VICA Market Sentiment Index (VMSI) Report | Data Through March 20, 2025

March 21, 2025 | VICA Research

What is the VMSI Report?

The VMSI tracks investor sentiment, risk conditions, and capital flows. Designed for fast insights, it guides smart decisions for asset managers and investors.

Current Market Sentiment

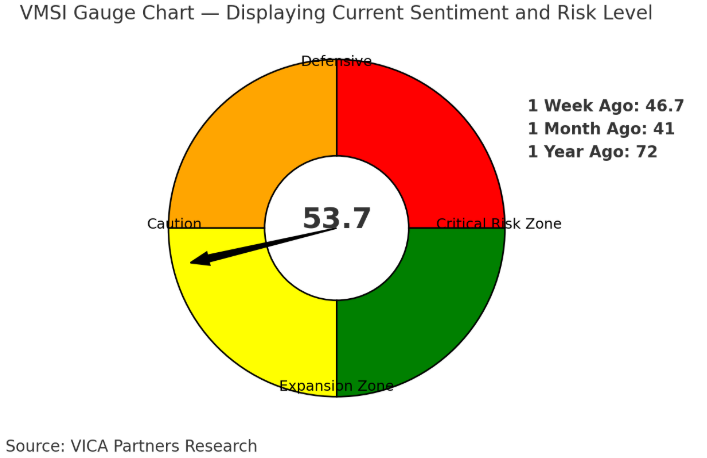

VMSI Score: 53.7 (Caution Zone)

This week’s VMSI reflects a shift from defensive positioning toward cautious optimism. ETF redemptions have eased, while institutional investors have selectively increased equity exposure. Bond demand remains elevated as a hedge against volatility.

Outlook: Caution dominates, with mixed signals driving sector rotation and cash preservation strategies.

VMSI Gauge Chart Here — Displaying Current Sentiment and Risk Level

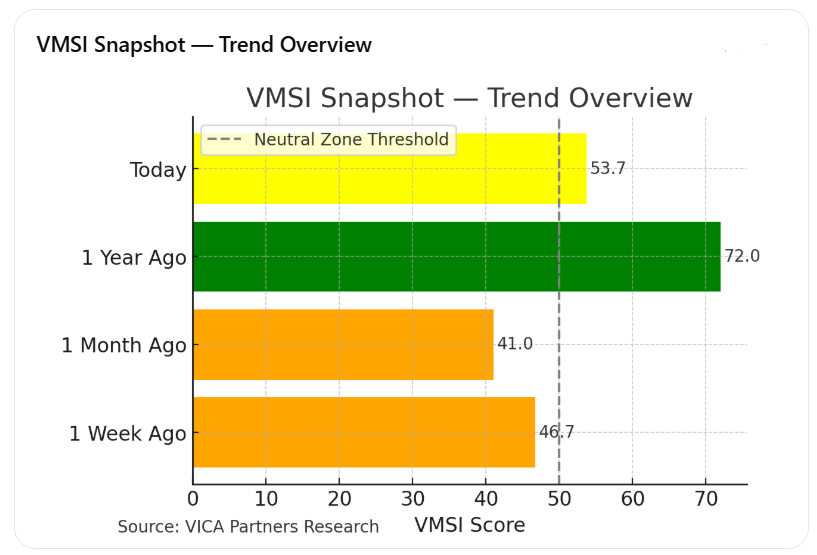

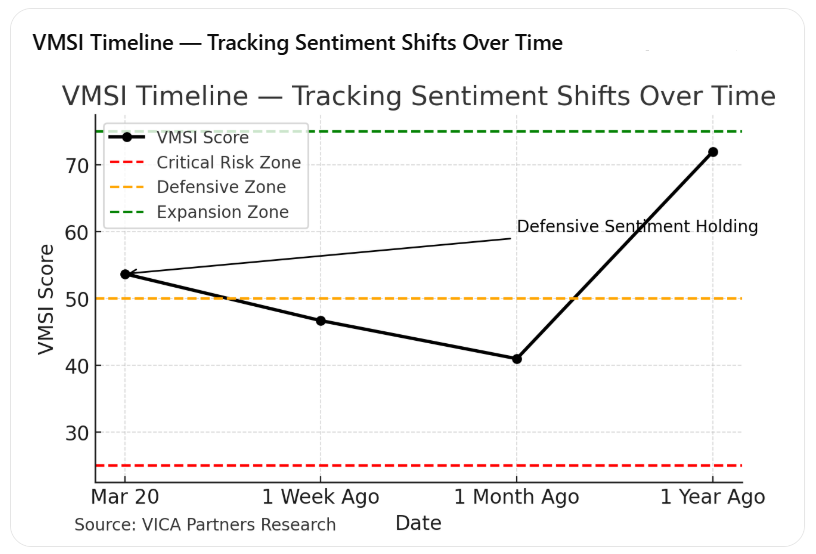

VMSI Timeline

- Today: 53.7 (Caution Zone) — Institutions cautiously re-entering equities while maintaining defensive cash reserves.

• 1 Week Ago: 46.7 — Defensive positioning still evident amid risk-off behavior.

• 1 Month Ago: 41 — Elevated defensive sentiment with rising bond demand.

• 1 Year Ago: 72 — Reflecting peak optimism before monetary tightening weighed on markets.

VMSI Timeline Chart with Threshold Markers

Key Insights

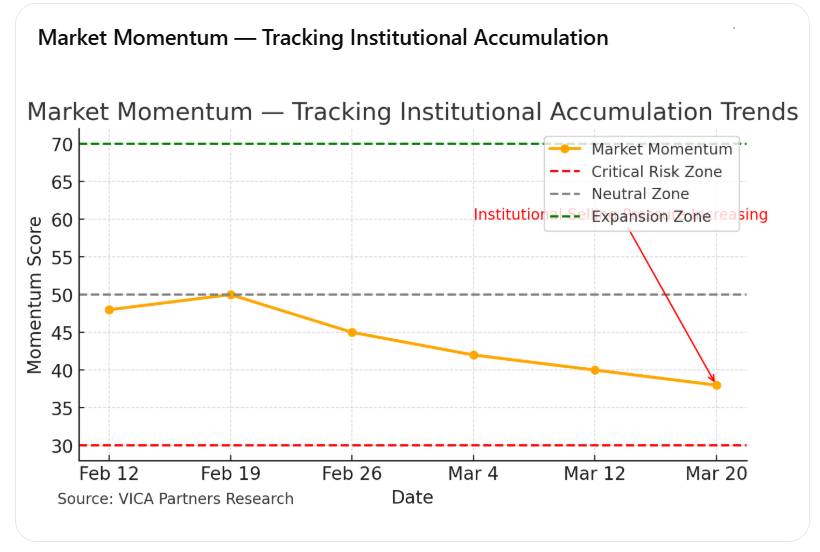

⬛ Market Momentum: Institutions are selectively accumulating key equity positions, favoring value stocks over growth.

Market Momentum

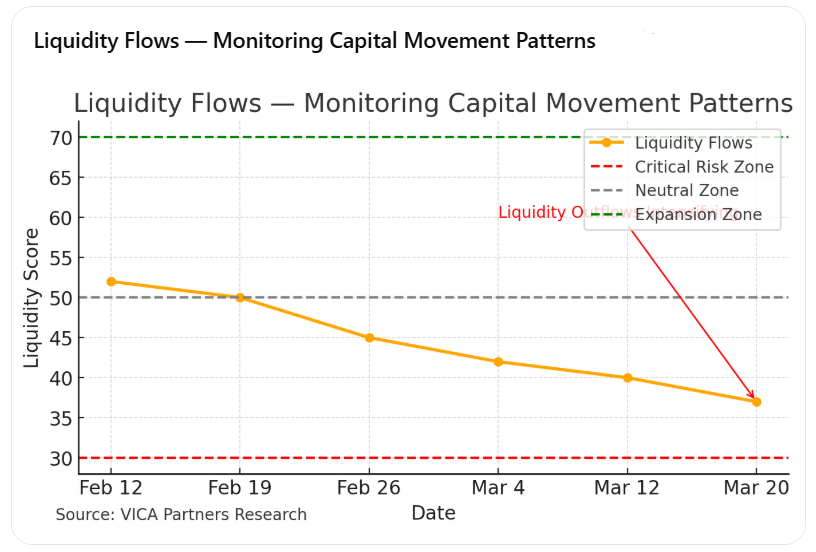

⬛ Liquidity Flows: Liquidity pressures eased slightly this week with moderate ETF inflows.

Liquidity Flows

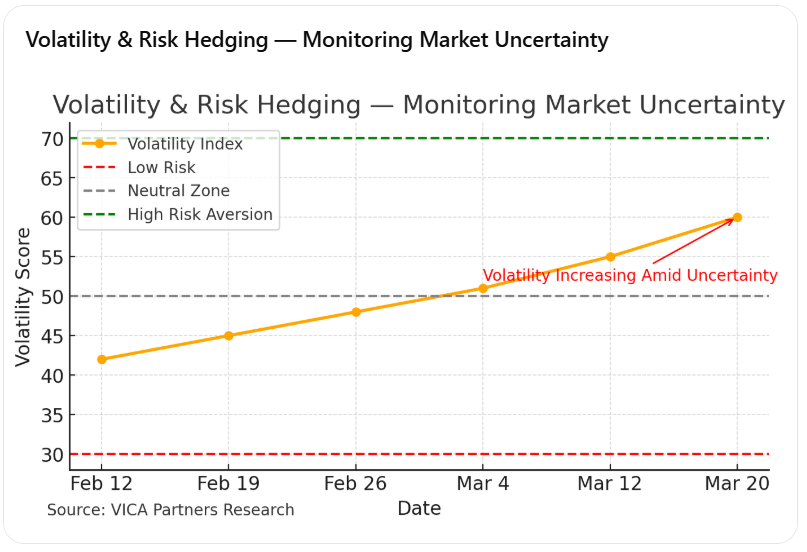

🟥 Volatility & Risk Hedging (High Risk Alert): The VIX retreated from last week’s spike but remains above its 50-day average, signaling persistent volatility risks.

Volatility & Risk Hedging

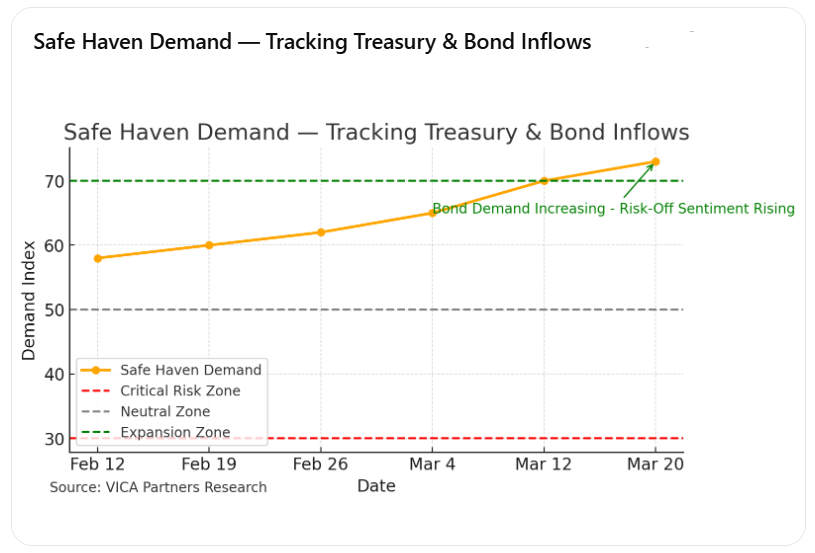

⬛ Safe Haven Demand: Treasury demand remains steady as institutions hedge against prolonged market uncertainty.

Safe Haven Demand

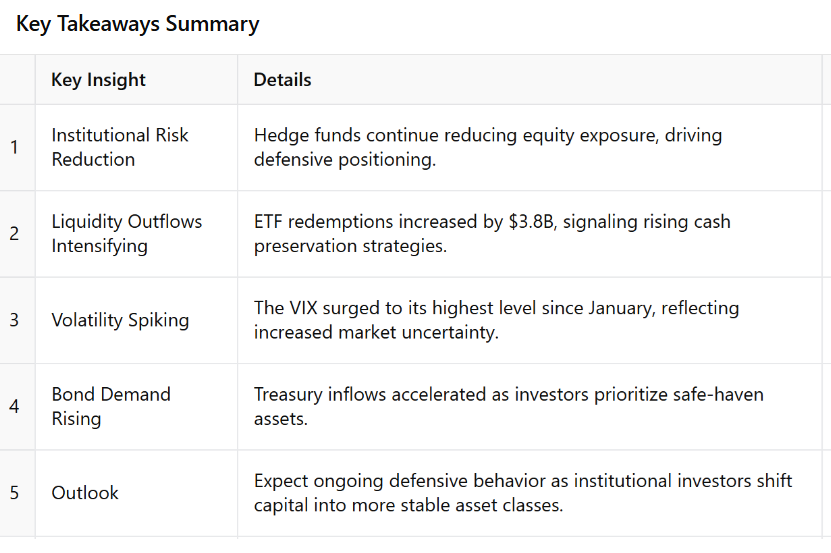

Key Takeaways — Featuring Key Drivers of the Week

Investor Takeaways

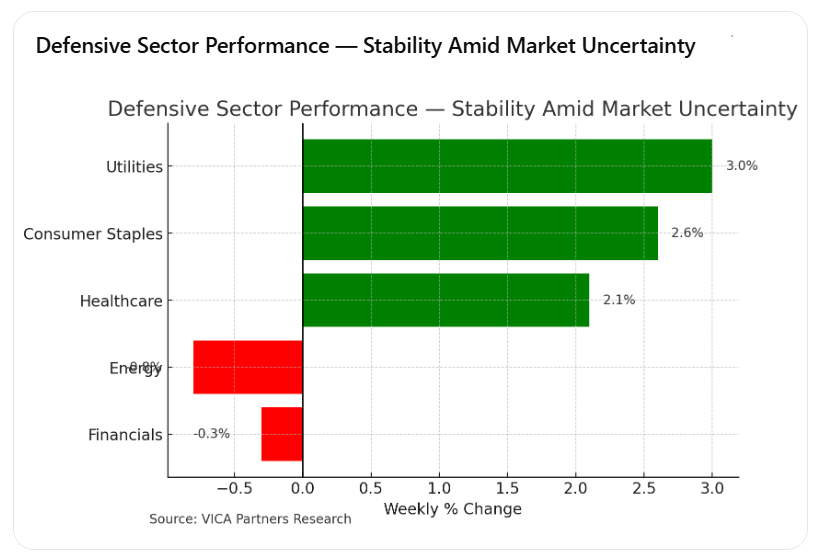

Defensive Sector Performance

Defensive Positioning:

⬛ Focus on Utilities, Consumer Staples, and Healthcare for stability.

⬛ Maintain elevated cash reserves to manage risk amid volatility.

Yield Opportunities:

⬛ Consider short-duration treasuries and dividend-focused ETFs for stable income.

Strategic Growth:

⬛ Selectively explore value-driven equities with strong fundamentals.

Tactical Focus: A barbell strategy — blending defensive fixed-income exposure with selective growth stocks — may improve risk-adjusted returns.

🟥 Defensive Sector Strength Aligns with Rising Volatility (Critical Risk Alert): ETF outflows have slowed, but volatility levels remain elevated, reinforcing defensive strategies.

🟥 Opportunity Insight (Strategic Alert): Investors seeking improved risk-adjusted returns may consider selectively re-entering key equity sectors with strong earnings visibility.

⬛ Strategic Positioning Tip: Diversifying with short-duration treasuries, dividend-focused ETFs, and value-driven equities may enhance portfolio resilience in the current environment.

For personalized portfolio strategies tailored to your investment goals, contact our research team.

Conclusion

With a VMSI score of 53.7, the market reflects Caution Zone Sentiment, signaling early signs of institutional risk re-entry while maintaining defensive positioning. Volatility remains elevated, and liquidity conditions show improvement but remain fragile.

VICA Outlook:

Data-Driven Note to Emphasize Strategic Opportunity

🟥 Defensive Sector Strength Aligns with Rising Volatility:

Recent ETF outflows have slowed, but volatility remains elevated, supporting defensive strategies.

🟥 Opportunity Insight: Investors seeking improved risk-adjusted returns may consider selectively re-entering key equity sectors with strong earnings visibility.

⬛ Strategic Positioning Tip: Diversifying with short-duration treasuries, dividend-focused ETFs, and value-driven equities may enhance portfolio resilience in the current environment.

For strategic insights tailored to your portfolio, follow VICA Research.

Disclaimer:

This report is for informational purposes only and should not be considered financial advice. Investors are encouraged to consult with a qualified professional before making any investment decisions. Market conditions are subject to change, and past performance is not indicative of future results.

#VMSI #MarketTrends #InvestmentInsights #RiskManagement #PortfolioStrategy #VICAResearch