MARKETS TODAY April 20th, 2023 (Vica Partners)

Good Thursday!

Yesterday, Indices closed broadly lower with Nasdaq and Russell 2000 leading gainers, defensive sector Utilities outperformed. Morgan Stanley (MS), U.S. Bancorp (USB) earning beats boosted the Regional Banking ETF (KRE) up 3.94%. Tech earnings continue to come in soft. Bloomberg Commodity Index, Oil, Bitcoin and Gold all dropped.

Overnight, Asian markets finished mixed with the Nikkei 225 +0.18% and the Hang Seng + 0.14%, the Shanghai Composite -0.09%. Premarket, European markets finished mixed the FTSE 100 +0.05%, the DAX -0.62% and the CAC 40 -0.14%. S&P 500 US futures were trading 0.75% below fair-value fair value at the opening bell.

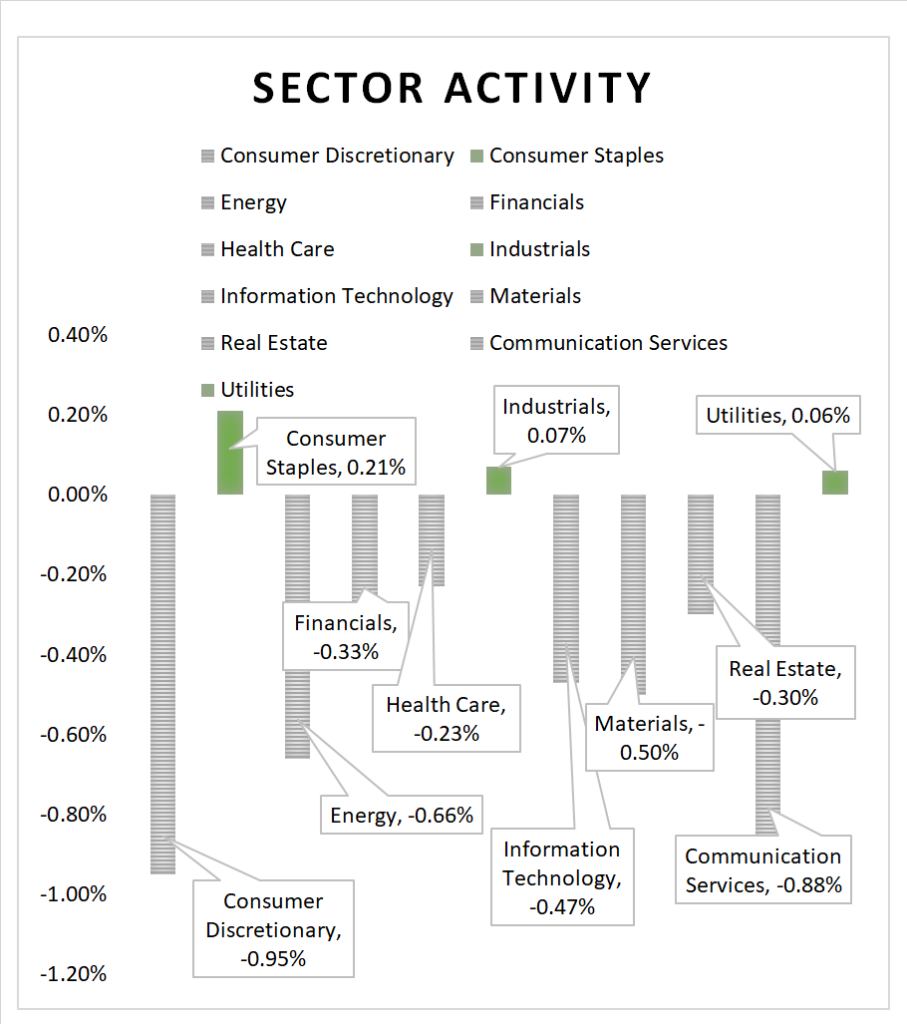

US markets today, over the past 5 days the DOW, S&P 500 and Nasdaq Composite declining 0.71%, 0.40% and 0.88% respectively. Indices declined on the day with 8 of 11 of the S&P 500 sectors finishing lower, Consumer Discretionary and Communication Services underperform. The Cboe Volatility Index rises sharply >4% on recessionary concerns. Bloomberg Commodity Index, Oil, Bitcoin all drop, Gold rises. In economic news, Jobless claims for the week ended March 25 topped estimates still but remain historically high. New applications for unemployment benefits up. Philly Fed’s Mfg. activity contraction accelerated in April, up 8th consecutive month.

Takeaways

- Inflation markers signaling contraction, consumer debt rising

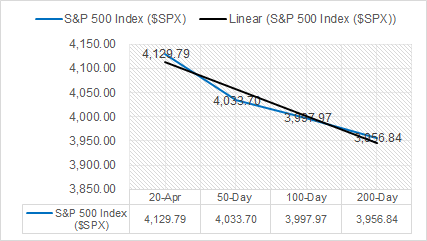

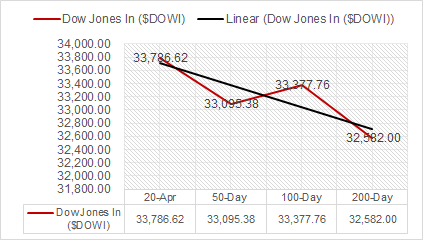

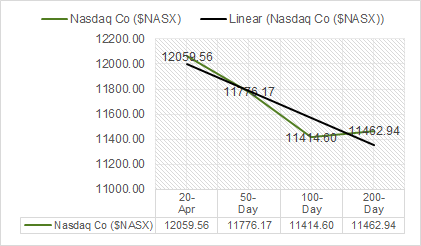

- Past 5 days DOW, S&P 500 and Nasdaq Composite declining 0.71%, 0.40% and 0.88% respectively

- Consumer Discretionary and Communication Services underperform as Tesla and AT&T miss on earnings

- Jobless claims for the week topped estimates still but remain historically high

Pro Tip: While it’s difficult to predict the timing and extent of a soft landing, here are 4 portfolio strategies to prepare a) Invest in defensive sectors: Defensive sectors, such as utilities, consumer staples, and healthcare, they perform well during economic slowdowns b) Focus on high-quality companies that have strong balance sheets, consistent earnings growth, and solid cash flows w/ goal is to invest for the long term c) Consider fixed-income investments such as bonds and treasury bills to provide income

Sectors/ Commodities/ Treasuries

Key Indexes (50d, 100d, 200d)

S&P Sectors

- 8 of 11 of the S&P 500 sectors finish lower, Consumer Discretionary -0.95% and Communication Services -0.88% underperform/ Consumer Staples +0.21% outperforms

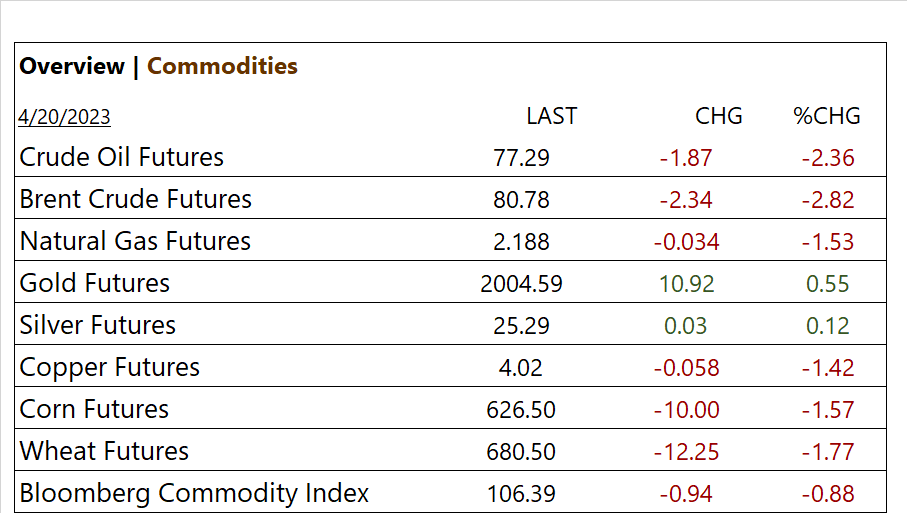

Commodities

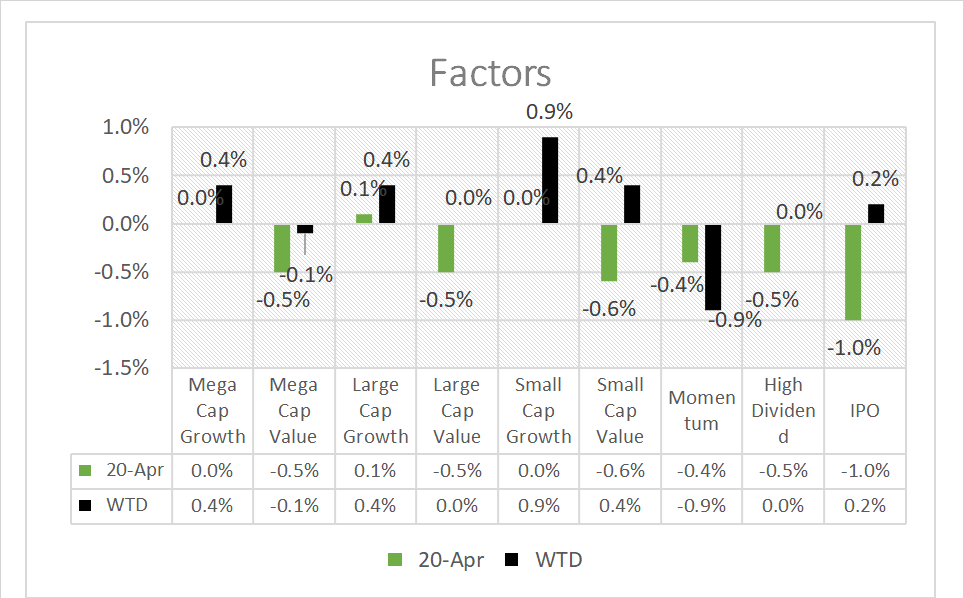

Factors

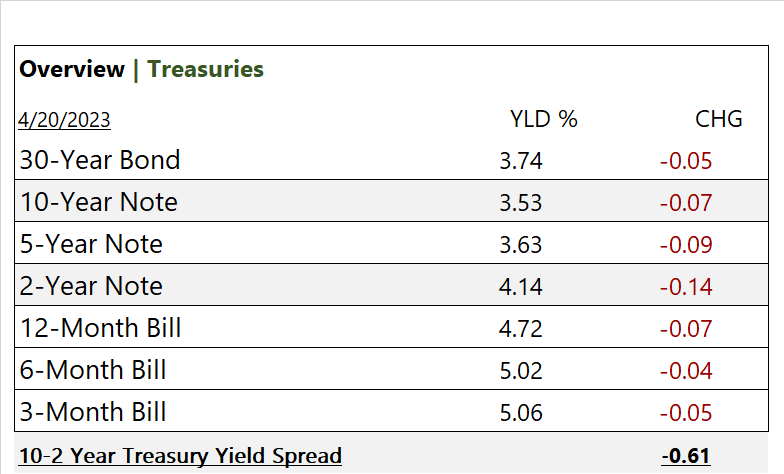

US Treasuries

Notable Earnings Today

- + Union Pacific (UNP), Blackstone Group (BX), Marsh McLennan (MMC), Volvo ADR (VLVLY)

- – Taiwan Semiconductor (TSM), Philip Morris (PM), AT&T (T), American Express (AXP), Truist Financial Corp (TFC), Nucor (NUE),

- * Strong support – NVIDIA (NVDA), QUALCOMM (QCOM), Analog Devices (ADI), Amazon (AMZN), Cintas Corp (CTAS), Owens Corning (OC),Berkshire Hathaway (BRK-B), Citigroup (C), BlackRock (BLK), Morgan Stanley (MS), Union Pacific (UNP)

Economic Data

US

- Initial jobless claims; period April 15, act 245,000, fc 244,000, prev. 240,000

- Continuing jobless claims; period April 8, act 1.87m, prev. 1.80m

- Philadelphia Fed manufacturing survey; period April, act -31.3, fc -20.0. prev. -23.2

- Existing home sales; period March, act 4.44m, fc 4.48m, prev. 4.55m

- S. leading economic indicators; period March, act -1.2%, fc -0.7%, prev. -0.5%

News

Company News/ Other

- Tesla shares sink as Musk’s sales push by price cuts hurts margins – Reuters

- Huawei launches in-house software system after being cut off from US services – Reuters

- IKEA plans new US stores in $2.2 billion push to challenge Walmart and Wayfair – Reuters

Central Banks/Inflation/Labor Market

- Fed’s Williams Says Banking Stress Likely to Tighten Credit – Bloomberg

- Home Prices in March Posted Biggest Annual Decline in 11 Years – WSJ

- Blackstone is in talks to help regional banks with lending – Reuters

China