VICA Market Sentiment Index (VMSI) Report March 13, 2025 | VICA Research

Current Market Sentiment

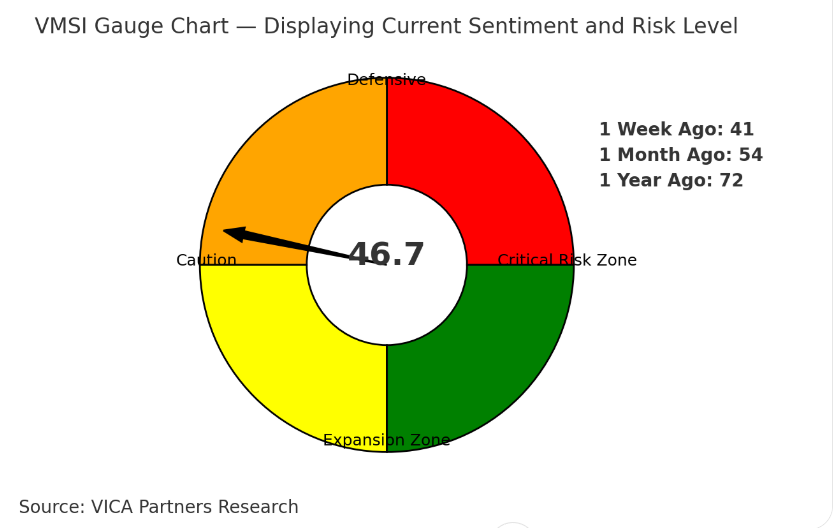

VMSI Score: 46.7 (Defensive Sentiment) This week’s VMSI reflects market positioning marked by a reduction in institutional exposure and rising bond demand as investors respond to ongoing ETF outflows and volatility concerns.

Outlook: Defensive positioning is expected to dominate, with rising cash reserves and cautious investor sentiment likely to continue.

VMSI Gauge Displaying Current Sentiment and Risk Level

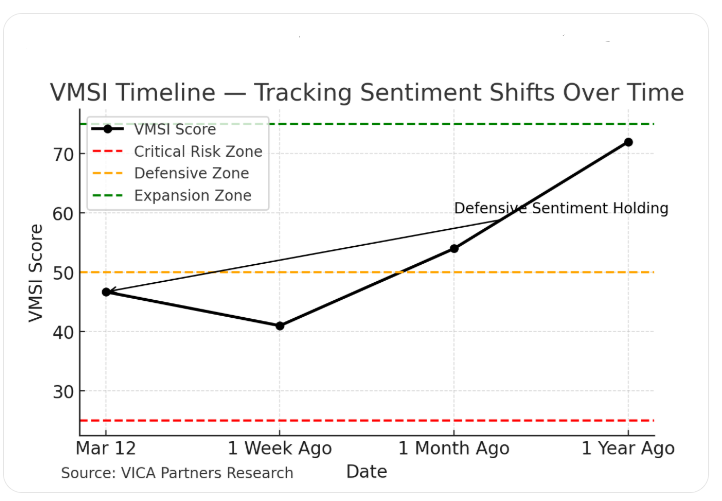

VMSI Timeline

- Today: 46.7 (Defensive Sentiment) — Elevated risk-off behavior driven by ETF outflows. • 1 Week Ago: 41 — Market still supported by limited institutional inflows. • 1 Month Ago: 54 — Early signs of volatility but broader equity confidence still visible. • 1 Year Ago: 72 — Reflecting peak optimism before tightening monetary policy weighed on markets.

VMSI Timeline Chart with Threshold Markers

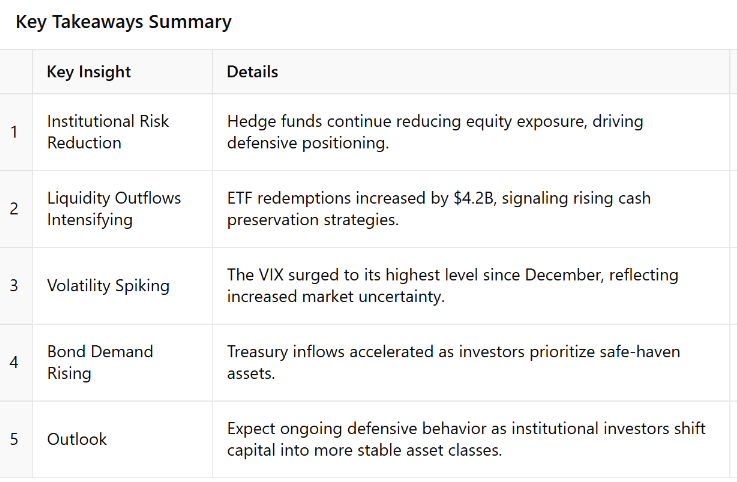

Key Insights

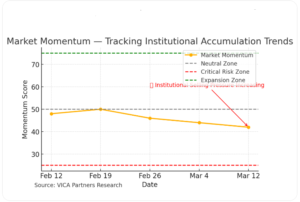

⬛ Market Momentum:

Market Momentum

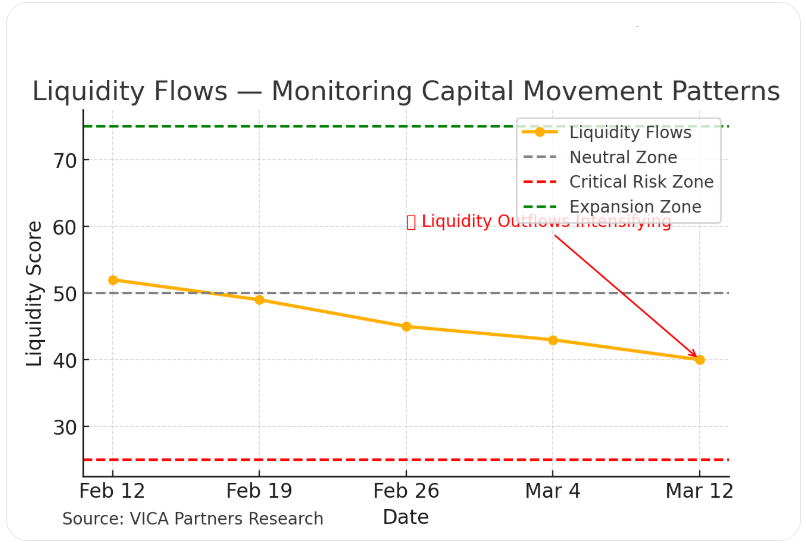

⬛ Liquidity Flows:

Liquidity Flows

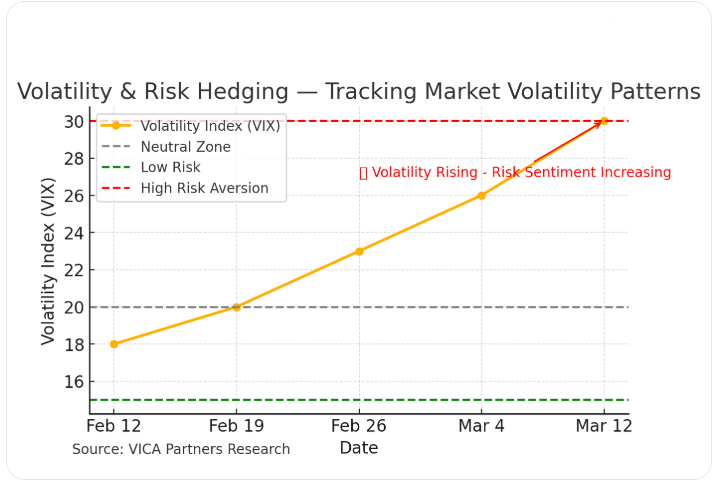

🟥 Volatility & Risk Hedging (High Risk Alert):

VIX/CDS Spread Movement

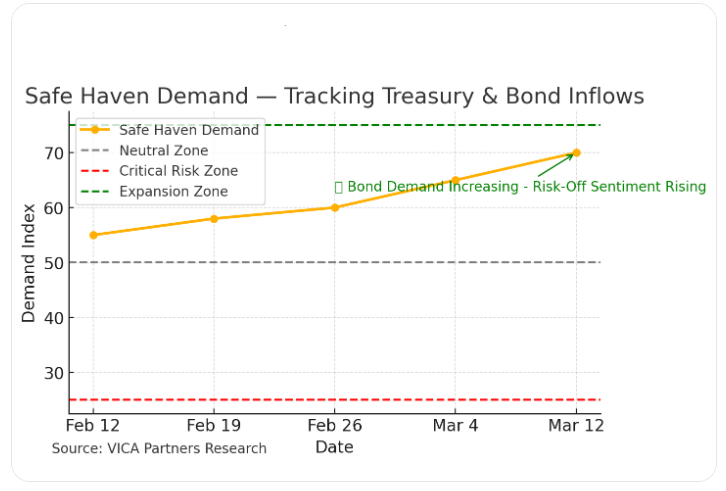

⬛ Safe Haven Demand:

Safe Haven Demand

Key Drivers of the Week

Investor Takeaways

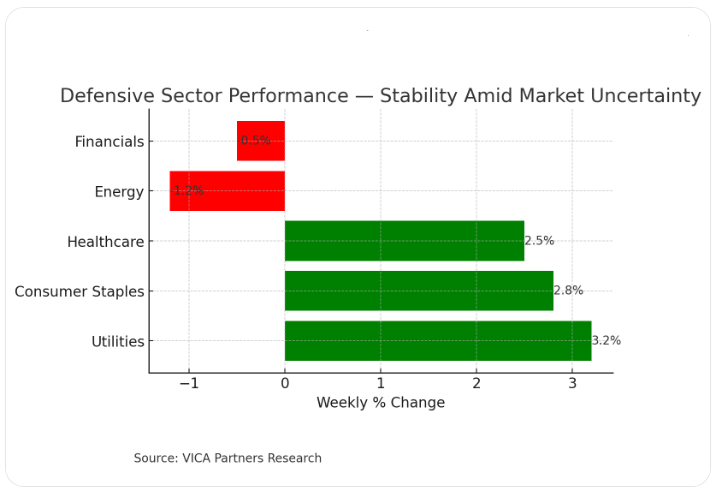

Defensive Sector Performance

Defensive Positioning:

⬛ Focus on Utilities, Consumer Staples, and Healthcare for stability.

⬛ Increase cash reserves to manage risk amid volatility.

Yield Opportunities:

⬛ Consider short-duration treasuries and dividend-focused ETFs for stable income.

Strategic Growth:

⬛ Selectively explore cyclical stocks poised for recovery as sentiment improves.

Tactical Focus: A barbell strategy — blending defensive fixed-income exposure with selective growth stocks — may improve risk-adjusted returns.

🟥 Defensive Sector Strength Aligns with Rising Volatility (Critical Risk Alert): Recent ETF outflows, heightened volatility levels, and sustained liquidity stress signal a growing shift toward defensive strategies.

🟥 Opportunity Insight (Strategic Alert): Investors seeking stability may find improved risk-adjusted returns by focusing on sectors demonstrating strong fundamentals amid uncertainty, such as Utilities, Consumer Staples, and Healthcare.

⬛ Strategic Positioning Tip: Diversifying with short-duration treasuries, dividend-focused ETFs, and value-driven equities may enhance portfolio resilience in the current environment.

For personalized portfolio strategies tailored to your investment goals, contact our research team.

Conclusion

With a VMSI score of 46.7, the market reflects Defensive Sentiment, signaling [Insert Key Takeaway on Investor Behavior]. While liquidity pressures persist, [Insert Positive or Negative Market Insight].

VICA Outlook: Data-Driven Note to Emphasize Strategic Opportunity

⬛ Defensive Sector Strength Aligns with Rising Volatility: Recent ETF outflows, heightened volatility levels, and sustained liquidity stress signal a growing shift toward defensive strategies.

⬛ Opportunity Insight: Investors seeking stability may find improved risk-adjusted returns by focusing on sectors demonstrating strong fundamentals amid uncertainty, such as Utilities, Consumer Staples, and Healthcare.

⬛ Strategic Positioning Tip: Diversifying with short-duration treasuries, dividend-focused ETFs, and value-driven equities may enhance portfolio resilience in the current environment.

For strategic insights tailored to your portfolio, follow VICA Research.

Disclaimer:

This report is for informational purposes only and should not be considered financial advice. Investors are encouraged to consult with a qualified professional before making any investment decisions. Market conditions are subject to change, and past performance is not indicative of future results.

#VMSI #MarketTrends #InvestmentInsights #RiskManagement #PortfolioStrategy #VICAResearch