MARKETS TODAY Dec 20 (Vica Partners)

DOW (^DJI) 32,850 (+92), S&P 500 (^GSPC) 3,822 (+4), Nasdaq (^IXIC) 10,547 (+1), Russell 2000 (^RUT) 1,752 (+13), NYSE FANG+ (^NYFANG) 4,533 (-50), Brent Crude $79.75/barrel (-$0.05), Gold $1,818/oz (+$31), Bitcoin 16.9k (+416)

US Markets moderately rise Tuesday following four consecutive losing sessions

US equity markets closed higher today following four consecutive losing sessions with S&P 500 haven falling more than 7%, from last week highs. On a technical note, Monday’s 300pt session S&P index decline was a 50% retracement of the rally from the October low.

8 of 11 S&P 500 Sectors higher: Energy/Materials and Financials lead, Consumer discretionary/ Real Estate lower

Energy lead all sectors +1.42%, with Materials outperforming in the metals markets with Gold up close to 2%/ breaking its 200 day moving average and Silver jumping +5%. Financials also + 0.76%. Consumer Discretionary and Real Estate led decliners. Tech and growth stocks continue to weigh on the markets.

US yields temporarily moved higher following the Bank of Japans 10-year bond yield shift

The Japanese Central Bank made a 50 basis point move to its 10-year bond, “to improve market function and to help facilitate the transmission of monetary-easing effects”. The move caught markets off guard as the Yen has gained back 5% on the Dollar since in October.

US yields ended mostly flat in session today

US – 2yr to 4.266%, 5yr to 3.791%, 10yr to 3.684%, 30yr to 3.735%

In economic news today; U.S. single-family housing starts better than expected while permits sharply fell

The Commerce Department reported a drop in new residential construction in November as housing starts declined however beating Economist’s forecasts. Building permits sharply declined far short of revised estimates.

- Building permits: 1.34m vs. 1.48m, prior revised to 1.51m from1.53m

- Housing starts: 1.43ml vs. 1.41m, prior revised to 1.43ml from 1.425m

Earnings from Nike and FedEx following the market

These early reports could set the tone for Q4 earnings season which kicks off for most of the market in mid-January. Following updates last quarter both companies fell +10%

Tomorrow’s economic calendar includes consumer confidence and existing home sales.

Other Indexes:

- Greed Index today was 38 (fear)

- CBOE Volatility Index (^VIX) -0.94 to 21.48

- USD index: -$0.76 to $103.96

Other Asset Classes:

- Oil prices – Brent: -0.06% to $79.75, WTI: +1.10% to $76.02, Nat Gas: -8.51% to $5.35

- Copper: +0.65% to $3.81

Currency/ Other:

- USD/JPY: -$5.08 to $131.78

Vica Momentum Stock Report

United Airlines (UAL) $UAL. (Grade B+) 50 Day Average +11.81%, 100 Day Average +4.05%, 200 Day Average +22.56

United Airlines Holdings is based in Chicago. The carrier changed its name from United Continental Holdings to United Airlines Holdings in June 2019. It is the holding company for both United Airlines and Continental Airlines.

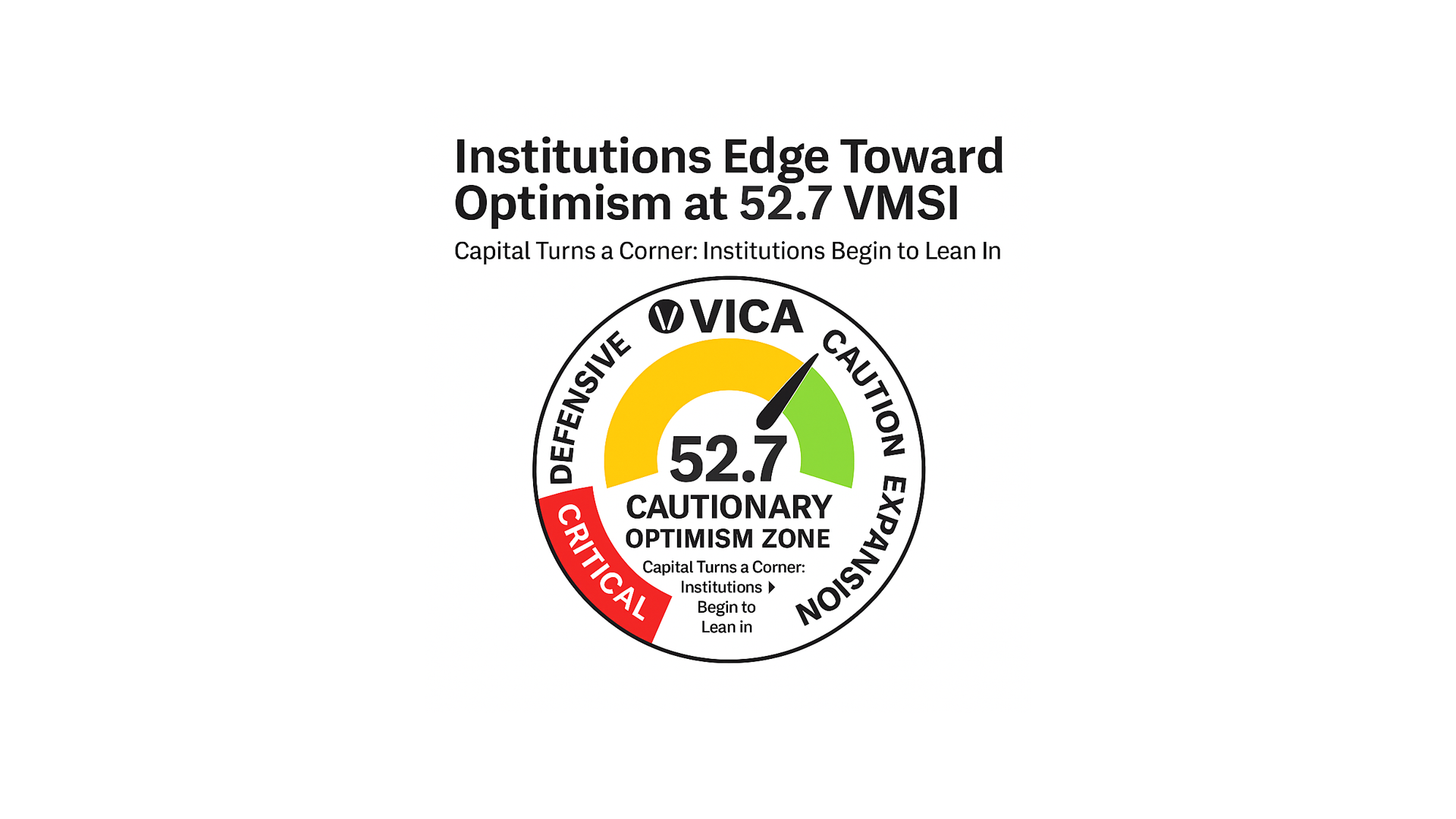

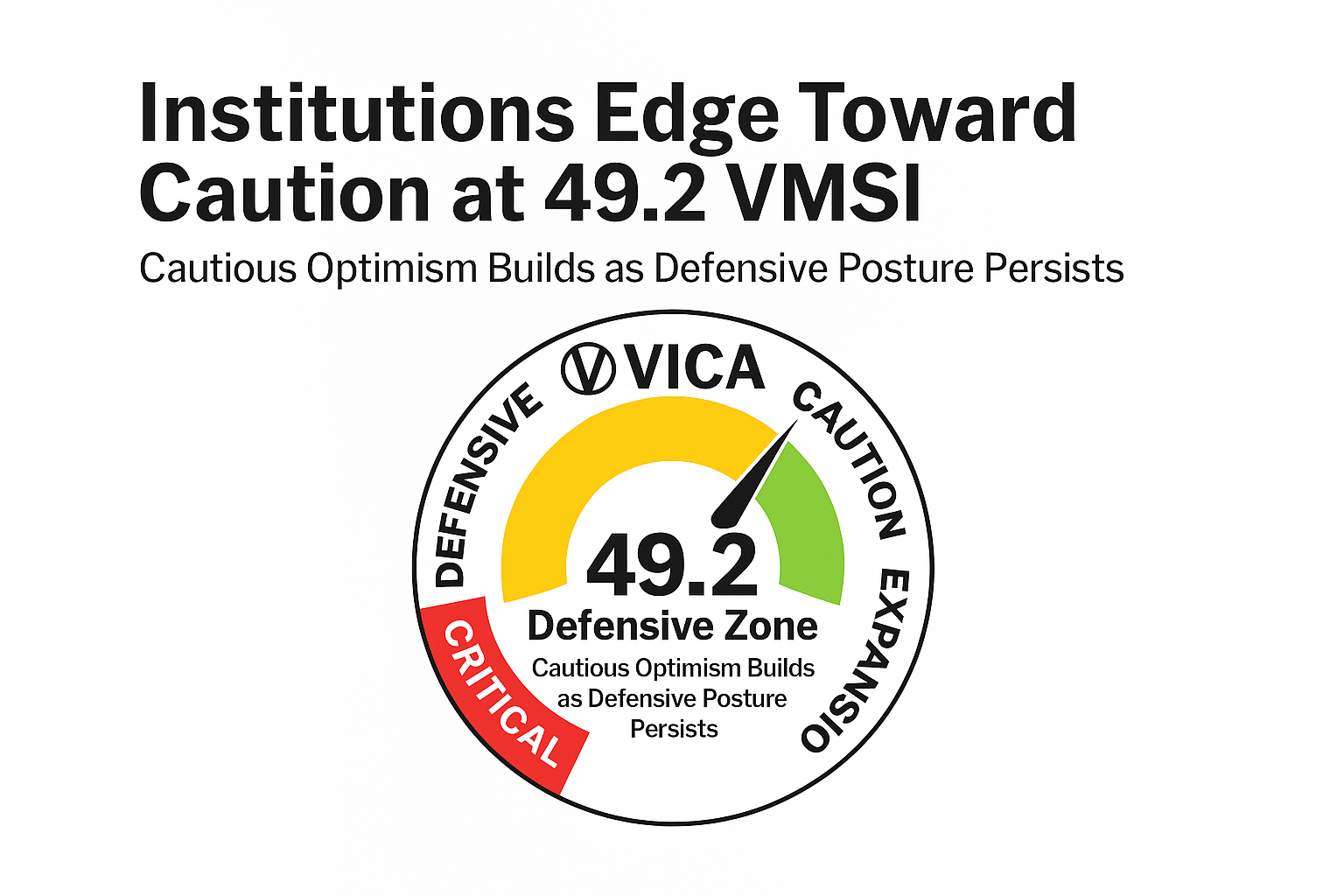

Market Outlook

Market Outlook and updates posted at vicapartners.com