MARKETS TODAY June 15th, 2023 (Vica Partners)

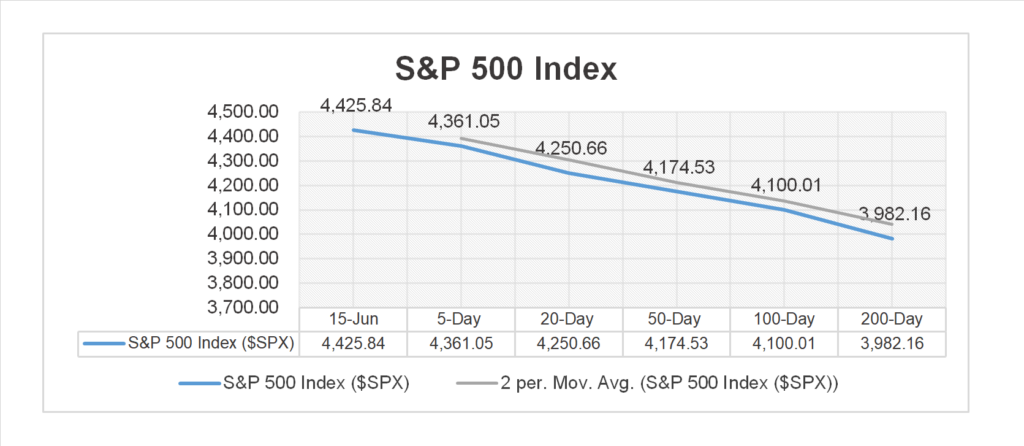

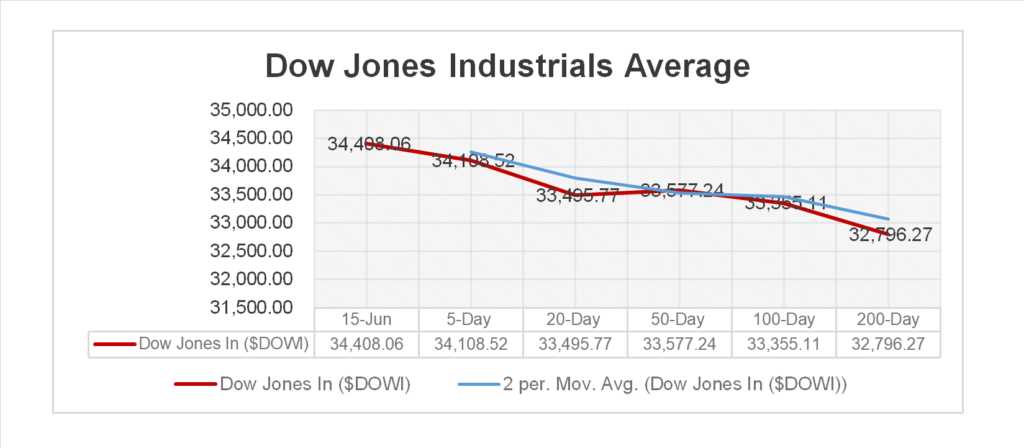

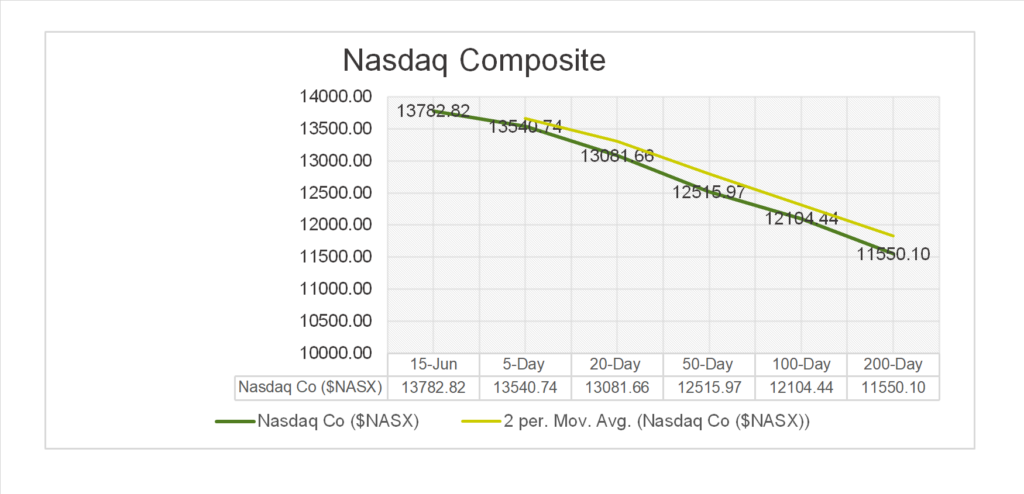

On Wednesday, US markets finished mixed, S&P 500 +0.12%, DOW -0.68% and the Nasdaq +0.39%. 7 of 11 of the S&P 500 sectors lower: Information Technology +1.14% outperforms/ Health Care and Energy both respectively -1.12% lag. On the upside, FANG+, Semiconductor ETF (SOXX), Mega Cap Growth and the Bloomberg Commodity Index. In economic news, US headline PPI easily beat estimates and Core-PPI was in line.

Overnight/US Premarket, Asian markets finished mixed, Hong Kong’s Hang Seng +2.17%, China’s Shanghai Composite +0.74% and Japan’s Nikkei 225 -0.05%. European markets finished mixed, London’s FTSE 100 +0.34%, France’s CAC 40 -0.51% and Germany’s DAX -0.13%. S&P futures were trading at 0.2% below fair-value.

Today US Markets finished higher, S&P 500 +1.22%, DOW +1.26% and the Nasdaq +1.15%. All 11 of the S&P 500 sectors advancing: Health Care +1.55% outperforms/ Real Estate +0.34% lags. On the upside, S&P Banking ETF (KRE), IPO’s, Gold, Bitcoin, Oil Brent and the Bloomberg Commodity Index. In economic news, initial claims remained flat with last week while headline retail sales came in better than expected. The regional surveys were mixed, Empire beat while Philly Fed was negative. Import and export prices both fell during the month.

Takeaways

- Mixed US economic data

- Managed healthcare rallies back

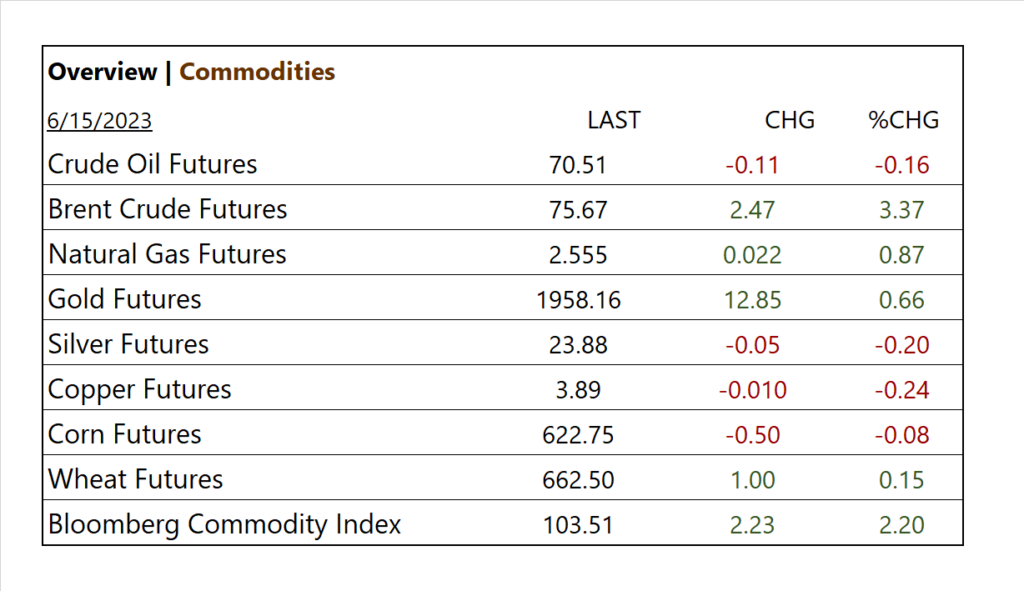

- Commodities jump! Bloomberg Commodity Index +2.20%

- SPDR S&P Banking ETF (KRE) +1.9%

- Semiconductor ETF (SOXX) <0.83%> drags

- All 11 of the S&P 500 sectors advancing: Health Care +1.55% outperforms/ Real Estate +0.34% lags.

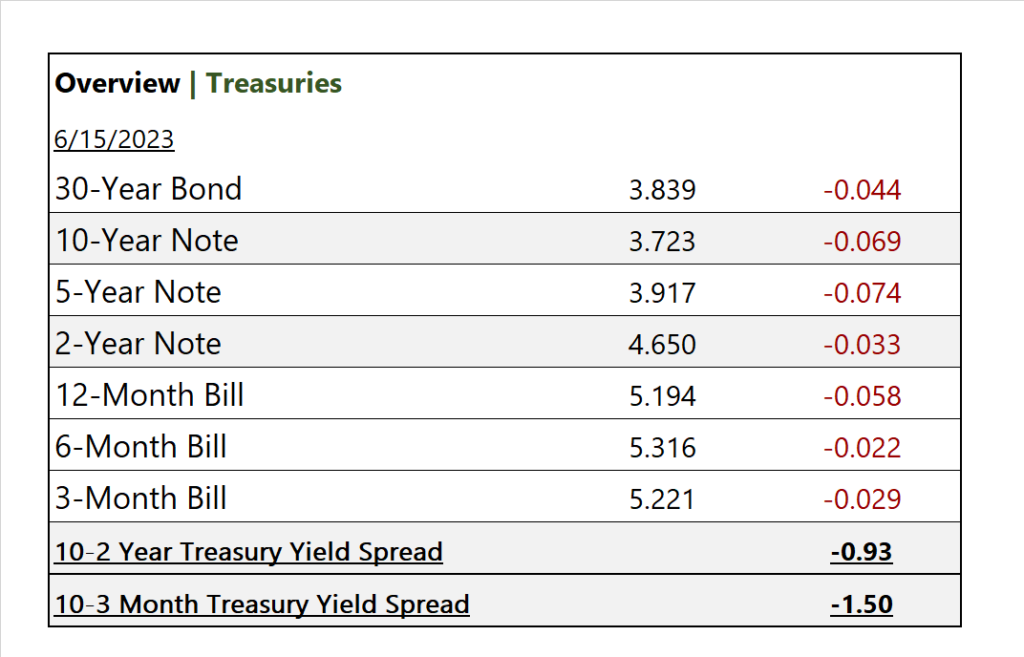

- Inversion increasing/ 10-2 Year Treasury Yield spread -0.93

- Ken Griffin ups credit bets, anticipating US Recession

- Adobe (ADBE ) earnings beat, Kroger (KR) miss

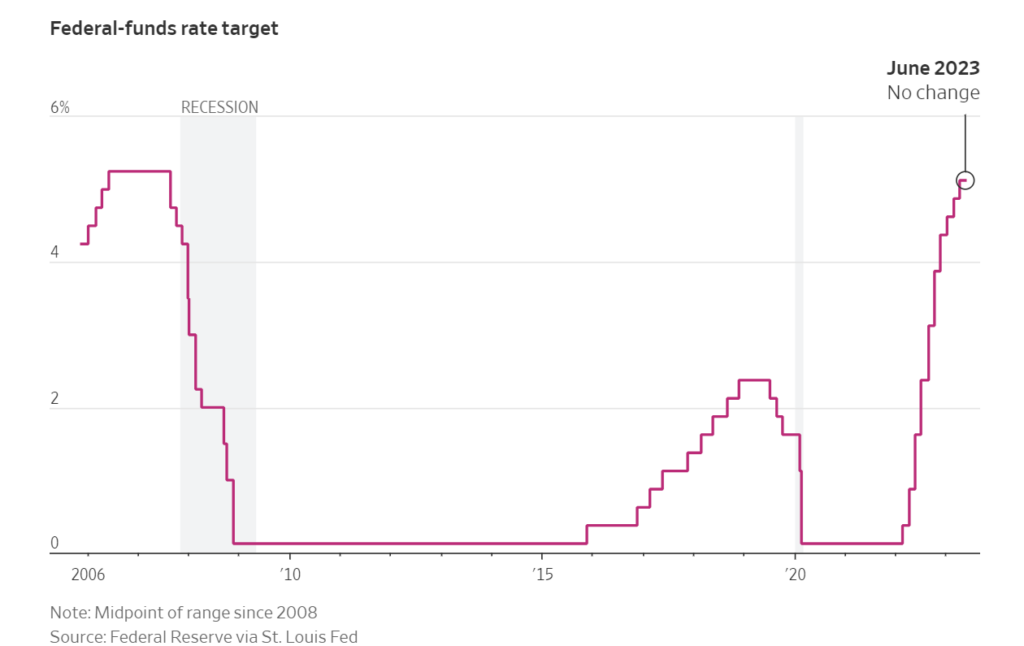

- Fed Signals a 25-Basis-Point Rate Hike in July

Pro Tip: During an economic downturn, credit markets to tighten, as borrowing becomes more expensive. Investors like “Ken Griffin” who anticipate a recession might choose to “ramp up credit bets” by taking positions that benefit from an increase in credit risk. For example, they may short-sell bonds or engage in credit default swaps (CDS) to profit from the decline in the creditworthiness of specific companies or sectors.

Sectors/ Commodities/ Treasuries

Key Indexes (5d, 20d, 50d, 100d, 200d)

S&P Sectors

- All 11 of the S&P 500 sectors advancing: Health Care +1.55%, Industrials +1.51% outperform/ Real Estate +0.34% lags.

Commodities

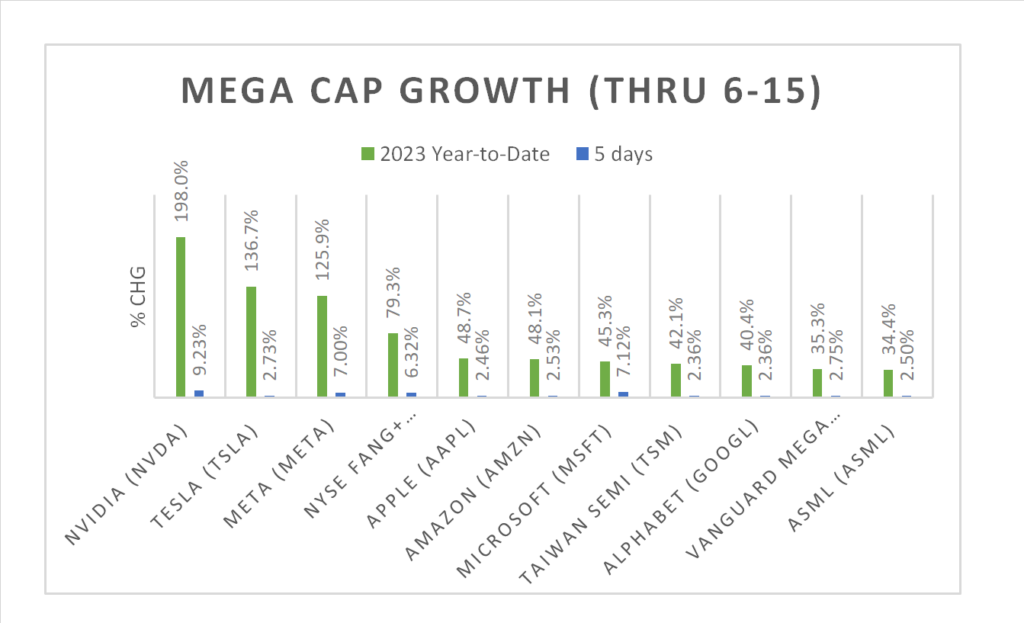

Factor/ Mega Cap Growth Chart (YTD)

US Treasuries

Notable Earnings Today

- +Beat: Adobe (ADBE), Jabil Circuit (JBL)

- – Miss: Ashtead Gro (ASHTY), Kroger (KR), John Wiley&Sons (WLY)

- * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), UI Path Inc. (PATH), Broadcom Inc (AVGO)

Economic Data

US

- Initial jobless claims; period June 10, act 262,000, fc 245,000, prior 262,000

- S. retail sales; period May, act 0.3%, fc -0.2%, prior 0.4%

- Retail sales minus autos; period May, act 1%, fc 0.0%, prior 0.4%

- Import price index; period May -0.6% -0.5% 3%

- Import price index minus fuel; period May, act -5.9%, prior 0%

- Empire State mfg. survey; period June, act 6.6, fc -16.0, prior -31.8

- Philadelphia Fed mfg. survey; period June, act -13.7, fc -14.8, prior-10.4

News

Company News

- Patterson-UTI, NexTier Oilfield Strike Merger Deal – WSJ

- Rivian’s SUV Production Is Outpacing Pickup Truck Volume – Bloomberg

Energy/ Materials

- Oil-Field-Services Companies Hold Merger Talks –

- The US Factory Boom Is a Golden Opportunity for Green Job Training – Bloomberg

Central Banks/Inflation/Labor Market

- Fed’s Powell Suggested July Rate Rise Is Likely, Analysts Say – WSJ

- Americans Are Shopping Through Uncertainty – WSJ

- Ken Griffin Ramps Up Credit Bets, Anticipating US Recession – Bloomberg

China/ Asia