Stay Informed and Stay Ahead: Market Watch, July 8th, 2024.

Early-Week Wall Street Markets

Key Takeaways

+ US stock indices—NASDAQ and S&P 500—rose, DOW falls. Six sectors lost; Information Tech led, with Communication Services trailing. Semiconductor Equipment continues to outperform.

+ US consumer borrowing rose by >$11 billion in May, driven by credit-card balances.

+ Shorter Bond terms yields rise. NASDAQ’s A/D ratio was 1.27. Small Caps outperform. Commodities soft, NVIDIA Corporation led in active trading with Zapp Electric Vehicles (ZAPP) noteworthy outperformance.

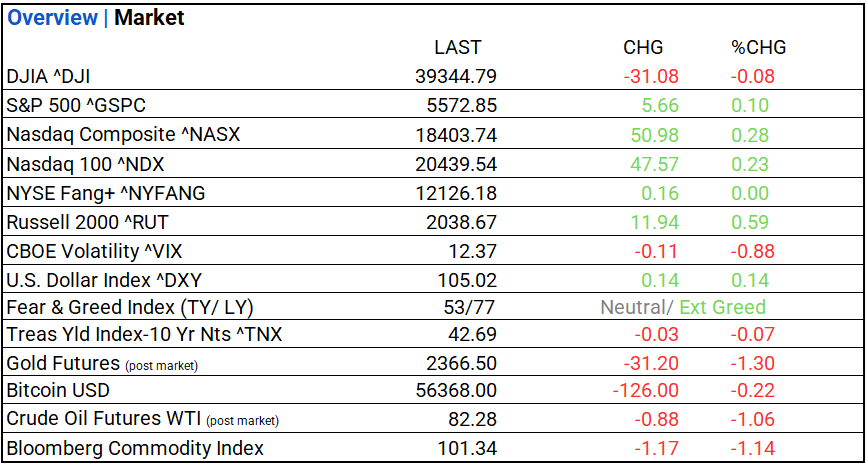

Summary of Market Performance

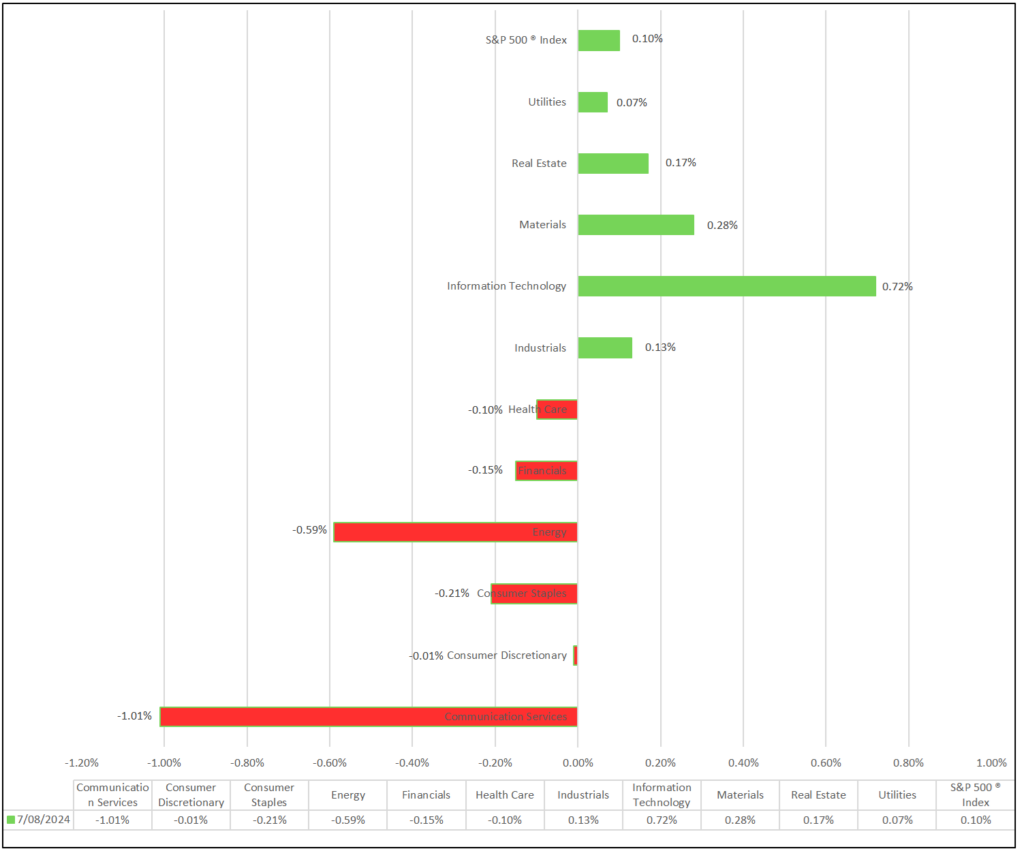

Indices & Sectors Performance:

- Today, major US stock indices—NASDAQ, S&P 500—up, DOW—off. Among eleven sectors, six lost. Information Tech led; Communication Services trailed. Top industries: Independent Power/Renewable Electricity Producers up 2.99%, Semiconductor Equipment up 1.99%.

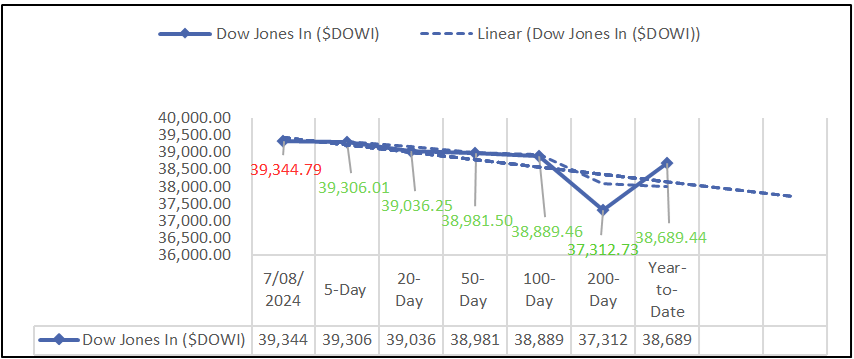

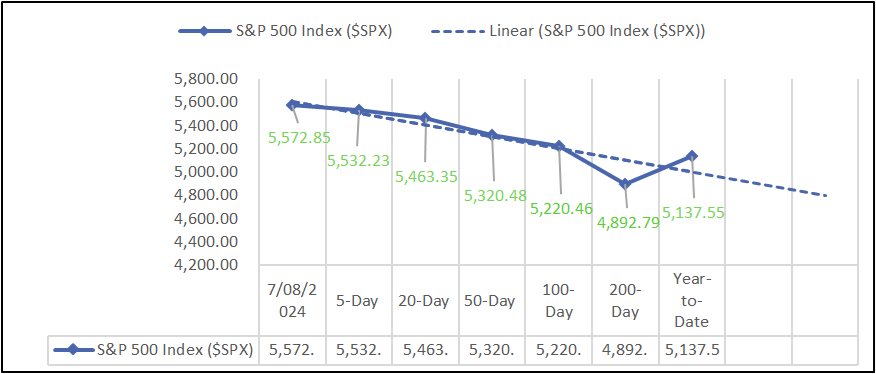

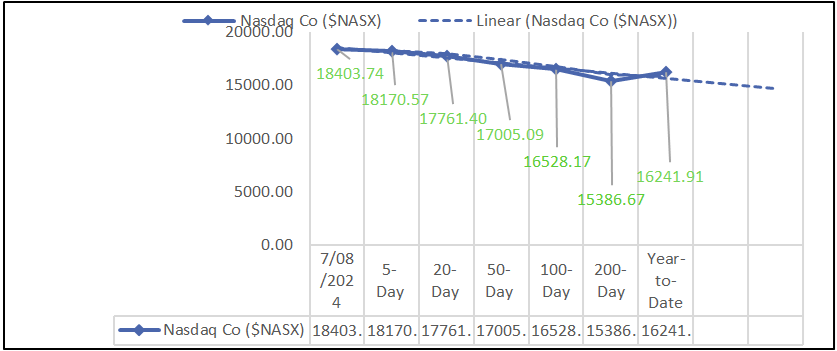

Chart: Performance of Major Indices

Moving Average Analysis:

S&P 500 Sectors:

- Among eleven sectors, six lost. Information Tech led; Communication Services trailed.

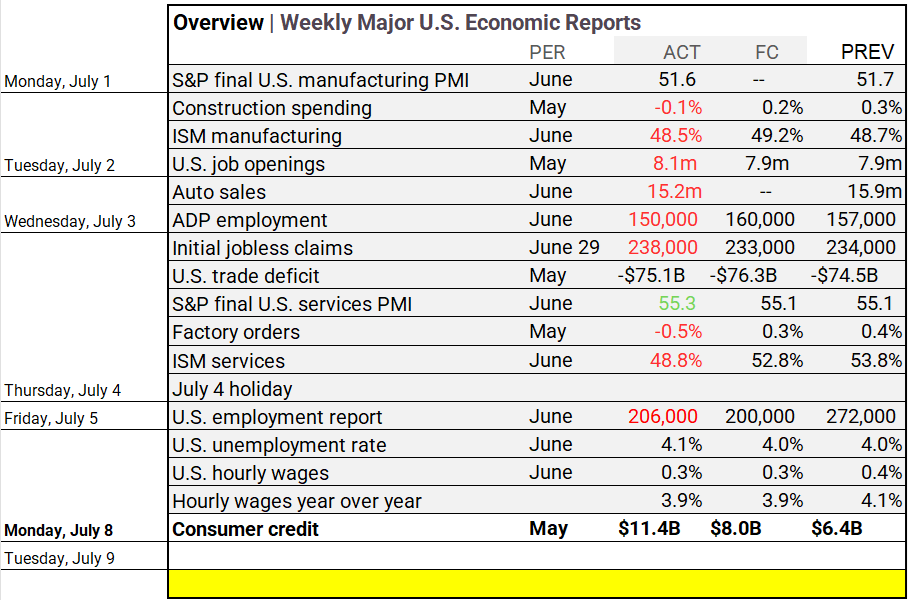

Economic Highlights:

- US consumer borrowing rose by $11.4 billion in May, driven by credit-card balances, after a $6.5 billion increase in April.

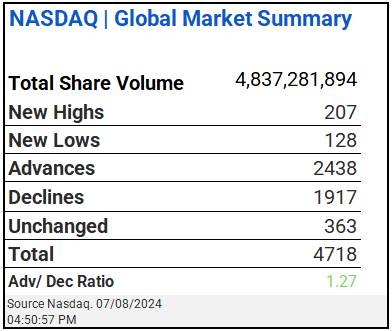

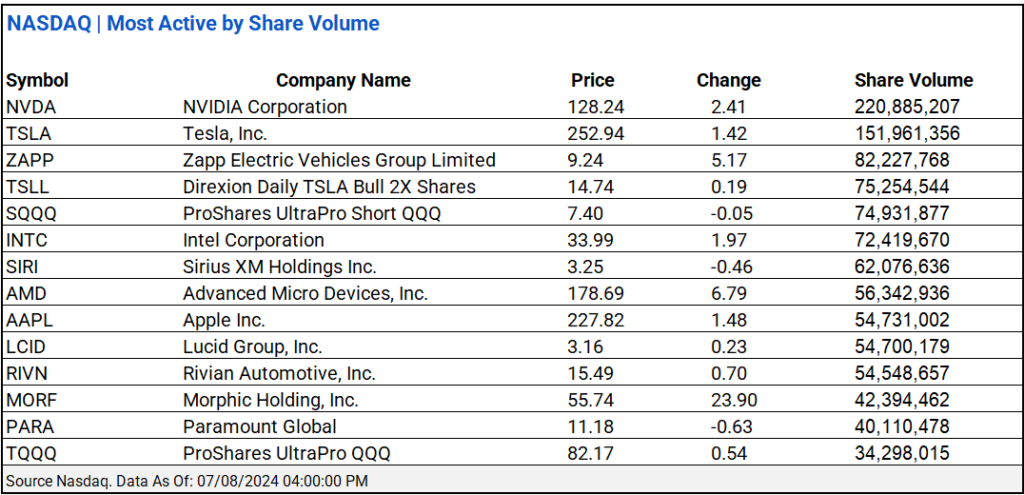

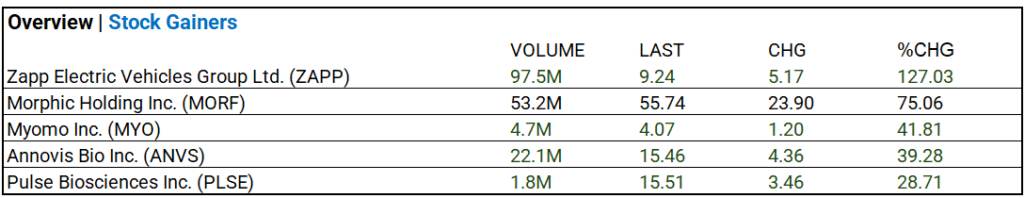

NASDAQ Global Market Update:

- NASDAQ showed positive sentiment with a total share volume of 4.84 billion, 207 new highs, 128 new lows, and an advance/decline ratio of 1.27. NVIDIA Corporation led in active trading and Zapp Electric Vehicles (ZAPP) noteworthy.

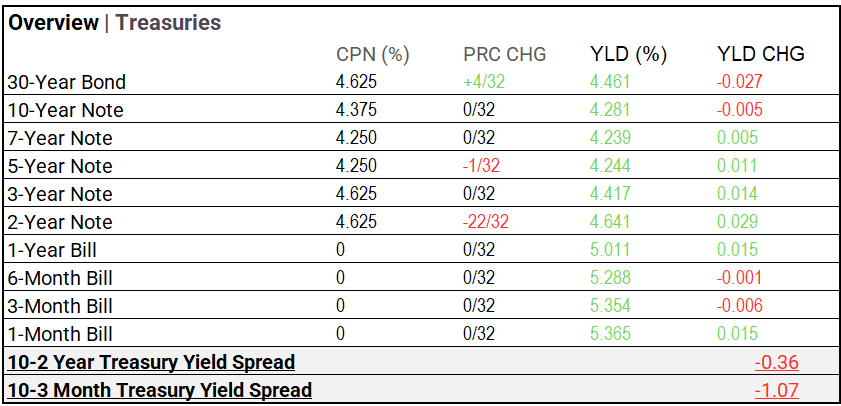

Treasury Markets:

- Yields on US Treasury securities mixed, with the 30-year bond yield falling to 4.461%, while the 1-year bill yield rose to 5.011%, and the 2-year note yield increased to 4.641%.

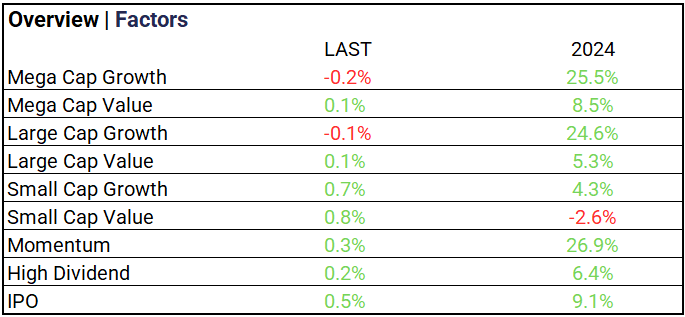

Market Factors:

- Small caps led today, with Small Cap Growth up 0.7% and Small Cap Value up 0.8%, outperforming Mega Cap and Large Cap segments.

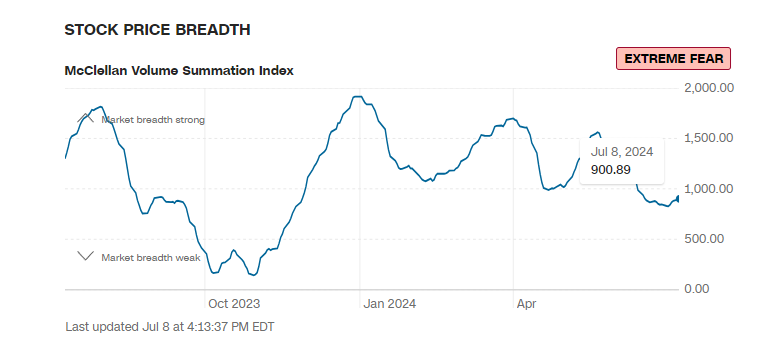

Currency & Volatility:

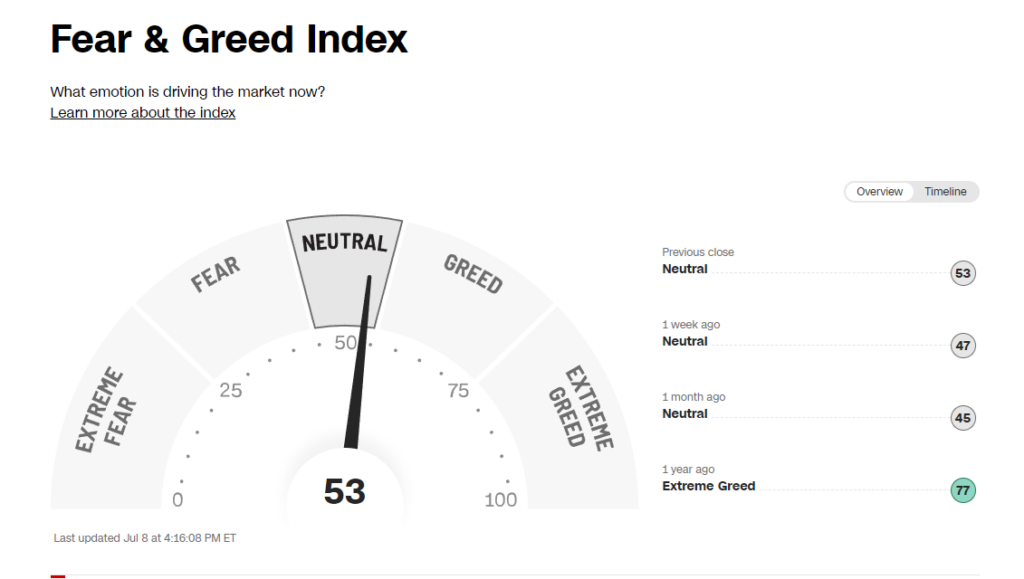

- The VIX fell to 12.37, signaling moderate security, while the Fear & Greed Index dropped from 77 (Extreme Greed) last year to 53 (Neutral).

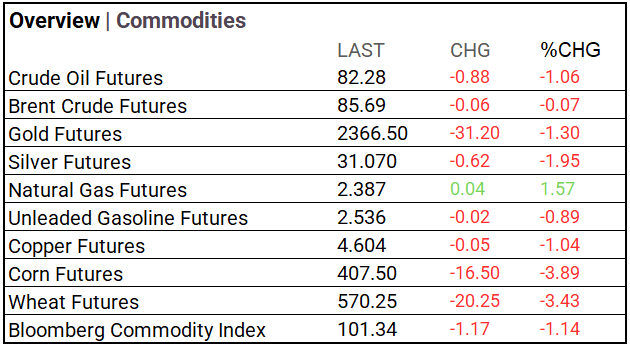

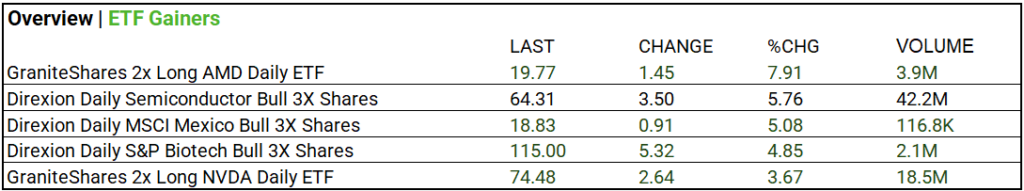

Commodities & ETFs:

- Commodity markets: Crude oil, Brent crude, gold, silver, and copper down, with corn and wheat seeing larger declines, while natural gas rose.

- ETFs: GraniteShares 2x Long AMD ETF up 7.91%; Direxion Daily Semiconductor Bull 3X up 5.76%.

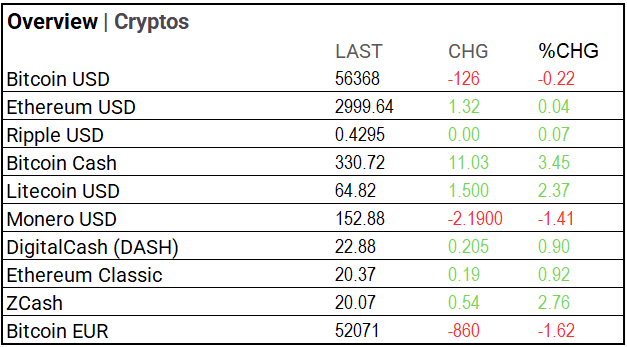

Cryptocurrency Update:

- Bitcoin USD down 0.22%, Ethereum up 0.04%, Bitcoin Cash rose 3.45%, Litecoin gained 2.37%.

Stocks:

- Zapp Electric Vehicles (ZAPP) traded 97.5 million shares, up 127.03% to $9.24. Morphic Holding Inc. (MORF) saw 53.2 million shares, rising 75.06% to $55.74.

Notable Earnings:

- Nothing notable until Thursday this week.

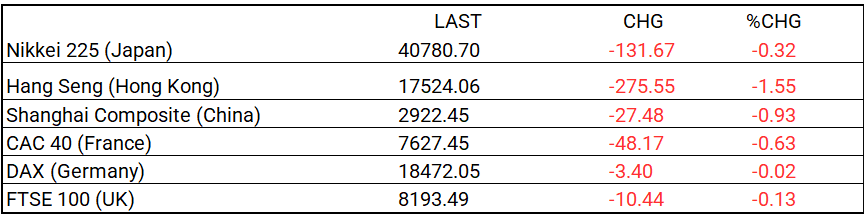

Global Markets Summary:

- Both Asia and Europe were down; Hang Seng and CAC 40 leading decliners.

In the NEWS:

Central Banking, Monetary Policy & Economics:

- Canada Unemployment Rate Continues to Climb – WSJ

- US Consumer Borrowing Rises Most in Three Months on Credit Cards – Bloomberg

Business:

- Paramount Global, Skydance Agree to Merger – WSJ

- Lucid Shares Jump on Better-Than-Expected Quarterly EV Sales – Bloomberg

China:

- China’s central bank ups control of interest rates with new operations amid reform push – SCMP