MARKETS TODAY July 6th, 2023 (Vica Partners)

Overnight/US Premarket, Asian markets finished lower, Japan’s Nikkei 225 -0.98%, Hong Kong’s Hang Seng and China’s Shanghai Composite closed. European markets finished sharply lower, France’s CAC 40 -3.13%, Germany’s DAX -2.57%, London’s FTSE 100 -2.17%. S&P futures were trading at -0.6% below fair-value.

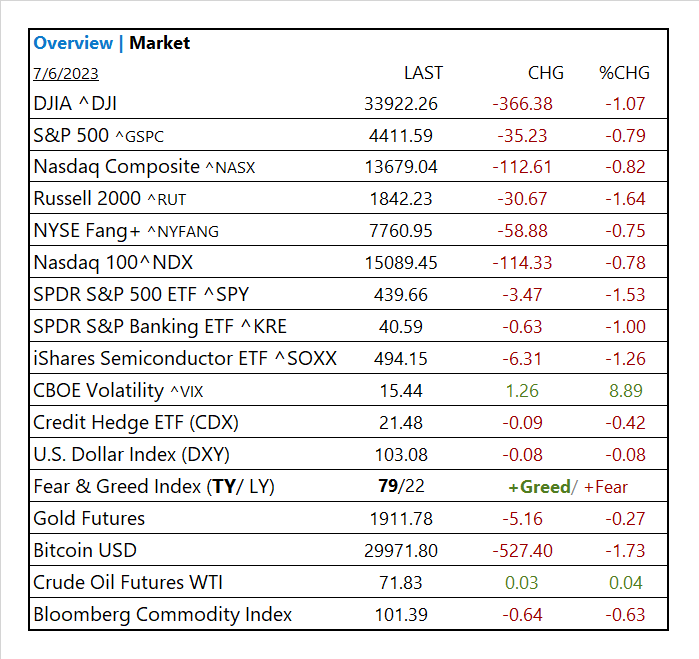

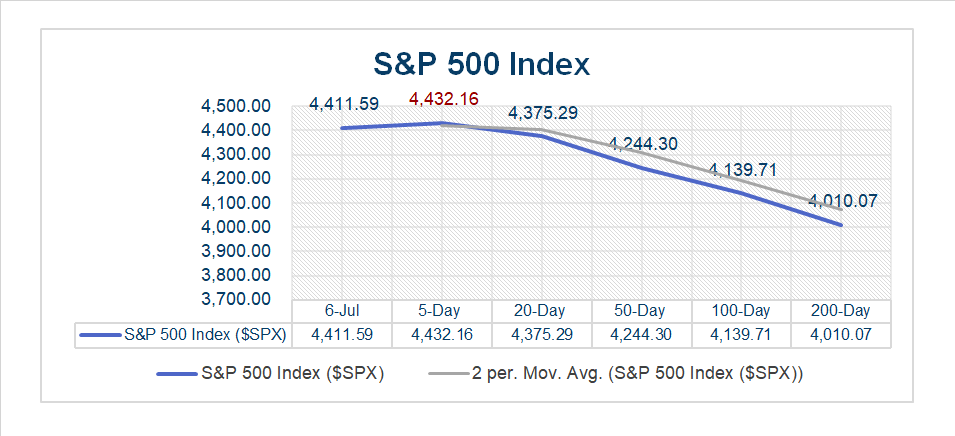

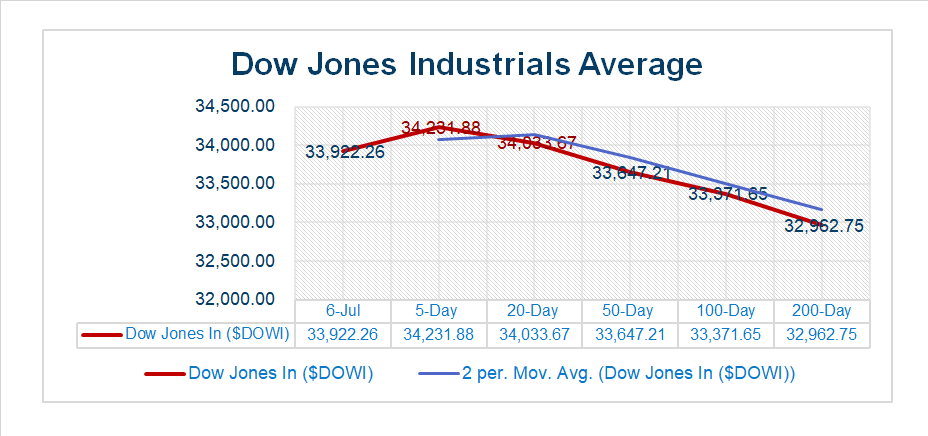

Today US Markets finished lower, S&P 500 -0.79%, DOW -1.07%, NASDAQ -0.82%. All 11 S&P 500 sectors declining: Information Technology -0.16% outperforms/ Energy -2.45% lags. On the upside, Mega Cap Tech and Oil. In economic news, the June ADP jobs survey was about 2X the estimate, driven by leisure and hospitality. Initial claims beat and Jolts were mostly inline. S&P U.S. services PM came in high, ISM Services also came in high on better than expected new orders.

Takeaways

- June ADP jobs survey was about 2X the estimate

- All 11 S&P 500 sectors declining: Information Technology -0.16% outperforms/ Energy -2.45% lags

- Mega Cap Tech/Defensives outperform

- Oil moderately gains

- >90% chance of Fed July hike

Vica Partner Guidance: Mega and Large Cap Growth continue to look attractive in early Q3. Highlighting Lithium Miners. Nasdaq 100^NDX 14,500 level is buying opportunity. Q3 2023/ credit default swap (CDS) will pick-up. Q1 2024/ expect economy pullback.

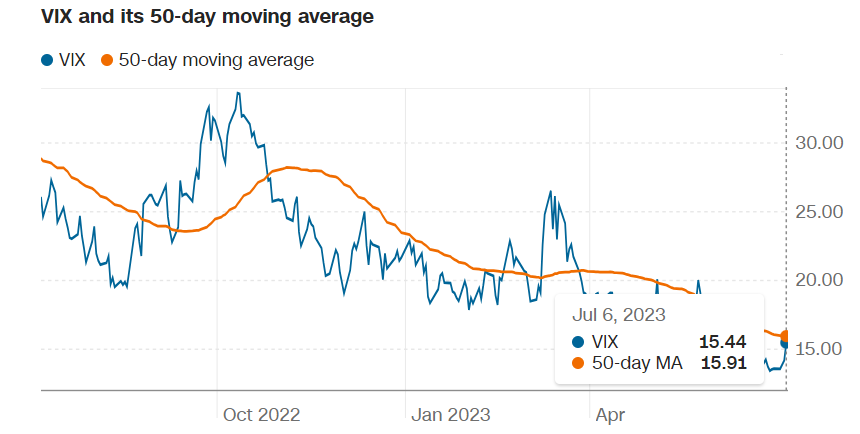

Pro Tip: The CBOE Volatility Index, or VIX measures volatility in the S&P 500 Index options over the next 30 days. The VIX declines on days when the broader market rallies and rises when stocks selloff.

Sectors/ Commodities/ Treasuries

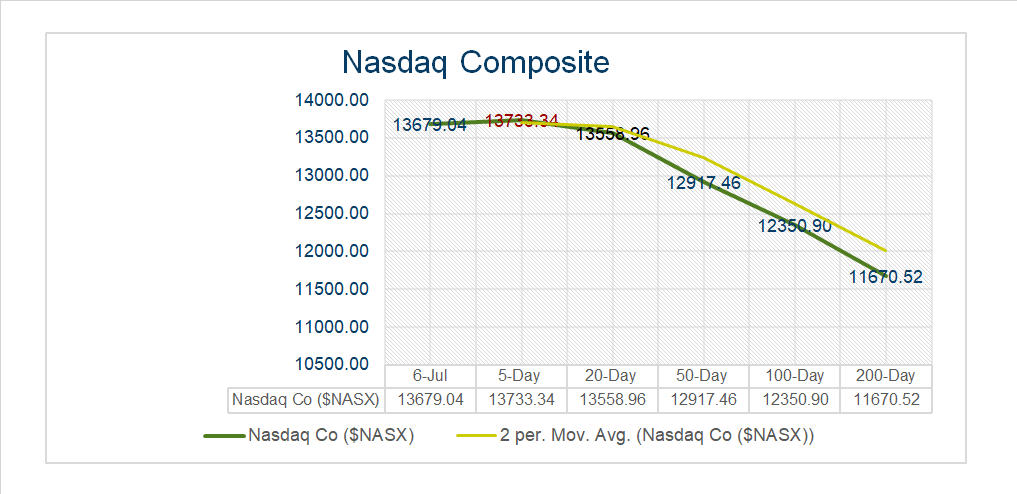

Key Indexes (5d, 20d, 50d, 100d, 200d)

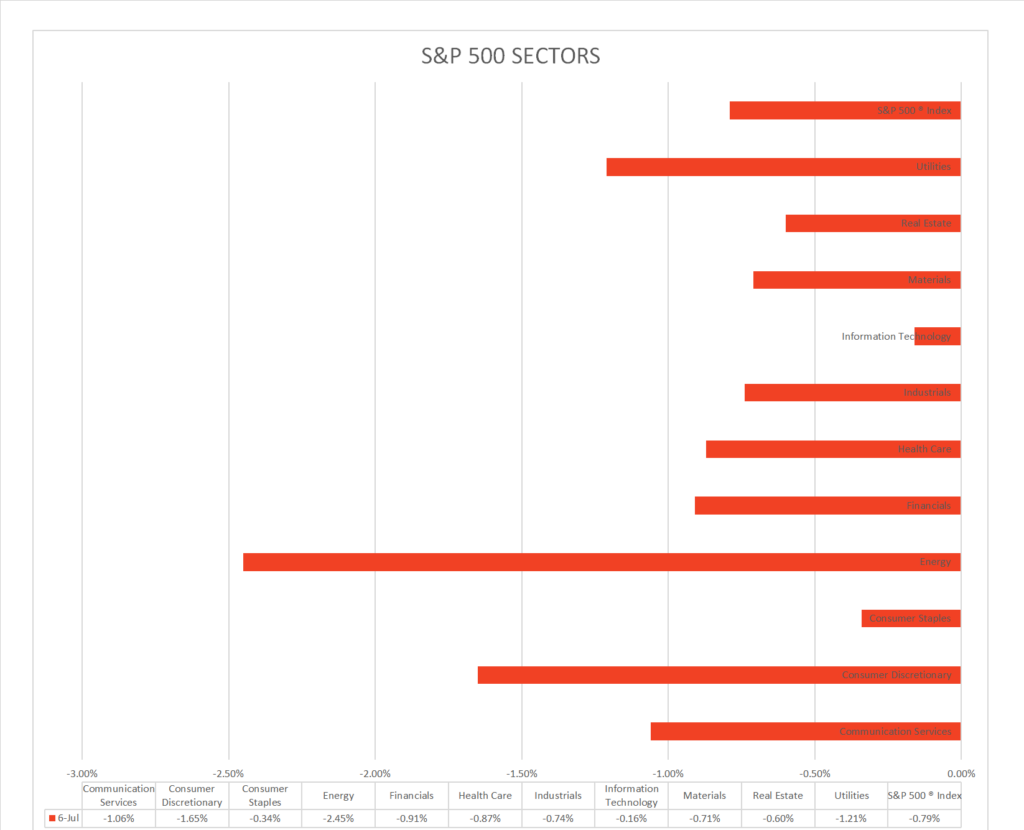

S&P Sectors

- All 11 S&P 500 sectors declining: Information Technology -0.16%, Consumer Staples -0.34% outperform/ Energy -2.45%, Consumer Discretionary -1.65%, lag.

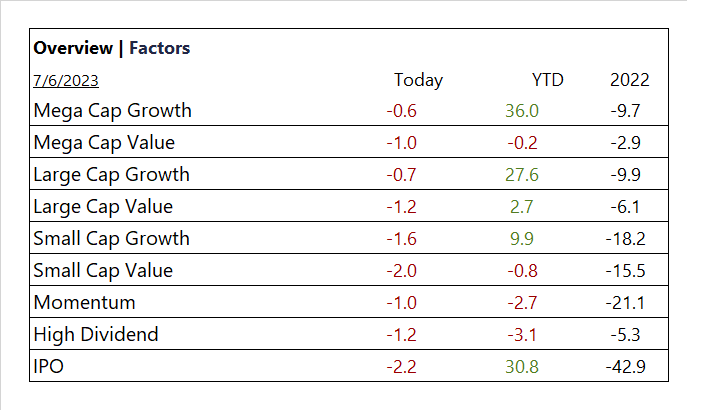

Factors

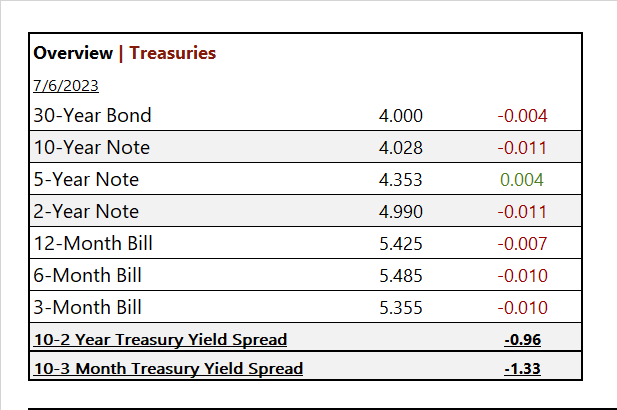

US Treasuries

Notable Earnings Today

- +Beat: Levi Strauss A (LEVI), Osisko Gold Ro (OR)

- – Miss: Chr Hansen ADR (CHYHY)

- * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), Sociedad Quimica y Minera (SQM)

Economic Data

US

- ADP employment; period June, act 497,000, fc 220,000, prior 267,000

- Initial jobless claims; period July 1, act 248,000, fc 245,000, prior 236,000

- US. trade deficit; period May, act -$69B, fc -$68.9B, prior -$74.4B

- Job openings; period May, act 9.8m, fc 10m, prior 10.3m

- S&P U.S. services PMI, act 54,4, fc 1, prior 54.1

- ISM services; period June, act 53.9%, fc 51.3%, prior 50.3%

News

Company News/ Other

- Meta’s Threads App Sees Early Success, Drawing Advertiser Interest and Twitter’s Ire – WSJ

- FDA Approves Leqembi, Extending Alzheimer’s Treatment to More Patient – WSJ

Energy/ Materials

- Billionaire Ratcliffe Sees UK Energy Policy Wrecking Industries – Bloomberg

Central Banks/Inflation/Labor Market

- Why Interest Rates Don’t Cool Inflation Enough: They Hit the Wrong Places – WSJ

Asia/ China