“Empowering Your Financial Success”

Daily Market Insights: October 25th, 2023

Global Markets Summary:

Asian Markets:

- Shanghai Composite (China): -0.06%

- Hang Seng (Hong Kong): -0.63%

- Nikkei 225 (Japan): Closed.

European Markets:

- CAC 40 (France): +0.89%

- DAX (Germany): +0.64%

- FTSE 100: -0.08%%

US Futures:

- S&P Futures: opened @ 4173.33 (+0.11%)

US Market Snapshot:

Key Stock Market Indices:

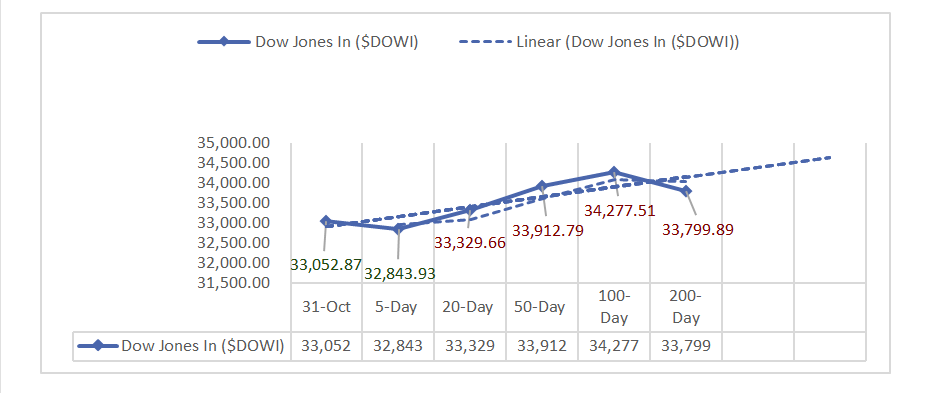

- DJIA ^DJI: 33,052.87 (+123.91, +0.38%)

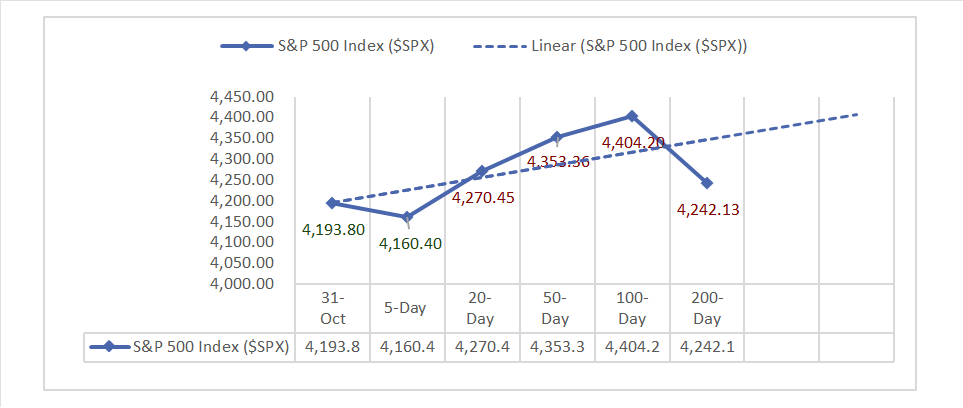

- S&P 500 ^GSPC: 4,193.80 (+26.98, +0.65%)

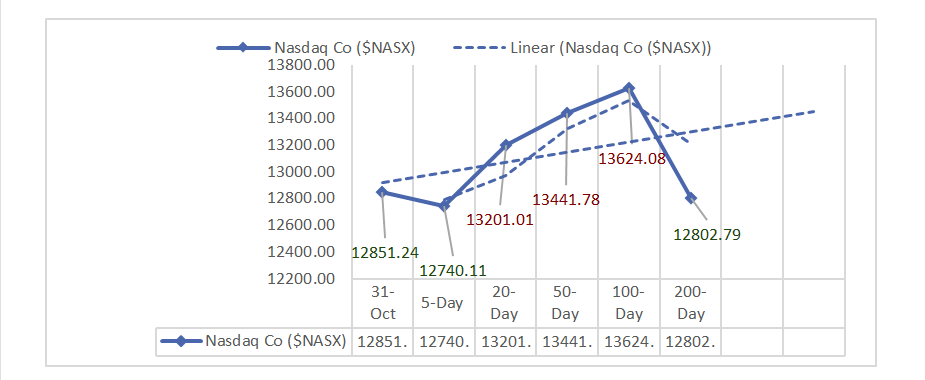

- Nasdaq Composite ^NASX: 12,851.24 (+61.76, +0.48%)

- Nasdaq 100 ^NDX: 14,409.78 (+74.28, +0.52%)

- NYSE Fang+ ^NYFANG: 7,265.59 (+11.55, +0.16%)

- Russell 2000 ^RUT: 1,662.28 (+14.99, +0.91%)

Market Insights: Performance, Sectors, and Trends:

- Economic Data: In Q3, the Employment Cost Index rose 1.1%, stabilizing with 1.0% increases in wages and benefits. S&P Case-Shiller showed 1.0% home price growth in August, while Chicago PMI was 44.0 in October, and consumer confidence reached 102.6 in October, surpassing expectations.

- Market Indices: US market indices all up today with S&P 500 (+0.65%) and Russell 2000 (0.915) leading.

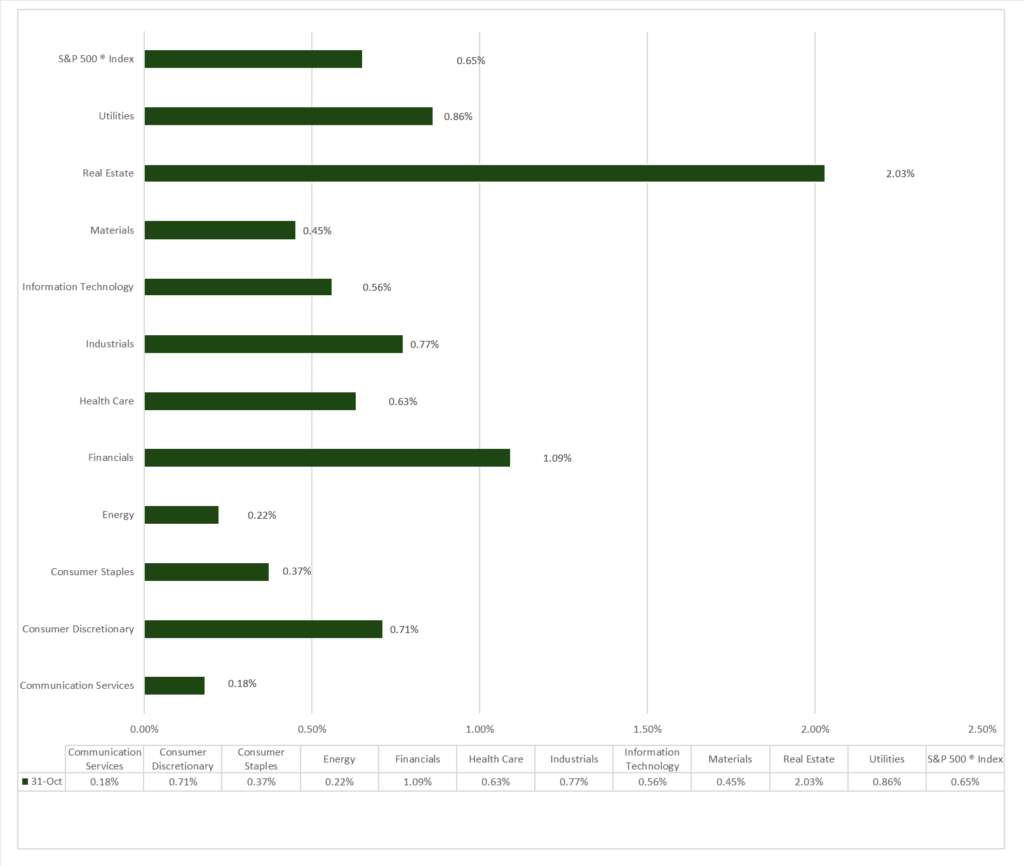

- Sector Performance: All 11 sectors were higher, with Real Estate (+2.03%) leading and Communication Services (+0.18%) lagging. Top industries: Retail REITs (+3.53%).

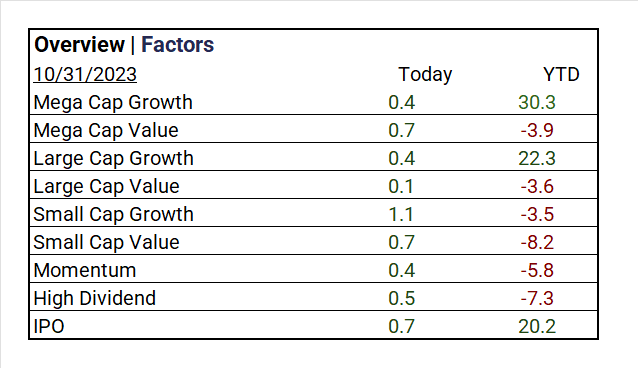

- Factors: Small Cap Growth easily led @+1.1%.

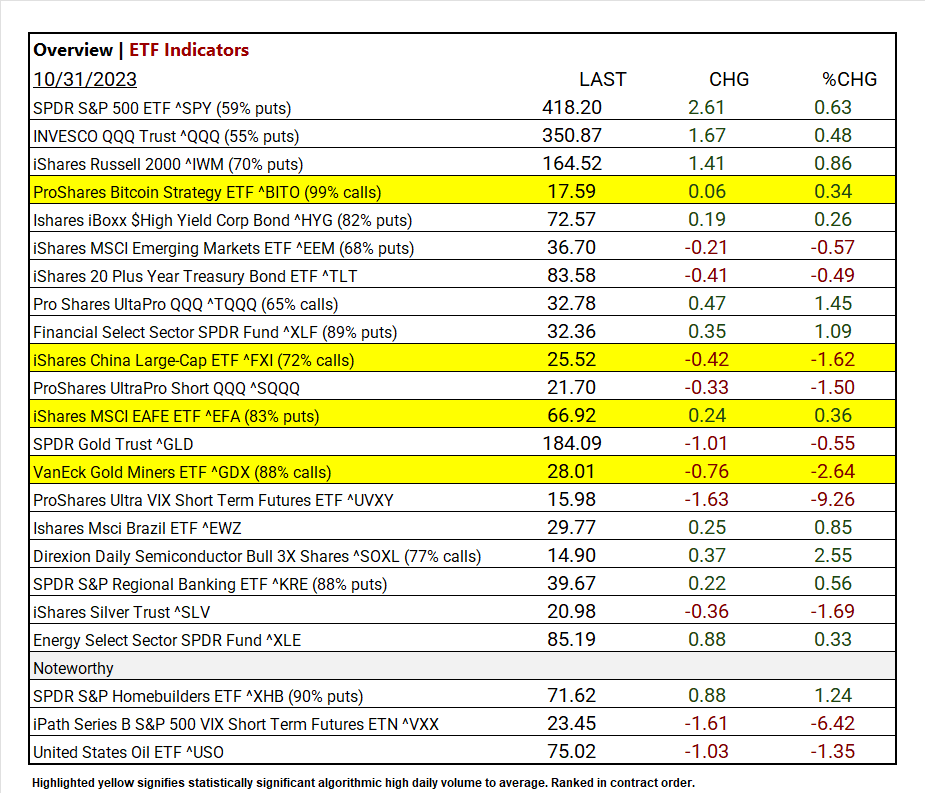

- Top ETF: Direxion Daily Semiconductor Bull 3X Shares ^SOX +2.55%

- Low ETF: ProShares Ultra VIX Short Term Futures ETF ^UVXY -9.26%

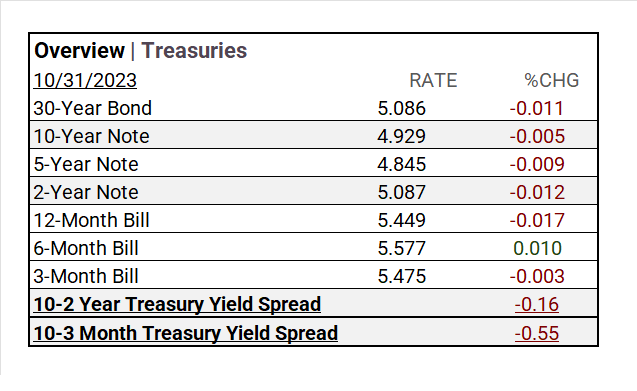

- Treasury Markets: In the bond and treasury markets, the 30-Year Bond decreased to 5.086%, the 10-Year Note declined to 4.929%, and yield spreads adjusted, indicating decreasing shifts in the yield curve.

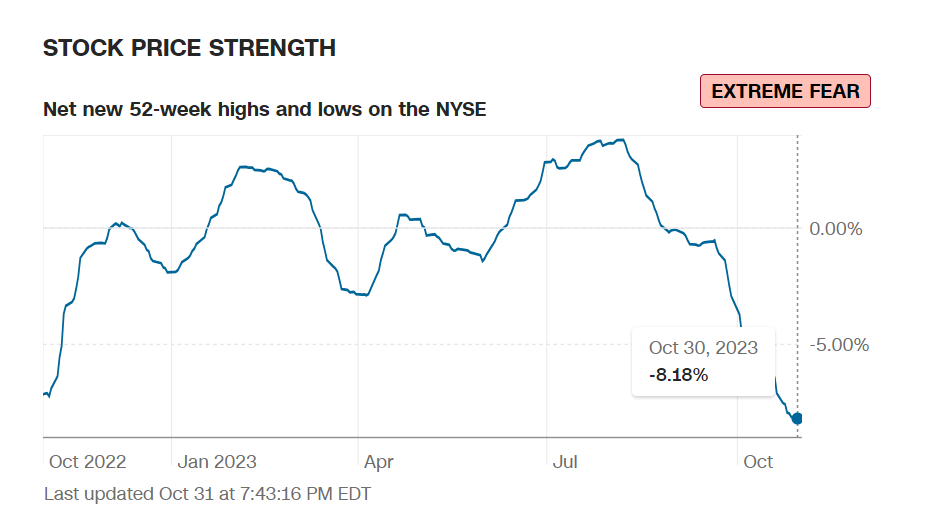

- Currency and Volatility: The U.S. Dollar Index gains, CBOE Volatility falls -8.15%, and the Fear & Greed reading: Fear.

- Commodity Markets: Gold futures and Bitcoin experiencing decreases, while Crude Oil futures and the Bloomberg Commodity Index showed modest gains.

- Notable: Options market activity, ProShares Bitcoin Strategy ETF ^BITO (99% calls) on >3000% daily volume. Heavily bearish positions continue for Regional Banks.

Sectors:

- All 11 sectors were higher, with Real Estate (+2.03%) leading and Communication Services (+0.18%) lagging. Top industries: Retail REITs (+3.53%), Real Estate Management & Development (+3.29%), and Communications Equipment (+2.88%).

Treasury Yields and Currency:

- In the bond and treasury markets, the 30-Year Bond decreased to 5.086%, the 10-Year Note declined to 4.929%, and yield spreads adjusted, indicating decreasing shifts in the yield curve.

- The U.S. Dollar Index ^DXY: 106.70 (+0.58, +0.54%)

Market Volatility and Sentiment:

- CBOE Volatility ^VIX: 18.14 (-1.61, -8.15%)

- Fear & Greed Index (TY/LY): 31/64 (Fear/ Greed).

source: CNN Fear and Greed Index

Commodities:

- Gold Futures: 1,983.81 (-11.80, -0.59%)

- Bitcoin USD: 34,656.40 (-18.90, -0.06%)

- Crude Oil Futures WTI: 81.34 (+0.32, +0.39%)

- Bloomberg Commodity Index: 104.62 (+0.14, +0.14%)

Factors:

- Small Cap Growth easily led market factor performance +1.1%.

ETF Performance:

Top 3 Best Performers:

- Direxion Daily Semiconductor Bull 3X Shares ^SOX +2.55%

- Pro Shares UltaPro QQQ ^TQQQ +1.45%

- Financial Select Sector SPDR Fund ^XLF +1.09%

Top 3 Lowest Performers:

- ProShares Ultra VIX Short Term Futures ETF ^UVXY -9.26%

- VanEck Gold Miners ETF ^GDX -2.64%

- iShares Silver Trust ^SLV -1.69%

US Major Economic Data

- Q3 saw a 1.1% rise in the Employment Cost Index with stable 1.0% wage and benefit increases.

- S&P Case-Shiller Home Price Index (20 cities) in August increased by 1.0%, in line with the 0.8% growth in both 10 and 20-city composites.

- October’s Chicago Business Barometer (PMI) reported 44.0, slightly lower than the previous 45.3, with a 44.1 three-month moving average.

- October’s consumer confidence improved to 102.6, exceeding September’s 100.0 and expectations at 104.3.

Earnings:

- Q1 ’23: 79% of companies beat analyst estimates.

- Q2 Forecast/Actual: Predicted <7.2%> FY 2023 S&P 500 EPS decline; FY 2023 EPS flat YoY. By 7-28, 51% reported Q2 2023, results; 80% beat EPS estimates, above 5-year (77%) and 10-year (73%) averages. Earnings exceeded estimates by 5.9%, slightly below the 5-year (8.4%) and 10-year (6.4%) averages.

- Q3 Forecast: 116 companies in the index have issued EPS guidance for Q3 2023, Of these 116 companies, 74 have issued negative EPS guidance and 42 have issued positive EPS guidance. The percentage of S&P 500 companies issuing negative EPS guidance for Q3 2023 is 64% (74 out of 116), which is above the 5-year average of 59% but equal to the 10-year average of 64%. Eight of the eleven sectors are expected to see year-over-year earnings growth, with Communication Services and Consumer Discretionary leading the way. Conversely, three sectors, mainly Energy and Materials, are expected to experience earnings declines.

Notable Earnings Today:

- BEAT: AMD (AMD), Caterpillar (CAT), Eaton (ETN), Marathon Petroleum (MPC), BBVA ADR (BBVA), Japan Tobacco ADR (JAPAY), Ambev SA (ABEV), Public Service Enterprise (PEG), Cameco (CCJ)

- MISSED: Pfizer (PFE), Amgen (AMGN), Anheuser Busch ADR (BUD), BP ADR (BP), Enterprise Products Partners LP (EPD), Mitsui & Company (MITSY), Ecolab (ECL), Denso ADR (DNZOY), BASF ADR (BASFY), Sysco (SYY), First Solar (FSLR)

Resources:

News

Investment and Growth News

- Yellow’s Rivals Are Getting a Boost From the Trucker’s Demise – WSJ

- Nvidia’s $5 Billion of China Orders in Limbo After Latest U.S. Curbs – WSJ

- Zillow Plunges After Verdict on Real Estate Brokerage Commissions – Bloomberg

- Ford’s Return to Investment Grade Solidifies Era of Rising Stars – Bloomberg

Infrastructure and Energy

- China’s Richest Person Made Billions Bottling Pristine Water – Bloomberg

- Oil and Gas Companies Face an Era of Credit Downgrades, Fitch Warns – Bloomberg

- China Loosens Carbon Rules After Prices Hit Record to Ensure Power Winter Demand Is Met- Bloomberg

Real Estate

- Jury Finds Realtors Conspired to Keep Commissions High- WSJ

- Global Real Estate Fundraising Slumps 71% With Rate Risk – Bloomberg

Central Banking and Monetary Policy

- U.S. Home Prices Rose to Record in August – WSJ

- Charting the Global Economy: Strong Data Send Bond Yields Surging – Bloomberg

International Market Analysis (China)

- China’s manufacturers ‘not in high spirits in October’ as activity contracts – SCMP