“Empowering Your Financial Success”

Daily Market Insights: October 10th, 2023

Global Markets Summary:

Asian Markets:

- Hang Seng (Hong Kong): +1.54%

- Shanghai Composite (China): +0.41%

- Nikkei 225 (Japan): Closed.

US Futures:

- S&P Futures: opened @ 4339.75 (+0.09%)

European Markets:

- CAC 40 (France): +2.01%

- DAX (Germany): +1.95%

- FTSE 100 (London): +1.82%

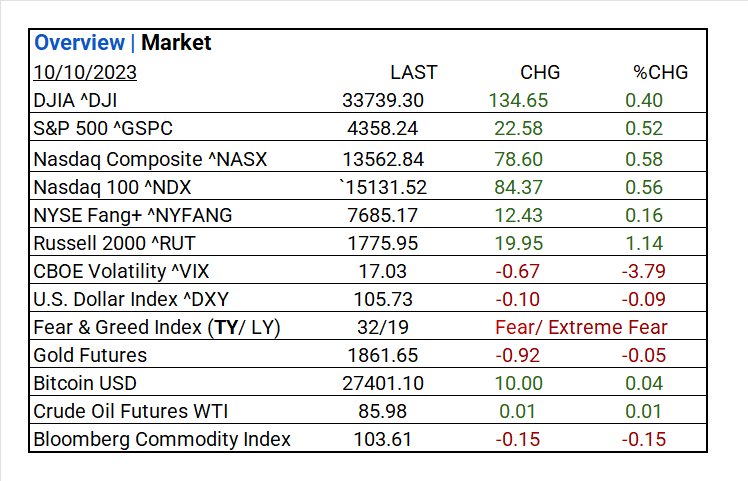

US Market Snapshot:

Key Stock Market Indices:

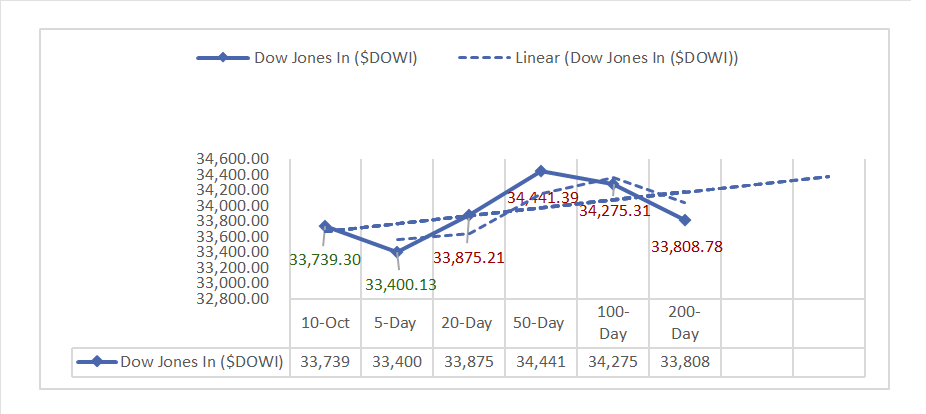

- DJIA ^DJI: 33,739.30 (+134.65, +0.40%)

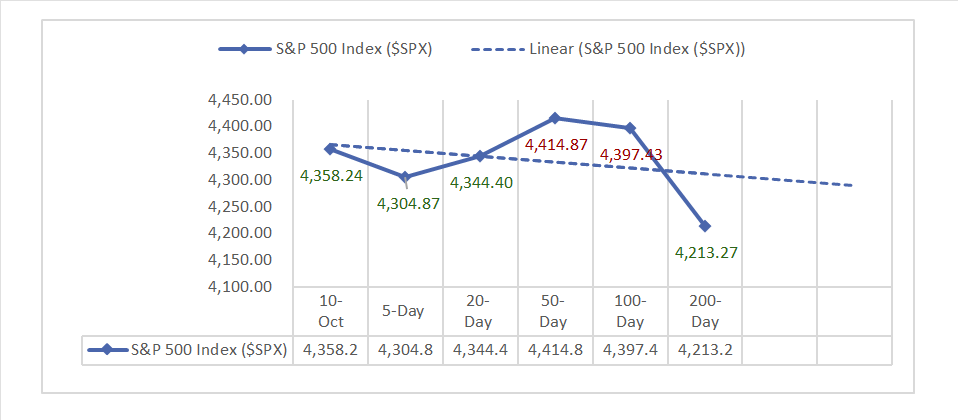

- S&P 500 ^GSPC: 4,358.24 (+22.58, +0.52%)

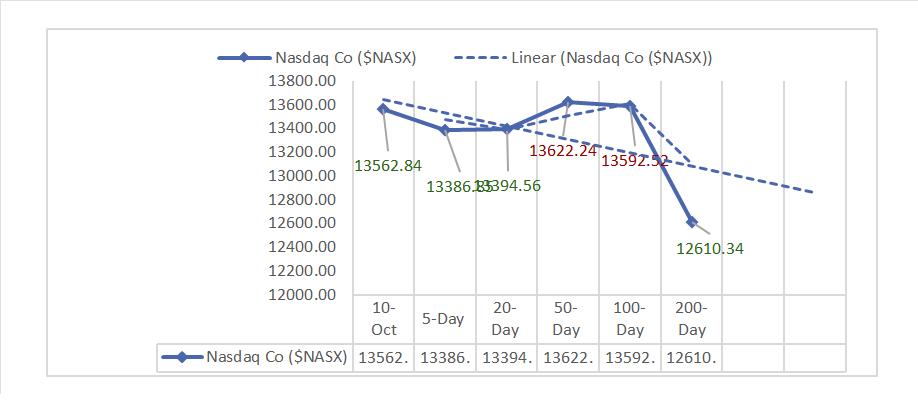

- Nasdaq Composite ^NASX: 13,562.84 (+78.60, +0.58%)

- Nasdaq 100 ^NDX: 15,131.52 (+84.37, +0.56%)

- NYSE Fang+ ^NYFANG: 7,685.17 (+12.43, +0.16%)

- Russell 2000 ^RUT: 1,775.95 (+19.95, +1.14%)

Market Insights: Performance, Sectors, and Trends:

- Economic Data: Aug Wholesale Inventories met expectations at +0.1%. Sep NFIB Business Optimism & NY Fed Consumer Expectations dipped.

- Market Indices: U.S. stock indices advanced, DJIA ^DJI closed at 33,739.30 (+0.40%).

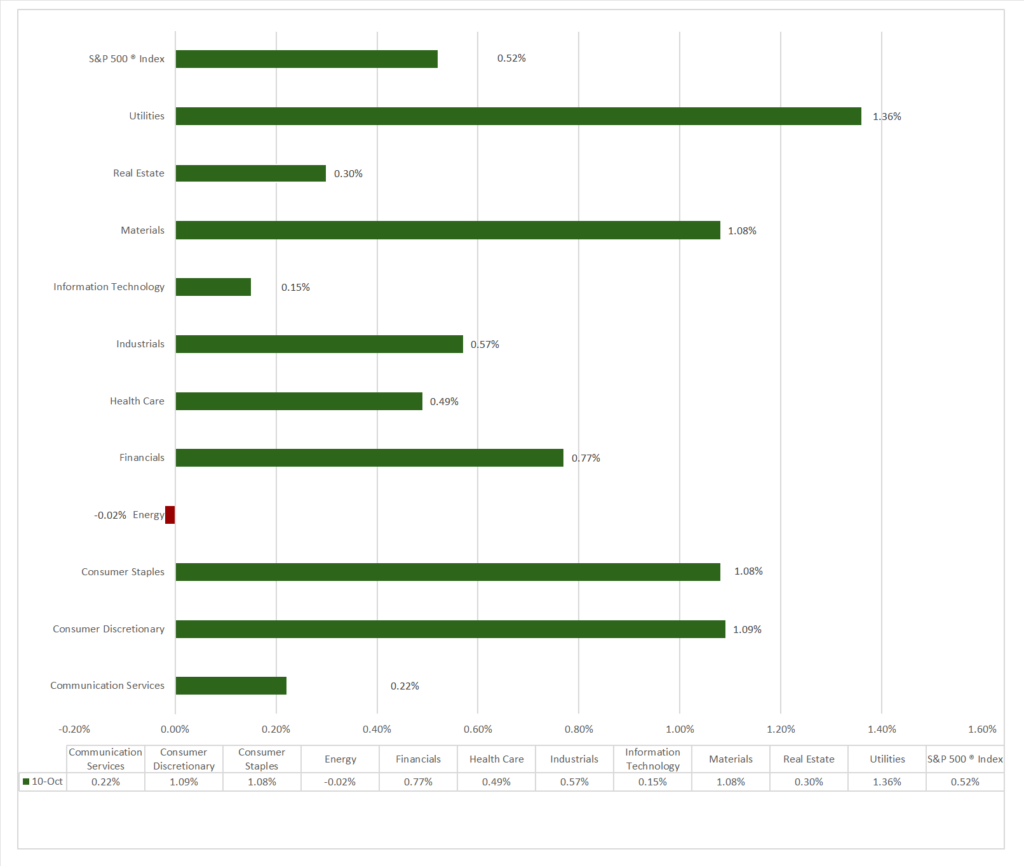

- Sector Performance: 10 of 11 sectors gained, led by Utilities (+1.36%). Energy lagged (-0.02%). Top Industry: Independent Power and Renewable Electricity Producers (+2.52%).

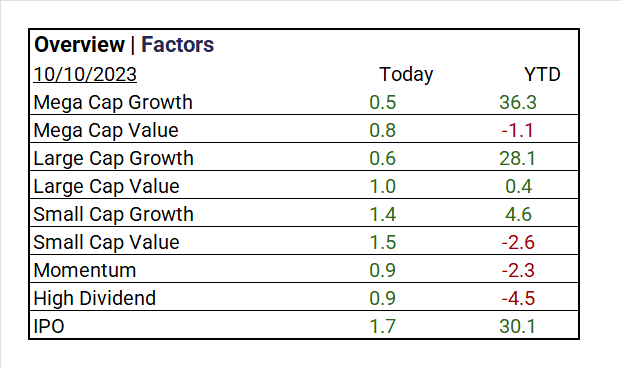

- Factors: IPOs lead (+1.7%).

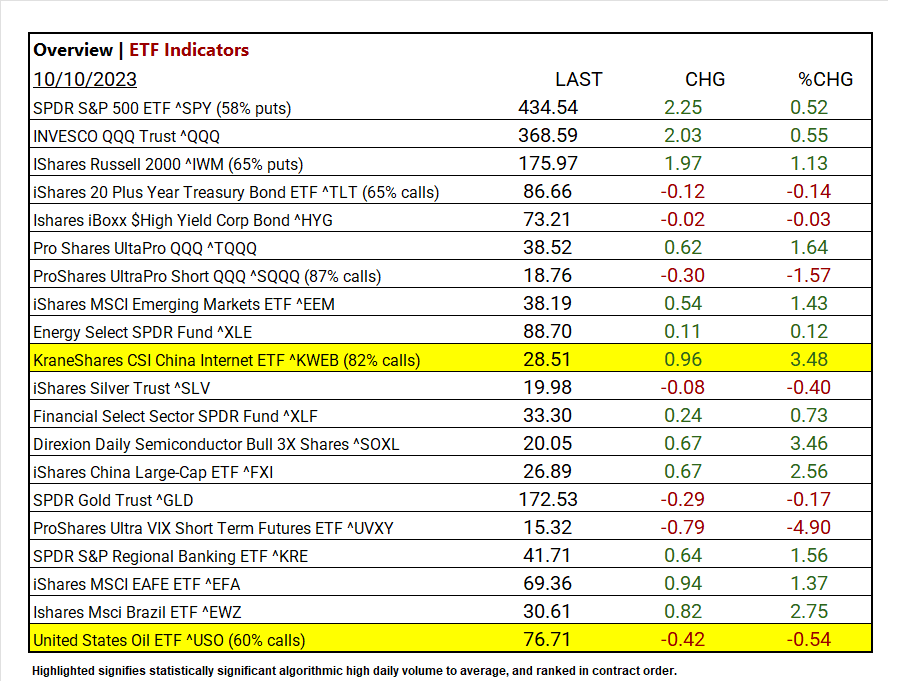

- Top ETF: KraneShares CSI China Internet ETF ^KWEB +3.48%.

- Worst ETF: ProShares Ultra VIX Short Term Futures ETF ^UVXY -4.90%.

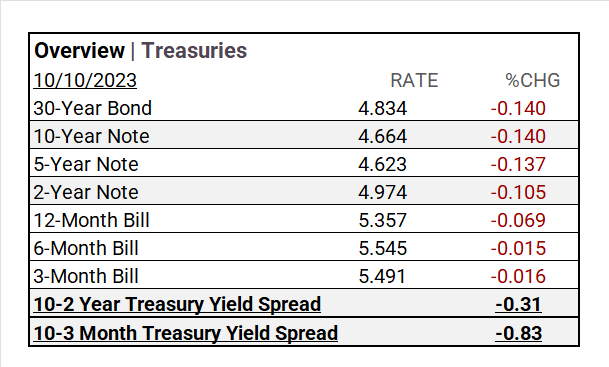

- Treasury Markets: US Treasury Yields declined, with the 30-Year Bond at 4.834%, 10-Year Note at 4.664%, and 2-Year Note at 4.974%.

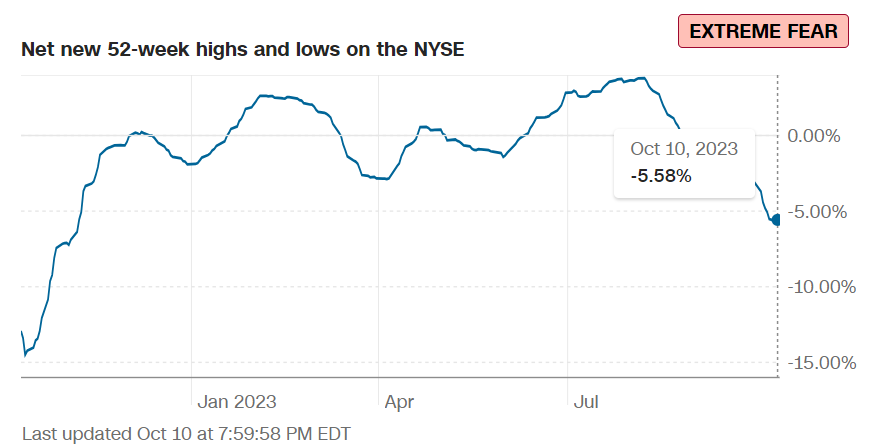

- Currency and Volatility: U.S. Dollar Index down, CBOE Volatility fell -3.79%, Fear & Greed reading: Fear.

- Commodity Markets: Gold falls, Bitcoin moderately rises, Oil up, Bloomberg Commodity Index declines.

Sectors:

- 10 of 11 sectors gained, Utilities outperformed (+1.36%), while Energy (-0.02%) lagged. Top Industry: Independent Power and Renewable Electricity Producers (+2.52%), Health Care REITs (+2.20%), Construction & Engineering (+2.15%).

Treasury Yields and Currency:

- Key US Treasury Yields fell: 30-Year Bond at 4.834%, 10-Year Note at 4.664%, and 2-Year Note at 4.974%. Yield spreads narrowed.

- The U.S. Dollar Index ^DXY: 105.73 (-0.10, -0.09%)

Market Volatility and Sentiment:

- CBOE Volatility ^VIX: 17.03 (-0.67, -3.79%)

- Fear & Greed Index (TY/LY): 32/19 (Fear/ Extreme Fear).

Commodities:

- Gold Futures: 1861.65 (-0.92, -0.05%)

- Bitcoin USD: 27,401.10 (+10.00, +0.04%)

- Crude Oil Futures WTI: 85.98 (+0.01, +0.01%)

- Bloomberg Commodity Index: 103.61 (-0.15, -0.15%)

Factors:

- Small Caps top Large Caps, IPO’s lead (+1.7%).

ETF Performance:

Top 3 Best Performers:

- KraneShares CSI China Internet ETF ^KWEB +3.48%

- KraneShares CSI China Internet ETF ^KWEB +3.46%

- Ishares Msci Brazil ETF ^EWZ +2.75%

Top 3 Worst Performers:

- ProShares Ultra VIX Short Term Futures ETF ^UVXY -4.90%

- ProShares UltraPro Short QQQ ^SQQQ -1.57%

- United States Oil ETF ^USO -0.54%

US Major Economic Data

August

- Wholesale Inventories MoM -0.1% vs -0.1% cons, prior -0.3%.

September

- NFIB Business Optimism Index Sept 90.8, prior 91.3

- NY Fed Survey of Consumer Expectations Sept 3.7%, prior 3.6%

Earnings:

- Q1 ’23: 79% of companies beat analyst estimates.

- Q2 Forecast/Actual: Predicted <7.2%> FY 2023 S&P 500 EPS decline; FY 2023 EPS flat YoY. By 7-28, 51% reported Q2 2023, results; 80% beat EPS estimates, above 5-year (77%) and 10-year (73%) averages. Earnings exceeded estimates by 5.9%, slightly below the 5-year (8.4%) and 10-year (6.4%) averages.

- Q3 Forecast: 116 companies in the index have issued EPS guidance for Q3 2023, Of these 116 companies, 74 have issued negative EPS guidance and 42 have issued positive EPS guidance. The percentage of S&P 500 companies issuing negative EPS guidance for Q3 2023 is 64% (74 out of 116), which is above the 5-year average of 59% but equal to the 10-year average of 64%. Eight of the eleven sectors are expected to see year-over-year earnings growth, with Communication Services and Consumer Discretionary leading the way. Conversely, three sectors, mainly Energy and Materials, are anticipated to experience earnings declines.

Notable Earnings Today:

- Beat: PepsiCo (PEP), AZZ (AZZ)

- Miss: Neogen (NEOG), E2open Parent Holdings (ETWO)

Resources:

- What’s Expected in October

- Vica Partners Economics Forecast

News

Investment and Growth News

- Sales Slow at Louis Vuitton’s Owner as China Sputters – WSJ

- LG Energy Profit Beats Estimates Thanks to Bumper US Tax Credit – Bloomberg

Infrastructure and Energy

- China’s Clean Car Exports Surge as Europe Starts Subsidy Probe – Bloomberg

Real Estate Market Updates

- The Californization of the Texas Housing Market – WSJ

Central Banking and Monetary Policy

- Fed Is Determined to Bring Inflation Back to 2% Target, Waller Says – Bloomberg

- Housing Groups, Mortgage Lenders Urge Powell to Halt Fed Hikes – Bloomberg

- Higher Bond Yields Likely to Extend Fed Rate Pause – WSJ

International Market Analysis (China)

- China GDP: as IMF lowers economic forecasts, is there still a window of opportunity to surpass the US? – SCMP