MARKETS TODAY March 17th, 2023 (Vica Partners)

Happy Irish Friday!

Yesterday the S&P 500 rallied 100pts off the intraday lows to close higher by +1.75% following the 11 big Banks $30B First Republic deposit infusion. Nasdaq and NYSE FANG outperformed Indices with investors seeking protection in mega cap stocks.

Overnight Asian markets finished higher with shares in Hong Kong leading the region. The Hang Seng is up 1.64% while Japan’s Nikkei 225 is up 1.20% and China’s Shanghai Composite is up 0.73%. Europe finished sharply lower with shares in France leading the region. The CAC 40 was down 1.43% while Germany’s DAX off 1.33% and London’s FTSE 100 lower by 1.01%. S&P futures were mostly flat but turned negative pre US Market.

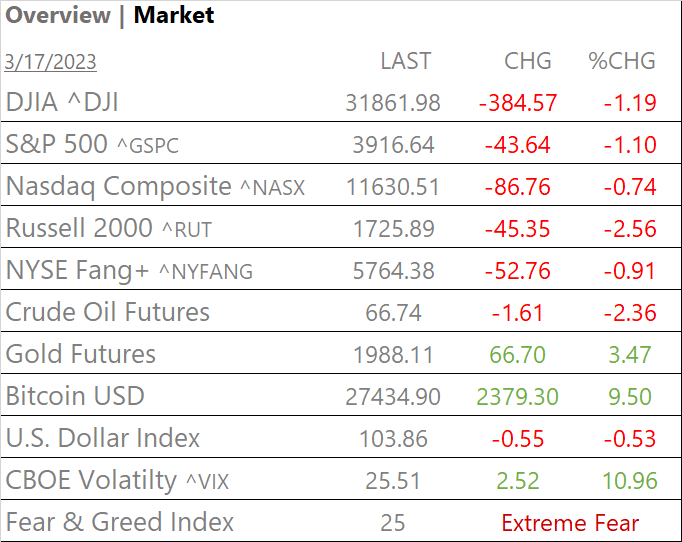

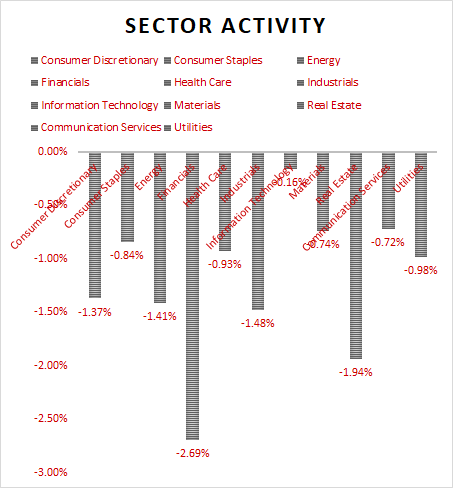

US equities opened lower and ended sharply lower. All 11 of the S&P 500 sectors were lower, Financials and Real Estate underperformed/ Information Technology outperformed. The S&P Regional Banking ETF (KRE) fell by 6% today. Yields and USD Index declined. Bitcoin jumped +9.5%, Gold +3.5% with Metals mostly outperforming. Oil futures declined >2%. On the Week, the S&P 500, +1.4% while the NYSE FANG+ index was up +9%.

In US economic news today – The Conference Board’s index of leading indicators, a gauge of future economic activity, fell in February by 0.3%, the 11th consecutive monthly decline. The University of Michigan’s Index of Consumer Sentiment fell for the first time in four months in March. Both reports are mild recessionary markers.

Takeaways

- The S&P Regional Banking ETF (KRE) fell by 6% today

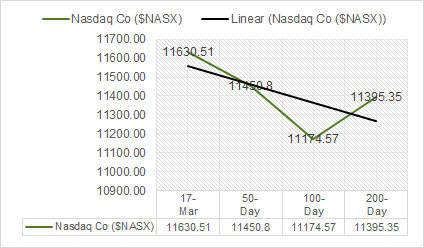

- Indexes finished lower, Nasdaq outperformed

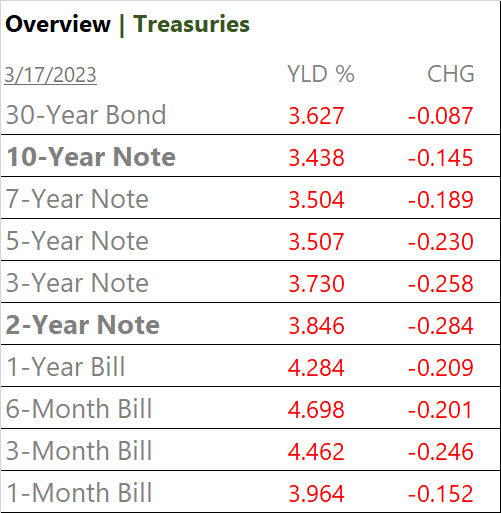

- Yields decline

- All 11 of the S&P 500 sectors were lower, Financials and Real Estate underperformed/ Information Technology outperformed.

- Fear & Greed index rating = Extreme Fear

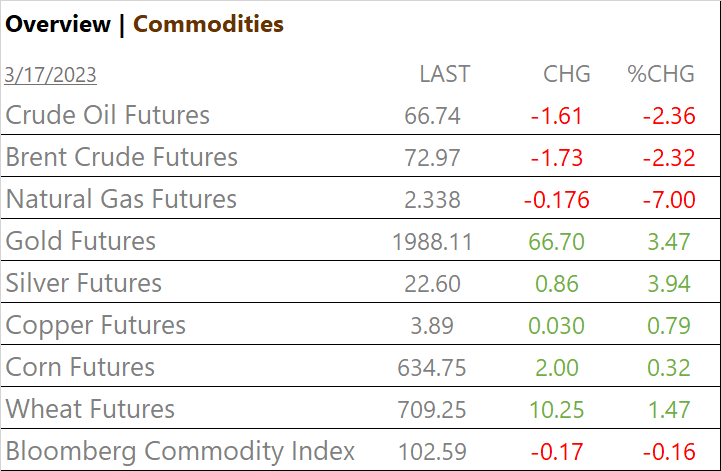

- Bloomberg Commodity Index, negative/flat

- Gold, up +3.5%

- Crude Oil Futures decline >2%

- Bitcoin soars, +9.5%

- USD Index, down

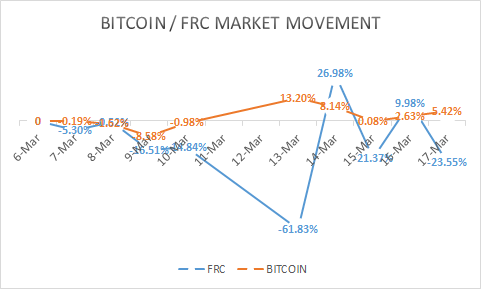

Last word, Investors are looking to Bitcoin for safety take a look at chart below see the inverse relationship day/ on day price change comparison. Watch Metals they look likely to breakout in Q2 (more on this shortly).

Sectors/ Commodities/ Treasuries

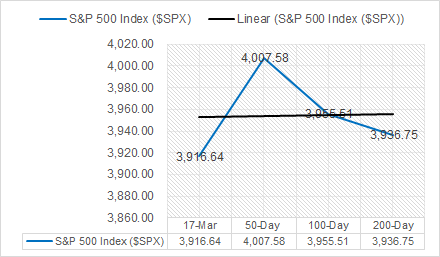

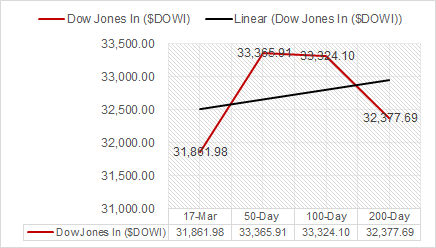

Key Indexes (50d, 100d, 200d)

S&P Sectors

- All 11 of the S&P 500 sectors were lower, Financials -2.69% and Real Estate -1.94%, underperform/ Information Technology -0.16%, outperforms

Commodities

US Treasuries

Economic Data

US

- Industrial production; period Feb., act 0.0%, fc 0.0%, prev. 0.3%

- Capacity utilization; period Feb., act 78%, fc 78.3%. prev. 78%

- U.S. leading economic index; period Feb., act 0.3%, fc -0.4%, prev. -0.3%

- Consumer sentiment; period March, act 63.4, fc 67, prev. 67

- Summary – The Conference Board’s index of leading indicators, a gauge of future economic activity, fell in February by 0.3%, the 11th consecutive monthly decline. The University of Michigan’s Index of Consumer Sentiment fell for the first time in four months in March, falling to 63.4 from last month’s reading of 67.

News

Company News

- UBS in talks to acquire Credit Suisse –FT – Reuters

- Bank of America said to buy Signature Bank, tweets Ackman – Reuters

Central Banks/Inflation/Labor Market

- Central Banks Should Press Ahead With Rate Rises Despite Bank Pains, Says OECD – WSJ

China

- Deloitte Hit by Record China Fine, Suspension Over Huarong – Bloomberg

Market Outlook and updates posted at vicapartners.com