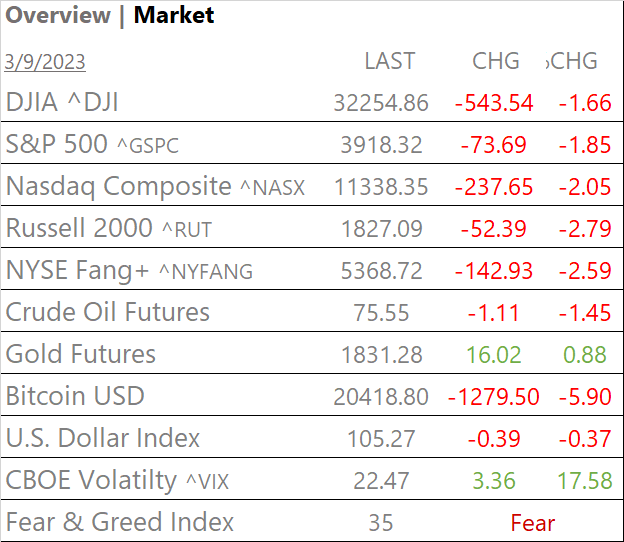

MARKETS TODAY March 9 (Vica Partners)

Overview

Happy Thursday!

Chair Powell’s message to Congress this week has been, “the latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated”. A late day rally helped eek out small gains for the S&P 500, while Nasdaq/Tech sector led advancers. Jolts and Employment data was a no factor.

Overnight, China inflation data came in below estimates while Asian markets were mixed w/ China – Hong Kong lower and Japan higher. European markets were muted, mostly lower over confusion concerning the US Fed monetary policy.

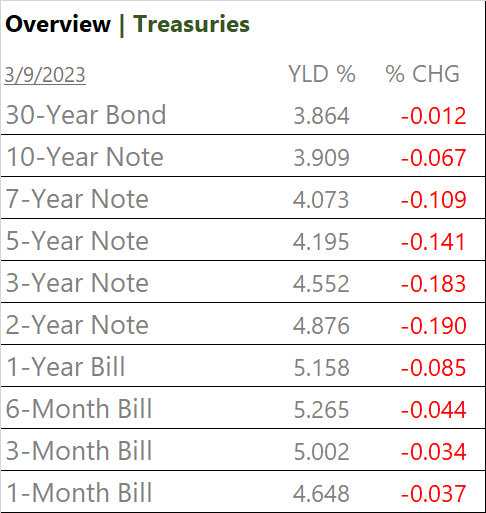

Economic data out this morning showed *initial job claims posting largest increase in five months (*see supplemental). US yields moderated with the 2yr and 10yr slightly down.

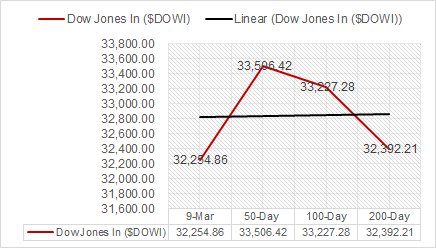

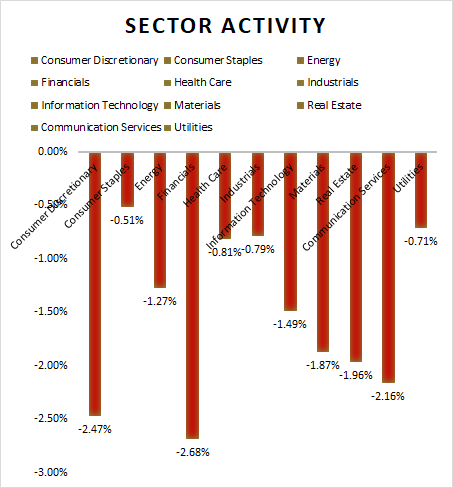

At Market close, Key Indexes all declined sharply, DOW dropped 544 points. All 11 S&P Sectors lower: Defensive Sectors, Consumer Staples and Utilities outperformed.

Key Takeaways

- Powell’s message to the Senate, quicker- higher rate hikes contributed to market selloff

- Jobless claims for the Week came in high w/ minimal impact on Market

- Indexes fell sharply, DOW dropped 544 points

- All 11 S&P Sectors lower: Defensive Sectors – Consumer Staples and Utilities outperformed

- Yields “all” declined

- Fear & Greed index shifted to FEAR

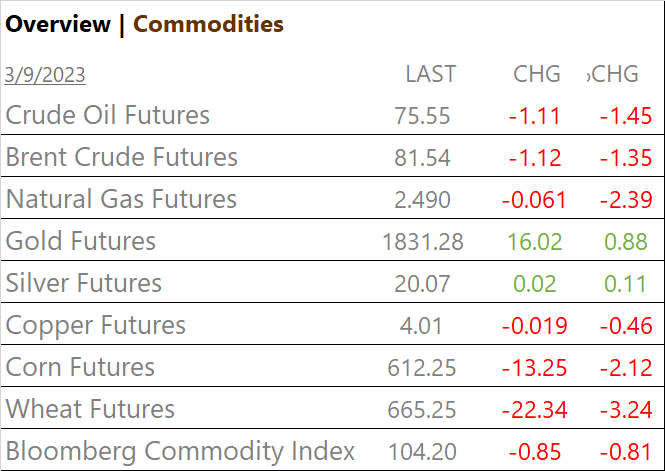

- Crude Oil Futures and Materials dropped, Gold +up

- USD Index, negative

- Later this Week; Friday, February jobs reports.

Tomorrow expecting Jobs reports to beat topline Unemployment, Services Sector missing Unemployment and contributing to topline Wage miss

Sectors/ Commodities/ Treasuries

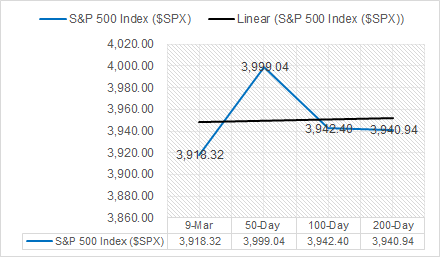

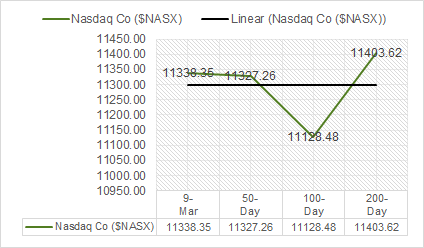

Key Indexes (50d, 100d, 200d)

- All 11 S&P Sectors lower: Financials -2.68% and Consumer Discretionary – 2.47% underperform/ Defensive Sectors, Consumer Staples -0.51% and Utilities -0.71% outperform

Commodities

US Treasuries

Economic Data

US

Jobless claims; period March 3, act 211,000, fc 195,000, prev. 190,000

- Weekly jobless claims increase 21k to 211,000

- Four-week average of claims rises 4k to 197,000

- Continuing claims up 69k to 1.718 million

- Largest increase since October, claims reach two-month high

News

Company News

- GM offers salaried employee buyouts, will take up to $1.5 bln charge – Reuters

- Credit Suisse delays annual report after SEC call, shares drop – Reuters

- Crypto stocks slide after Silvergate decides to shut down – Reuters

Central Banks/Inflation/Labor Market

- Janice Eberly Seen as Leading Candidate for Fed Vice Chair – WSJ

- The Bank of Japan Has Its Own Inflation Problem. It’s the Opposite of the Fed’s. – Barrons

- Here’s What the Fed Chair Said This Week, and Why It Matters – NY Times

Energy

- Russia And Saudi Arabia Vow To Continue OPEC+ Oil Policy – Oilprice

- One State Generates Much, Much More Renewable Energy Than Any Other—and It’s Not California – Inside Climate News

China

- Why do Chinese billionaires keep vanishing? – BBC

- China’s modest growth outlook weighs on commodities – analysts – Kitco

Supplemental

Jobless Claims Report

Jobless claims are metrics/ data points issued by the U.S. Department of Labor as part of its weekly Unemployment Insurance Weekly Claims Report. Initial jobless claims measure emerging unemployment, and it is released after one week; whereas continued claims data measure the number of persons claiming unemployment benefits, and it is released one week later than the initial claims.

Jobless claims are near-real-time indicator produced by the government. The report is released weekly at 08:30 Eastern Time on Thursdays. It is a supporting indicator for the more senior monthly BLS’s/ Employment Report.

Market Outlook and updates posted at vicapartners.com