“Empowering Your Financial Success”

Daily Market Insights: November 17th, 2023

Global Markets Summary: Asian & European Markets:

- Nikkei 225 (Japan): +0.48%

- Shanghai Composite (China): +0.11%

- Hang Seng (Hong Kong): -2.12%

- CAC 40 (France): +2.07%

- FTSE 100: +1.23%

- DAX (Germany): +0.84%

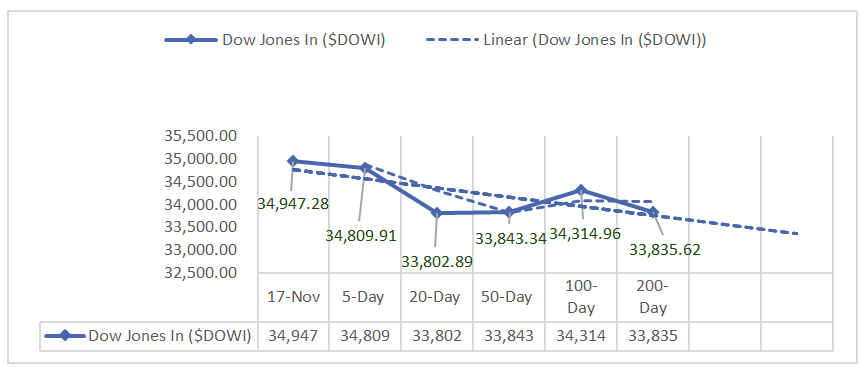

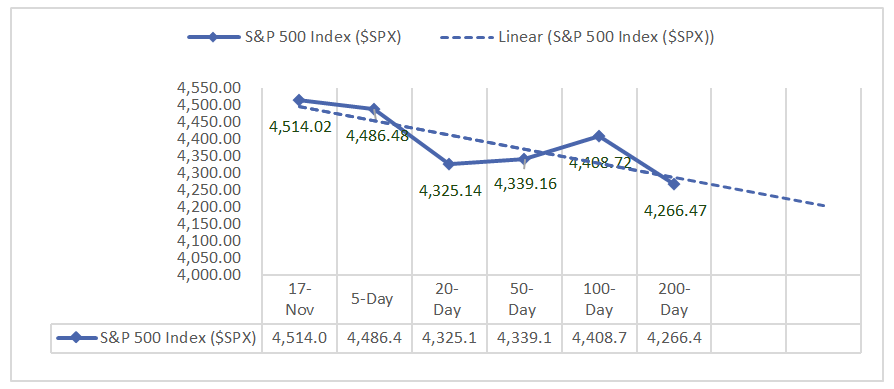

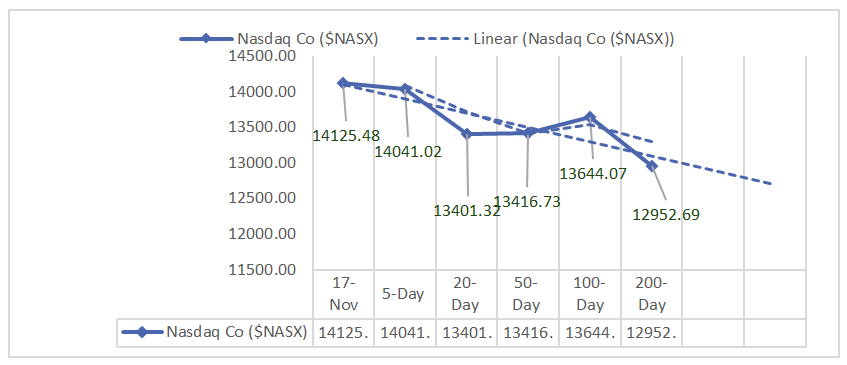

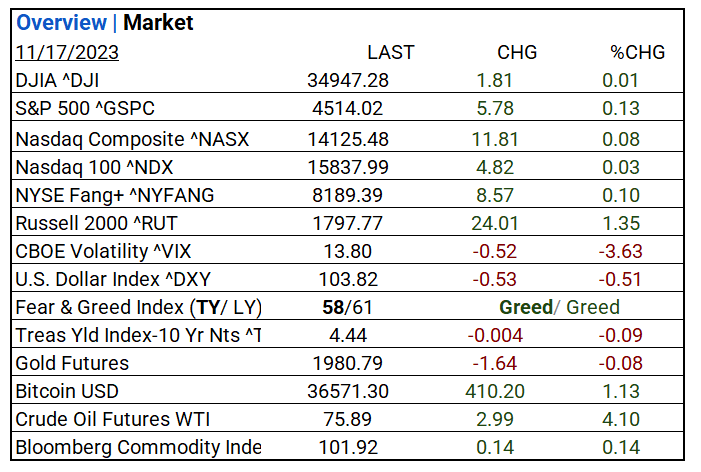

US Market Snapshot: Key Stock Market Indices:

- S&P Futures: opened@ 4509.55 (+0.03%)

- DJIA ^DJI: 34,947.28 (1.81, 0.01%)

- S&P 500 ^GSPC: 4,514.02 (5.78, 0.13%)

- Nasdaq Composite ^NASX: 14,125.48 (11.81, 0.08%)

- Nasdaq 100 ^NDX: 15,837.99 (4.82, 0.03%)

- NYSE Fang+ ^NYFANG: 8,189.39 (8.57, 0.10%)

- Russell 2000 ^RUT: 1,797.77 (24.01, 1.35%)

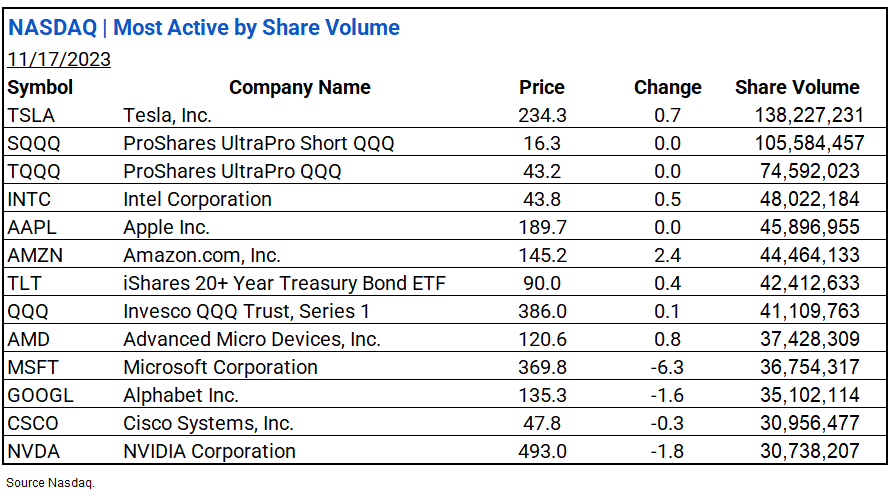

NASDAQ Global Market Summary:

Market Insights: Performance, Sectors, and Trends:

- Economic Data: In October, Initial Building Permits increased by 1.1% to 1.487M, while Housing Starts rose 1.9% to 1.372M.

- Market Indices: DJIA (+0.01%), S&P 500 (+10.13%), Nasdaq Composite (+0.08%).

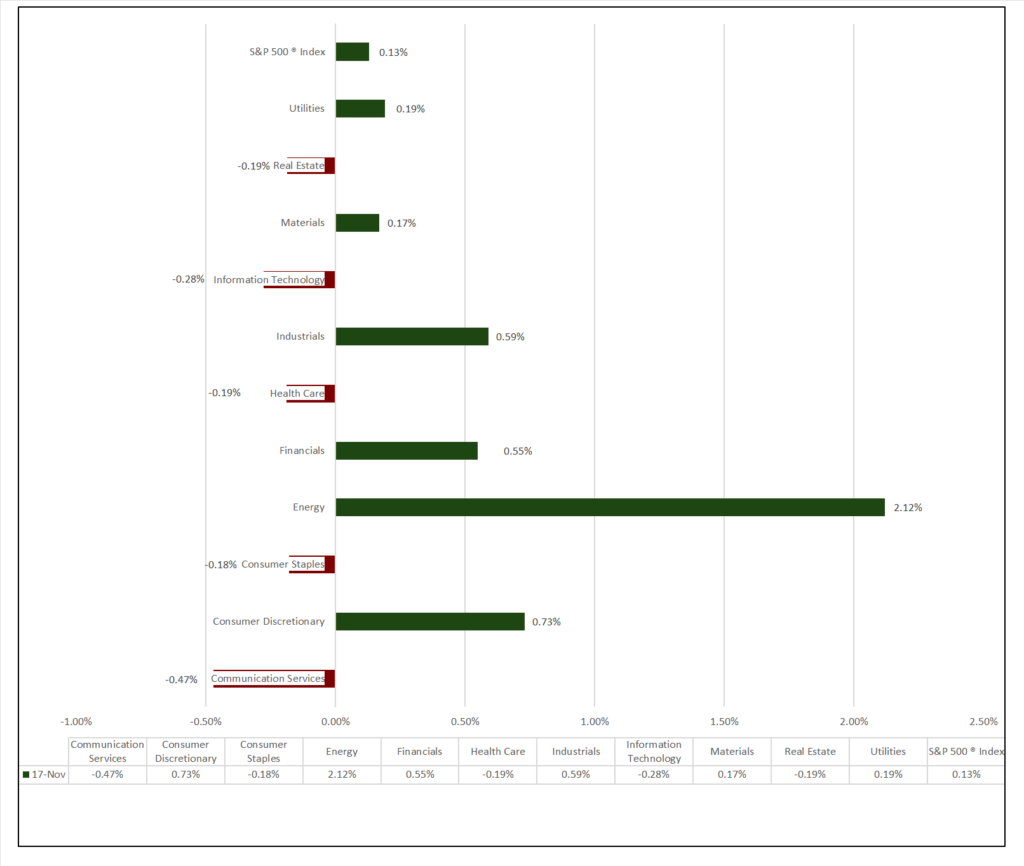

- Sector Performance: 6 of 11 sectors higher; Energy (+2.12%) leading, Communication Services (-0.47%) lagging. Top industry: Consumer Finance (+2.42%).

- Factors: –

- Top Volume ETF’s: SPDR S&P 500 ETF Trust ^SPY+0.12%, Invesco QQQ Trust ^QQQ, +0.02%, and iShares Russell 2000 ETF ^IWM +1.39%.

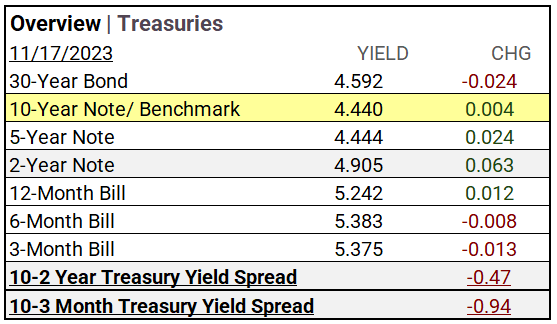

Treasury Markets:

- Treasury yields saw marginal changes: the 30-Year Bond decreased by -0.024, while the 2-Year Note increased by +0.063.

Currency and Volatility:

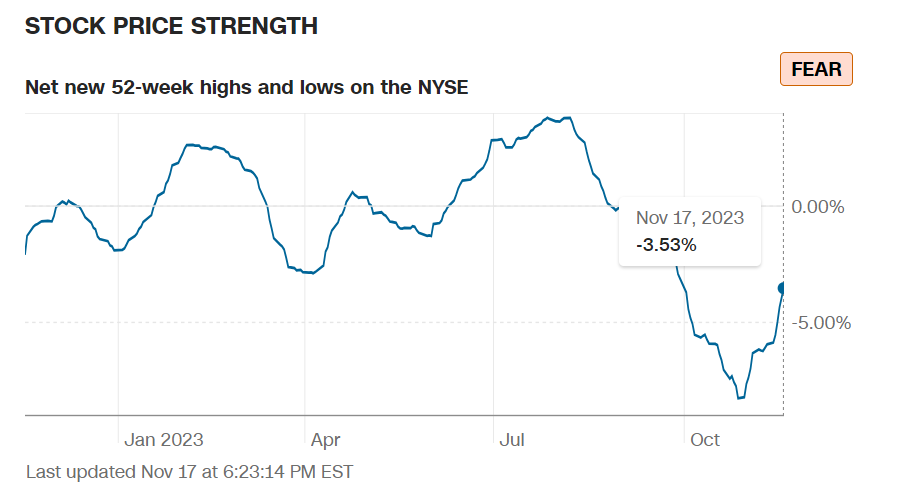

- U.S. Dollar Index declined, CBOE Volatility fell 3.63%, Fear & Greed reading reflects Greed.

source: CNN Fear and Greed Index

Commodity Markets:

- Bitcoin, Crude Oil futures and the Bloomberg Commodity Index gained; Gold futures declined.

- Gold Futures: 1,980.79 (-1.64, -0.08%)

- Bitcoin USD: 36,571.30 (+410.20, +1.13%)

- Crude Oil Futures WTI: 75.89 (+2.99, +4.10%)

- Bloomberg Commodity Index: 101.92 (+0.14, +0.14%)

Sectors:

- 6 of 11 sectors higher; Energy (+2.12%) leading, Communication Services (-0.47%) lagging. Top industries: Consumer Finance (+2.42%), Automobile Components (+2.36%0, and Oil, Gas & Consumable Fuels (+2.17%).

ETF Performance:

Top Volume:

- SPDR S&P 500 ETF Trust ^SPY, $450.79, +0.12% (55% calls)

- Invesco QQQ Trust ^QQQ, $386.04, +0.02% (61% calls)

- iShares Russell 2000 ETF ^IWM, $178.29, +1.37%, (64% puts)

Noteworthy:

- Energy Select Sector SPDR Fund ^XLE, $84.69, +2.10% (80% puts)

US Economic Data:

- Initial Building Permits MoM for Oct: 1.487M, +1.1% (prior: 1.471M, -4.5%)

- Housing Starts MoM Oct: 1.372M, +1.9% (prior: 1.358M, +7%).

Earnings:

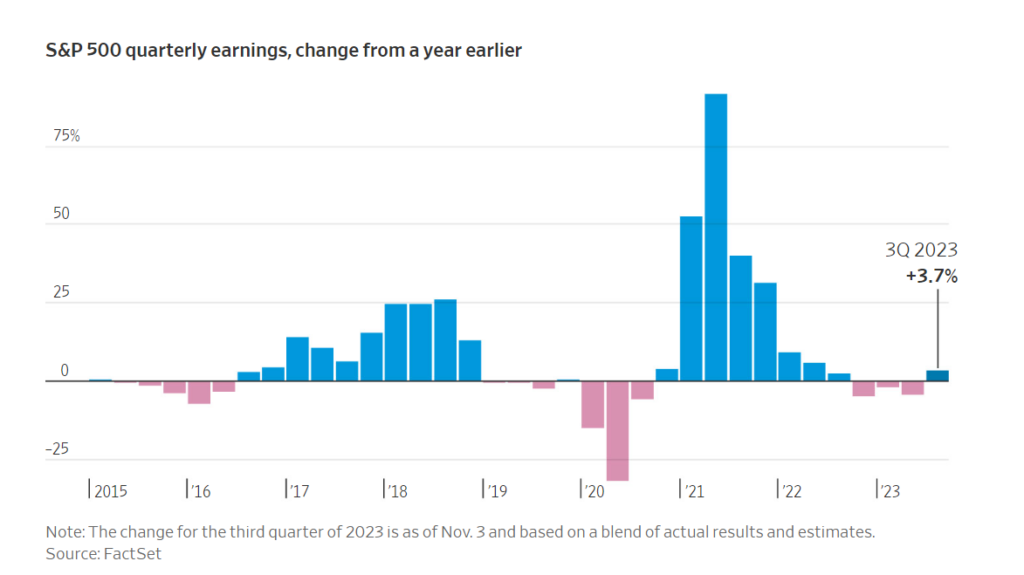

- Q3 Forecast: 64% of S&P 500 companies issue negative EPS guidance for Q3 2023. Communication Services and Consumer Discretionary lead in expected YoY earnings growth.

Notable Earnings Today:

- BEAT: Assicurazioni Generali (ARZGY), BJs Wholesale Club (BJ), Twist Bioscience (TWST).

- MISSED: MS&AD (MSADY), Atkore Intl (ATKR), Spectrum Brands (SPB), Buckle (BKE).

Central Banking and Monetary Policy:

- Powell’s Fed Sticks Together in Fight Against Inflation Despite Differences – Bloomberg

- The Global Fight Against Inflation Has Turned a Corner – WSJ

- US Continuing Jobless Claims Rise to Highest in Almost Two Years – Bloomberg

- Summers Says ‘Transitory Factors’ Behind Inflation Are Now Easing – Bloomberg

Energy:

- U.S. Crude-Oil Inventories Rise by 3.6 Million Barrels in Week to Nov. 10 – WSJ

- Carbon Removal Is Falling Behind. One Number Can Fix It – Bloomberg

China:

- US, China must curb national security impact on trade: commerce minister – SCMP