MARKETS TODAY March 1 (Vica Partners)

Opening Monthly March Commentary

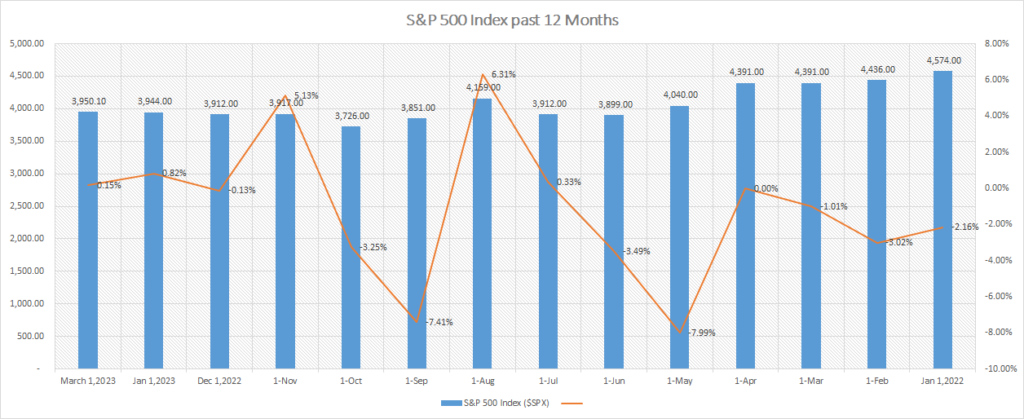

Over the last 50 years, Oct thru Jan have been the best time to buy stocks, with each month averaging between 1% and 1.6% per month gain on the S&P 500.

Historically, the stock market tends to gain in the first half of the month of February and lose in the second half. Between 1985 and 2022, the S&P 500 ended the month of February up 0.3%. March tends to be better than February and a reliable positive return month.

Session Overview

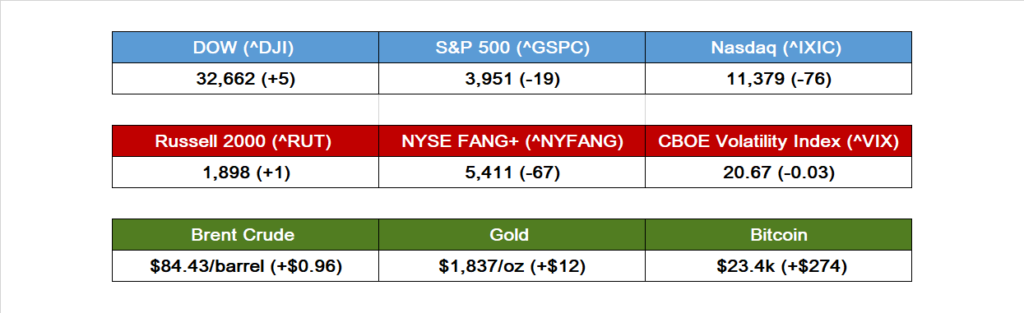

- Indexes mixed and mostly flat, DOW and Russell gain

- Yields rise, sluggish manufacturing data lifts Treasury’s

- U.S. construction spending declined in January missing analyst estimates

- Energy and Materials jumped

- 7 of 11 S&P sectors lower: Utilities and Real Estate underperformed/ Energy and Materials outperformed

- Salesforce Inc (CRM), RBC (RY), Dollar Tree (DLTR) with solid earnings beats

- Oil +up

- Metals markets higher

- USD index pulls back

- Bitcoin advances

- Fear & Greed Index Rating 56/ Greed

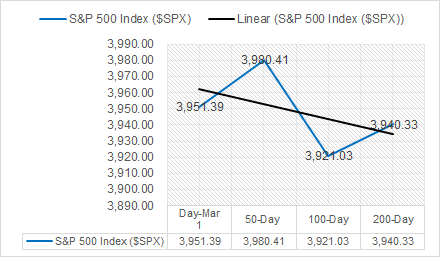

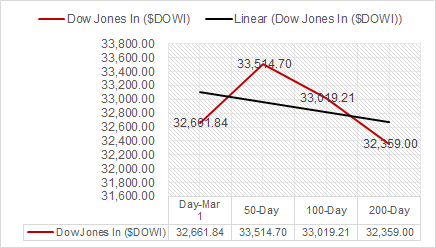

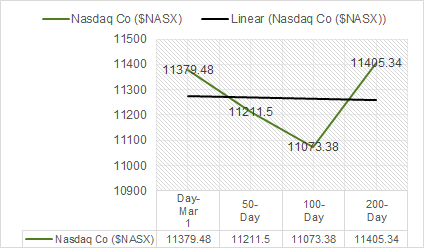

Key Index’s (50d, 100d, 200d)

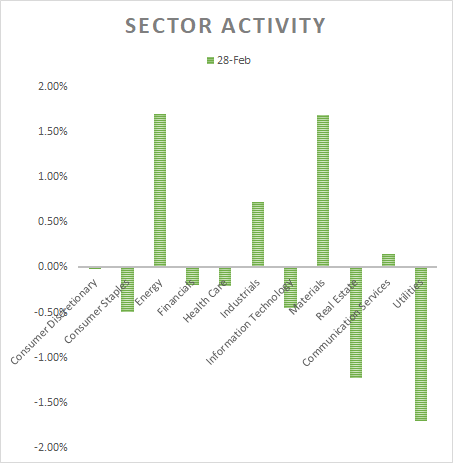

Sectors

- 7 of 11 S&P sectors lower: Utilities and Real Estate underperformed/ Energy and Materials outperformed. Utilities and Real Estate were the largest decliners, down 1.70% and 1.22% respectively. Energy and Materials were the biggest advancers, up 1.70% and 1.68% respectively.

Other Asset Classes:

- US Treasury: 2yr to 4.881% +, 5yr to 4.259%+, 10yr to 3.996%+, 30yr to 3.96%+

- USD index: -0.48 to $104.39

- Oil prices: Brent +1.15% to $84.41, WTI +0.90% to $77.74, Nat Gas +2.62% to $2.819

- Gold: +0.64% to $1,837.41, Silver: +0.52% to $20.99, Copper: +1.94% to $4.17

- Bitcoin: +1.19% to $23.4k

Notable Company Earnings

- Beats/ Salesforce Inc (CRM)RBC (RY), Dollar Tree (DLTR), Clean Harbors (CLH), Horizon Therapeutics (HZNP), Splunk (SPLK)

- Misses/ Nio A ADR (NIO), Reckitt Benckiser ADR (RBGLY), Kohl’s Corp (KSS), Lowe’s (LOW), Abercrombie&Fitch (ANF), Qurate Retail A (QRTEA)

U.S Economic News

Topline – S&P Global U.S. manufacturing PMI and ISM manufacturing for Feb increased to 47.3/ 47.4 respectively however numbers below 50 show contraction. U.S. construction spending declined in January missing analyst estimates.

- S&P Global U.S. manufacturing PMI (final): period Feb., act 47.3, fc 47.8, prev. 46.9

- ISM manufacturing: period Feb., act 47.7, fc 47.6%, prev. 47.4%

- Construction spending: period Jan., act -0.1%, fc 0.3%, prev. -0.7%

Business News

- Lilly to cut some list prices by 70% and offer $25 insulin – Reuters

- Caterpillar reaches tentative deal with union, averting possible strike – Reuters

- EV startups from Lucid to Rivian see demand fade, supply chain issues linger – Reuters

International Related News and Other

- U.S. House panel approves bill giving Biden power to ban TikTok – Reuters

- At the National People’s Congress China expected to outline a GDP growth target for 2023 of higher than 5% (last year the economy grew 3%) – Bloomberg

Vica Momentum Stock Report

- Coinbase Global Inc (COIN) $COIN (Momentum A) (Value D) (Growth C+), moving averages/ 50-Day +68.75%, 100-Day -12.17%, 200-Day +9.56%, Year-to-Date +81.10

Strong Momentum Buy Rating

Coinbase, Inc. provides data and transaction processing services. The Company offers digital currency wallet and platform for general transactions. Coinbase serves customers worldwide.

Market Outlook and updates posted at vicapartners.com