MARKETS TODAY May 31st, 2023 (Vica Partners)

Yesterday, US Markets finished mixed, S&P 500 +0.00%, DOW -0.15% and the Nasdaq +0.32%. 7 of 11 of the S&P 500 sectors lower: Consumer Staples -1.08% underperforms/ Consumer Discretionary +0.76% outperforms. On the upside, FANG+, Gold, Oil and Bitcoin. In economic news, S&P Case-Shiller April home price index narrowly beat forecast, Consumer Confidence Index misses forecast and declines to 6 month low.

Overnight/US Premarket, Asian markets finished lower. Hong Kong’s Hang Seng -1.94%, Japan’s Nikkei 225 -1.41% and China’s Shanghai Composite -0.61%. US S&P futures were trading at 0.9% below fair value. European markets finished lower, France’s CAC 40 -1.54%, Germany’s DAX -1.54% and London’s FTSE 100 -1.01%.

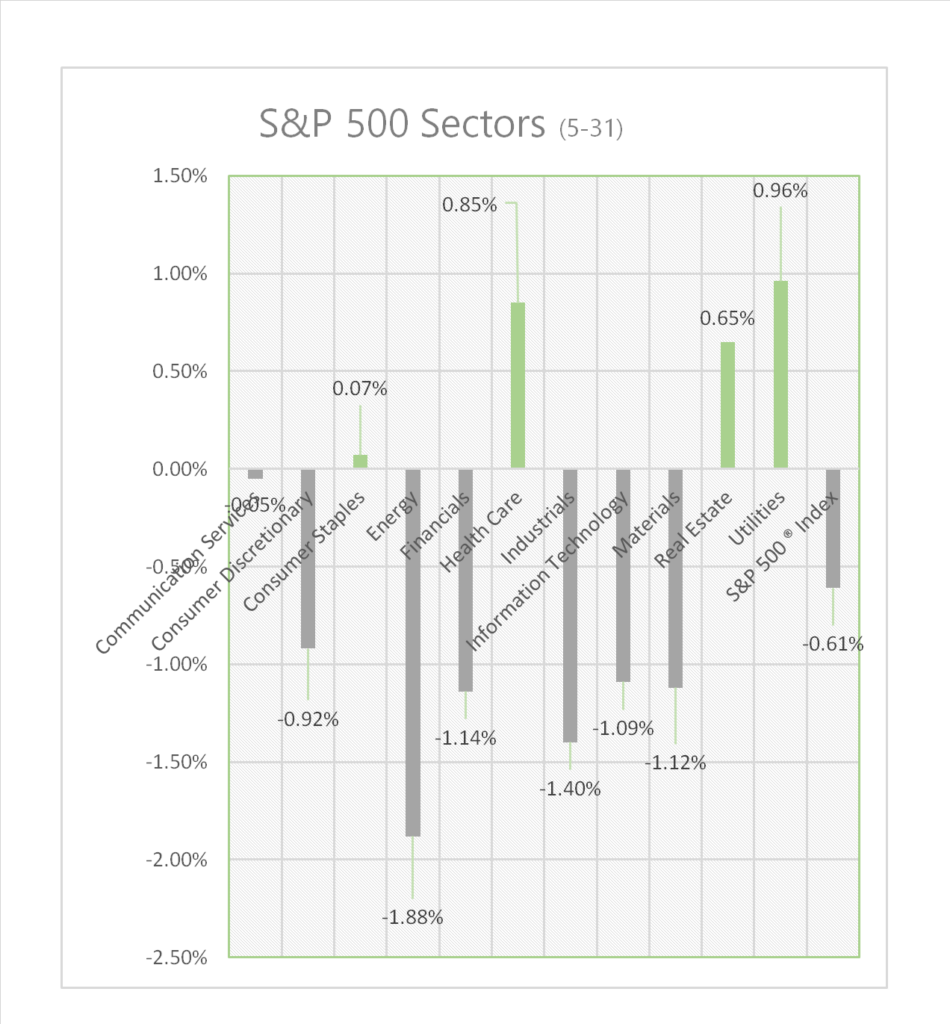

Today US Markets finished lower, S&P 500 -0.61%, DOW -0.41% and the Nasdaq -0.63%. 7 of 11 of the S&P 500 sectors lower: Energy -1.88% underperforms/ Utilities +0.96% outperforms. On the upside, Defensives and Gold. In economic news, Chicago PMI fell more than expected but JOLTS job openings unexpectedly beat estimates.

Takeaways

- Premarket weak economic data out of Asia, China PMIs miss

- Mixed US economic data

- The MSCI Momentum Indexes rebalance last day of May

- SPDR S&P Banking ETF (KRE) down >3%

- 7 of 11 of the S&P 500 sectors lower: Energy -1.88% underperforms/ Utilities +0.96% outperforms.

- Energy, Material Sectors and Oil fall on China contraction

- Salesforce Inc (CRM), Crowdstrike Holdings (CRWD) beat on earnings

- Probability of June Fed hike revised from 70% to 30% today

Pro Tip: The MSCI Momentum Indexes provide a systematic approach to capturing this momentum effect in equity markets. Each index in the MSCI family is reviewed quarterly and rebalanced twice a year in May and November (more information here)

Back to the market headline story …

Sectors/ Commodities/ Treasuries

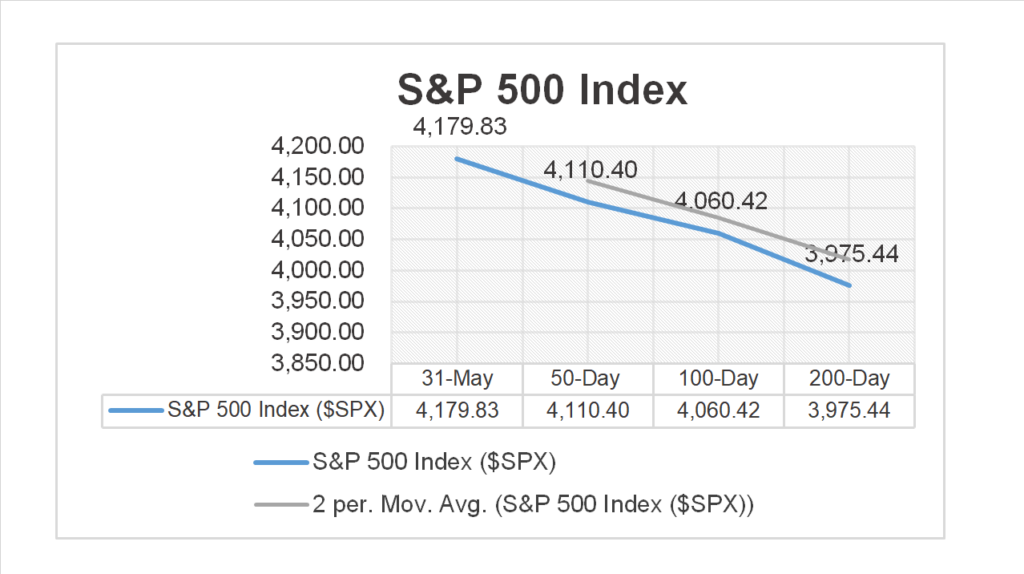

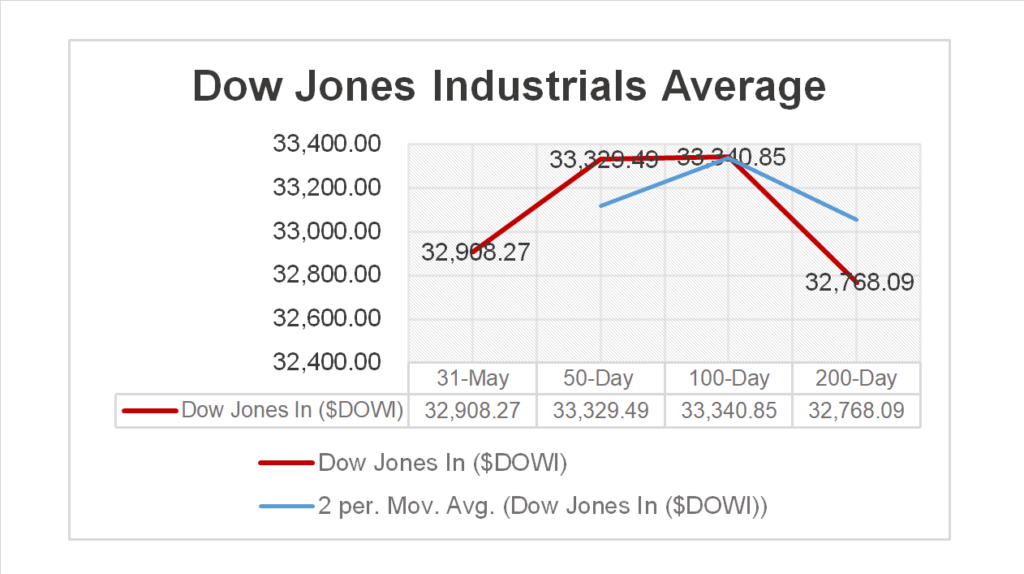

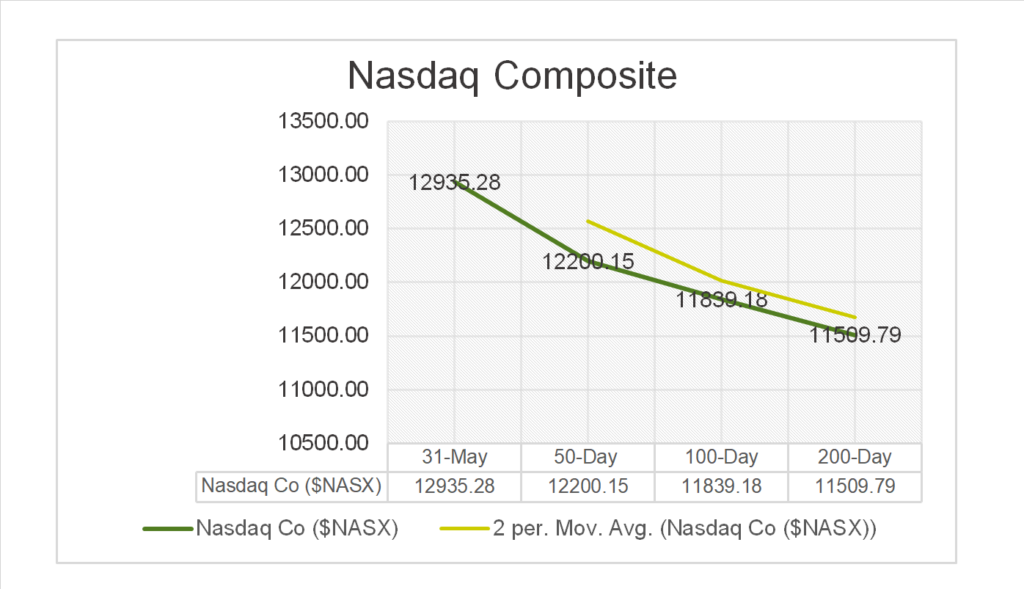

Key Indexes (50d, 100d, 200d)

S&P Sectors

- 7 of 11 of the S&P 500 sectors lower: Energy -1.88%, Industrials -1.40% underperform/ Utilities +0.96%, Real Estate outperform.

Commodities

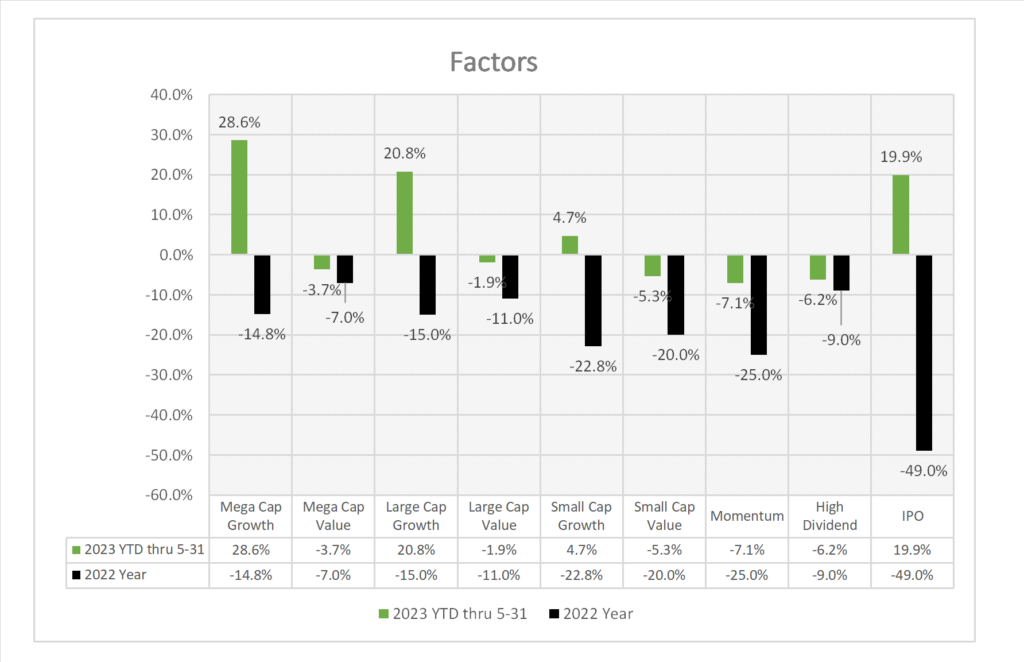

Factors (YTD)

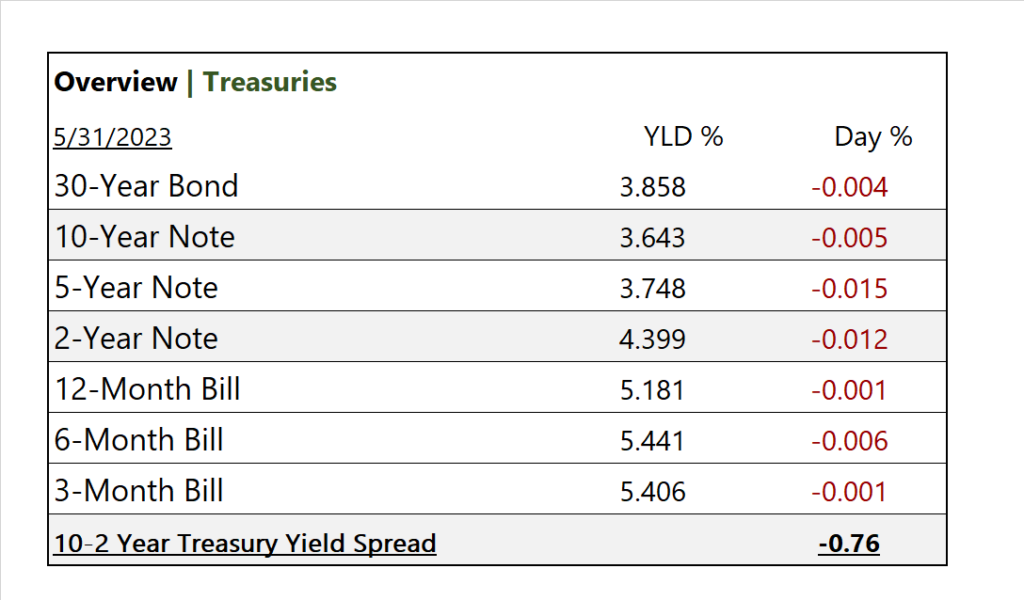

US Treasuries

Notable Earnings Today

- +Beat: Salesforce Inc (CRM), Crowdstrike Holdings (CRWD), Veeva Systems A (VEEV), Okta (OKTA), NetApp (NTAP), Chewy (CHWY), Pure Storage Inc (PSTG), Donaldson (DCI)C3 Ai (AI), CAE Inc. (CAE), Nordstrom (JWN)

- – Miss: National Bank of Canada (NTIOF), IVERIC bio (ISEE), Advance Auto Parts (AAP), Frontline (FRO), Victoria’s Secret Co (VSCO)

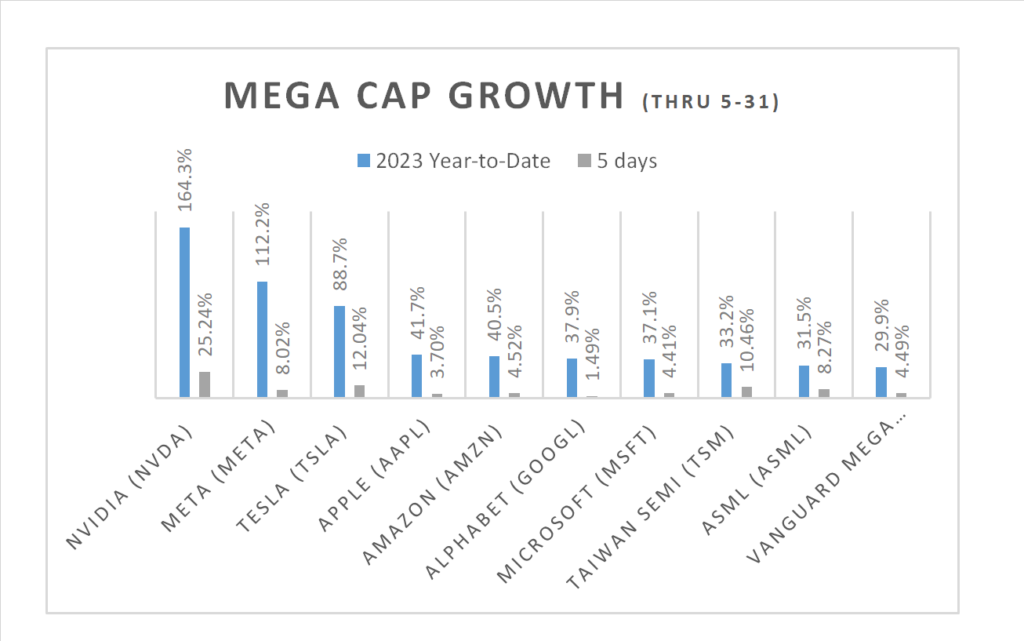

- * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), UI Path (PATH)

Economic Data

US

- Chicago Business Barometer; period May, act 40.4, fc 47.3, prev. 48.6

- US job openings; period April, act 10.1m, fc 9.5m, prev. 9.7m

News

Company News

- Meta Platforms Asks Federal Court to Block FTC in Privacy Fight – WSJ

- Hyundai Motor, LG Plan $4.3 Billion EV Battery Plant in US – Bloomberg

Energy/ Materials

- US-China Green Energy Rivalry ‘Great for World,’ Forrest Say – Bloomberg

Central Banks/Inflation/Labor Market

- Fed Prepares to Skip June Rate Rise but Hike Later – WSJ

- Chicago Business Barometer™ & Research – ISM

- US. Job Openings Rose in April, Reversing Three Months of Decline – WSJ

China

- China Slowdown Fear Is Starting to Show Up in Korean Markets – Bloomberg

Education

- In technical analysis, a death cross is a term used to describe a bearish signal that occurs on a price chart when a shorter-term moving average crosses below a longer-term moving average. The interpretation of a death cross depends on the specific moving averages being used and the context in which it occurs. Here’s a general interpretation of a technical death cross: