MARKETS TODAY Feb 3 (Vica Partners)

DOW (^DJI) 33,926 (-128), S&P 500 (^GSPC) 4,136 (-43), Nasdaq (^IXIC) 12,007 (-194), Russell 2000 (^RUT) 1,986 (-16), NYSE FANG+ (^NYFANG) 5,732 (-151), Brent Crude $79.94/barrel (-$2.23), Gold $1,866/oz (-$49), Bitcoin $23.3k (-$125)

Session Overview

- Growth/tech rally week declines following Apple, Amazon and Alphabet earnings

- Key Indexes decline

- Yields rise

- S&P 500, up 7.7% YTD

- All 11 S&P 500 Sectors lower: The Utilities and Consumer Discretionary underperformed/ Health Care and Energy outperformed

- Nonfarm payrolls reported better than expected w/ +job gains

- Soft landing supports w/ unemployment rate down @ 50 year low, labor participation up

Technicals/ Sector Performance/ Yields+

Index Moving Averages

S&P 500 Index ($SPX) close 4,137+/ 50 Day 3,957+/ 100 Day 3,872+/ 200 Day 3,950+

Dow Jones In ($DOWI) close 33,926+/ 50 Day 33,665+/ 100 Day 32,437+/ 200 Day 32,336+

Nasdaq Co ($NASX) close 12,007+/ 50 Day 11,022+/ 100 Day 10,977+/ 200 Day 11,465+

6 of 11 S&P 500 Sectors higher: Communication Services and Information Technolgy outperforms, Energy and Materials underperforms.

All 11 S&P 500 Sectors lower: The Utilities and Consumer Discretionary sectors were the biggest decliners, down 2.05% and 2.01% respectively. Health Care and Energy outperformed, down 0.20% and 0.23% respectively.

Note- energy and defensive sectors have underperformed YTD and reflects in the Dow Jones Industrial Average.

Yields advance: US – 2yr to 4.287%+, 5yr to 3.652%+, 10yr to 3.519%+, 30yr to 3.616%+

Greed Index Rating 76/ Greed

Notable Company Earnings

- Beats / Regeneron Pharma (REGN), Mitsui & Company (MITSY) , Zimmer Biomet (ZBH)

- Misses/ Deutsche Bank AG (DB), Cigna (CI), Sanofi ADR (SNY)

U.S Economic News

- Nonfarm payrolls; period , actual 517,000, forecast 187,000, previous 260,000

- Unemployment rate; period Jan., actual 3.4%, forecast 3.6%, previous 3.5%

- Average hourly earnings; period Jan., actual 0.3%, forecast 0.3%, previous 0.4%

- S&P U.S. services PMI (final); period , actual 46.8, forecast 46.6, previous 46.6

- ISM services index; period Jan., actual 55.2%, forecast 50.6%, previous 49.6%

Other Asset Classes:

- CBOE Volatility Index (^VIX): +0.86 to 18.73

- USD index: +$0.12 to $101.87

- Oil prices: Brent: -2.71% to $79.94, WTI: -3.28% to $73.39, Nat Gas: -1.87% to $2.410

- Gold: -2.57% to $1,865.94, Silver: -4.78% to $22.35, Copper: -1.48% to $4.03

- Bitcoin: -0.53% to $23.3k

Business News

- French, German ministers to tell U.S. don’t poach EU investments –sources reuters

- Indian watchdog tells investors markets stable despite Adani rout reuters

- Nestle to hike food prices further in 2023, CEO says reuters

- Japan to restrict chip manufacturing machine exports to China, Kyodo reports reuters

Vica Momentum Stock Report

Humana (HUM) $HUM (Momentum B) (Value A+) (Growth A), moving averages – 50 Day -9.26%, 100 Day -1.97%, 200 Day +3.90%, Year-to-Date -6.95%

Humana Inc. is one of the largest health care plan providers in the United States. It was organized as a Delaware corporation in the year 1964. It provides health insurance benefits under Health Maintenance Organization (HMO), Private Fee-For-Service (PFFS), and Preferred Provider Organization (PPO).

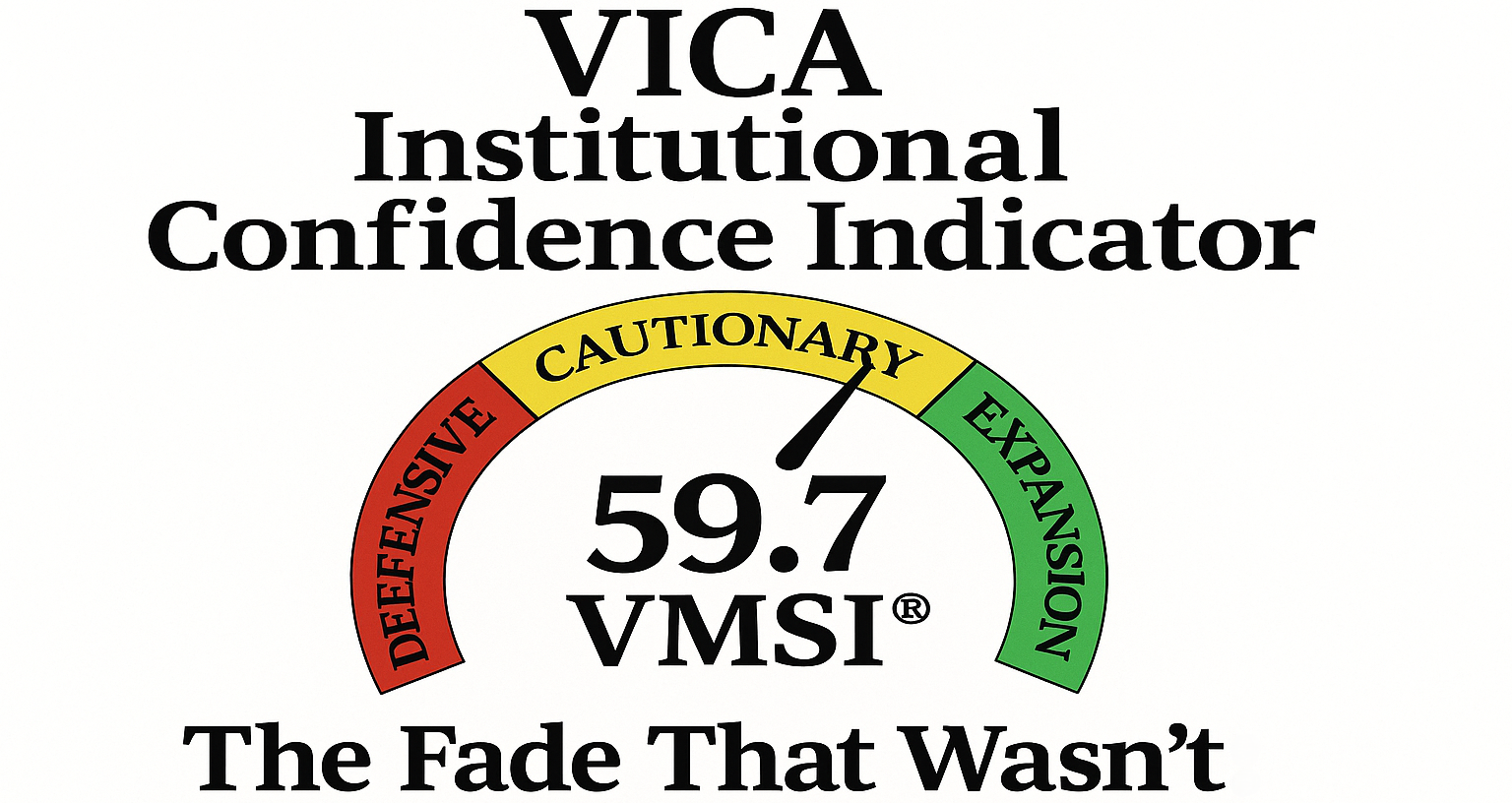

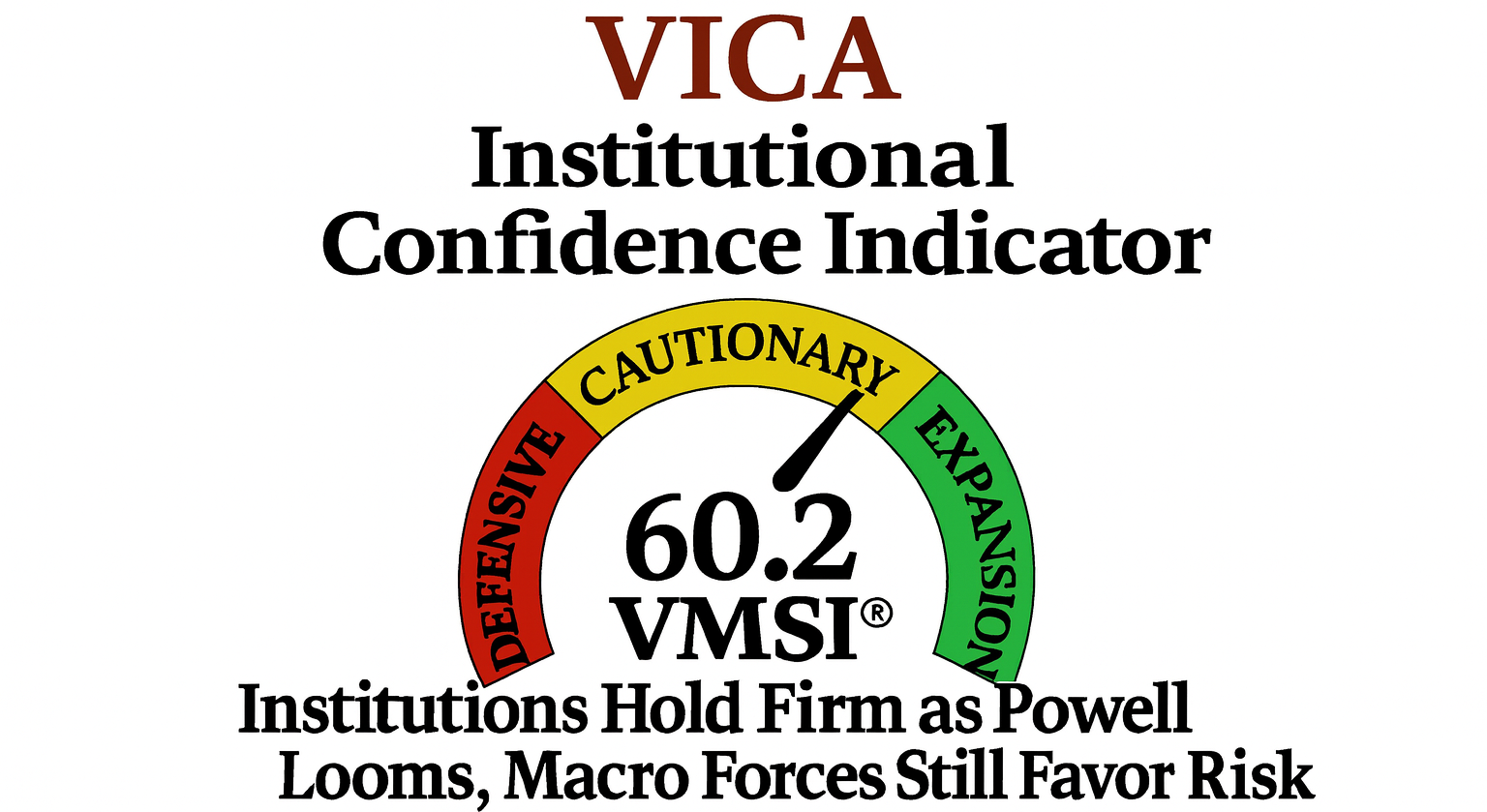

Market Outlook

Market Outlook and updates posted at vicapartners.com