VICA Market Sentiment Index (VMSI): A New Era of Investor Insight

March 2025 | VICA Research

Introduction: Understanding Market Psychology

Market sentiment is the invisible force driving financial markets—dictating risk appetite, liquidity flows, and institutional positioning. While traditional sentiment indicators like CNN’s Fear & Greed Index offer a broad snapshot, they fail to capture the nuanced, forward-looking dynamics that shape real investment decisions.

VICA Research is proud to introduce the VICA Market Sentiment Index (VMSI)—a comprehensive, data-driven measure designed to provide investors with actionable intelligence on prevailing market psychology. Unlike generic models, VMSI integrates liquidity, institutional flows, and leverage trends to offer a sharper, institutional-grade perspective on risk and opportunity.

How VMSI Works

The VICA Market Sentiment Index is built on seven core indicators, each reflecting a key driver of investor behavior. These metrics are dynamically weighted to ensure a balanced, data-driven sentiment assessment.

- Market Momentum (Institutional Accumulation)

Tracks stocks above their 125-day moving average and institutional accumulation trends.

- Caution Zone: Broad selling and net outflows.

- Optimism Zone: Strong price expansion and accumulation.

- Breadth & Divergence (Market Health)

Monitors net 52-week highs vs. lows across all sectors.

- Caution Zone: More stocks hitting new lows than highs.

- Optimism Zone: Market-wide participation in rallies.

- Liquidity Flows (Leverage & Risk Appetite)

Analyzes margin debt, ETF inflows, and hedge fund positioning.

- Caution Zone: Deleveraging and defensive positioning.

- Optimism Zone: Expansion of risk-based leverage.

- Volatility & Risk Hedging (VIX & CDS Spreads)

Measures volatility, credit default swaps, and risk hedging.

- Caution Zone: Rising volatility and increased hedging demand.

- Optimism Zone: Low volatility and unwinding of hedges.

- Options Market Sentiment (Put-Call & Gamma Exposure)

Examines put-call ratios, dealer gamma exposure, and institutional flow.

- Caution Zone: Spike in put-buying and risk hedging.

- Optimism Zone: Call-buying surges and long gamma exposure.

- Safe Haven Rotation (Stock vs. Bond Demand)

Compares equity returns to bond returns over 20-day rolling periods.

- Caution Zone: Strong bond inflows and equity underperformance.

- Optimism Zone: Stocks significantly outperforming bonds.

- Credit Market Risk Premiums (Junk Bond Spreads)

Tracks junk bond vs. investment-grade bond yield spreads.

- Caution Zone: Widening spreads indicate higher risk aversion.

- Optimism Zone: Narrowing spreads signal increased risk-taking.

Interpreting VMSI Scores

The VICA Market Sentiment Index is measured on a scale from 0 to 100, with four distinct sentiment zones:

- 0-25: High Risk Aversion – Panic selling, extreme caution dominates.

- 26-50: Defensive Sentiment – Reduced risk appetite, cautious positioning.

- 51-75: Growth Sentiment – Investors seeking opportunities, increasing exposure.

- 76-100: Speculative Confidence – High risk-taking, potential market exuberance.

Our proprietary scoring model ensures that VMSI is not just a reflection of past trends—but a forward-looking indicator that anticipates shifts in sentiment before they impact asset prices.

VMSI in Action

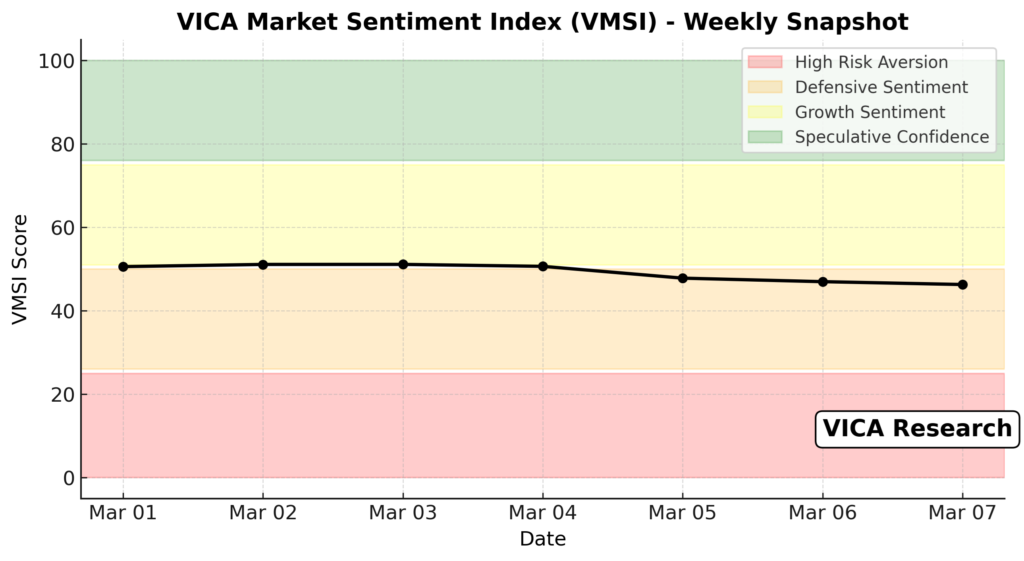

Below is a real-time visualization of the VICA Market Sentiment Index (VMSI), showcasing how sentiment will deploy the forecast each week.

This chart highlights key sentiment zones and serves as a real-time tool for assessing investor psychology.

Why VMSI is Superior

✅ Institutional Insight – Tracks hedge fund and institutional positioning. ✅ Liquidity & Leverage Factors – Incorporates margin debt and leverage expansion. ✅ Dynamic Credit Market Signals – Identifies early warning signs in risk premiums. ✅ Options & Gamma Influence – Recognizes the impact of derivative markets on price action.

The Future of Market Intelligence

At VICA Research, we believe that data-driven sentiment analysis is critical to navigating today’s volatile markets. With VMSI, investors now have access to an advanced, institutionally informed sentiment model that delivers a clearer picture of market psychology.

Stay ahead of market trends. Follow VICA Research for real-time VMSI updates and expert analysis.