MARKETS TODAY June 5nd, 2023 (Vica Partners)

Last Friday, US Markets finished sharply higher, S&P 500 +1.45%, DOW +2.12% and the Nasdaq +1.07%. All 11 of the S&P 500 sectors higher: Materials +3.37% outperforms/ Communication Services +0.10% lags. On the upside, Russell 2k Treasury Yields, USD Index, Oil and Bitcoin. In economic news, headline Jobs numbers easily beat forecasts, the unemployment rate missed while wages showed deceleration.

Overnight/US Premarket, Asian markets finished higher, Japan’s Nikkei 225 +2.20% Hong Kong’s Hang Seng +0.84% and China’s Shanghai Composite +0.07%. US S&P futures were trading at 0.2% above fair value. European markets finished lower, France’s CAC 40 -0.96%, Germany’s DAX -0.54% and London’s FTSE 100 -0.10%.

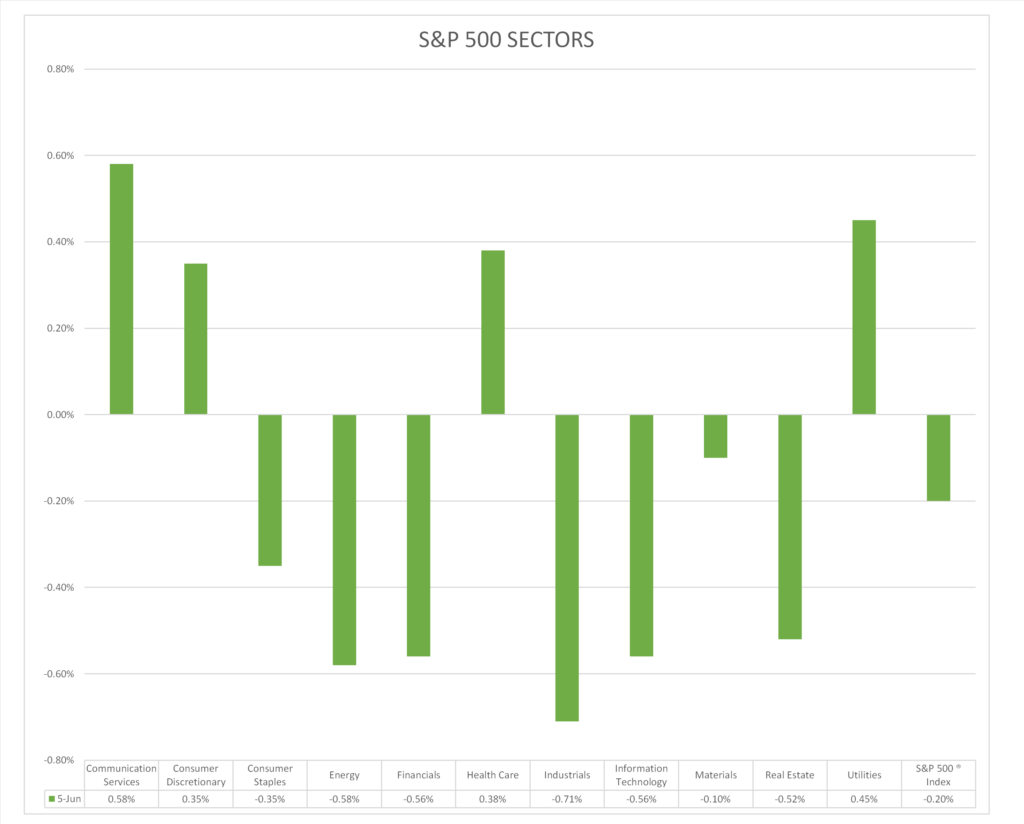

Today US Markets finished lower, S&P 500 -0.20%, DOW -0.59% and the Nasdaq -0.09%. 8 of 11 of the S&P 500 sectors lower: Communication Services +0.58% outperforms/ Industrials -0.71% lags. On the upside, FANG+, Gold and Brent Crude In economic news, S&P Global US Composite PMI for May in line with expectations, S&P Global US Services PMI came in light and ISM Services PMI misses.

Takeaways

- Mixed economic news out today, ISM renews recession fears

- FANG+, up 0.63%

- 8 of 11 of the S&P 500 sectors lower: Communication Services +0.58% outperforms/ Industrials -0.71% lags.

- SPDR S&P Banking ETF (KRE) >-2.5%

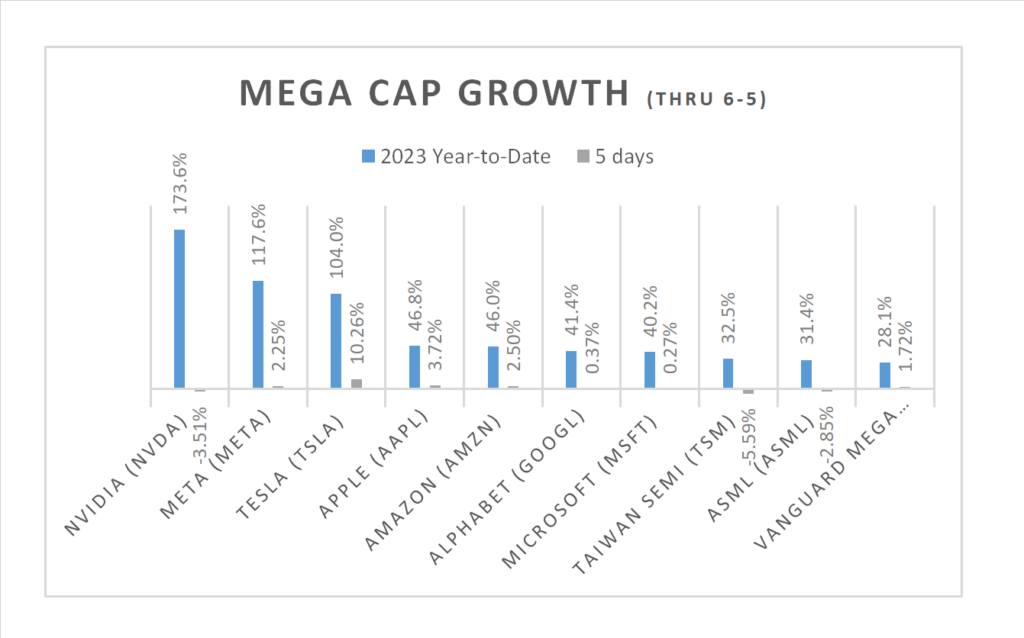

- Tesla (TSLA) +>10% over past 5 days

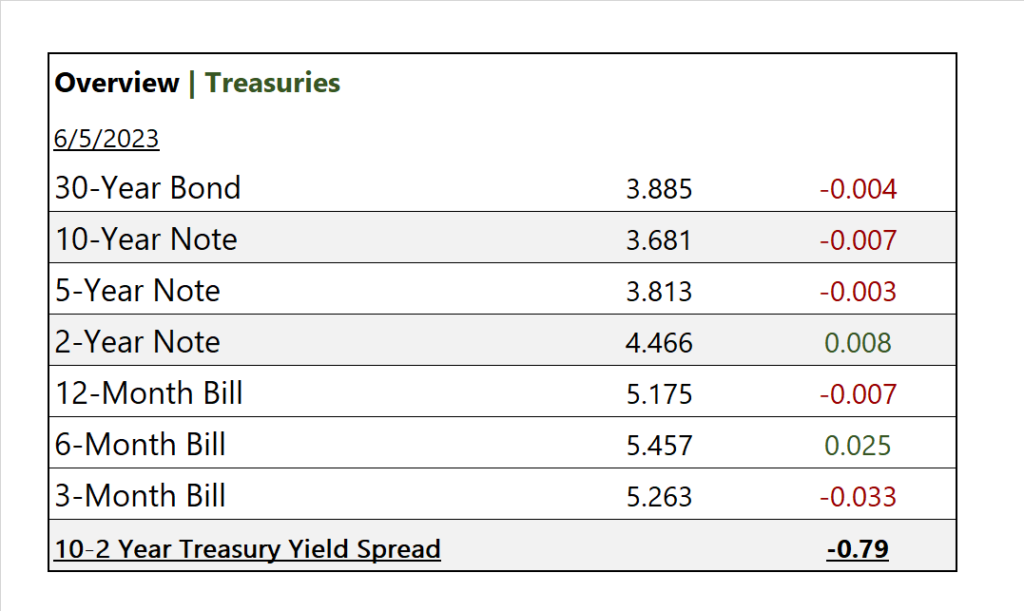

- Yields decline on ISM Services

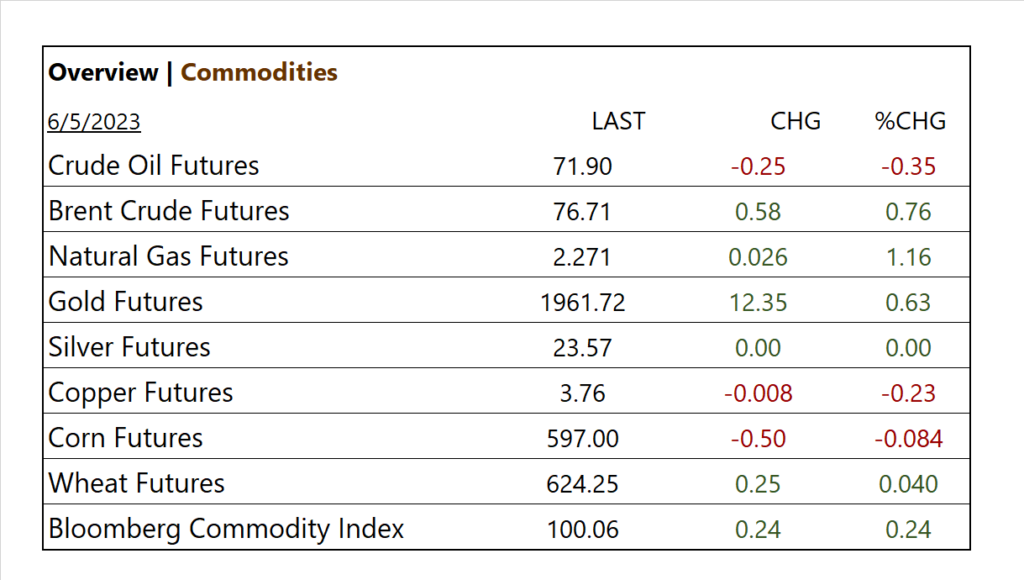

- Brent Oil rises

Pro Tip: will be back tomorrow/ Mega Cap Weekly below

Sectors/ Commodities/ Treasuries

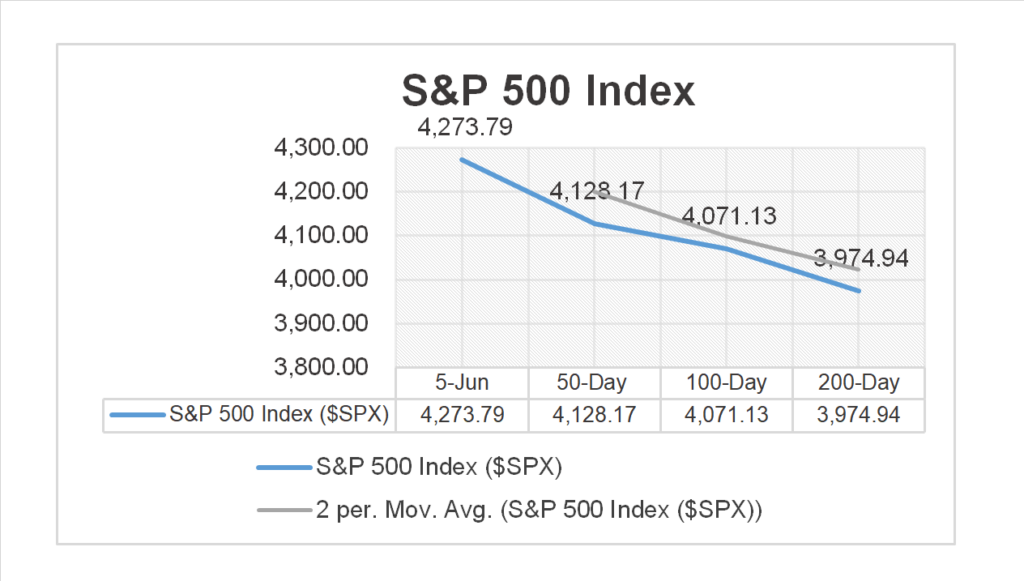

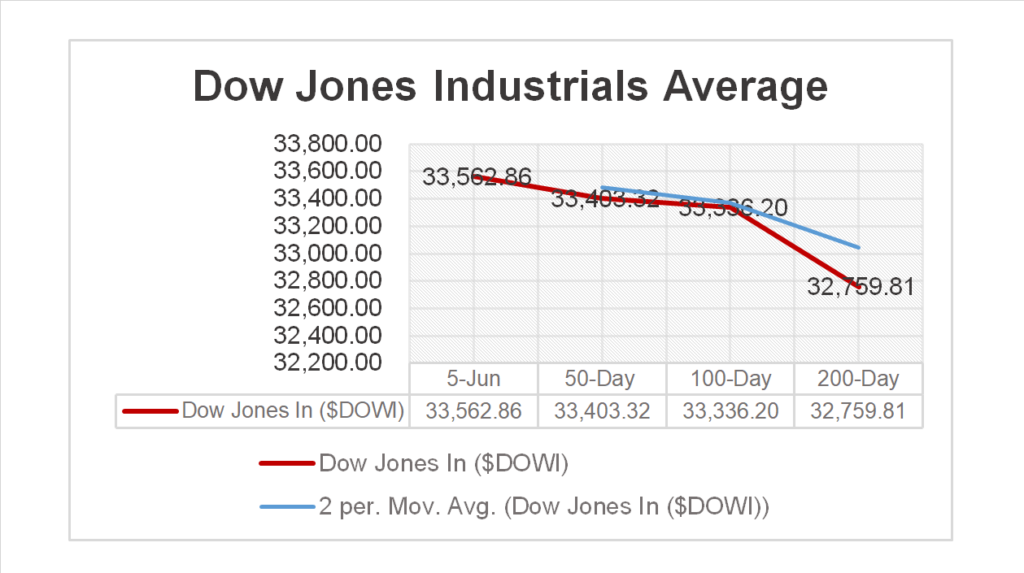

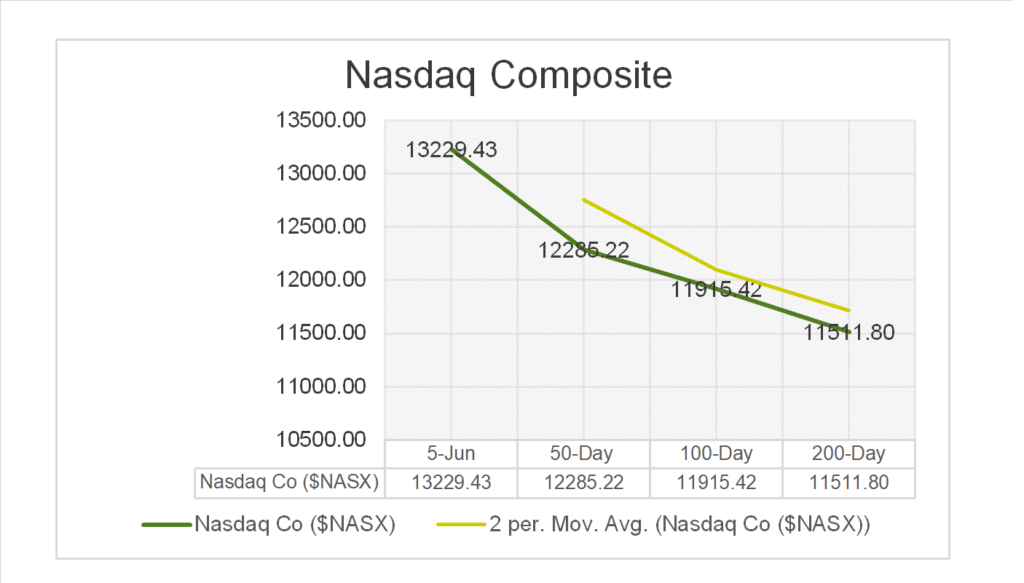

Key Indexes (50d, 100d, 200d)

S&P Sectors

- 8 of 11 of the S&P 500 sectors lower: Communication Services +0.58%, Health Care +0.38% outperform/ Industrials -0.71%, Energy -0.58% lag.

Commodities

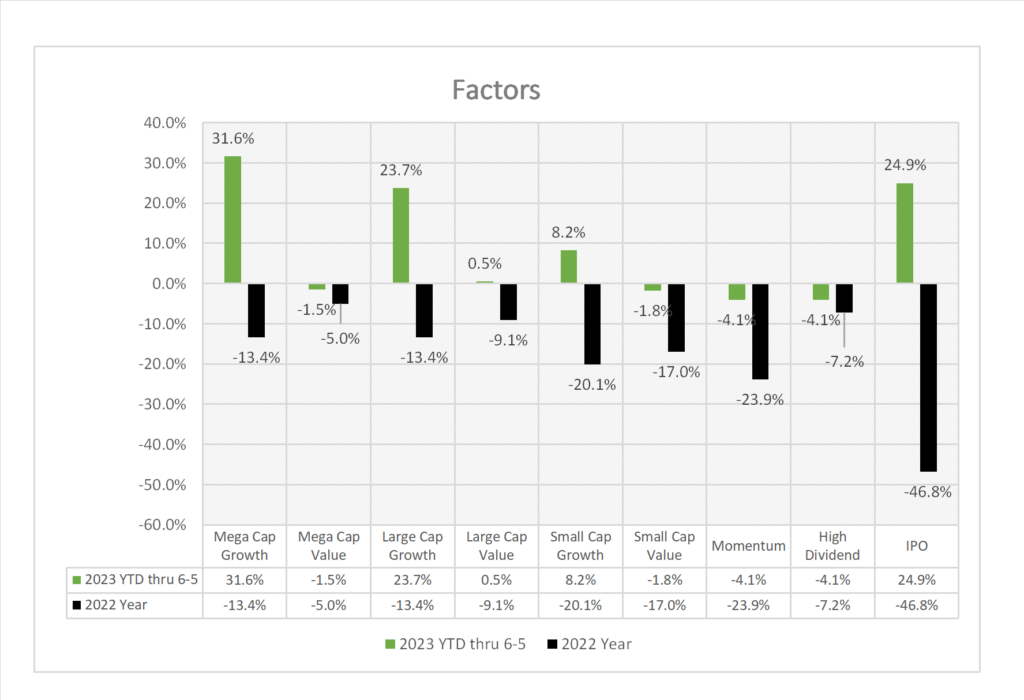

Factors (YTD)

US Treasuries

Notable Earnings Today

- +Beat: Science Applications (SAIC), Gitlab (GTLB), Healthequity Inc (HQY), Sprinklr (CXM)

- – Miss: Allego US (ALLG)

- * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), UI Path (PATH)

Economic Data

US

- S&P U.S. services PMI; period May, act 54.9, fc 55.1, prev. 55.1

- Factory orders; period April, act 0.4%, fc 0.6%. prev. 0.6%

- ISM services; period May, act 50.3%, fc 52.3%. prev. 51.9%

News

Company News

- SEC Says Binance Misused Customer Funds, Ran Illegal Crypto Exchange in U.S. – WSJ

- Intel to Raise About $1.5 Billion in Sale of Part of Mobileye – Bloomberg

Energy/ Materials

- Saudi Output Cut to Boost Oil Prices Could Be Costly – WSJ

Central Banks/Inflation/Labor Market

- Big Banks Could Face 20% Boost to Capital Requirements – WSJ

- A $1.5 Trillion Backstop for Homebuyers Props Up Banks Instead – Bloomberg

China

- Charting the Global Economy: Business Activity Slows in China – Bloomberg