Stay Informed and Stay Ahead: Research, November 25th, 2024

Key Leaders, Disruptors, and Growth Drivers

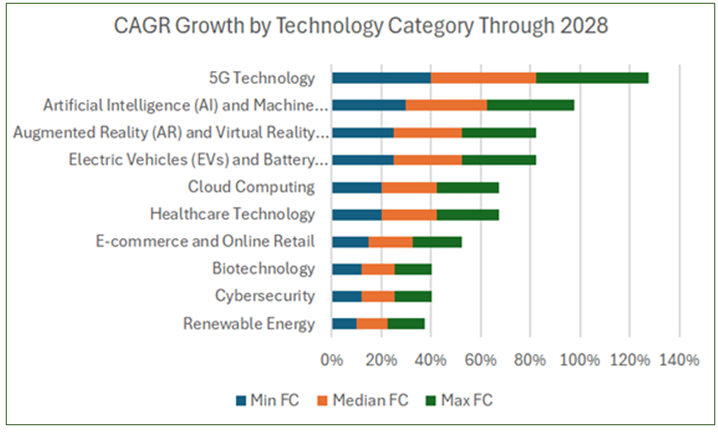

As we approach 2028, the technology landscape is poised for dramatic shifts driven by rapid innovation and market evolution. Below, we explore the top 10 technology sectors forecasted to achieve the highest Compound Annual Growth Rates (CAGR), highlighting the key players, emerging disruptors, and growth drivers propelling these sectors forward. We also encourage everyday investors to consider funds that provide exposure to these high-growth categories.

1. 5G Technology

- CAGR: Approximately 40% to 45%

- Growth Drivers: The ongoing global rollout of 5G infrastructure, surging demand for ultra-fast, low-latency networks, and the exponential growth of connected devices.

- Industry Leaders:

- Qualcomm Incorporated – Leading in 5G chipsets and technologies.

- Huawei Technologies Co., Ltd. – Dominant in 5G infrastructure and equipment.

- Ericsson AB – Renowned for 5G network solutions and services.

- Emerging Disruptor:

- Cohere Technologies – Pioneering advanced signal processing to enhance 5G performance and efficiency.

- Top Fund: Global X 5G ETF (FIVG)

- Why It’s a Top Choice: This ETF offers targeted exposure to companies driving the 5G revolution, including infrastructure providers and chipset manufacturers.

2. Artificial Intelligence (AI) and Machine Learning

- CAGR: Approximately 30% to 35%

- Growth Drivers: Significant advancements in AI algorithms, increasing demand for personalized and predictive solutions, and cross-industry applications from healthcare to finance.

- Industry Leaders:

- Alphabet Inc. – Leading with Google AI and DeepMind’s cutting-edge research.

- Microsoft Corporation – Integrating AI across Azure and other platforms.

- NVIDIA Corporation – Dominating the AI hardware market with GPUs.

- Emerging Disruptor:

- OpenAI – Revolutionizing AI with transformative models like GPT.

- Top Fund: ARK Innovation ETF (ARKK)

- Why It’s a Top Choice: This fund invests in cutting-edge technologies, including AI and machine learning, with a focus on transformative innovations and disruptive companies.

3. Electric Vehicles (EVs) and Battery Technologies

- CAGR: Approximately 25% to 30%

- Growth Drivers: Government incentives, breakthroughs in battery efficiency, and growing consumer demand for sustainable transportation.

- Industry Leaders:

- Tesla, Inc. – Leading the EV and battery technology revolution.

- BYD Company Limited – Expanding with both EVs and batteries.

- NIO Inc. – Innovating with battery-swapping technology.

- Emerging Disruptor:

- Rivian Automotive – Gaining traction with all-electric adventure vehicles.

- Top Fund: Global X Autonomous & Electric Vehicles ETF (DRIV)

- Why It’s a Top Choice: Provides broad exposure to leading EV and battery technology companies, capturing the growth of electric transportation and advanced battery solutions.

4. Augmented Reality (AR) and Virtual Reality (VR)

- CAGR: Approximately 25% to 30%

- Growth Drivers: Increased adoption in gaming, training, and immersive experiences, coupled with continual technological advancements.

- Industry Leaders:

- Meta Platforms, Inc. – Pushing the boundaries with Oculus and Reality Labs.

- Microsoft Corporation – Innovating with HoloLens AR technology.

- Sony Corporation – Expanding VR capabilities with PlayStation VR.

- Emerging Disruptor:

- Magic Leap – Leading the charge in mixed reality technology.

- Top Fund: ETFMG Video Game Tech ETF (GAMR)

- Why It’s a Top Choice: Focuses on companies driving innovation in AR and VR, with a significant portion of its holdings in gaming and immersive technology.

5. Cloud Computing

- CAGR: Around 20% to 25%

- Growth Drivers: The rise of remote work, accelerating digital transformation, and innovations in cloud-native architectures.

- Industry Leaders:

- Amazon Web Services (AWS) – Setting the standard in cloud infrastructure.

- Microsoft Azure – Offering robust enterprise cloud solutions.

- Google Cloud Platform – Pioneering cloud services across various sectors.

- Emerging Disruptor:

- Snowflake Inc. – Transforming data warehousing with a cloud-native approach.

- Top Fund: First Trust Cloud Computing ETF (SKYY)

- Why It’s a Top Choice: Invests in a diverse range of companies providing cloud computing services, from infrastructure to software solutions.

6. Healthcare Technology

- CAGR: About 20% to 25%

- Growth Drivers: Growing adoption of telemedicine, wearable health monitoring devices, and personalized medicine tailored to genetic profiles.

- Industry Leaders:

- Medtronic plc – Leading in innovative medical devices.

- Philips Healthcare – Dominating the imaging systems market.

- Teladoc Health, Inc. – Expanding telemedicine capabilities globally.

- Emerging Disruptor:

- Neurotechnology Inc. – Advancing brain-computer interface technologies.

- Top Fund: Health Care Select Sector SPDR Fund (XLB)

- Why It’s a Top Choice: Offers exposure to leading healthcare technology companies, including those focused on telemedicine and medical innovations.

7. E-commerce and Online Retail

- CAGR: Around 15% to 20%

- Growth Drivers: Expanding internet access, increased mobile device usage, and the growing demand for convenience and speed in shopping experiences.

- Industry Leaders:

- Amazon.com, Inc. – Continuing to lead global e-commerce.

- Alibaba Group Holding Limited – Dominating the Asian online retail market.

- Shopify Inc. – Enabling businesses with innovative e-commerce platforms.

- Emerging Disruptor:

- Temu – Innovating in cross-border e-commerce with a unique approach.

- Top Fund: Amplify Online Retail ETF (IBUY)

- Why It’s a Top Choice: Invests in companies benefiting from the growth of online retail and e-commerce, providing targeted exposure to this rapidly expanding sector.

8. Cybersecurity

- CAGR: About 12% to 15%

- Growth Drivers: Rising cyber threats, stricter regulatory compliance, and increased investments in advanced security technologies.

- Industry Leaders:

- Palo Alto Networks – Leading with next-generation firewalls and security.

- CrowdStrike Holdings – Pioneering cloud-native endpoint protection.

- Cisco Systems – Dominating in network security solutions.

- Emerging Disruptor:

- Snyk – Focusing on developer-first security for open-source software.

- Top Fund: ETFMG Prime Cyber Security ETF (HACK)

- Why It’s a Top Choice: Focuses on companies specializing in cybersecurity solutions, capturing growth from heightened security needs and innovations in the sector.

9. Renewable Energy

- CAGR: Around 10% to 15%

- Growth Drivers: Strong government support, declining costs of renewable technologies, and a global emphasis on sustainability.

- Industry Leaders:

- NextEra Energy, Inc. – Investing heavily in wind and solar power.

- Enphase Energy, Inc. – Innovating with solar microinverters.

- Vestas Wind Systems A/S – Leading in wind turbine manufacturing.

- Emerging Disruptor:

- Bloom Energy – Revolutionizing energy with solid oxide fuel cells.

- Top Fund: iShares Global Clean Energy ETF (ICLN)

- Why It’s a Top Choice: Provides exposure to global companies involved in renewable energy production and technology, aligning with the sector’s growth trends.

10. Biotechnology

- CAGR: About 12% to 15%

- Growth Drivers: Advances in genetic research, the rise of personalized medicine, and the development of groundbreaking treatments.

- Industry Leaders:

- Gilead Sciences, Inc. – Innovating in antiviral drug development.

- Biogen Inc. – Focused on neuroscience-driven biotechnology.

- Amgen Inc. – Leading in therapeutics and biopharmaceutical innovation.

- Emerging Disruptor:

- CRISPR Therapeutics – Transforming medicine with gene-editing technologies.

- Top Fund: iShares Nasdaq Biotechnology ETF (IBB)

- Why It’s a Top Choice: Invests in a wide range of biotech companies focused on innovative therapies and cutting-edge research.

Conclusion

As we move toward 2028, these sectors are expected to drive substantial economic growth and technological advancement. From the groundbreaking impact of AI and 5G to the transformative potential of biotechnology and renewable energy, the next decade will be shaped by both established industry leaders and innovative disruptors. Investors should consider funds that offer targeted exposure to these high-growth categories, as they hold the keys to the future of technology and the global economy.