MARKETS TODAY April 17th, 2023 (Vica Partners)

Good Monday afternoon!

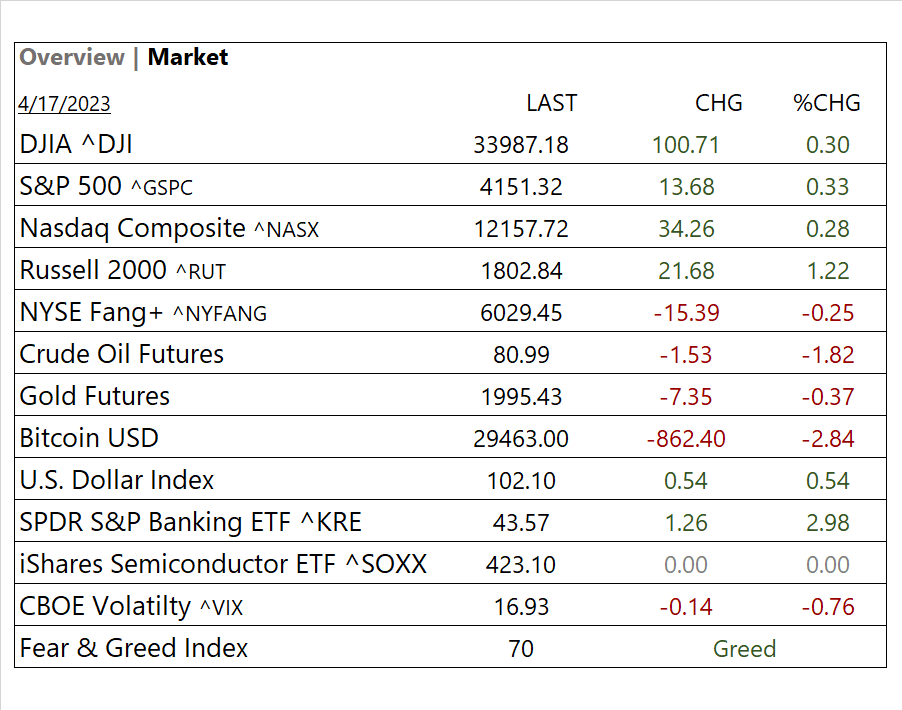

Last Week, was the “best beat rate” to start earnings season since 2012. Key Indices closed higher for the Week w/ the DOW +1.2%, S&P +0.08%, Nasdaq +0.03% while NYSE FANG+/ tech ended lower for the second week. 7 of 11 of the S&P 500 sectors were higher, Financials +2.86% and Energy +2.47% outperformed/ Real Estate -1.45% lagged. BIG Banks JP Morgan, Citi and Wells beat on earnings with yields modestly rising across the curve. The Volatility Index ^VIX closed at 17.07, YTD low. Retail sales data showed a slowdown in consumer spending by 1% in March. The Market priced in a >75% chance of a 25-basis-point rate hike in the May.

Overnight, Asian markets finished higher with shares in Hong Kong leading the region. The Hang Seng up 1.62%, China’s Shanghai Composite up 1.42% and Japan’s Nikkei 225 up 0.07%. Premarket, European markets finished mixed the FTSE 100 gained 0.10%, the CAC 40 lower 0.28%, and DAX lower 0.11%. S&P 500 US futures were trading in-line with fair value.

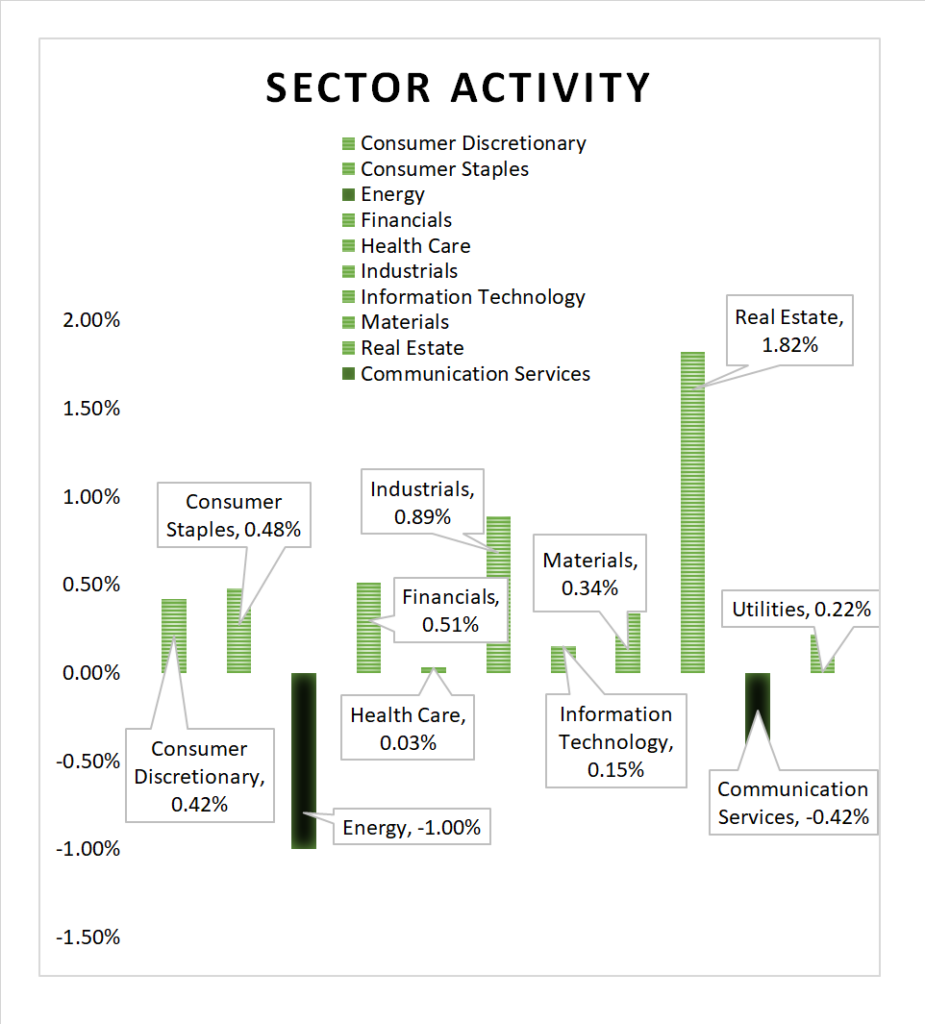

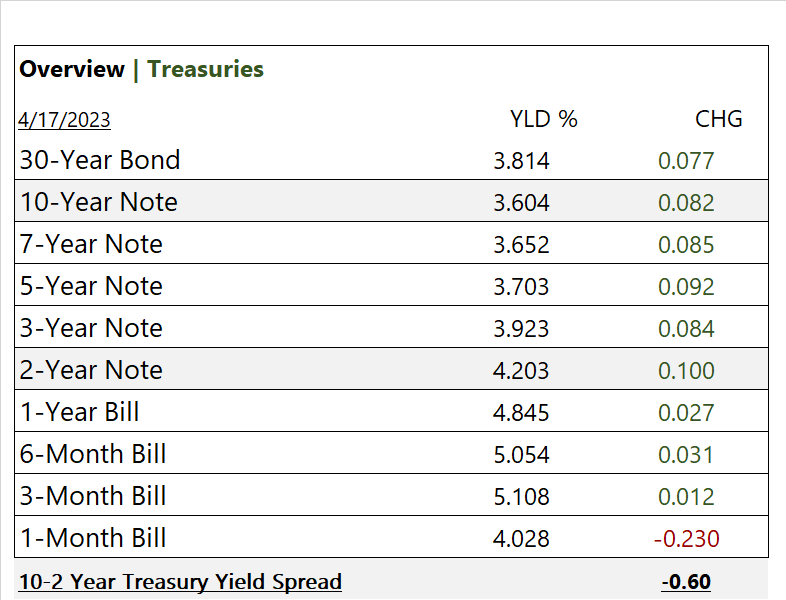

US markets today, Key Indices close moderately higher with S&P 500 and Russell 2000 leading. 9 of 11 of the S&P 500 sectors finish higher, Real Estate and Industrials outperform/ Energy lags. Yield rise across the curve with 2/10 inversion increasing. USD Index and Bloomberg Commodity Index gaining. In economic news, Empire Manufacturing survey easily beat expectations on new orders (+10.8 vs. -18 cons., prior -24.6). Confidence among U.S. single-family homebuilders improved for a second straight month in February.

Takeaways

- Last week was best start to earnings season since 2012

- Empire Manufacturing BIG beat

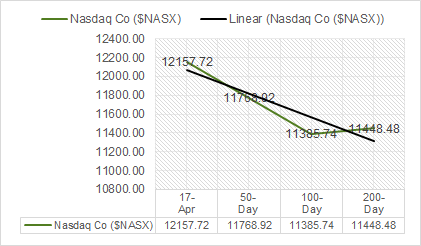

- Russell 2000 leads Indices, up +1.2% while NY FANG+ lags -0.25% and continued underperformance by tech

- 9 of 11 of the S&P 500 sectors finish higher, Real Estate and Industrials outperform

- Regional Banking ETF (KRE) +3% on M&T Bank (MT) big earnings beat

- Markets priced in 25-basis-point rate hike in the May

Pro Tip: using the news, and or other resources that heavily rely on marketing as a sole source of investment is common investor mistake. Keep in mind that time the information has become public, it is already has been factored into market pricing.

Sectors/ Commodities/ Treasuries

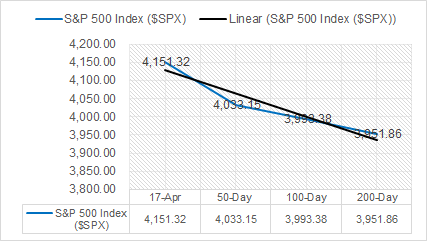

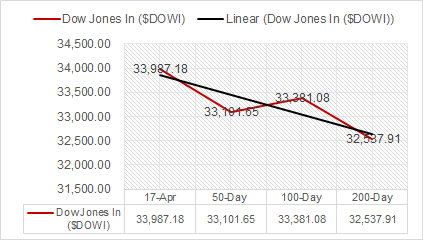

Key Indexes (50d, 100d, 200d)

S&P Sectors

- 9 of 11 of the S&P 500 sectors finish higher, Real Estate +1.82% and Industrials +0.89% outperform/ Energy -1.00% and Communication Services -0.42% underperform

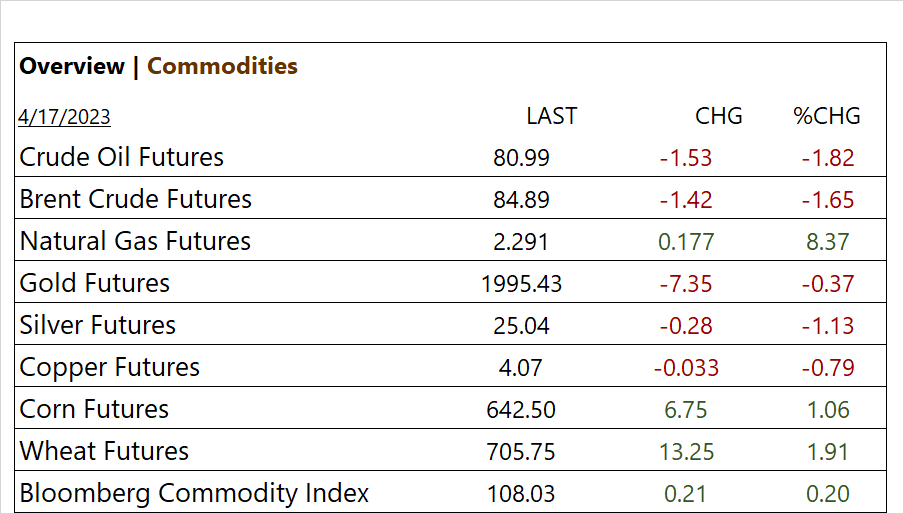

Commodities

US Treasuries

Notable Earnings Today

- + M&T Bank (MTB)

- – Charles Schwab (SCHW), State Street (STT), JB Hunt (JBHT), Equity Lifestyle (ELS)

- * Strong support – Berkshire Hathaway (BRK-B) Sociedad Quimica y Minera (SQM), Citigroup (C), Morgan Stanley (MS), BlackRock (BLK), Albermarie (ALB), Alpha Metal Res (AMR)

Economic Data

US

- Empire State manufacturing; period April, act 10.8, fc -18, prev. -24.6

- Home builder confidence index; period April. Act 45, fc 45, prev. 44

Summary Empire Manufacturing survey easily beat expectations on new orders (+10.8 vs. -15 cons., prior -24.6). Confidence among U.S. single-family homebuilders improved for a second straight month in February. Confidence among U.S. single-family homebuilders improved for a second straight month in February.

News

Company News/ Other

- Alphabet shares fall on report Samsung may dump Google Search for Bing – Reuters

- China’s electric car drive, led by BYD, leaves global brands behind – Reuters

- Dollar jumps after strong New York manufacturing survey – Reuters

Central Banks/Inflation/Labor Market

- European Central Bank to Lift Deposit Rate to 3.75% Peak in July, Survey Shows – Bloomberg

- ECB’s Lagarde Says She Can’t Imagine US Will Default on Debt – Bloomberg

China

- Risk of deflation, lacklustre consumption are red signals on China’s path to economic recovery – SCMP