“Empowering Your Financial Success”

Daily Market Insights: October 24th, 2023

Global Markets Summary:

Asian Markets:

- Nikkei 225 (Japan): +1.07%

- Hang Seng (Hong Kong): Closed

- Shanghai Composite (China): Closed

European Markets:

- CAC 40 (France): +0.63%

- DAX (Germany): +0.54%

- FTSE 100 (London): +0.20%

US Futures:

- S&P Futures: opened @ 4235.79 (+0.44%)

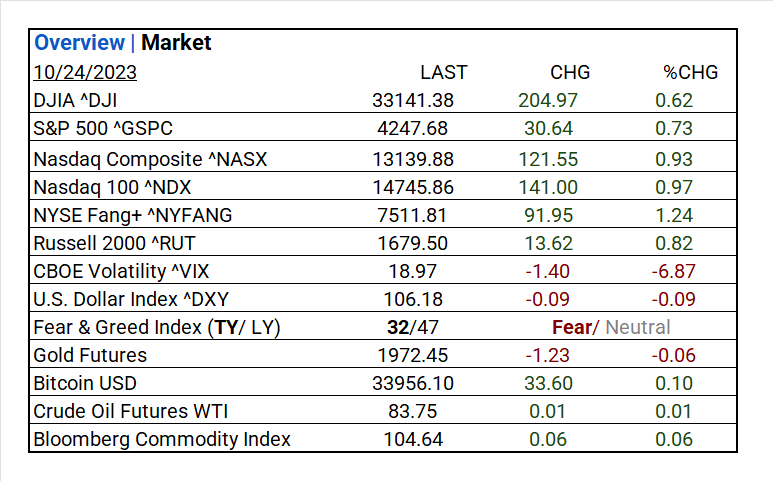

US Market Snapshot:

Key Stock Market Indices:

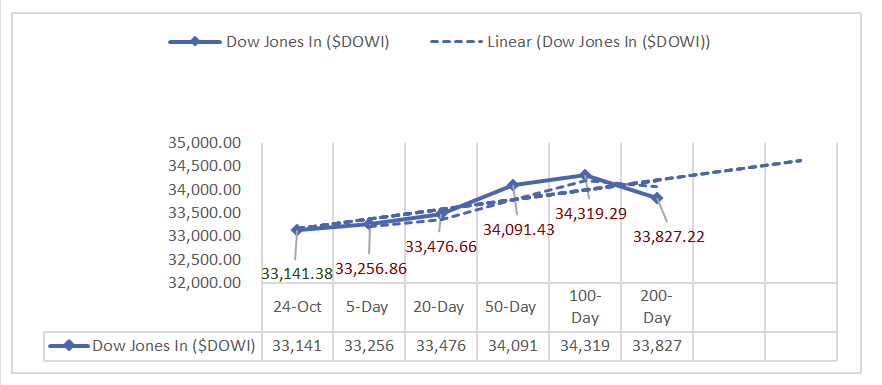

- DJIA ^DJI: 33,141.38 (+204.97, +0.62%)

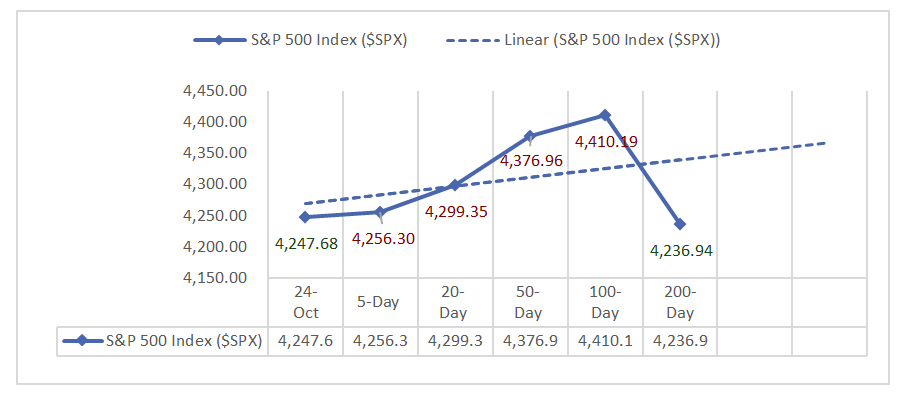

- S&P 500 ^GSPC: 4,247.68 (+30.64, +0.73%)

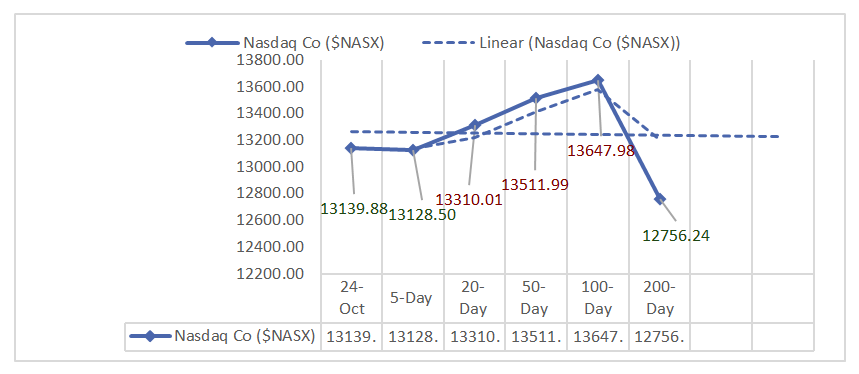

- Nasdaq Composite ^NASX: 13,139.88 (+121.55, +0.93%)

- Nasdaq 100 ^NDX: 14,745.86 (+141.00, +0.97%)

- NYSE Fang+ ^NYFANG: 7,511.81 (+91.95, +1.24%)

- Russell 2000 ^RUT: 1,679.50 (+13.62, +0.82%)

Market Insights: Performance, Sectors, and Trends:

- Economic Data: U.S. services PMI exceeded expectations at 50.9, up from the consensus of 49.9, while U.S. manufacturing PMI also beat forecasts at 50.0, surpassing the consensus of 49.0.

- Market Indices: Major US indices all up on the day: Nasdaq Composite/ Tech leading with the NYSE Fang+ (+1.24%).

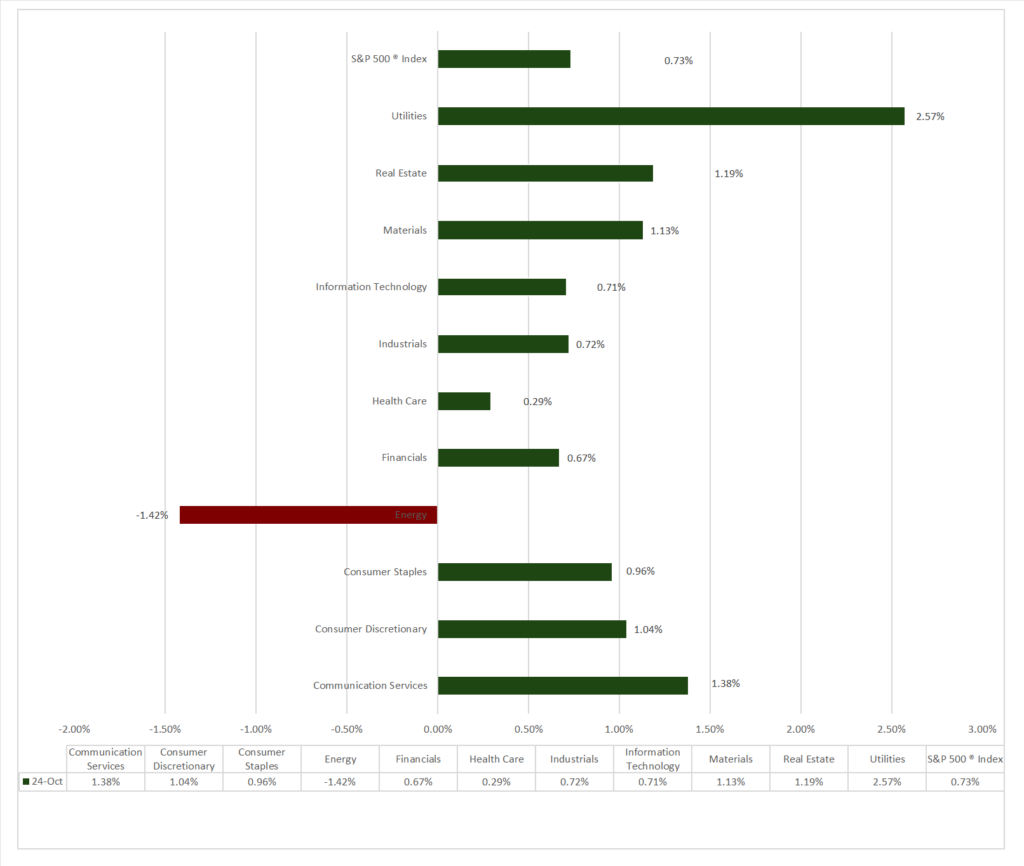

- Sector Performance: 10 of 11 sectors advanced, with Utilities (+2.57%) leading and Energy (-1.42%) lagging. Top industries: Diversified Telecommunication Services (+6.86%).

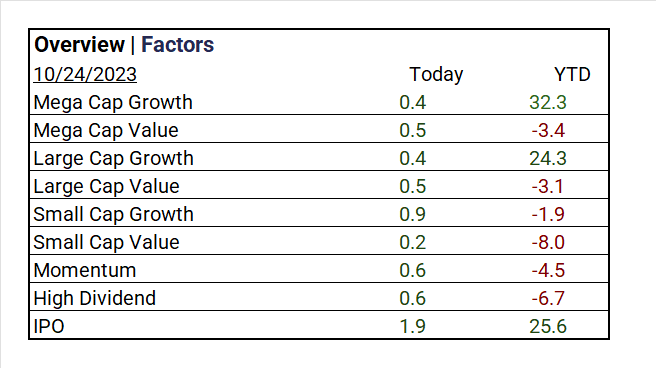

- Factors: IPO’s lead (+1.9%), followed by Small Cap Growth (+0.9%).

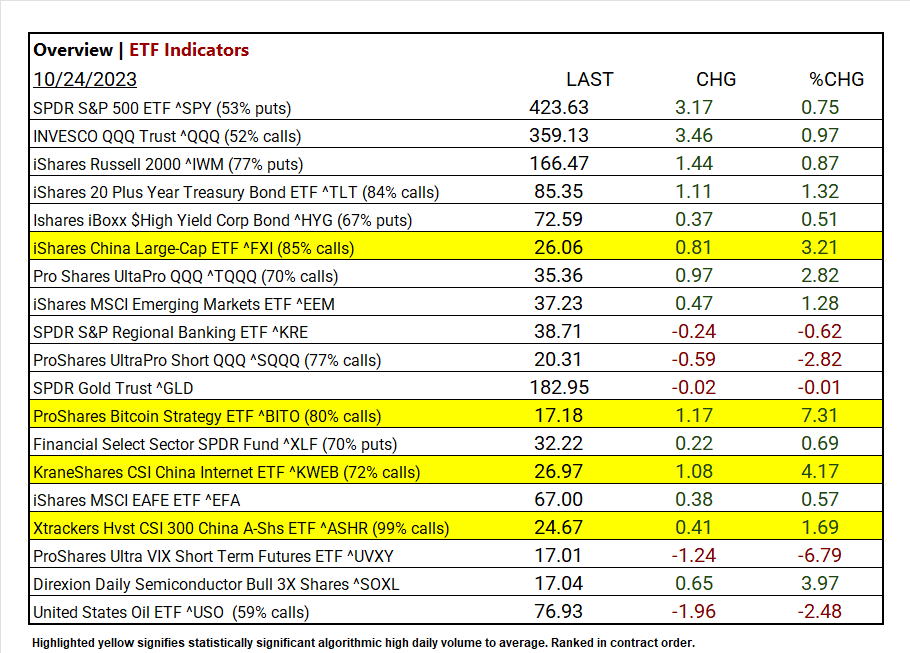

- Top ETF: ProShares Bitcoin Strategy ETF ^BITO +7.30%.

- Low ETF: ProShares Ultra VIX Short Term Futures ETF ^UVXY -6.79%.

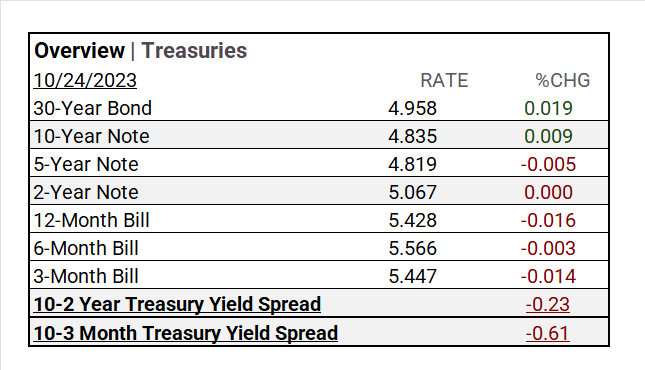

- Treasury Markets: The 30-Year Bond and 10-Year Note increased. The 12-Month, 6-Month, and 3-Month Bills all saw yield decreases.

- Currency and Volatility: The U.S. Dollar Index pulls back, CBOE Volatility falls -6.87%, and the Fear & Greed reading: Fear.

- Commodity Markets: Bitcoin, Oil and the Bloomberg Commodity Index rise while Gold declines.

- Notable: In Options market activity, heavy Bitcoin calls continue and high volume activity in China Mega Cap Techs Tech ETF’s.

Sectors:

- 10 of 11 sectors advanced, with Utilities (+2.57%) leading and Energy (-1.42%) lagging. Top industries: Diversified Telecommunication Services (+6.86%), Independent Power and Renewable Electricity Producers (+3.79%), and Industrial Conglomerates (+3.76%).

Treasury Yields and Currency:

- The 30-Year Bond and 10-Year Note increased, the 5-Year Note decreased, and the 2-Year Note remained unchanged. The 12-Month, 6-Month, and 3-Month Bills all saw yield decreases. The yield spread between the 10-year and 2-year Treasury notes was -0.23, while the spread between the 10-year and 3-month Treasury yields was -0.61.

- The U.S. Dollar Index ^DXY: 106.18 (-0.09, -0.09%)

Market Volatility and Sentiment:

- CBOE Volatility ^VIX: 18.97 (-1.40, -6.87%)

- Fear & Greed Index (TY/LY): 32/47 (Fear/ Neutral).

source: CNN Fear and Greed Index

Commodities:

- Gold Futures: 1,972.45 (-1.23, -0.06%)

- Bitcoin USD: 33,956.10 (+33.60, +0.10%)

- Crude Oil Futures WTI: 83.75 (+0.01, +0.01%)

- Bloomberg Commodity Index: 104.64 (+0.06, +0.06%)

Factors:

- IPO’s lead (+1.9%), followed by Small Cap Growth (+0.9%)

ETF Performance:

Top 3 Best Performers:

- ProShares Bitcoin Strategy ETF ^BITO +7.30%

- KraneShares CSI China Internet ETF ^KWEB +4.17%

- Direxion Daily Semiconductor Bull 3X Shares ^SOXL +3.97%

Top 3 Lowest Performers:

- ProShares Ultra VIX Short Term Futures ETF ^UVXY -6.79%

- ProShares UltraPro Short QQQ ^SQQQ -2.82%

- United States Oil ETF ^USO -2.48%

US Major Economic Data

- S&P flash U.S. services PMI for October: 50.9 (actual) vs. 49.9 (consensus) and 50.1 (previous).

- S&P flash U.S. manufacturing PMI for October: 50.0 (actual) vs. 49.0 (consensus) and 49.8 (previous).

Earnings:

- Q1 ’23: 79% of companies beat analyst estimates.

- Q2 Forecast/Actual: Predicted <7.2%> FY 2023 S&P 500 EPS decline; FY 2023 EPS flat YoY. By 7-28, 51% reported Q2 2023, results; 80% beat EPS estimates, above 5-year (77%) and 10-year (73%) averages. Earnings exceeded estimates by 5.9%, slightly below the 5-year (8.4%) and 10-year (6.4%) averages.

- Q3 Forecast: 116 companies in the index have issued EPS guidance for Q3 2023, Of these 116 companies, 74 have issued negative EPS guidance and 42 have issued positive EPS guidance. The percentage of S&P 500 companies issuing negative EPS guidance for Q3 2023 is 64% (74 out of 116), which is above the 5-year average of 59% but equal to the 10-year average of 64%. Eight of the eleven sectors are expected to see year-over-year earnings growth, with Communication Services and Consumer Discretionary leading the way. Conversely, three sectors, mainly Energy and Materials, are expected to experience earnings declines.

Notable Earnings Today:

- BEAT: Microsoft (MSFT), Alphabet C (GOOG), Visa A (V), Visa A (V), Danaher (DHR), Verizon (VZ) Texas Instruments (TXN), Rtx Corp (RTX), NextEra Energy (NEE), Chubb (CB), Fiserv (FI), Sherwin-Williams (SHW), 3M (MMM), PACCAR (PCAR), General Motors (GM), Centene (CNC), Dow (DOW), Spotify Tech (SPOT)

- MISSED: Novartis ADR (NVS), Texas Instruments (TXN), Canadian National Railway (CNI), Illinois Tool Works (ITW), Waste Management (WM), HCA (HCA), Kimberly-Clark (KMB), Archer-Daniels-Midland (ADM), Halliburton (HAL)

Resources:

News

Investment and Growth News

- Microsoft Earnings Growth Accelerates on Stronger-Than-Expected Cloud Demand – WSJ

- Visa Beats Profit Estimates, Plans $25 Billion Stock Buyback – Bloomberg

- Google’s Cloud Sales Disappoint as Advertising Rebounds – WSJ

Infrastructure and Energy

- Japan Is Miles Behind on Electric Vehicle Charging, Hurting Carmakers’ Goals – Bloomberg

Real Estate

- Thanks to Big Data, Landlords Know How to Squeeze the Most Out of Renters – WSJ

Central Banking and Monetary Policy

- How the Highest Bond Yields in 16 Years Could Chill the Hot U.S. Economy – WSJ

- Israel’s Rating Outlook Cut to Negative by S&P on War Risks – Bloomberg

International Market Analysis (China)

- China turns to belt and road countries in race to secure tech-critical minerals – SCMP