MARKETS TODAY April 28th, 2023 (Vica Partners)

Yesterday, US Markets sharply rose as strong earnings reversed the early Week selloff. The DOW gained +500 points with Nasdaq/Tech leading advancers. All 11 of the S&P 500 sectors finished higher, Communications outperformed/ Energy lagged. Treasury Yields rose across the curve, Bitcoin jumped >4%.

Overnight, Asian markets finished higher, The Nikkei 225 +1.40%, China’s Shanghai Composite +1.14%, Hong Kong’s Hang Seng +0.55%. Pre-market, European markets finished mixed, the DAX +0.49%, FTSE 100 +0.30%, CAC 40 -0.25%. S&P 500 US futures were trading 0.2% below fair-value.

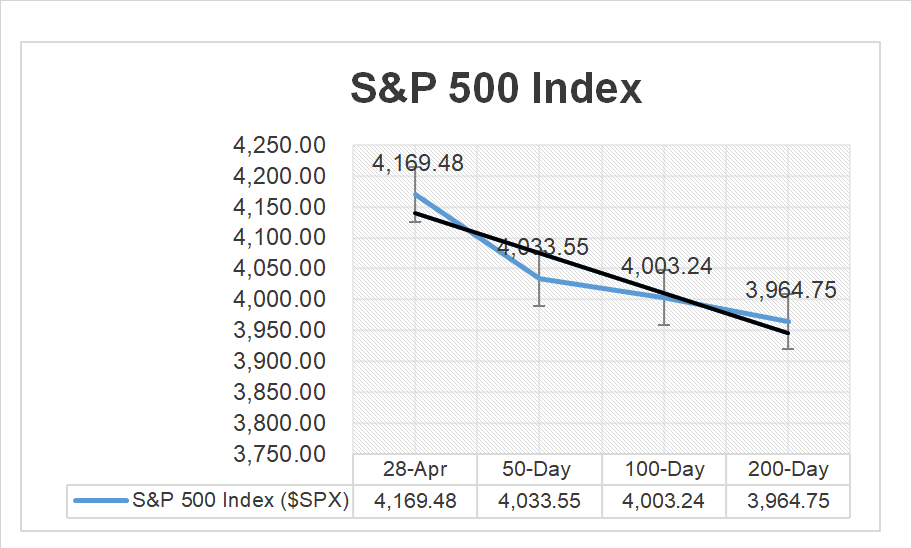

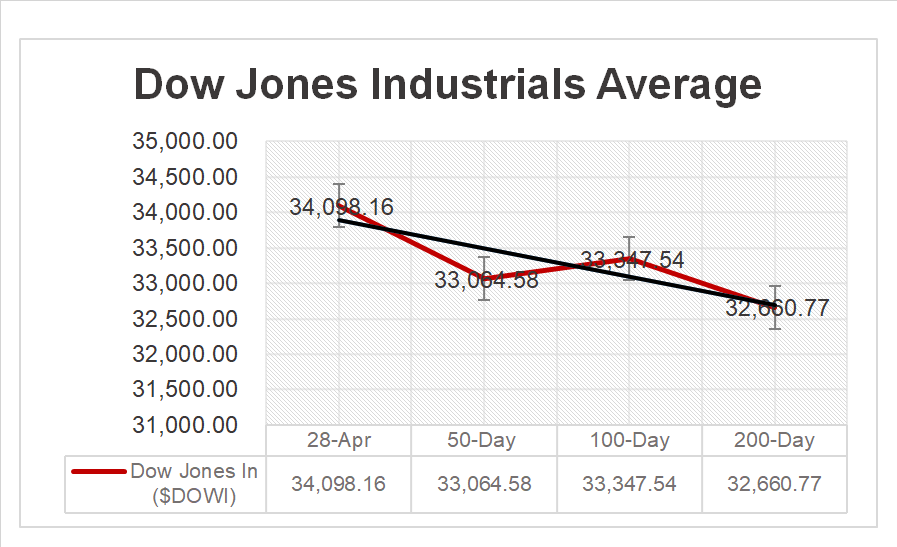

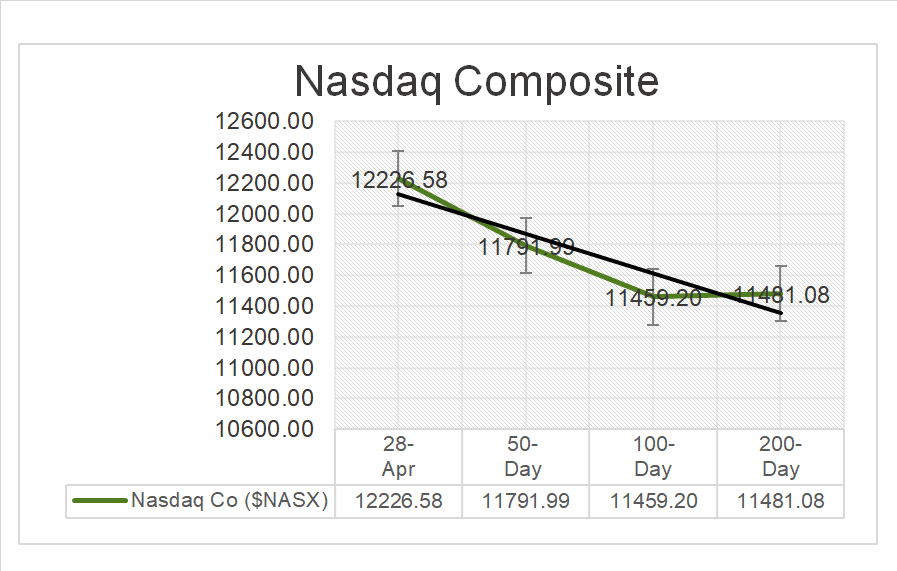

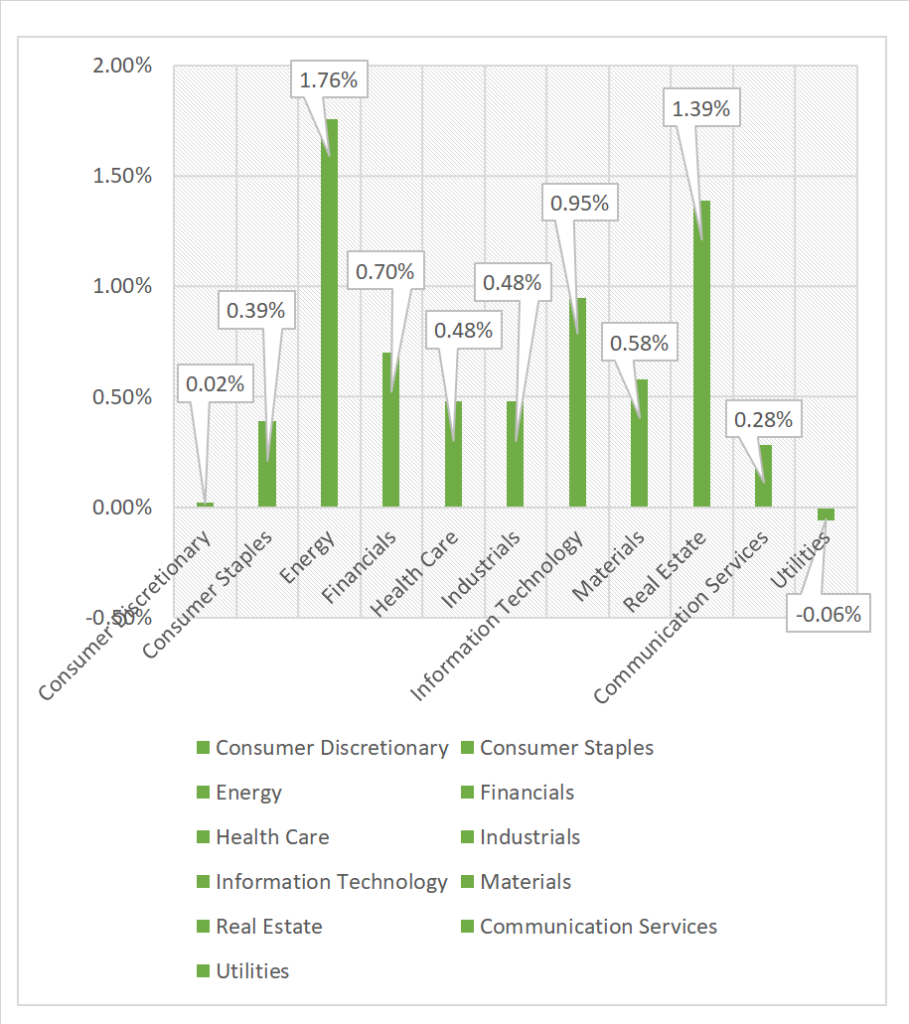

Today, US Markets finished higher with the 3 major Indices all returning a weekly gain. The Nasdaq led Weekly gainers picking up 1.3% over the past 5 days. 10 of 11 of the S&P 500 sectors finished higher on the day, Energy +1.76% outperformed. The Volatility Index dropped to a +17 month low today. Oil rose and SPDR S&P Banking ETF (KRE) +1.74%. Exxon and Chevron delivered solid earnings beats. In economic news, the Fed’s favored Inflation metric Core PCE remained historically high at 4.6% but moderating, as consumer spending was unchanged in March

Takeaways

- Exxon and Chevron delivered solid earnings beats that’s sparks market

- 3 major Indices all returning a weekly gain

- The Volatility Index dropped to close to 18 month low

- Energy +1.76% and Real Estate 1.39% led Sector advancers

- iShares Semiconductor ETF ^SOXX, up 1.80%

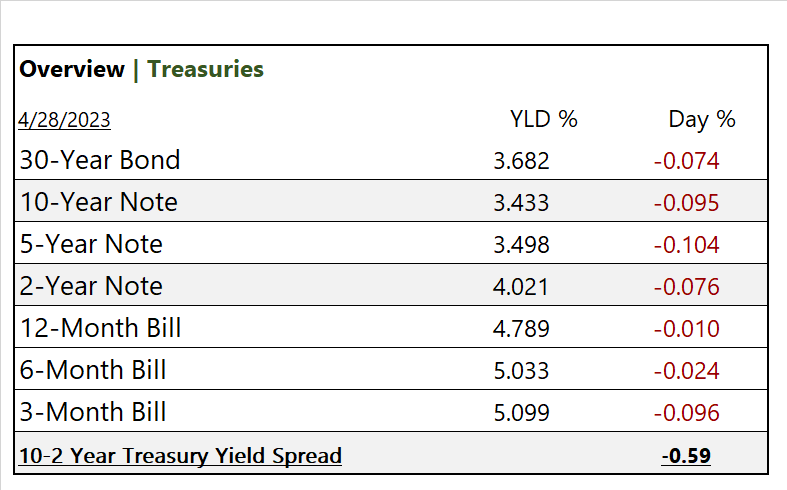

- Treasury 10/2 inverted curve moderating

- Inflation cooling, wage gains still continue weigh on the Fed

Pro Tip:

There are several basic chart patterns that are commonly used in financial market analysis. Head and shoulders is a chart pattern in which a large peak has a slightly smaller peak on either side of it. Traders look at head and shoulders patterns to predict a bullish-to-bearish reversal (click here to learn more).

Sectors/ Commodities/ Treasuries

Key Indexes (50d, 100d, 200d)

S&P Sectors

- 10 of 11 of the S&P 500 sectors finish higher, Energy +1.76% and Real Estate 1.39% led advancers/ Utilities -0.06% lags

Commodities

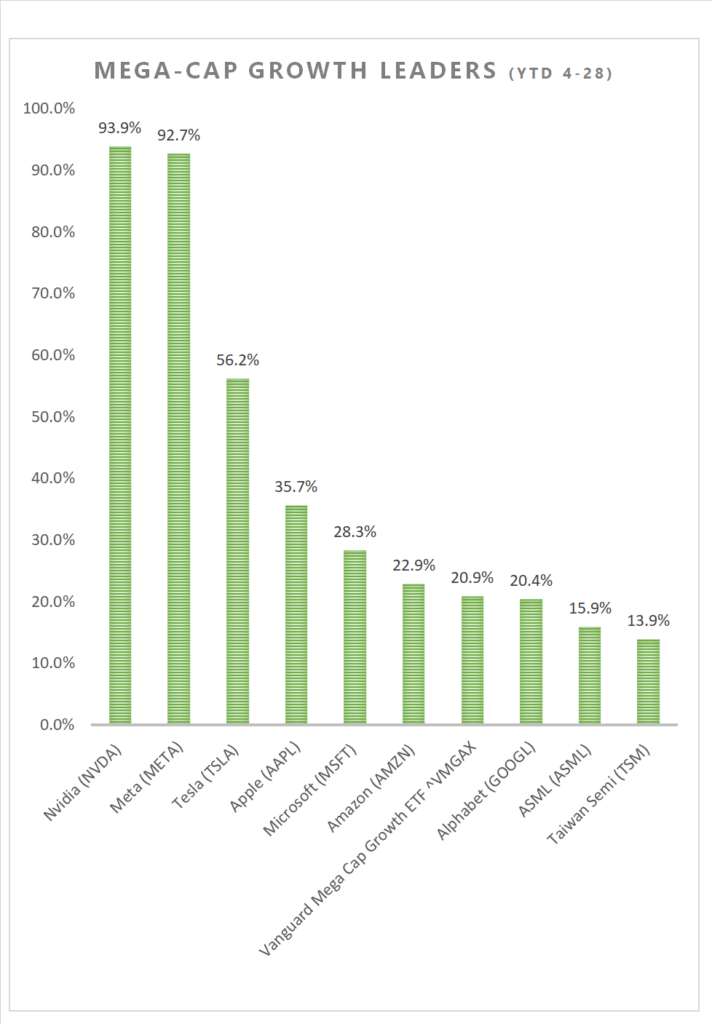

Mega Caps Growth (YTD)

US Treasuries

Notable Earnings Today

- +Beat: Exxon Mobil (XOM), Chevron (CVX), Sony ADR (SONY), Colgate-Palmolive (CL), Natwest Group (NWG), Mitsubishi Electric ADR (MIELY), Komatsu (KMTUY)

- – Miss: Industrial Commercial Bank of China (IDCBY), Aon (AON), Charter Communications (CHTR), TC Energy (TRP), Newell Brands (NWL)

- * Strong support – Meta Platforms (META) Microsoft (MSFT), Alphabet (GOOG,GOOGL), Visa (V), NVIDIA (NVDA), Owens Corning (OC),Berkshire Hathaway (BRK-B), Citigroup (C), BlackRock (BLK), Morgan Stanley (MS), Union Pacific (UNP), Coca-Cola (KO), PACCAR (PCAR), Centene (CNC), Humana (HUM), Mastercard (MA), Caterpillar (CAT), ConocoPhillips (COP)

Economic Data

US

- Employment cost index; period Q1, act 1.2%, fc 1.0%. prev. 1.0%

- Personal income (nominal); period March, act 0.3%, fc 0.2%. prev. 0.3%

- Personal spending (nominal); period March, act 0.0%, fc 0.0%, prev. 0.1%

- PCE index; period March, act 0.1%. prev. 3%

- Core PCE index; period March, act 3%. fc 0.3%, prev. 0.3%

- PCE (year-over-year); period March, act 2%, prev. 5.1%

- Core PCE (year-over-year); period March, act 4.6%. fc 4.5%, prev. 4.7%

- Chicago Business Barometer; period April, act 48.6, fc 43.5, prev. 43.8

- Consumer sentiment (final); period April, act 63.5, fc 63.5. prev. 63.5

News

Company News/ Other

- S. officials lead urgent rescue talks for First Republic – Reuters

- Amazon’s cloud warning rattles investors – Reuters

- Chevron tops estimates with Q1 profit gain despite slide in oil prices – Reuters

Central Banks/Inflation/Labor Market

- Inflation pressures remain persistent as consumers pull back – AP

- Fed Says It Failed to Act on Problems That Led to Silicon Valley Bank Collapse – WSJ

China