MARKETS TODAY June 9th, 2023 (Vica Partners)

Yesterday, US markets finished higher, S&P 500 +0.62%, DOW +0.50% and the Nasdaq +1.02%. 7 of 11 of the S&P 500 sectors advancing: Information Technology +1.20% outperforms/ Real Estate -0.62% lags. On the upside, NY FANG+, Gold, Bitcoin and the Bloomberg Commodity Index. In economic news, Initial Claims data came in higher than last week and above forecast while Continuing claims declined and below consensus.

Overnight/US Premarket, Asian markets finished higher, Japan’s Nikkei 225 +1.97%, China’s Shanghai Composite +0.55% and Hong Kong’s Hang Seng +0.47%. US S&P futures were trading at 0.3% above fair value. European markets finished lower, London’s FTSE 100 -0.62%, Germany’s DAX -0.25% and France’s CAC 40 -0.12%

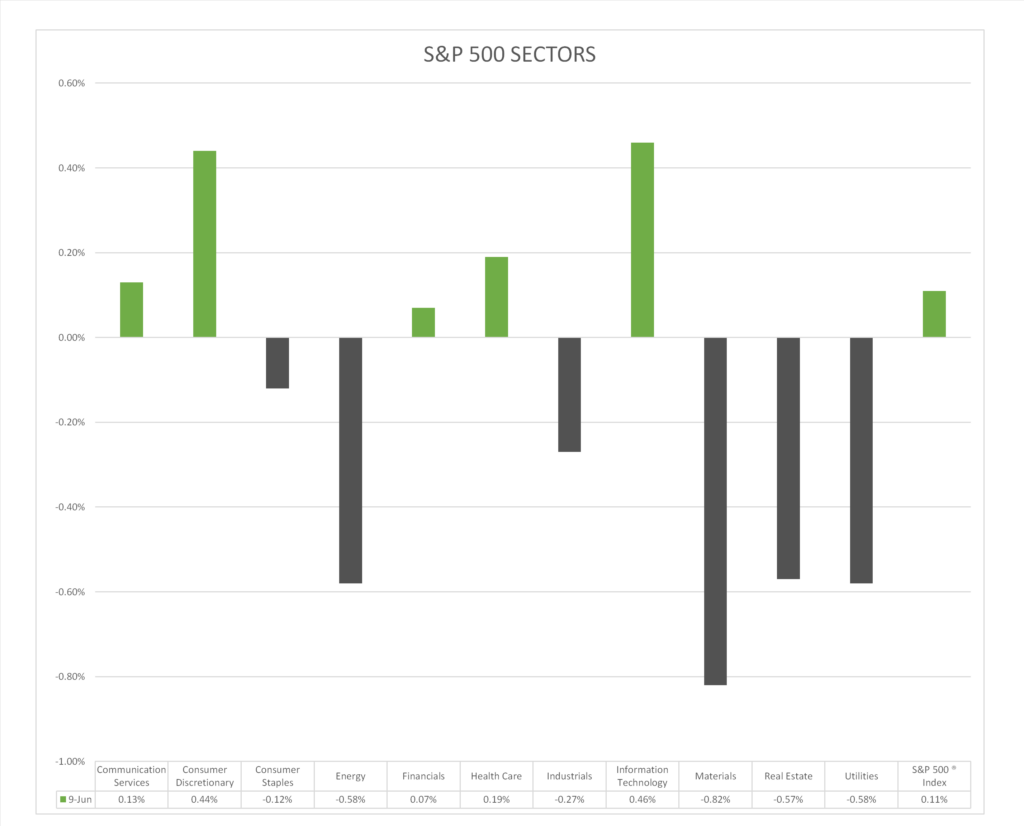

Today US Markets finished moderately higher, S&P 500 +0.11%, DOW +0.13% and the Nasdaq +0.16%. 6 of 11 of the S&P 500 sectors lower: Information Technology +0.46% outperforms/ Materials -0.82% lags. On the upside, NY FANG+, Treasury Yields and the USD Index. No economic news scheduled today, CPI and Fed rate decision next Tuesday/ Wednesday.

Takeaways

- For the Week the Russel 2k +1.7% outperforming S&P 500 <0.4% and FANG+1.2%

- SPDR S&P Regional Banking ETF 2.86%

- Small Cap Growth +1.8%, Small Cap Value +1.7%, Mega Cap Growth -0.2%

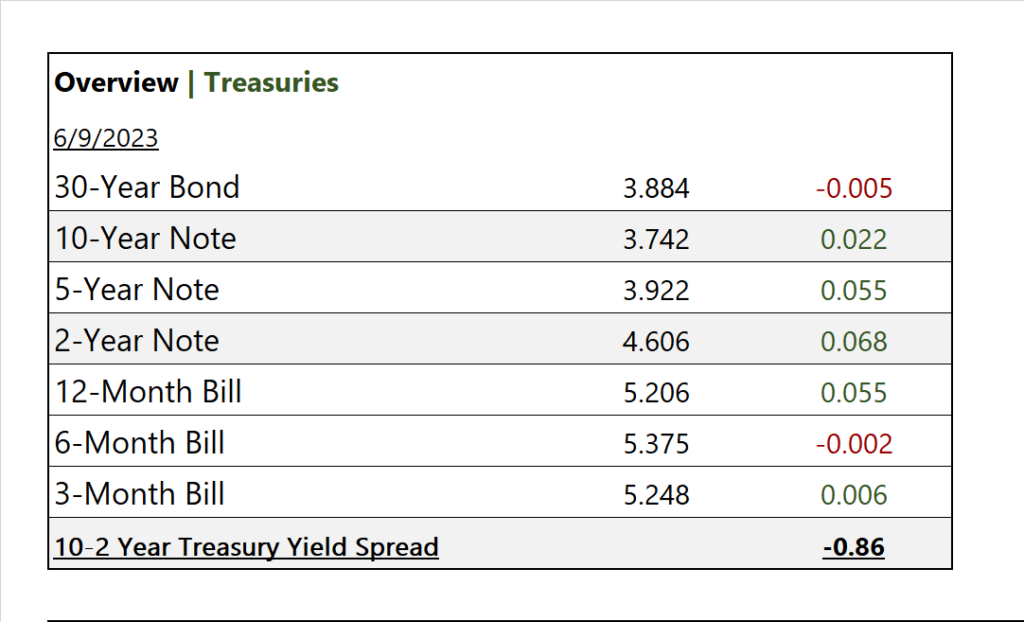

- Yields have moved higher, 2/10 spread more inverted @-0.86

- Today, Fang+ leads +0.90%

- 6 of 11 of the S&P 500 sectors lower: Information Technology +0.46% outperforms/ Materials -0.82% lags

- Big Tech/ Mega Cap Growth +0.4%

- USD Index gains

- Nio A ADR (NIO) misses on earnings

Pro Tip: Recognizing good companies that are trading at reasonable prices requires a combination of fundamental analysis and valuation techniques. Steps you can follow

Sectors/ Commodities/ Treasuries

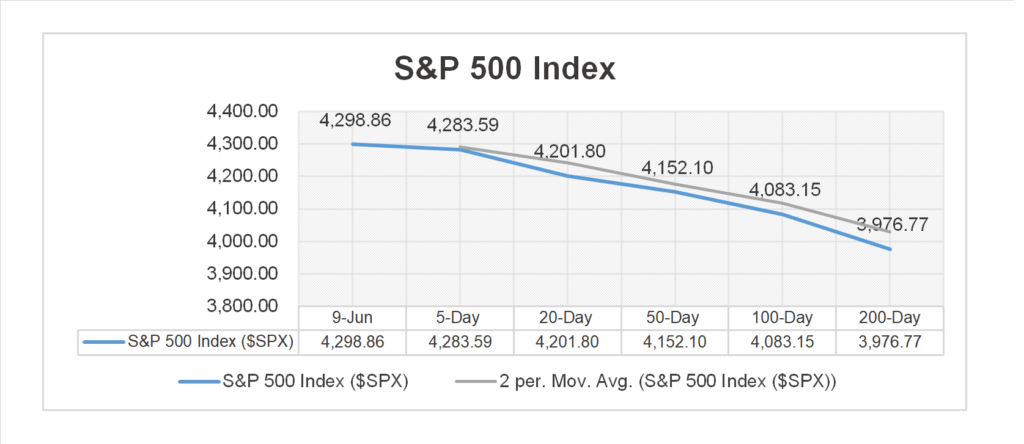

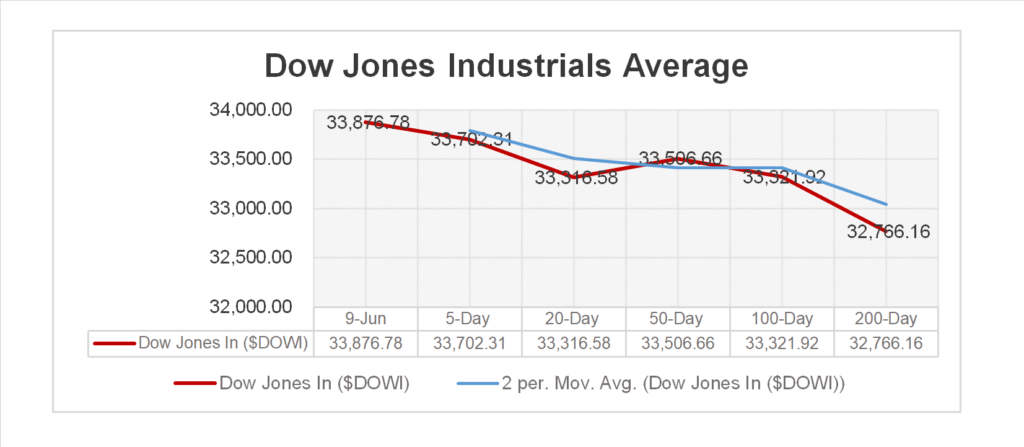

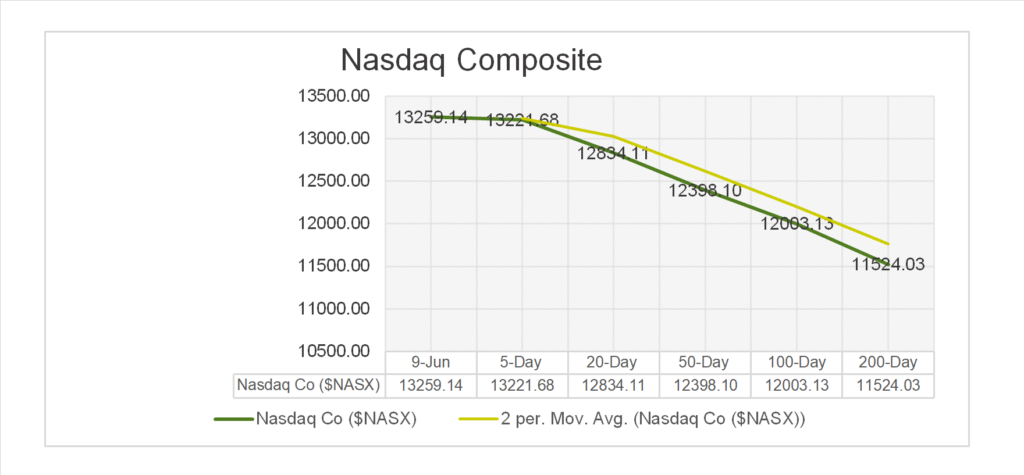

Key Indexes (50d, 100d, 200d)

S&P Sectors

- 6 of 11 of the S&P 500 sectors lower: Information Technology +0.46%, Consumer Discretionary 0.44% outperform/ Materials -0.82% lags.

Commodities

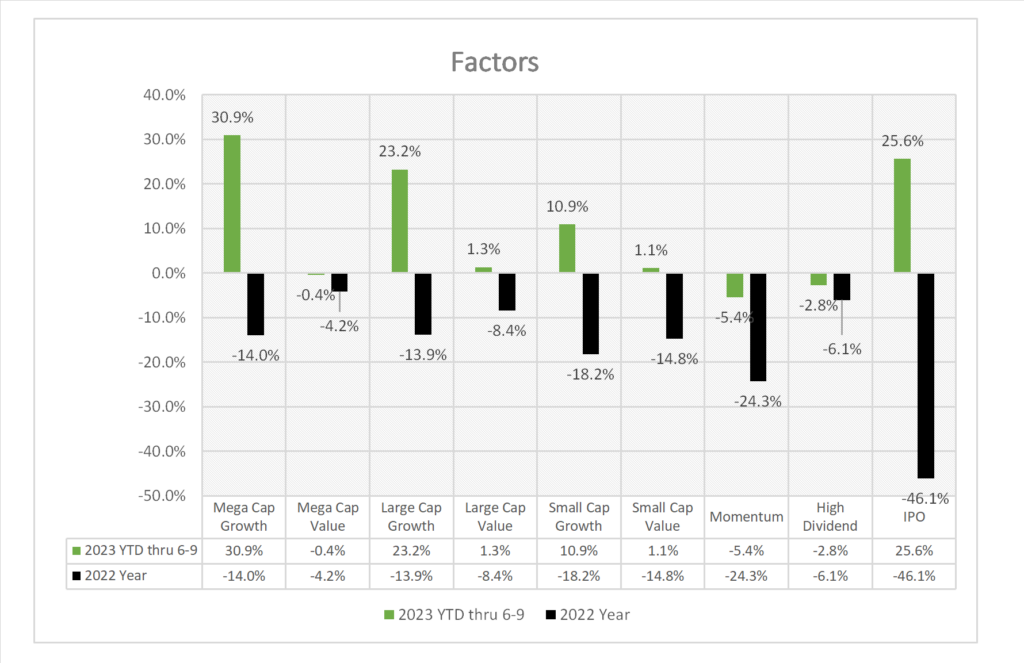

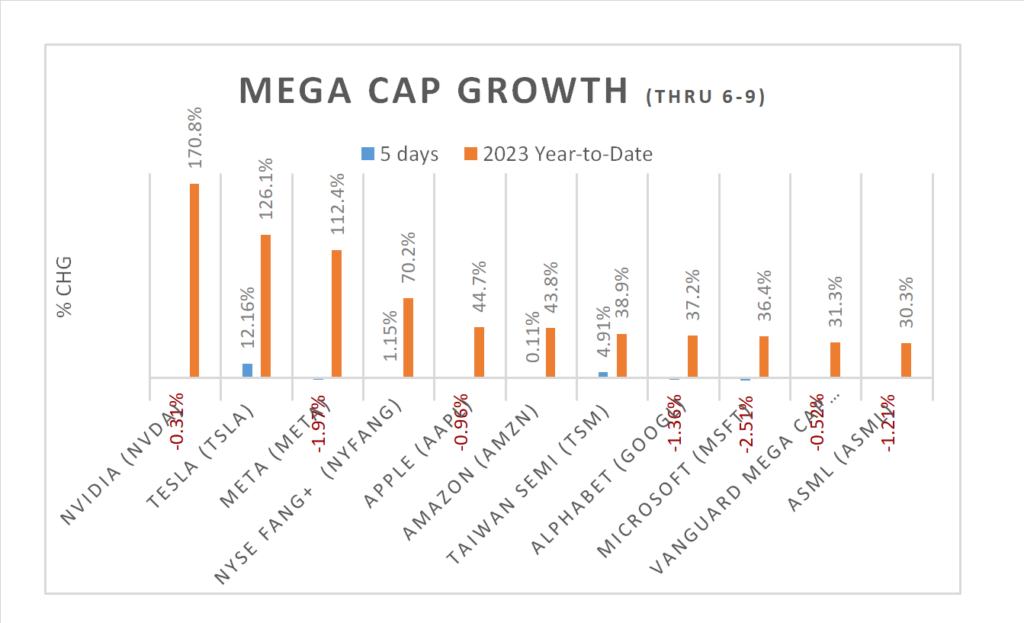

Factor/ Mega Cap Growth Chart (YTD)

US Treasuries

Notable Earnings Today

- +Beat:

- – Miss: Nio A ADR (NIO), Uranium Energy (UEC)

- * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML)

Economic Data

US

- None scheduled today

- CPI and the Fed rate decision next Tuesday and Wednesday.

News

Company News

- GM EV Owners to Tap Tesla’s Supercharger Network – WSJ

- Crypto’s Quiet Gains: Ownership Climbs Despite Crash in Prices – WSJ

Energy/ Materials

- ‘War for Talent’ at Mines Could Drive Up Cost of Energy Transition – WSJ

- Shell Announces Plan to Sell Household Energy Supply Arm – Bloomberg

Central Banks/Inflation/Labor Market

- Japan’s Rapid Return of Tourists Helping Fuel Inflation for BOJ – Bloomberg

- US Jobless Claims Surge to 261,000, Highest Since October 2021 – Bloomberg

China/ Asia