MARKETS TODAY March 16th, 2023 (Vica Partners)

Happy Thursday!

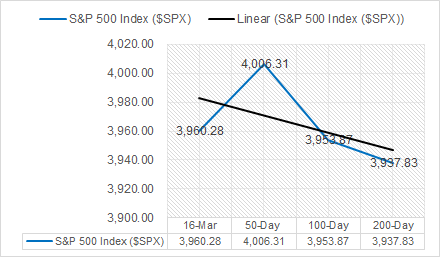

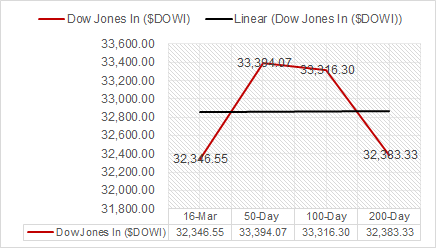

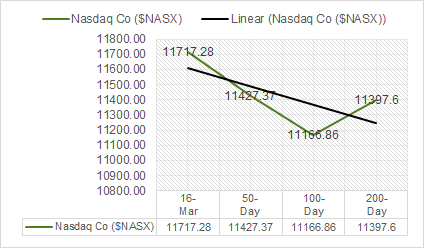

Yesterday the S&P 500 ended lower by <1%, as the Nasdaq and NYSE FANG ended the session higher with mega-cap tech stocks outperforming. Energy and Materials sectors got hammered yesterday on bank fears!

Overnight, Asian markets finished broadly lower today with shares in Hong Kong leading the region. The Hang Seng was down 1.72% while China’s Shanghai Composite off 1.12% and Japan’s Nikkei 225 lower by 0.80%. Late last night Credit Suisse announced that the Swiss National Bank loaned them $54B to sure-up liquidity which helped futures rally overnight. European markets finished higher today with shares in France leading. The CAC 40 is up 2.03% while Germany’s DAX was up 1.57% and London’s FTSE 100 up 0.85%. Delayed ECB headlines that some EU banks could be financially vulnerable, briefly sent S&P futures to new lows prior to US exchange opening.

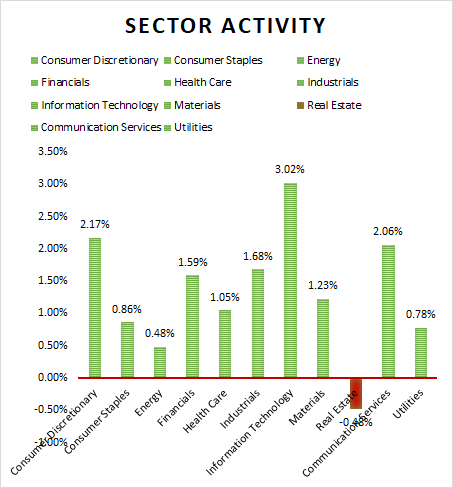

US equities were in the red but then turned positive on reports that large banks had rescue plan for First Republic. At closing all the Major Indices were up, the Nasdaq and NYSE FANG+ led with investors seeking protection in mega cap stocks. Material, Energy and Cyclicals bounced back from yesterday’s sharp losses. 10 of 11 of the S&P 500 sectors were higher, Information Technology outperformed/ Real Estate underperformed. Yields rose and USD Index declined. Oil and Materials made back gains on Bank rescue news.

In US economic news, Initial and Continuing Claims declined while the Philly Fed missed estimates with losses in orders, employment and prices “inflation markers mild”.

Takeaways

- Credit Suisse gets bailed out by Swiss Government!

- Equities rally on First Republic Bank rescue

- Indexes finished higher, Nasdaq and NYSE FANG continue to lead

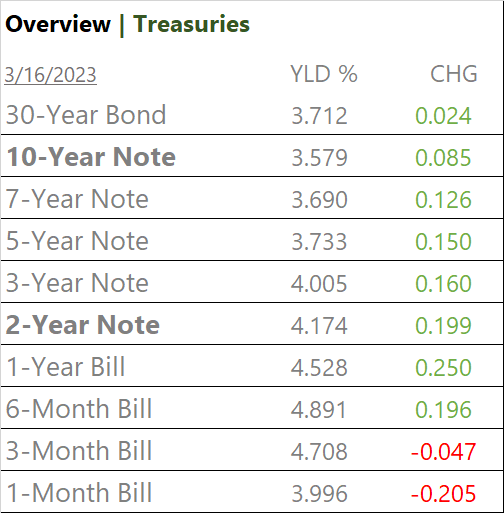

- Yields rise

- 10 of 11 of the S&P 500 sectors were higher, Information Technology outperformed/ Real Estate underperformed

- Fear & Greed index rating = Fear

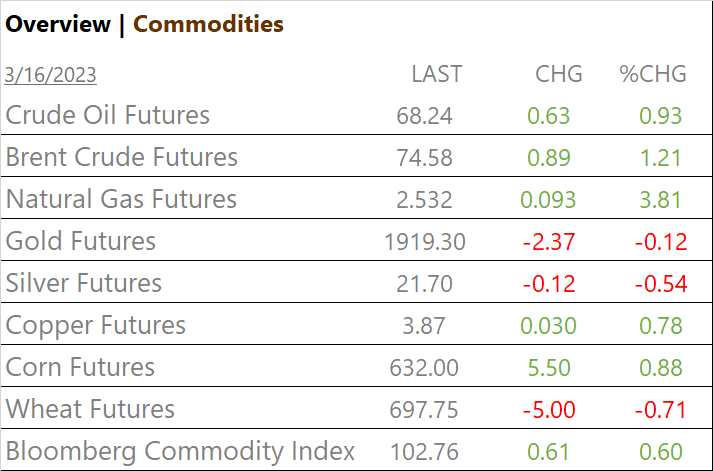

- Bloomberg Commodity Index, up

- Crude Oil Futures rise

- Bitcoin maintains strength

- USD Index, down

Last word, Investors continue to flock to mega cap tech this week for safety. Bailing out Banks rather than inflation targets is the new norm! Bitcoin and digital currencies may hold the future for aging banking sector??

Sectors/ Commodities/ Treasuries

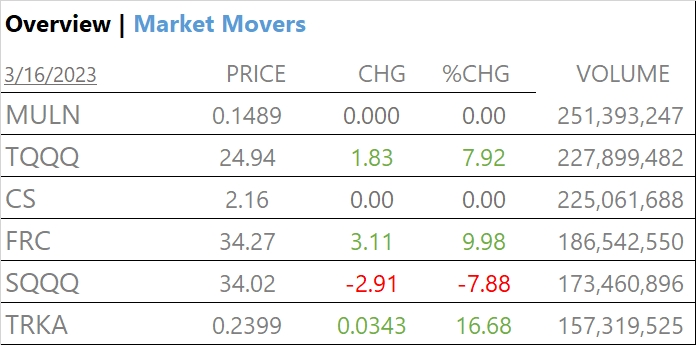

Key Indexes (50d, 100d, 200d)

S&P Sectors

- 10 of 11 S&P 500 Sectors higher, Information Technology +3.02%, Consumer Discretionary +2.17, outperform/ Real Estate -0.48% underperforms

Commodities

US Treasuries

Economic Data

US

- Initial jobless claims; period Mar 11, act 192,000, fc 205,000, prev. 212,000

- Continuing jobless claims; period March 3, act 1.68m, fc 1.7m, prev. 1.71m

- Import price index; period Feb., act -0.1%, fc -0.2%, prev. -0.4%

- Housing starts; period Feb., act 1.45m, fc 1.31m, prev. 1.32m

- Building permits; period Feb., act 1.52m, fc 1.34m, prev. 1.34m

- Philadelphia Fed manufacturing; period March, act -23.2, fc -15.5, prev. -24.3

Summary – Initial and Continuing Claims declined while the Philly Fed missed estimates with losses in orders, employment and prices “inflation markers mild”.

Tomorrow; U.S. leading economic index, Consumer sentiment

News

Company News

- First Republic Bank Is Exploring Options Including a Sale – Bloomberg

Central Banks/Inflation/Labor Market

- ECB cuts through bank turmoil to keep rate hike pledge – Reuters

Energy

- Republicans introduce major energy package with party’s top priorities – The Hill

China

- China’s US Treasury holdings hit 14-year low – TBS News

Market Outlook and updates posted at vicapartners