“Empowering Your Financial Success”

Daily Market Insights: October 9th, 2023

Global Markets Summary:

Asian Markets:

- Hang Seng (Hong Kong): +0.18%

- Shanghai Composite (China): 0.00%

- Nikkei 225 (Japan): -0.26%

US Futures:

- S&P Futures: opened @ 4289.02 (-0.45%)

European Markets:

- FTSE 100 (London): -0.03%

- CAC 40 (France): -0.55%

- DAX (Germany): -0.67%

US Market Snapshot:

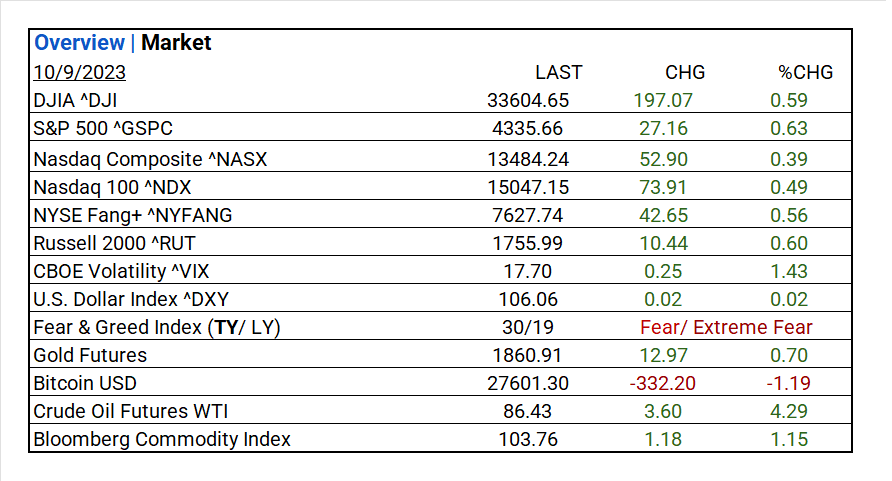

Key Stock Market Indices:

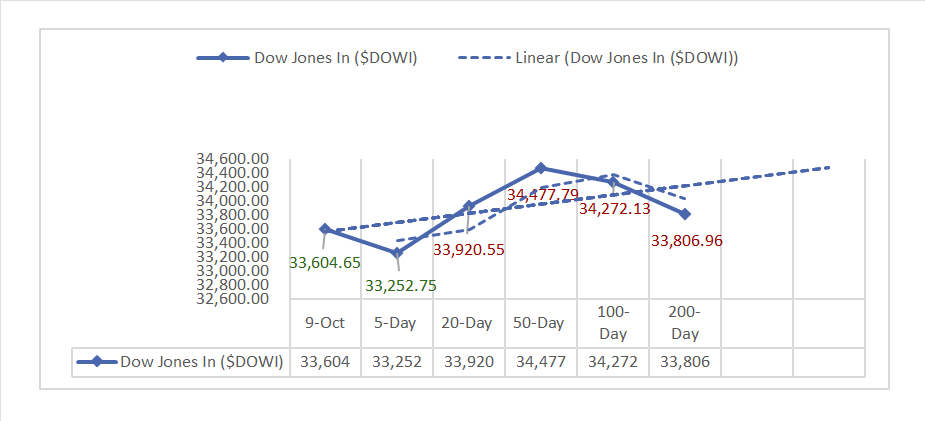

- DJIA ^DJI: 33,604.65 (+197.07, +0.59%)

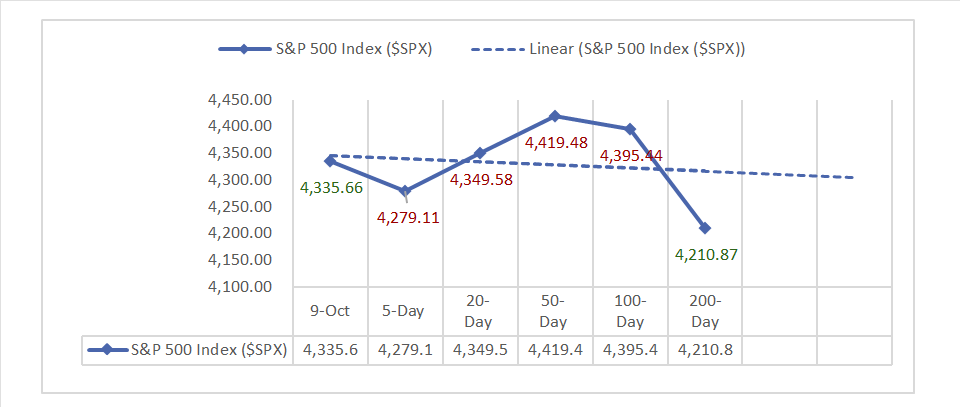

- S&P 500 ^GSPC: 4,335.66 (+27.16, +0.63%)

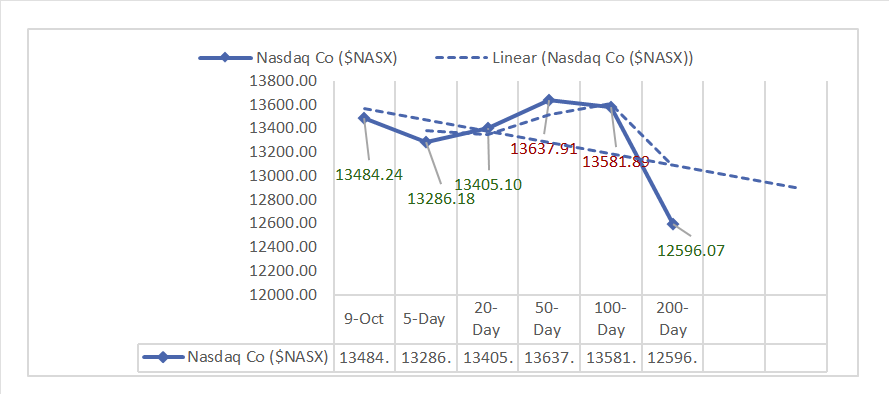

- Nasdaq Composite ^NASX: 13,484.24 (+52.90, +0.39%)

- Nasdaq 100 ^NDX: 15,047.15 (+73.91, +0.49%)

- NYSE Fang+ ^NYFANG: 7,627.74 (+42.65, +0.56%)

- Russell 2000 ^RUT: 1,755.99 (+10.44, +0.60%)

Market Insights: Performance, Sectors, and Trends:

- Economic Data: No reports issued today.

- Market Indices: U.S. stock indices all advanced as the S&P 500, Nasdaq Composite, Nasdaq 100, NYSE Fang+, and Russell 2000 all posted gains.

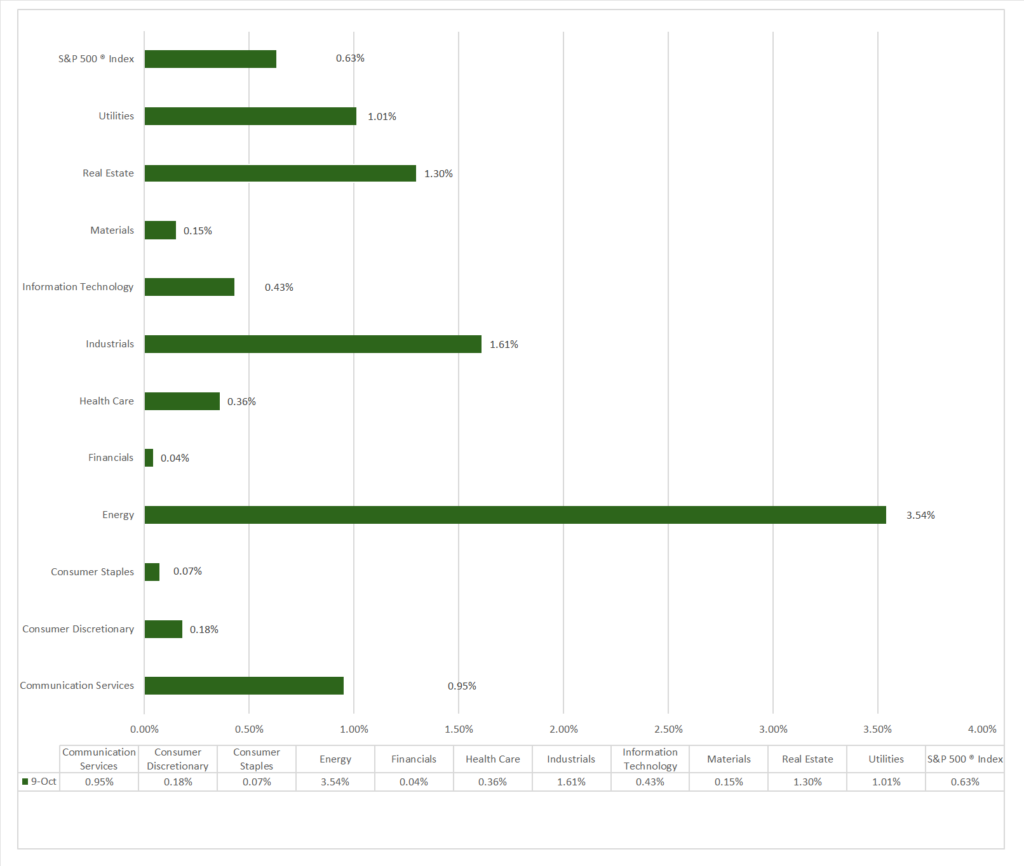

- Sector Performance: All 11 sectors gained, Energy outperformed (+3.54%), while Financials (0.04%) lagged. Top Industry: Aerospace & Defense (+5.63%), Energy Equip & Services (+4.76%), Oil, Gas & Consumable Fuels (+3.41%).

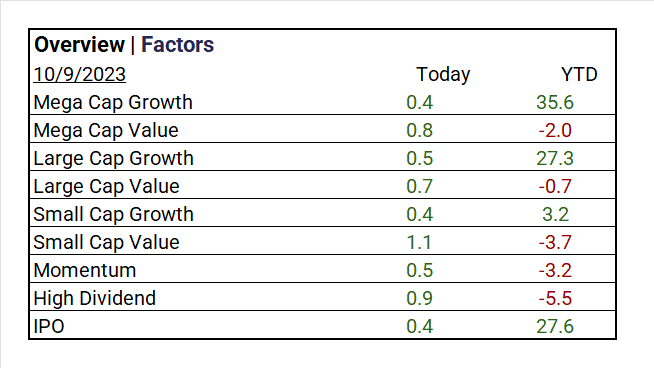

- Factors: Value tops Growth.

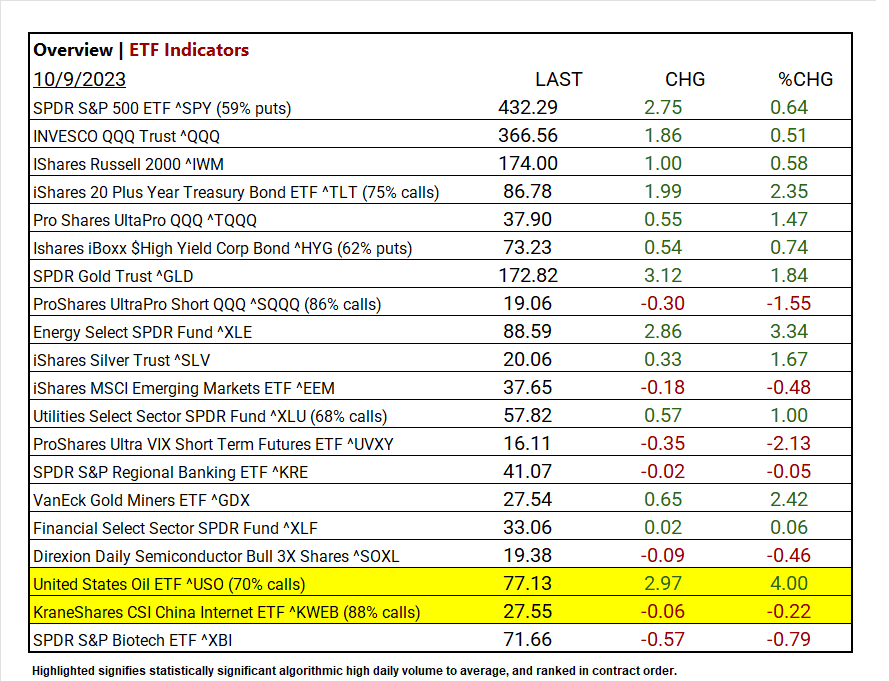

- Top ETF: United States Oil ETF ^USO +4.00%.

- Worst ETF: ProShares Ultra VIX Short Term Futures ETF ^UVXY -2.13%.

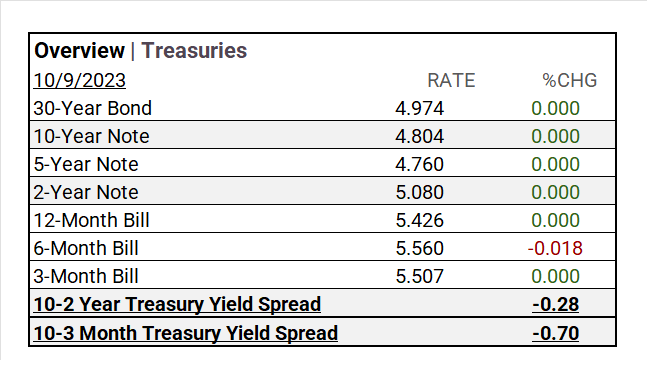

- Treasury Markets: Bond Market closed.

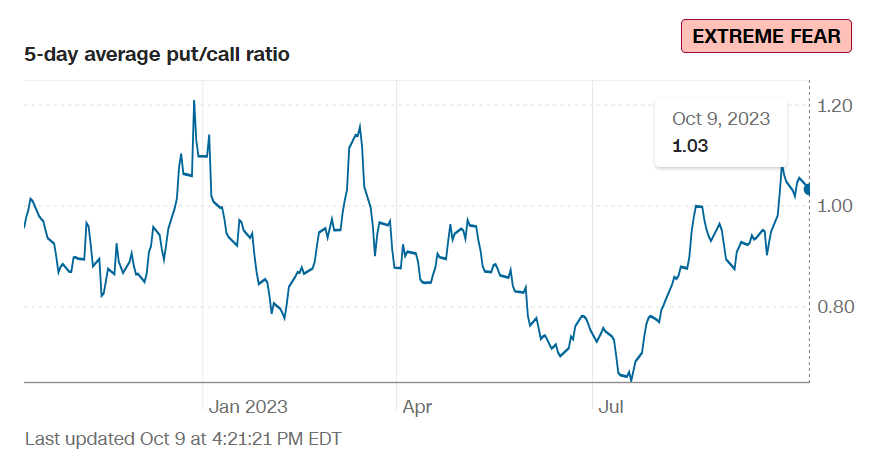

- Currency and Volatility: The U.S. Dollar Index rises, CBOE Volatility up +1.43%, and the Fear & Greed reading: Fear.

- Commodity Markets: Gold, Crude Oil Futures WTI the Bloomberg Commodity gain, Bitcoin falls.

Sectors:

- All 11 sectors gained, Energy outperformed (+3.54%), while Financials (0.04%) lagged. Top Industry: Aerospace & Defense (+5.63%), Energy Equip & Services (+4.76%), Oil, Gas & Consumable Fuels (+3.41%), and Office REITs (+2.43%).

Treasury Yields and Currency:

Treasury Yields and Currency:

- Bond Market closed for Holiday.

- The U.S. Dollar Index ^DXY: 106.06 (+0.02, +0.02%)

Market Volatility and Sentiment:

- CBOE Volatility ^VIX: 17.70 (+0.25, +1.43%)

- Fear & Greed Index (TY/LY): 30/19 (Fear/ Extreme Fear).

Source: CNN Fear and Greed Index

Commodities:

- Gold Futures: 1860.91 (+12.97, +0.70%)

- Bitcoin USD: 27,601.30 (-332.20, -1.19%)

- Crude Oil Futures WTI: 86.43 (+3.60, +4.29%)

- Bloomberg Commodity Index: 103.76 (+1.18, +1.15%)

Factors:

- Value tops Growth, Small Cap Value, (+1.1%), High Dividend (+0.9%).

ETF Performance:

ETF Performance:

Top 3 Best Performers:

- United States Oil ETF ^USO +4.00%

- Energy Select SPDR Fund ^XLE +3.34%

- VanEck Gold Miners ETF ^GDX +2.42%

Top 3 Worst Performers:

- ProShares Ultra VIX Short Term Futures ETF ^UVXY -2.13%

- ProShares UltraPro Short QQQ ^SQQQ -1.55%

- SPDR S&P Biotech ETF ^XBI -0.79%

US Major Economic Data

August

- n/a

September/ October

- n/a

Earnings:

- Q1 ’23: 79% of companies beat analyst estimates.

- Q2 Forecast/Actual: Predicted <7.2%> FY 2023 S&P 500 EPS decline; FY 2023 EPS flat YoY. By 7-28, 51% reported Q2 2023, results; 80% beat EPS estimates, above 5-year (77%) and 10-year (73%) averages. Earnings exceeded estimates by 5.9%, slightly below the 5-year (8.4%) and 10-year (6.4%) averages.

- Q3 Forecast: 116 companies in the index have issued EPS guidance for Q3 2023, Of these 116 companies, 74 have issued negative EPS guidance and 42 have issued positive EPS guidance. The percentage of S&P 500 companies issuing negative EPS guidance for Q3 2023 is 64% (74 out of 116), which is above the 5-year average of 59% but equal to the 10-year average of 64%. Eight of the eleven sectors are expected to see year-over-year earnings growth, with Communication Services and Consumer Discretionary leading the way. Conversely, three sectors, mainly Energy and Materials, are anticipated to experience earnings declines.

Notable Earnings Today:

- Beat: n/a

- Miss: n/a

Resources:

- What’s Expected in October

- Vica Partners Economics Forecast

News

Investment and Growth News

- Tesla Prices Now Rival Average US Cars After Billions in Cuts – Bloomberg

- Activist Investor Nelson Peltz Seeks Board Seats at Disney – Bloomberg

- US allows Samsung and SK Hynix to expand their chip plants in China in key concession to South Korea – SCMP

Infrastructure and Energy

- U.S. Probe of Russia-Sanctions Busting Focuses on Major Oil Trader – WSJ

- OPEC Boosts Oil Demand Forecast to 2045 Despite Climate Crisis – Bloomberg

Real Estate Market Updates

- Texas Cities Are Booming, but Their Offices Are the Most Vacant – WSJ

Central Banking and Monetary Policy

- Rate Cliff Awaits Global Economy After Higher-for-Longer Plateau – Bloomberg

- Big-Company Bankruptcies Hang Over Economy – WSJ

International Market Analysis (China)

- China struggling to wean itself off US dollar assets despite financial de-risking calls – SCMP