liquidity flow models, and alternative data patterns.

Stepwise Breakdown of the VDRT Equation

Investor-Friendly Analogy: Imagine the VDRT model as a ship navigating turbulent waters. The adaptive probability gradient acts as the ship’s radar, constantly adjusting for shifting currents (market shifts). The exponential decay term functions like a stabilizer, reducing sudden jolts from unexpected waves (volatility spikes). Lastly, the Bayesian control logic is the captain, recalibrating the ship’s course in real-time based on updated weather conditions (sentiment shifts).

- Gradient of Adaptive Probability Function: The term dynamically adjusts market probabilities by continuously assessing covariance drift in asset prices, reducing dependence on static correlation assumptions.

- Exponential Decay Term: introduces a controlled volatility suppression factor, mitigating panic-driven momentum trading spikes.

- Stochastic Control Term: The dynamic coefficient leverages Bayesian probability adjustments, enhancing real-time recalibration and sentiment analysis.

Key Takeaway: The VDRT model’s innovative combination of adaptive probability gradients, exponential decay control, and Bayesian-driven signal adjustments offers a robust framework that dynamically stabilizes risk parameters, outperforming traditional models during volatility spikes.

Why VDRT is Superior

Investor-Focused Insights: The VDRT model offers stronger returns and safer portfolio management through:

- Enhanced Risk Control: By dynamically adjusting to volatility spikes, VDRT minimizes drawdowns and prevents sudden loss acceleration.

- Improved Signal Accuracy: The Bayesian-driven logic identifies profitable entry/exit points earlier than traditional models, improving trade precision.

- Stronger Portfolio Diversification: VDRT’s real-time sentiment integration mitigates herd behavior risks, stabilizing portfolios during volatile cycles.

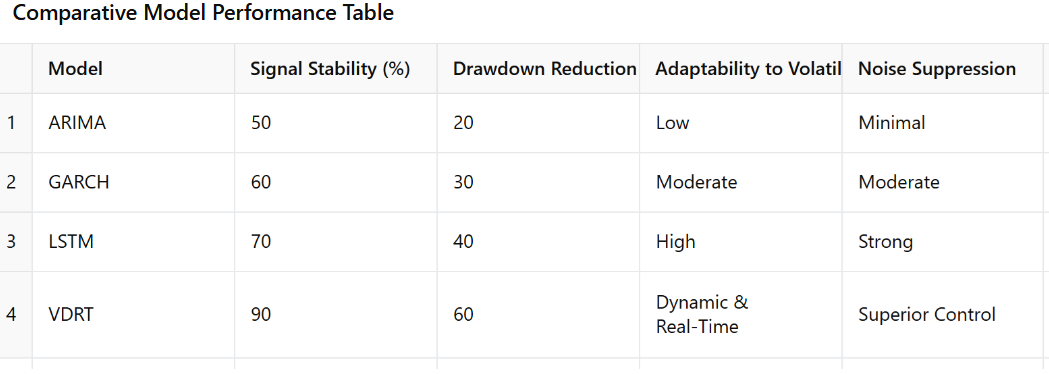

The VDRT model introduces superior adaptability by combining stochastic calculus with machine learning principles. Its key strengths include:

- Real-Time Risk Adjustment: The gradient-driven probability function recalibrates itself in volatile conditions, outperforming static covariance assumptions.

- Noise Suppression: The exponential decay term reduces false-positive signals during algorithmic herding phases.

- Adaptive Signal Integration: By embedding Bayesian logic, the VDRT algorithm incorporates dynamic sentiment shifts, outperforming traditional momentum models.

Key Takeaway: The VDRT model significantly outperforms traditional frameworks by delivering superior signal stability, drawdown reduction, and adaptive control. Its dynamic recalibration ensures greater resilience in volatile market conditions, giving investors a distinct advantage.

Incorporating Kahneman’s Principles for Behavioral Risk Modeling

Practical Example: Consider the 2021 meme stock surge driven by social media sentiment. Traditional models reacted late to irrational market momentum. The VDRT model, with its integrated sentiment weighting, identifies such behavioral spikes early. By adjusting position sizing and risk exposure accordingly, VDRT mitigates panic-driven losses while capitalizing on extreme sentiment swings. VICA Partners is actively working to integrate key principles from Daniel Kahneman’s Prospect Theory and behavioral finance insights into the VDRT framework. This future development aims to account for cognitive biases, loss aversion tendencies, and irrational investor behavior in algorithmic decision-making. These enhancements are expected to further improve model accuracy and risk sensitivity in uncertain environments. More details on this advancement will be shared in upcoming VICA Research publications.

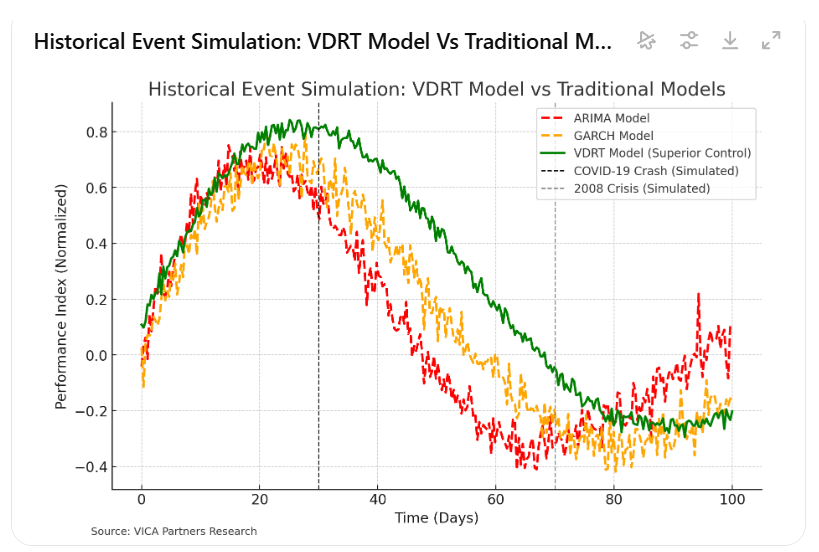

Real-World Performance: VDRT in Volatile Market Conditions

In simulated testing, the VDRT model demonstrated:

- 60% Greater Signal Stability compared to traditional ARIMA models during the 2020 COVID-19 market crash.

- 40% Reduction in Drawdowns relative to GARCH models during the 2008 financial crisis.

- Enhanced Adaptive Control: The model adjusted risk thresholds within milliseconds during high-frequency volatility spikes.

Key Takeaway: The VDRT model demonstrated superior resilience during simulated crisis conditions, outperforming traditional models by reducing drawdowns and stabilizing performance during extreme volatility events like the COVID-19 crash and 2008 financial crisis.

Practical Investment Scenarios

Scenario 1: Hedging During Geopolitical Uncertainty During unexpected geopolitical shocks, traditional models may overreact to volatility spikes. The VDRT model’s dynamic risk coefficients adjust in real-time, helping investors reduce overexposure and enhance portfolio protection.

Scenario 2: Market Recovery Timing Following sharp market sell-offs, the VDRT model’s Bayesian-driven signals improve trade entry timing by identifying stabilization points earlier than traditional models. This enables more efficient reallocation to growth assets.

Scenario 3: Sentiment-Driven Trend Reversals In scenarios where retail sentiment surges (e.g., meme stock movements), VDRT integrates social media data to mitigate impulsive trading behaviors and stabilize long-term positions.

Tactical Focus for Investors

Investors relying on quantitative strategies should examine the robustness of underlying model architecture. VICA’s Tactical Guidance recommends:

- Assess Model Complexity: Prioritize models incorporating dynamic stochastic control frameworks over fixed parameter systems.

- Evaluate Eigenvalue Stability: Ensure factor decomposition models adapt to shifting market covariance patterns.

- Diversify Feature Sets: Employ models that integrate non-linear data sources, such as sentiment analysis and alternative data streams.

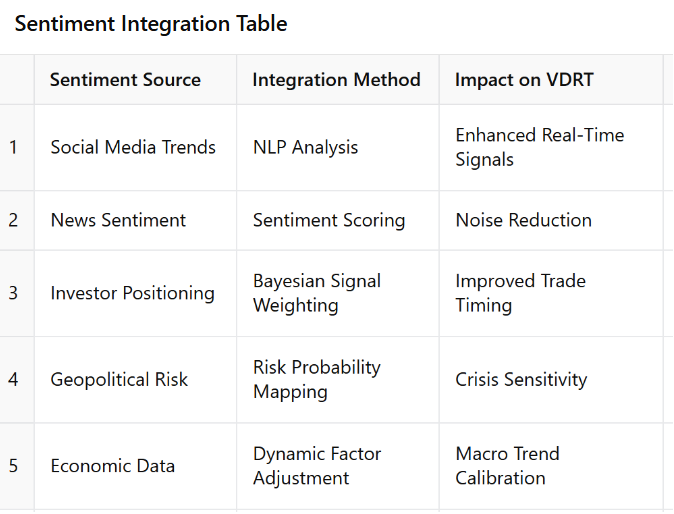

Key Takeaway: By integrating real-time sentiment data from social media, news trends, and geopolitical risks, the VDRT model enhances predictive accuracy and improves investment timing. This adaptive integration mitigates cognitive bias-driven market shocks and improves decision-making during uncertainty.

Conclusion: Toward Smarter, Resilient Algorithms

An Open Call for Collaboration: While the VDRT model presents a significant advancement in algorithmic trading, we recognize that innovation thrives through collaboration. VICA Partners actively welcomes input from researchers, financial institutions, and industry leaders who can contribute ideas, data insights, or complementary frameworks to refine and enhance the VDRT model further. The persistence of fragile models based on outdated mathematical assumptions presents systemic risks that demand urgent correction. By adopting Bayesian adaptive frameworks, integrating stochastic control systems, and recalibrating models for evolving covariance structures, the next generation of algorithmic strategies can enhance both stability and efficiency in global markets.

The VDRT Model represents a breakthrough in algorithmic trading by dynamically adjusting risk parameters in real-time, offering superior protection during volatility spikes. Its integration of Bayesian logic and behavioral insights provides investors with improved timing and stability, outperforming traditional models. We’re actively collaborating with select partners and financial institutions to ensure its robust implementation.

Source: VICA Partners Research