VICA Research – April 3, 2025

In this analysis, we break down the real-time market impact of President Trump’s sweeping tariff announcement. With sharp declines across the S&P 500, NASDAQ, and Dow, and technical indicators confirming a structural shift, this piece offers a concise yet comprehensive look at why this isn’t a correction—but a full regime reset. Investors seeking tactical clarity and macro insight will find their answers here.

Tariffs and the Index Shock: Why It Hits Now

■ Tariffs Are a Direct Shock to Earnings Multiples By raising the cost of imported inputs, tariffs compress corporate margins—especially in globally integrated sectors like tech, manufacturing, and retail. Lower earnings expectations mean multiple contraction—a fundamental driver of index repricing.

■ Index Weightings Amplify Exposure to Global Trade The S&P 500 and NASDAQ are heavily weighted toward multinational firms. With over 40% of S&P 500 revenues coming from overseas, the introduction of tariffs acts as a broad-based penalty on index constituents, forcing downside repricing.

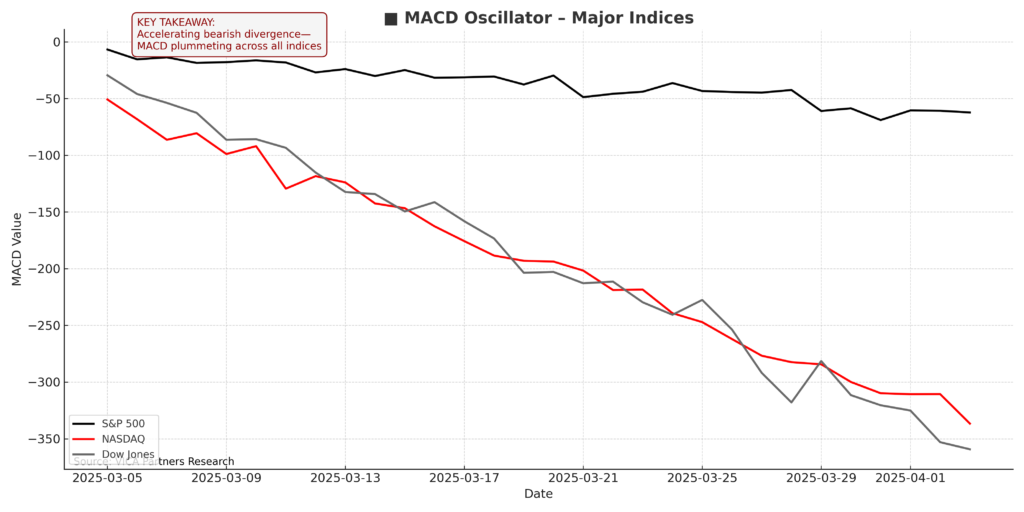

■ Volatility Signals Capital Flight from Risk Assets The market’s reaction today—sharp drawdowns, rising ATRs, and collapsing MACD—reflects a systemic response: investors are exiting forward-growth names and reallocating to defensives. This isn’t stock-picking—it’s index-wide derisking.

I. Executive Trigger: Tariffs as a Structural Market Catalyst

President Donald Trump’s declaration of a 10% across-the-board import tariff—escalating up to 54% for strategic adversaries like China—has landed not as a political gesture, but as a definitional market catalyst. The initiative represents a structural tax on globalized cost efficiency, instantly repricing risk, valuations, and future cash flows for nearly every index-weighted company.

■ Key Message: This isn’t a rotation. It’s a regime reset. The tariff announcement is a macro shock with technical legs and volatility teeth.

II. Technical Shockwaves: Major Index Breakdown & Realignment

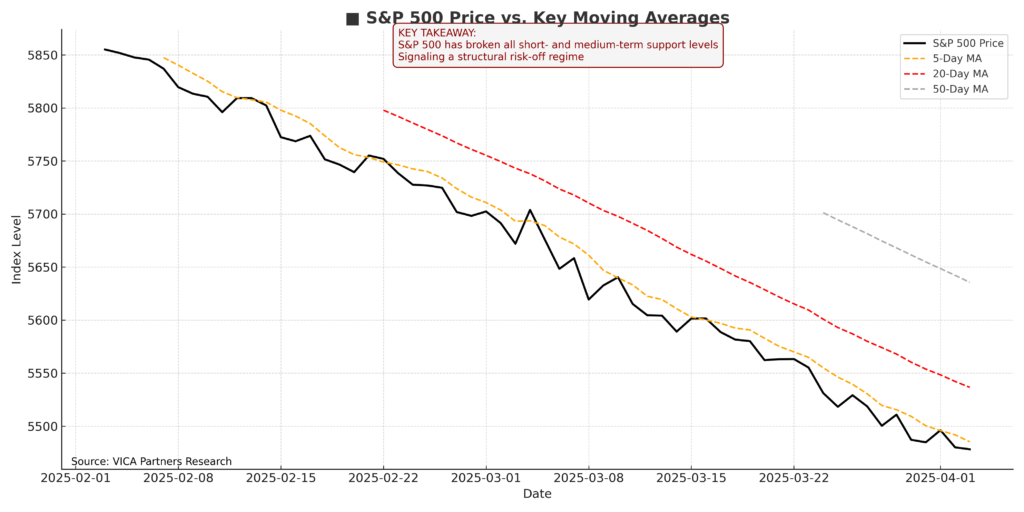

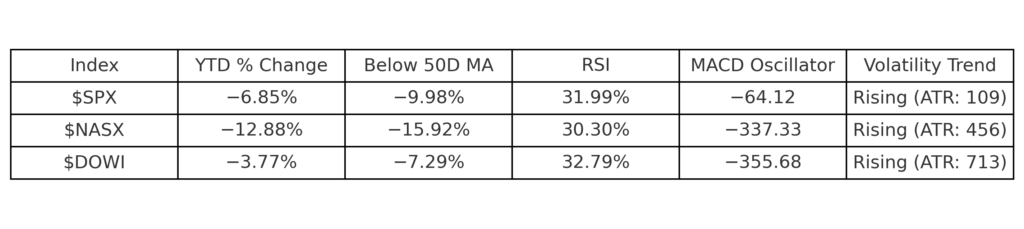

■ S&P 500 ($SPX): Confirmed Breakdown — Structural Rotation Underway

-

Close: 5,472.66 (−3.50% on day)

-

Below all short- and mid-term MAs, including 50D (5,866.65) and 100D (5,920.91)

-

Year-to-Date loss: −6.85%

-

Relative Strength Index (RSI): 31.99% → oversold threshold

-

MACD: −64.12 (bearish divergence accelerating)

-

Stochastics: All signals collapsing below 40%

■ Technical Summary: SPX has decisively lost its 200-day moving average and confirmed a 9.98% drop from 50D—a hard technical break indicative of structural derisking.

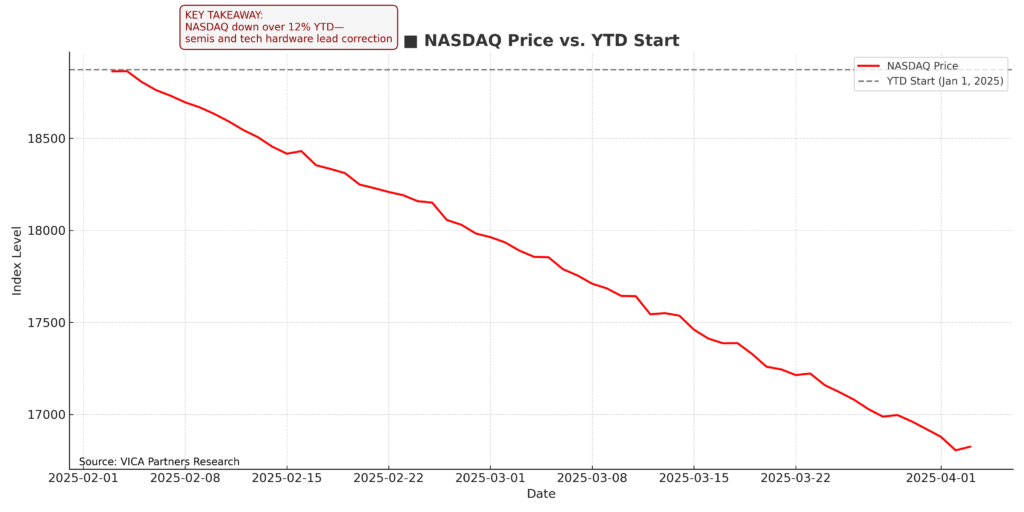

■ NASDAQ Composite ($NASX): Global Tech Under Siege

-

Close: 16,805.53 (−4.52% intraday)

-

YTD loss: −12.88%

-

50-Day Drawdown: −15.92%

-

MACD: −337.33

-

RSI: 30.30% → deep stress zone

■ Technical Summary: NASDAQ is undergoing a full-blown correction led by semiconductors and hardware—a direct result of tariff implications on offshore fabs and supply chains.

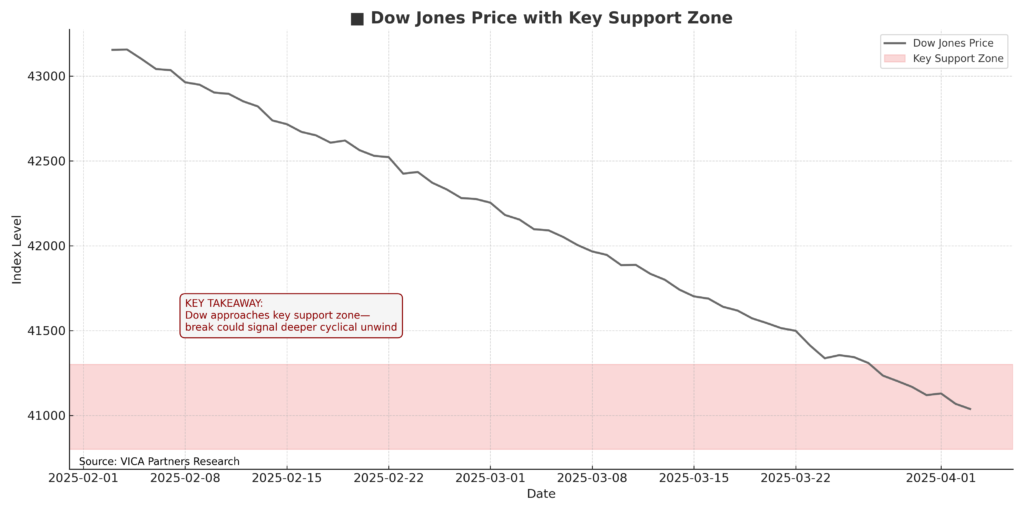

■ Dow Jones Industrial Average ($DOWI): Industrial Realignment Begins

-

Close: 41,035.86 (−2.82% intraday)

-

5-Day: −3.22%, 50-Day: −7.29%

-

200-Day MA still positive: +6.09%

-

MACD: −355.68

-

ATR: 713.24 → elevated volatility without peak exhaustion

■ Technical Summary: The Dow broke its multi-month wedge, triggering a broader trend reversal. Domestic industrial exposure buffers the full drawdown, especially in reshoring plays.

III. Why This Matters: The Mechanics of Tariff-Induced Repricing

■ Margin Destruction Tariffs raise input costs—especially in tech, auto, pharma—compressing EPS projections and leading to sectoral rebalancing.

■ Valuation Compression High-multiple tech and consumer discretionary names are no longer protected by deflationary globalization. Repricing is unavoidable.

■ Liquidity Reallocation Volatility-driven repositioning favors domestic dividend-paying sectors over cyclical multinationals.

■ Inflation Transmission Risk Supply chain taxations may lead to cost-push inflation, a scenario markets have not priced in for years.

IV. Market Profile: Where We Stand Now

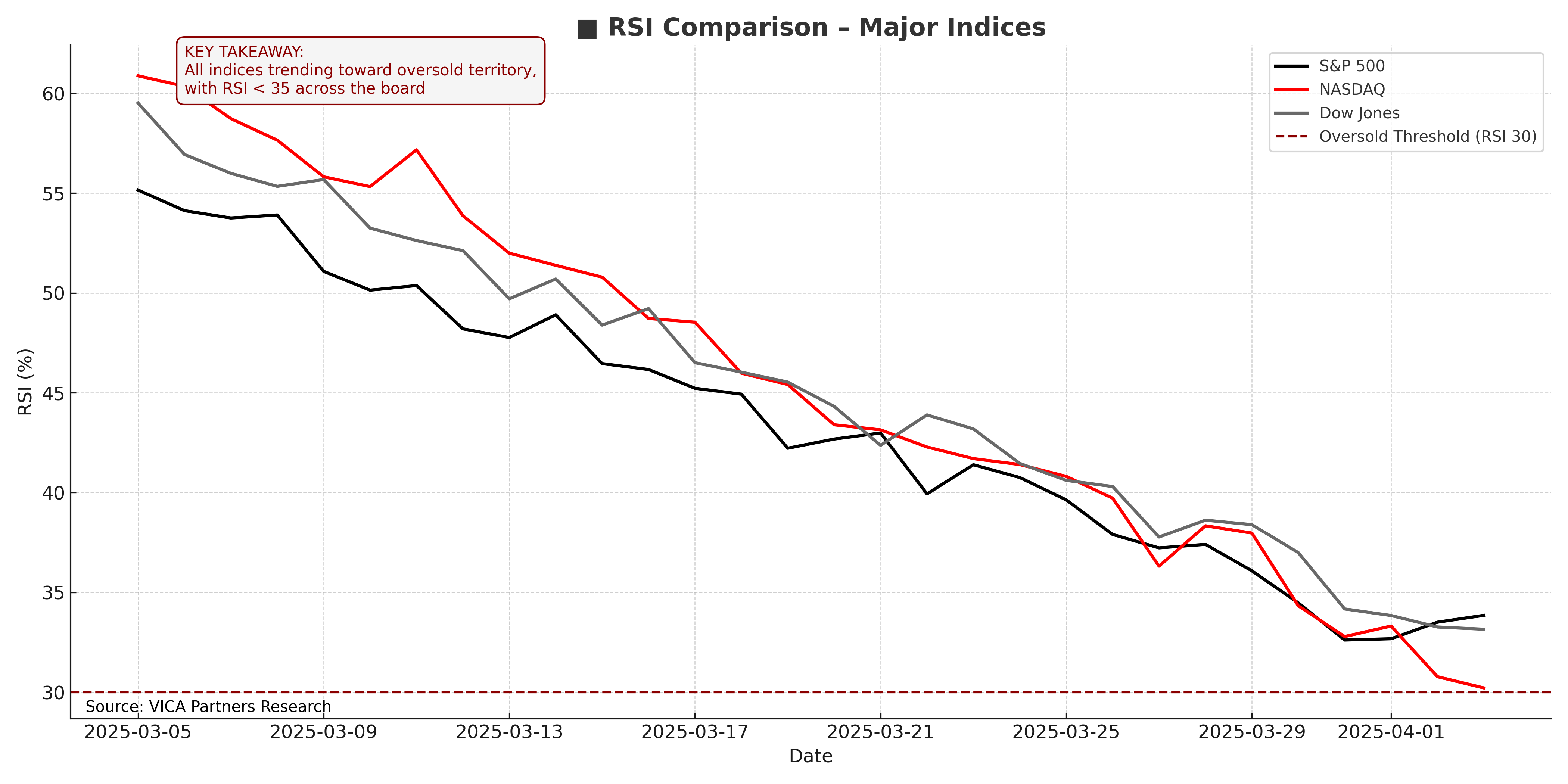

RSI Comparison – Major Indices

MACD Oscillator – Major Indices

■ Synthesis: All indices are technically damaged, trading below key support levels, with collapsing momentum, deteriorating breadth, and surging volatility.

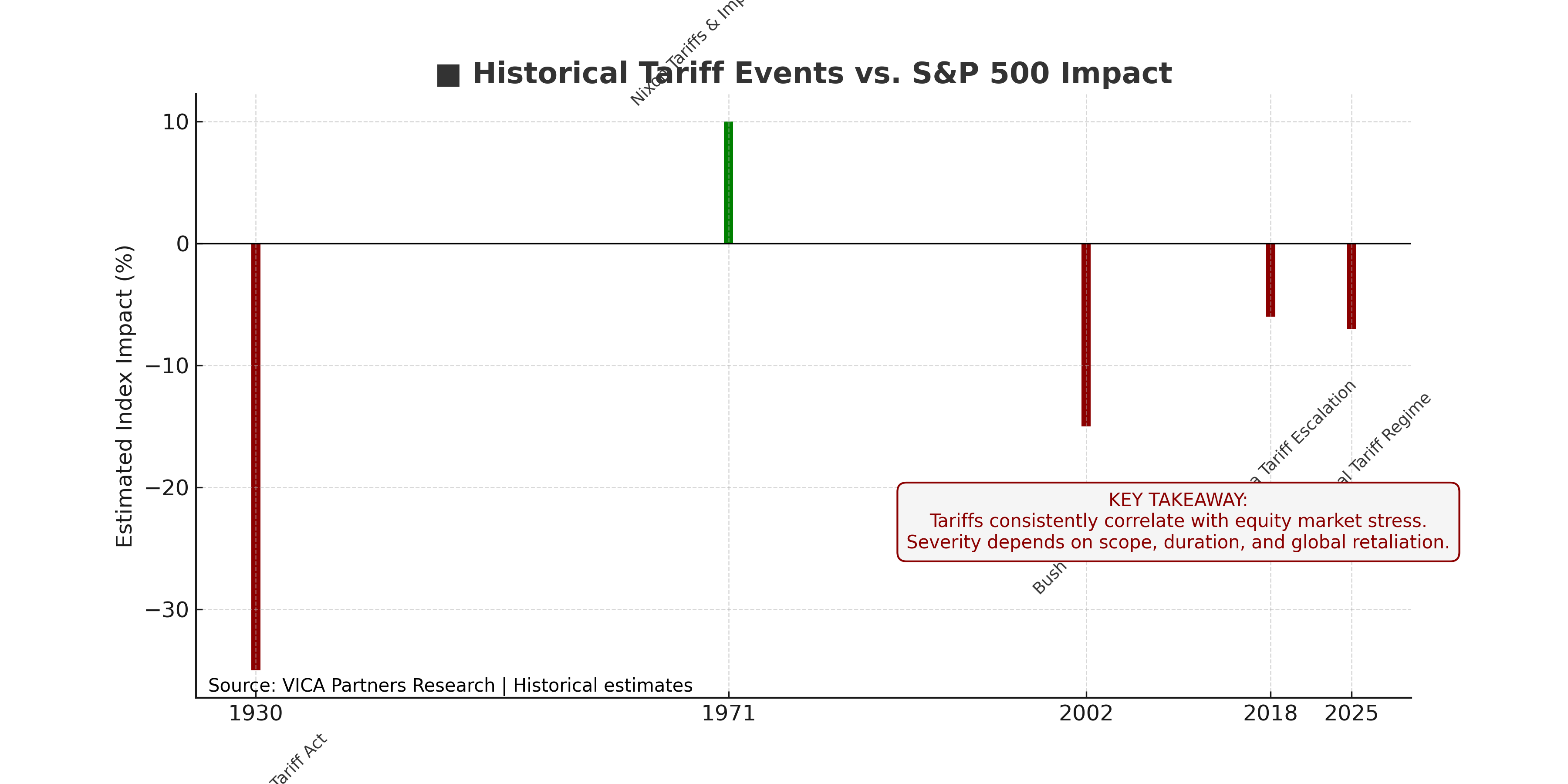

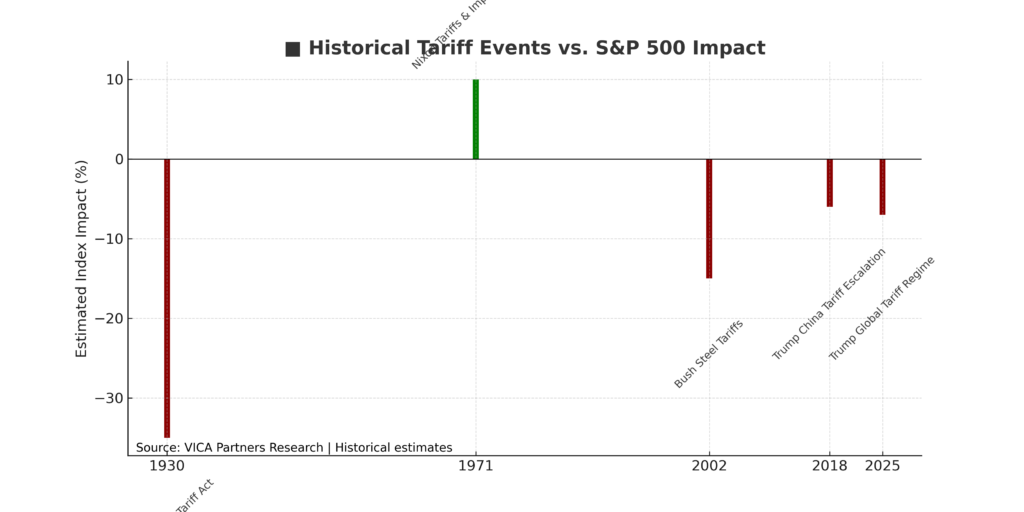

V. Historical Context: Tariffs and Past Market Reactions

Historical Tariff Events vs. S&P 500 Impact

■ Key Takeaway: Tariff announcements have historically triggered sharp equity corrections, with downside index volatility tied to the breadth and duration of the trade policy shift.

VI. Conclusion: The Tariff-Driven Market Regime Is Here

Trump’s tariff doctrine isn’t rhetoric—it’s policy realignment with structural implications. Financial markets are no longer trading on liquidity alone; they’re reacting to policy-induced input disruption and supply chain tax shocks.

■ This is a macro catalyst, a technical breakdown, and a capital reallocation event—rolled into one.

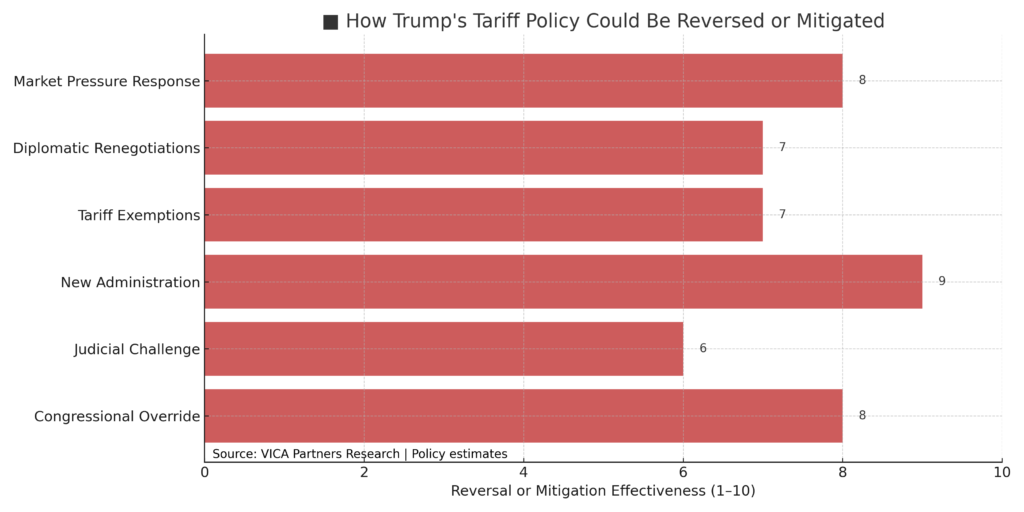

How Trump’s Tariff Policy Could Be Reversed or Mitigated