“Vica Partners: Navigating the Economic Landscape – 2023 Economic Forecast

- Recession Prediction: Vica Partners predicts a potential recession that is more severe than just a “soft landing.” This means they believe the economy might experience a significant downturn.

- Factors for Concern:

- Debt and Consumer Credit: They are concerned about increasing levels of debt and consumer credit, which can be problematic for the economy if they become unsustainable.

- Rising Oil Prices: The increase in oil prices is seen as a negative factor for the economy.

- Overvalued Valuations: They believe that asset prices, such as stock values, are overvalued.

- Strong Dollar: A strong U.S. dollar is anticipated to persist into 2024, which can have implications for trade and the overall economy.

- Market Behavior: Vica Partners suggests that market bottoms (the lowest points of market performance) often occur during periods of negative news and deflationary signals. This implies that they expect challenging times in the market.

- Concerns about Rising Interest Rates and Consumer Debt: Rising interest rates and high levels of consumer debt are considered significant concerns, as they can impact consumer spending and the overall economic health.

- Expectations for Information Technology Companies: They anticipate slight adjustments in the valuations of Information Technology companies.

- Suggested Investment Areas:

- Utilities and Health Care: These sectors are suggested as areas where investors may find gains.

- Energy: Energy is expected to continue rising, which can be interpreted as a positive outlook for the energy sector.

- Shift from Growth to Value Stocks: Vica Partners recommends a moderate shift from growth stocks to value stocks, indicating a preference for companies with solid fundamentals over those with high growth potential but possibly overvalued stocks.

- Inflation Control: They suggest that the Federal Reserve may have limitations in controlling inflation in the modern highly automated global economy. They also mention that a 2% inflation target may no longer be realistic and that a base interest rate exceeding 3% might be needed to support various economic initiatives, such as increasing wages, transitioning to cleaner energy sources, improving operational efficiency, and guarding against deflation.

In summary, Vica Partners is cautioning against a potential recession and expressing concerns about various economic factors, while also providing investment recommendations and highlighting the challenges the Federal Reserve may face in controlling inflation. Their outlook suggests a more cautious and conservative approach to economic and investment decisions.

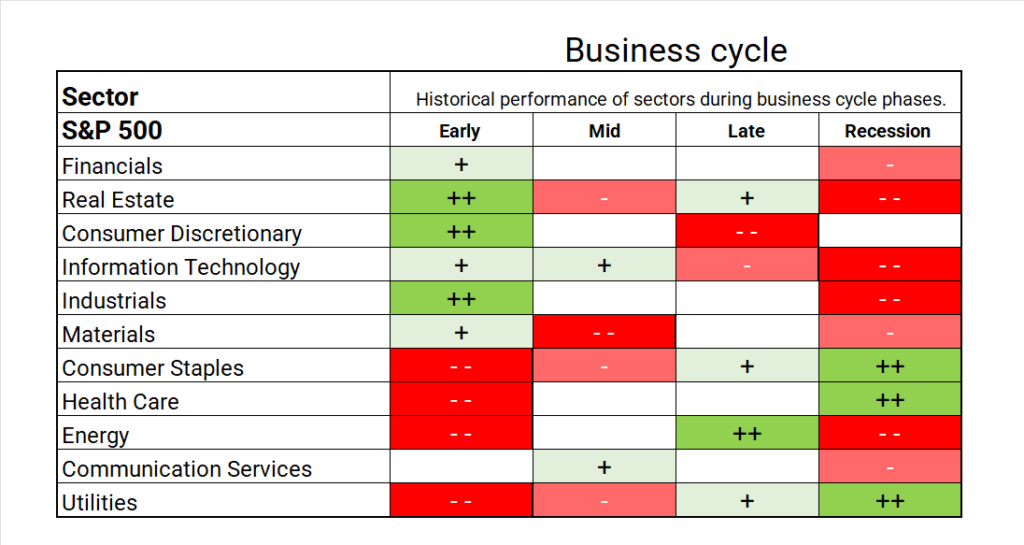

Sector Trending Chart: A sector trending chart typically displays the performance of different sectors of the economy over time.

- Upward Trends: Sectors that are performing well and experiencing growth will show ++, + on the chart.

- Downward Trends: Sectors that are struggling or facing economic challenges will show –, -downward trends.

- Cyclical Patterns: Some sectors may exhibit cyclical patterns, meaning they go through periods of growth and decline in a predictable manner.

- Outliers: Occasionally, a sector may stand out from the others by showing exceptionally strong growth or a sudden drop. These outliers can also be visible on the chart.

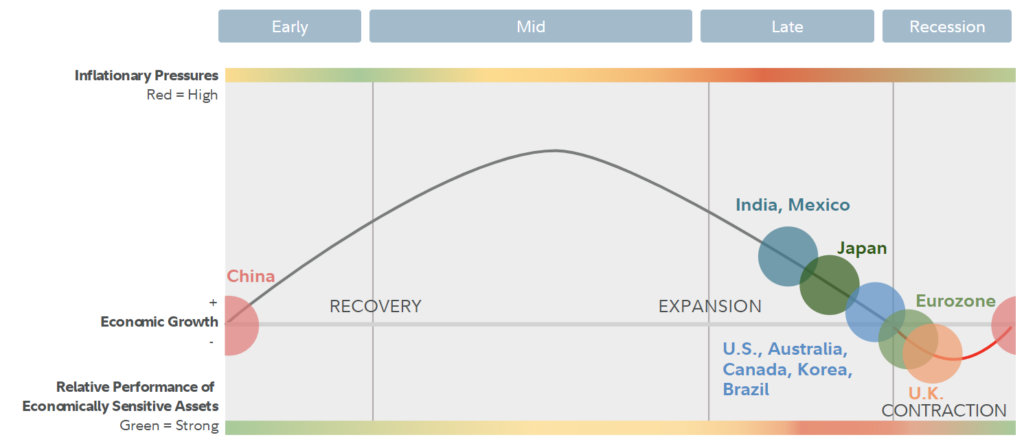

Business Cycle: The business cycle represents the recurring stages of economic growth and contraction in an economy. It typically consists of four phases:

- Expansion: This phase is characterized by economic growth, increased production, rising employment, and consumer confidence. It’s often associated with positive trends in the stock market and high business activity.

- Peak: The peak marks the highest point of economic activity in the cycle. It’s a period of prosperity, but it can also lead to inflationary pressures and overvaluation of assets.

- Contraction (Recession): Following the peak, the economy enters a contraction phase. This is characterized by declining economic activity, increased unemployment, reduced consumer spending, and a potential downturn in the stock market.

- Trough: The trough is the lowest point of the business cycle. It represents the end of the recession and the beginning of a new expansion phase. It’s a period of economic recovery and stabilization.

The business cycle is often represented as a sine wave or a circular diagram to illustrate its repetitive nature.