MARKETS TODAY June 20th, 2023 (Vica Partners)

Last Friday, US Markets finished lower, S&P 500 -0.37%, DOW -0.32%, Nasdaq -0.68%. 8 of 11 of the S&P 500 sectors declining: Utilities +0.53% outperforms/ Communication Services -1.00% lags. On the upside, Treasury Yields, USD Index, Bitcoin, Oil and the Bloomberg Commodity Index. In economic news, U of Mich. Sentiment beats as consumers more upbeat on inflation.

Overnight/US Premarket, Asian markets finished mixed, Japan’s Nikkei 225 +0.06%, Hong Kong’s Hang Seng -1.54%, China’s Shanghai Composite -0.47%. European markets finished lower, Germany’s DAX -0.55%, France’s CAC 40 -0.27%, London’s FTSE 100 -0.25%. S&P futures were trading at 0.4% below fair-value.

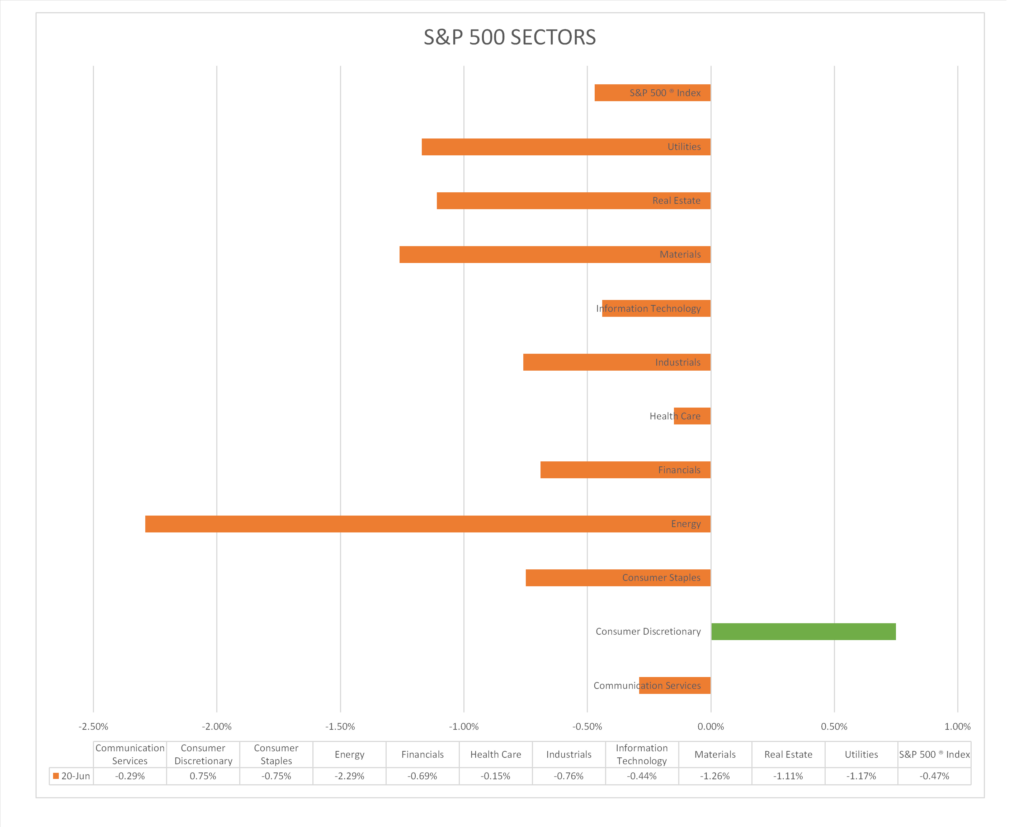

Today US Markets finished lower, S&P 500 -0.47%, DOW -0.72%, Nasdaq -0.16%. 10 of 11 of the S&P 500 sectors declining: Consumer Discretionary +0.75% outperforms/ Energy -2.29% lags. On the upside, NY FANG+, Mega Cap Tech, Bitcoin, Treasury Yields mixed. In economic news, Housing Marker Index and starts beat consensus.

Takeaways

- Underwhelming China rate cut

- US Housing Market Index @55 first time >50 since July ‘22

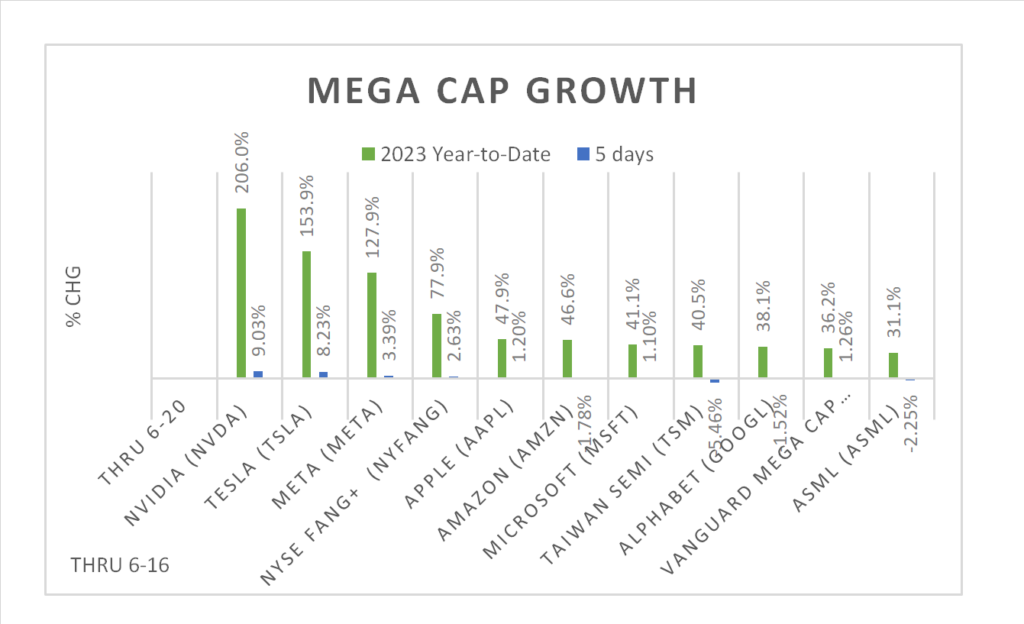

- FANG+ Mega Cap Growth Tech delivers, Tesla +>5%

- 10 of 11 of the S&P 500 sectors declining: Consumer Discretionary +0.75% outperforms/ Energy -2.29% lags

- Bitcoin, up 5%

- FedEx (FDX) misses on earnings

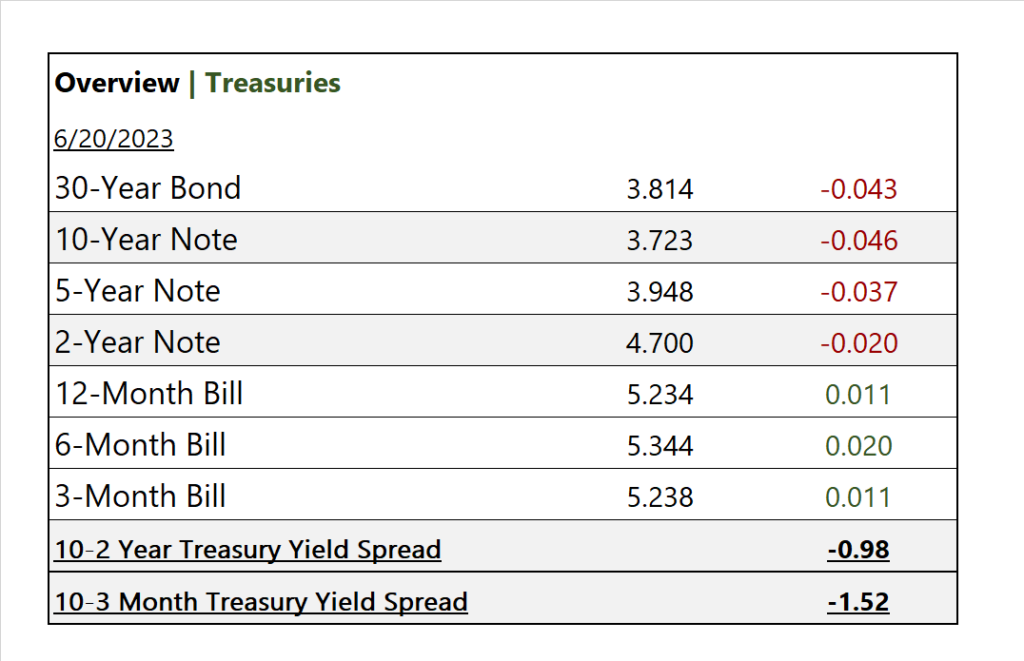

- Inversion curve increasing/ 10-2year -0.98, 10– 3m -1.52

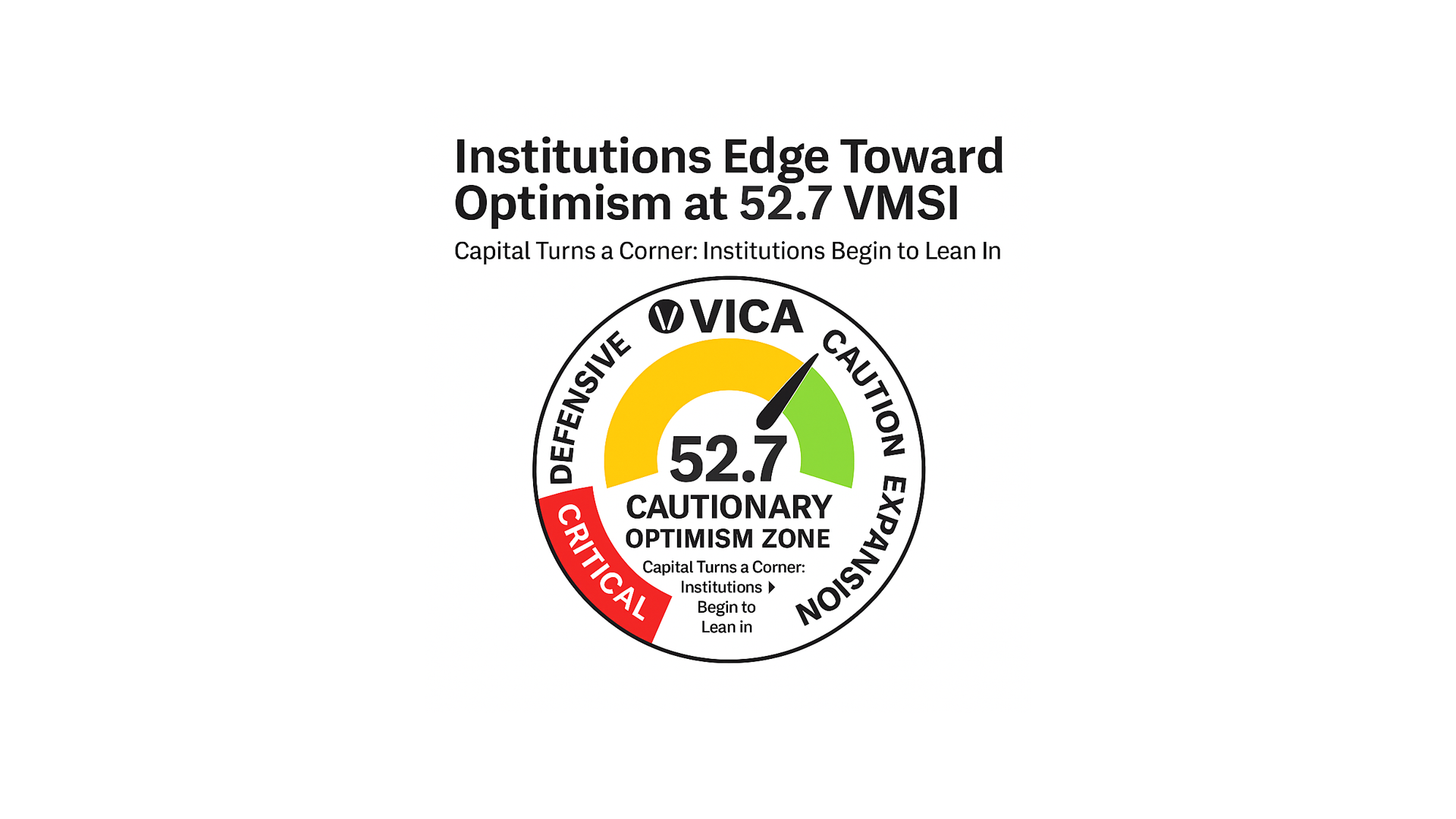

Pro Tip: Shadow the FANG+ leaders as Index YTD market performance is @77.91%.

Sectors/ Commodities/ Treasuries

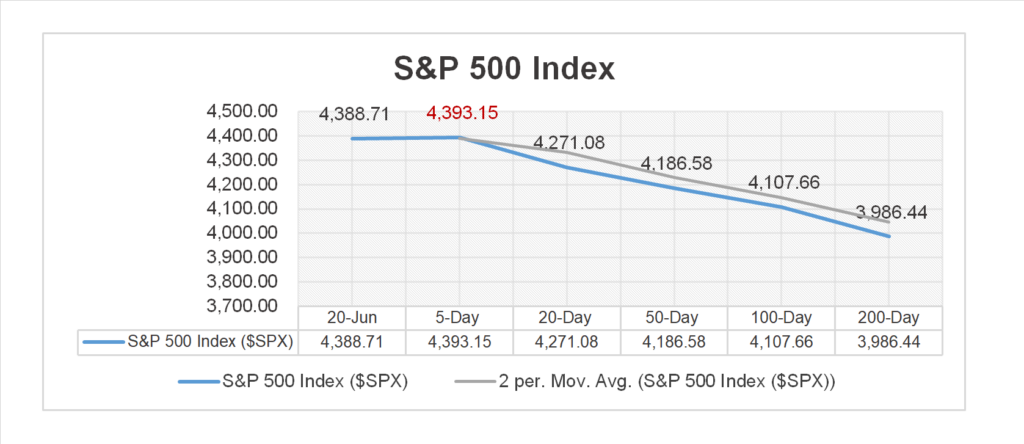

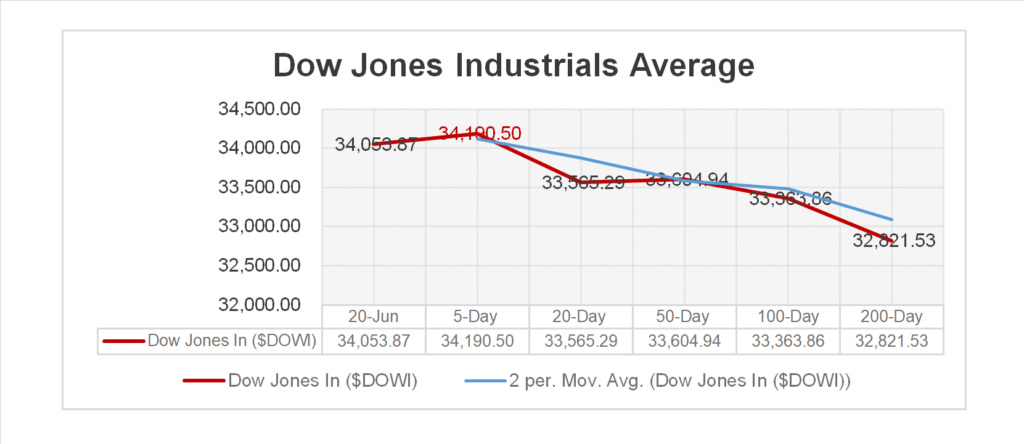

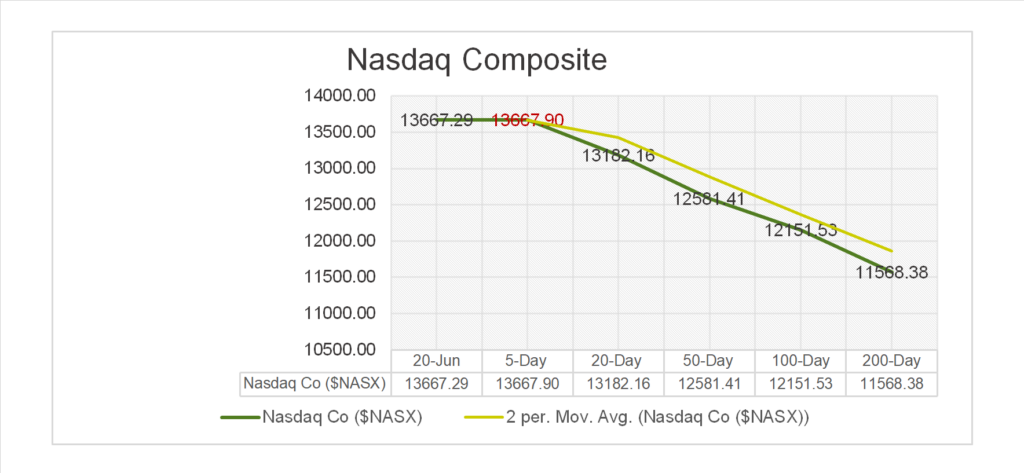

Key Indexes (5d, 20d, 50d, 100d, 200d)

S&P Sectors

- 10 of 11 of the S&P 500 sectors declining: Consumer Discretionary +0.75% outperforms/ Energy -2.29%, Materials -1.26% lag.

Commodities

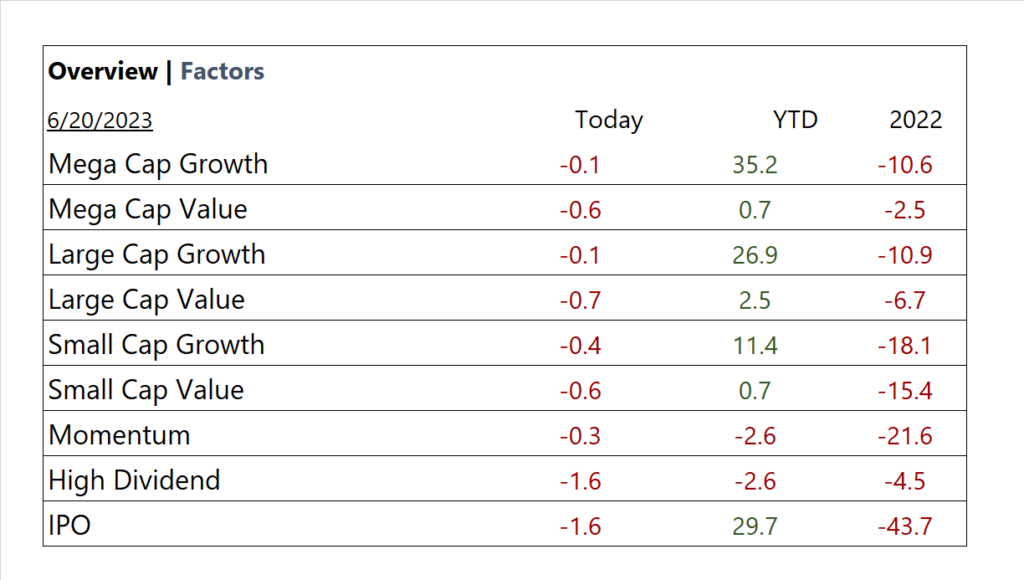

Factors

Factors

US Treasuries

Notable Earnings Today

Notable Earnings Today

- +Beat: La-Z-Boy (LZB)

- – Miss: FedEx (FDX)

- Pending: Tesco PLC (TSCDY)

- * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), Broadcom Inc (AVGO), Intel (INTC)

Economic Data

US

- Housing starts; period May, act 1.63m, fc 1.39m. prior 1.40m

News

Company News

- Why Tesla’s Stock Rally Doesn’t Make Sense—in Eight Charts – WSJ

- Electronic Arts Restructures, Names New Head of Entertainment – Bloomberg

Energy/ Materials

- China Signs 27-Year Qatar LNG Deal to Boost Energy Security – Bloomberg

Central Banks/Inflation/Labor Market

- Wall Street Buys More T-Bills, Parks Less at Fed – WSJ

- ECB Has Completed Most of Its Rate-Hike Path, Villeroy Says – Bloomberg

China/ Asia