Stay Informed and Stay Ahead: Market Watch, April 29th, 2024.

Deciphering Rate-Cut Odds: A Market Insight

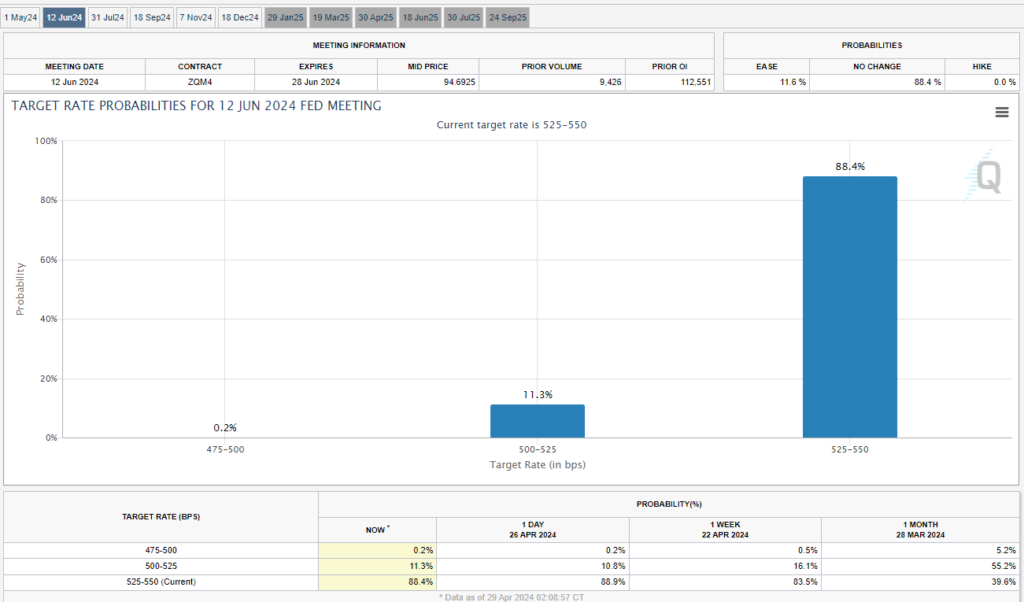

Investors exercise caution before the June Fed meeting, with a mere 11.1% chance of a quarter-point rate cut, sharply contrasting the significant 70.1% expectation in March and 18.2% in April.

June 12: Investor Caution Before June Fed Meeting : Investors approach the June 11-12 Federal Reserve meeting with caution, with an 11.1% chance of a quarter-point rate cut and a mere 0.2% likelihood of a 50 basis points adjustment. This contrasts sharply with the 18.2% probability noted on April 19 and the significant 70.1% expectation on March 27.

Given the cautious sentiment before the June Fed meeting, investors may consider adopting a conservative approach in their market strategy. This could involve reducing exposure to high-risk assets and increasing allocations to defensive sectors or safe-haven assets like bonds and gold.

source: CME FedWatch Tool

Looking forward past June

July 31: Decrease in Expectations for July Fed Meeting: Anticipation for adjustments at the July 30-31 meeting sees a decline, with probabilities dropping to 31.3% for a quarter-point cut and 5.7% for 50 basis points. This reflects a notable decrease from 43.6% and 6.1% on April 19, respectively, and a significant shift from 83.7% and 35.4% on March 27.

Sept. 18: Market Forecasts Point Towards Rate Cut: Forecasts for the September 17-18 Federal Reserve meeting indicate an inclination towards a rate cut, with a 57.4% likelihood. Additionally, there’s a 13.5% chance of a 50 basis points reduction. These figures contrast with 68.4% and 22.6% on April 19, respectively, and significantly higher probabilities noted on March 27.

Nov. 7: Anticipation Builds Ahead of November Fed Meeting: As the November 6-7 meeting approaches, investors anticipate a 67% chance of a quarter-point rate cut and a 23.4% likelihood of a 50 basis points adjustment. This differs from 75.6% and 33% on April 19 and higher probabilities on March 27.

Dec. 18: Caution Persists for December Fed Meeting: Investor sentiment for the December 17-18 meeting suggests caution, with a 79.8% probability of a rate cut, a 40.3% chance of a 50 basis points reduction, and an 11.4% likelihood of a 75 basis points adjustment. These figures differ from those on April 19 and indicate a notable shift from March 27.