Stay Informed and Stay Ahead: Market Watch, January 9th, 2024.

Market Highlights & Analysis: Indices, Sectors, and More…

- Economic Data: November saw a narrowed U.S. trade deficit of -$63.2B, NFIB Business Optimism at 91.9, and notable increases in exports/imports and consumer credit.

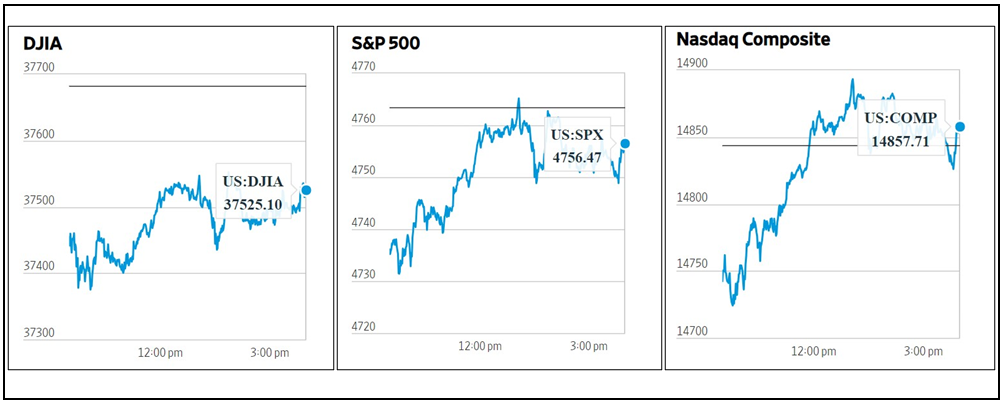

- Market Indices: DJIA (-0.42%), S&P 500 (-0.15%), Nasdaq Composite (+0.09%).

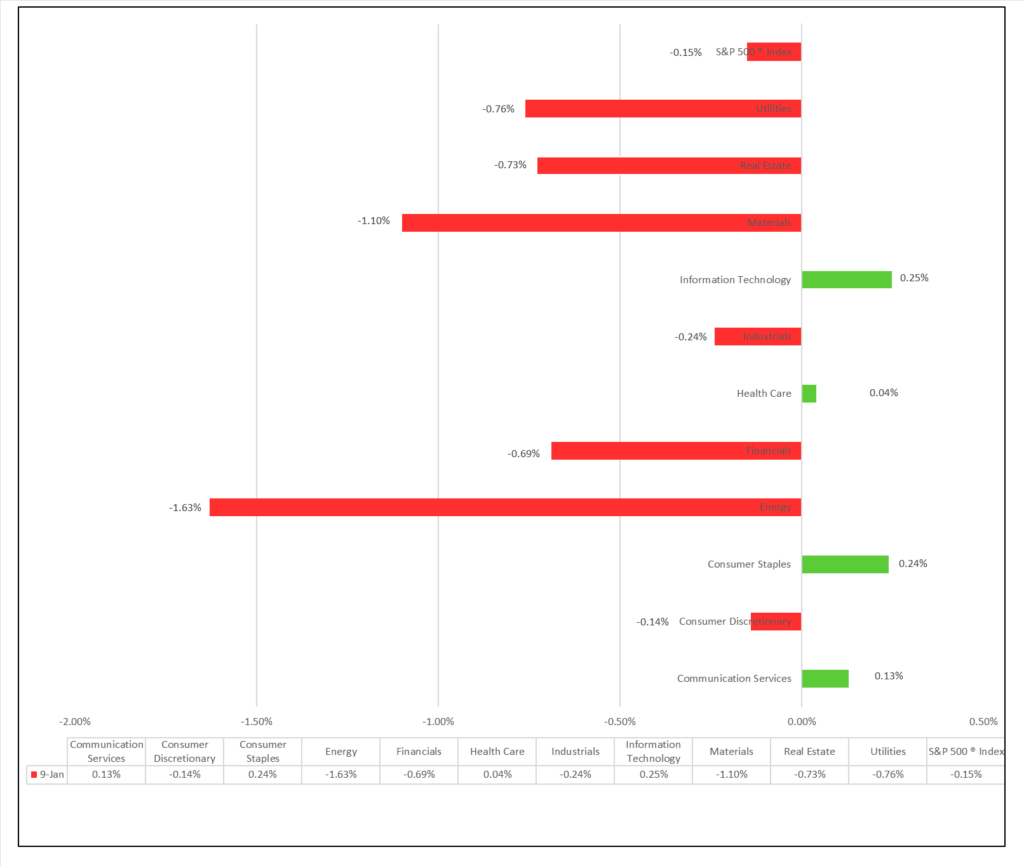

- Sector Performance: 7 of 11 sectors lower; Information Technology (+0.25%) leading, Energy (-1.63%) lagging. Top industry: Broadline Retail (+1.45%).

- Treasury Markets: Yields show mixed movements across various Treasury maturities, with the 30-Year Bond and 10-Year Note experiencing slight increases.

- Commodities: Gold moderately rises while Bitcoin declines due to a midday gain reversal pending ETF approval tomorrow. Crude Oil futures and the Bloomberg Commodity Index show moderate increases.

- Factors: Mega and Large-Cap Growth outperform.

- ETFs: United States Natural Gas Fund L.P. gained 7.82% with heavily active 85.2 million volume.

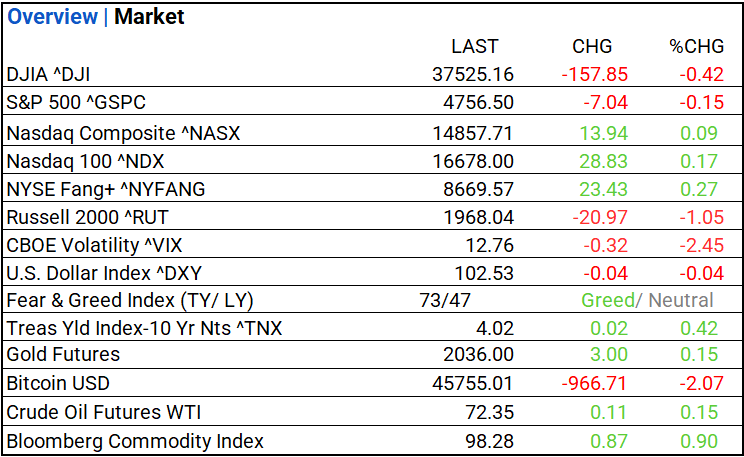

US Market Snapshot: Key Stock Market Indices:

- DJIA ^DJI: 37,525.16 (-157.85, -0.42%)

- S&P 500 ^GSPC: 4,756.50 (-7.04, -0.15%)

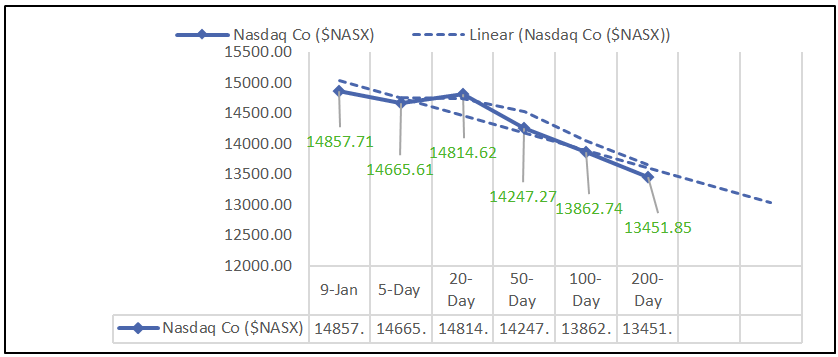

- Nasdaq Composite ^NASX: 14,857.71 (+13.94, +0.09%)

- Nasdaq 100 ^NDX: 16,678.00 (+28.83, +0.17%)

- NYSE Fang+ ^NYFANG: 8,669.57 (+23.43, +0.27%)

- Russell 2000 ^RUT: 1,968.04 (-20.97, -1.05%)

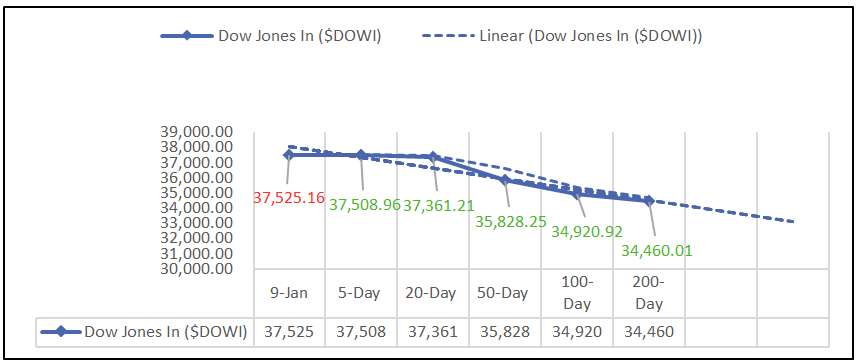

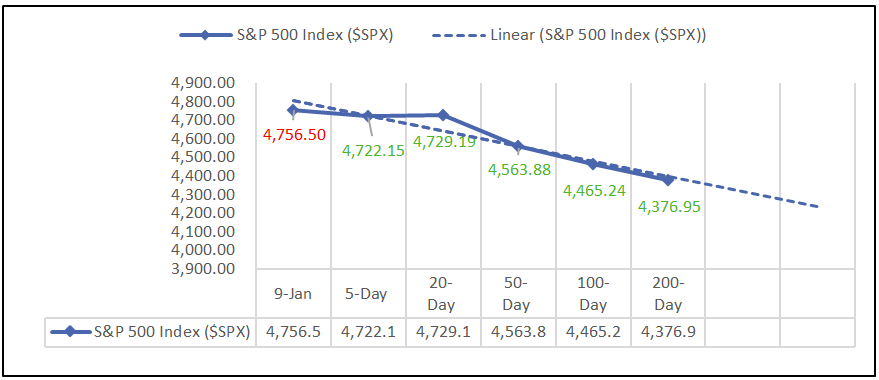

Moving Averages: DOW, S&P 500, NASDAQ:

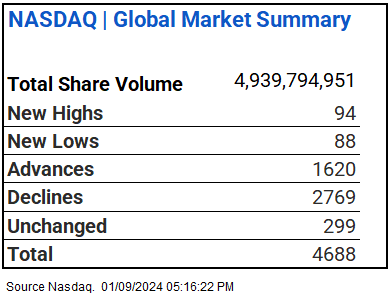

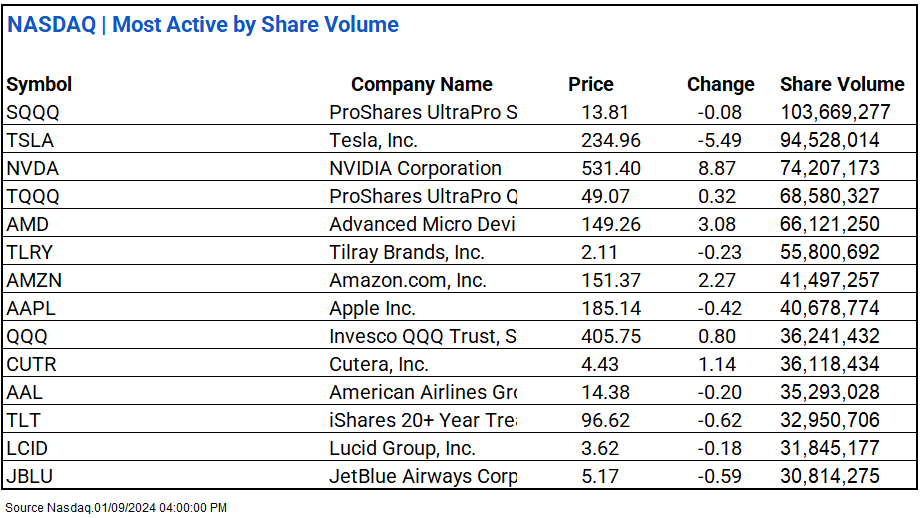

NASDAQ Global Market Summary:

Sectors:

- 7 of 11 sectors lower; Information Technology (+0.25%) leading, Energy (-1.63%) lagging. Top industries: Broadline Retail (+1.45%), Passenger Airlines (+0.94%), and Interactive Media & Services (+0.87%).

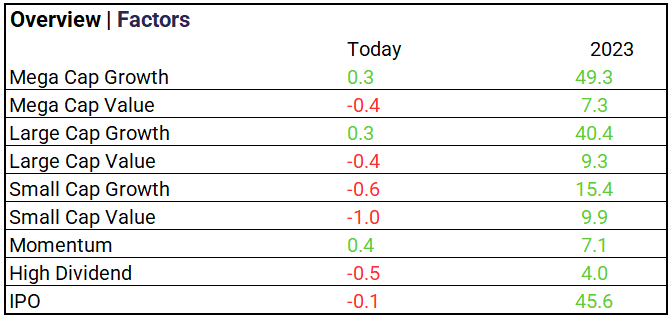

Factors:

- Mega and Large-Cap Growth outperform, while Small-Cap Value lags.

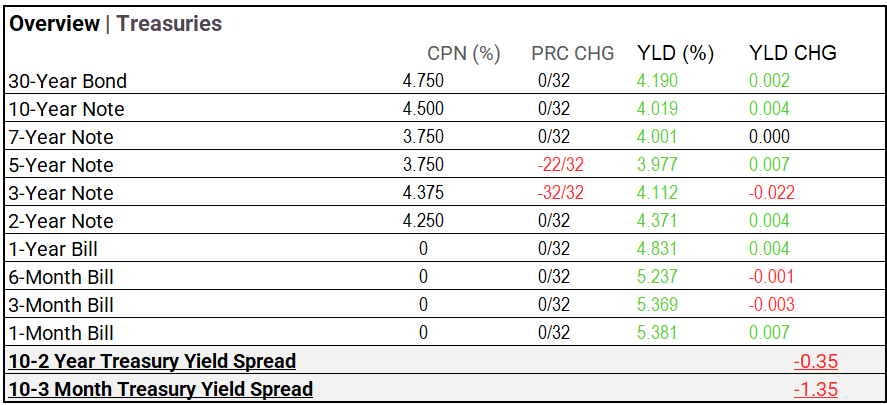

Treasury Markets:

- Yields show mixed movements across various Treasury maturities, with the 30-Year Bond and 10-Year Note experiencing slight increases, while the 5-Year Note and 3-Year Note see declines.

Currency and Volatility:

- U.S. Dollar Index ^DXY: 102.53 (-0.04, -0.04%)

- CBOE Volatility ^VIX: 12.76 (-0.32, -2.45%)

- Fear & Greed Index: 73/LY 47 (Greed/ Neutral)

Commodity Markets:

- Gold Futures: $2,036.00 (+$3.00, +0.15%)

- Bitcoin USD: $45,755.01 (-$966.71, -2.07%)

- Crude Oil Futures WTI: $72.35 (+$0.11, +0.15%)

- Bloomberg Commodity Index: 98.28 (+$0.87, +0.90%)

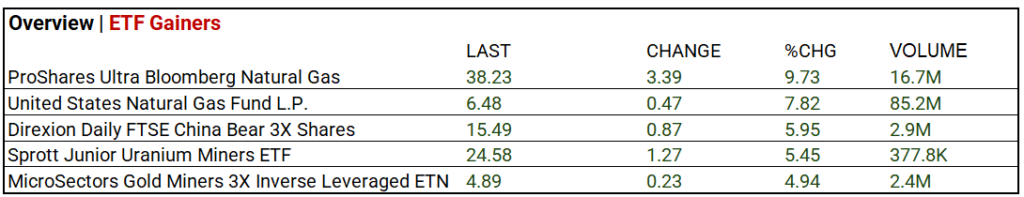

ETF’s:

- ProShares Ultra Bloomberg Natural Gas surged by 9.73% with solid 16.7 million volume, while United States Natural Gas Fund L.P. gained 7.82% with heavily active 85.2 million volume.

US Economic Data:

- U.S. Trade Deficit for November: -$63.2 billion (Forecast: -$64.7 billion, Prior: -$64.5 billion)

- NFIB Business Optimism Index (Dec): 91.9 (Forecast: 90.7, Prior: 90.6)

- Exports/Imports (Nov): $253.7 billion/$316.9 billion (Prior: $258.8 billion/$323.1 billion)

- Consumer Credit Change (Nov): $23.75 billion (Consensus: $9 billion, Prior: $5.13 billion)

Earnings:

- Q4 Forecast: Analysts significantly lowered S&P 500 companies’ Q4 earnings per share (EPS) estimates during October and November, with a 5.0% decline in the bottom-up EPS estimate. This drop surpasses the average declines over the past 5, 10, 15, and 20 years, marking the most substantial decrease since Q1 2023. Among sectors, Health Care experienced the largest decline (-19.9%), while Information Technology saw a modest increase (+1.5%) in their Q4 2023 bottom-up EPS estimates.

Notable Earnings Today:

- BEAT: Albertsons (ACI), WD-40 (WDFC), PriceSmart (PSMT), AZZ (AZZ).

- MISSED: Synnex (SNX), Acuity Brands (AYI), MSC Industrial Direct (MSM), Neogen (NEOG), Tilray (TLRY).

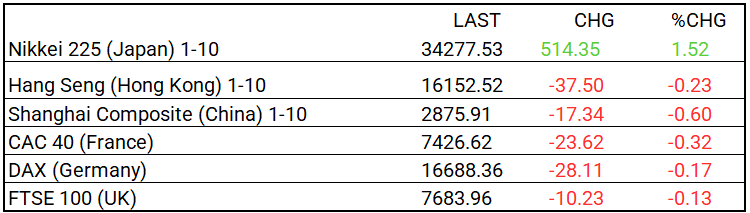

Global Markets Summary: Asian & European Markets:

- Nikkei 225 (Japan): 34,277.53 (+514.35, +1.52%)

- Hang Seng (Hong Kong): 16,152.52 (-37.50, -0.23%)

- Shanghai Composite (China): 2,875.91 (-17.34, -0.60%)

- CAC 40 (France): 7,426.62 (-23.62, -0.32%)

- DAX (Germany): 16,688.36 (-28.11, -0.17%)

- FTSE 100 (UK): 7,683.96 (-10.23, -0.13%)

Central Banking and Monetary Policy, Noteworthy:

- Nation’s Top Economists Are Short-Term Happy, Long-Term Glum – WSJ

- Lael Brainard Says ‘Work Is Not Done’ on Lowering Prices for Consumers – Bloomberg

- ECB’s Villeroy Reiterates That Rates Will Be Cut This Year – Bloomberg

Energy:

- Biden Mulls Tougher Climate Test for New LNG Projects – Bloomberg

China:

- Why is a unified national market now so vital for Beijing’s policymakers? – SCMP