MARKETS TODAY May 11th, 2023 (Vica Partners)

Yesterday, US Markets finished mixed S&P 500 +0.45%, DOW -0.17% and the Nasdaq +1.04%. 6 of 11 of the S&P 500 sectors higher: Information Technology outperforms/ Energy lags. On the upside, mega cap growth rallied continued with NY FANG+ > 1.9%, the Semiconductor ETF (SOXX) >1%. Treasury Yields, Gold and Oil all declined. The Consumer-Price Index and Core CPI were in line with analysts’ expectations.

Overnight/Premarket, Asian markets finished mixed, Japan’s Nikkei 225 +0.02%, Shanghai Composite -0.29% and Hong Kong’s Hang Seng -0.29%. European markets finished mixed, Frances CAC 40 +0.28%, Germany’s DAX -0.39% and London’s FTSE 100 -0.33%. US futures were trading at 0.1% below fair-value.

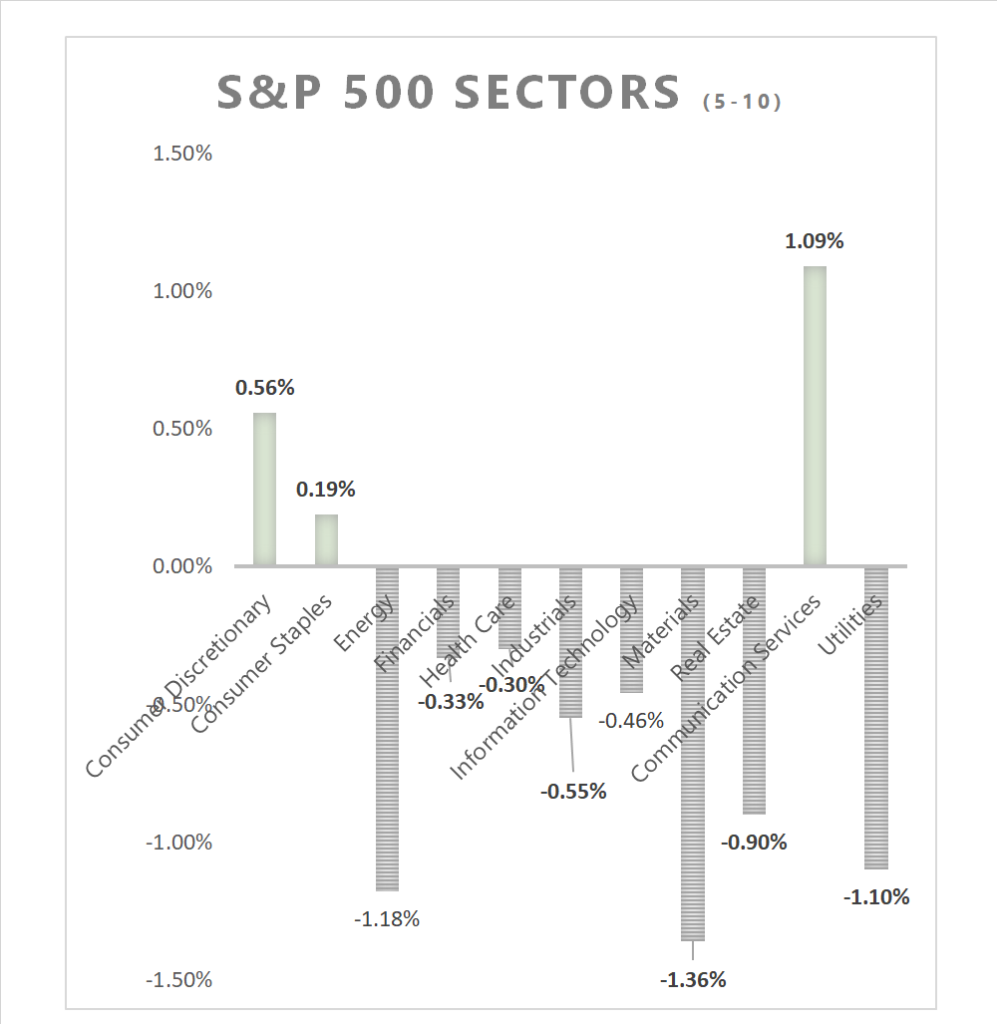

Today, US Markets finished mixed S&P 500 -0.17%, DOW -0.66% and the Nasdaq +0.18%. 8 of 11 of the S&P 500 sectors lower: Materials and Energy underperform/ Communication Services outperforms. On the upside, mega cap growth continues to gain with NY FANG+ 0.90%. Treasury Yields, Gold, Bitcoin and Oil all declined. In economic news, wholesale prices rose less than estimate, weekly unemployment claims came in higher than consensus.

Takeaways

- Economy cooling

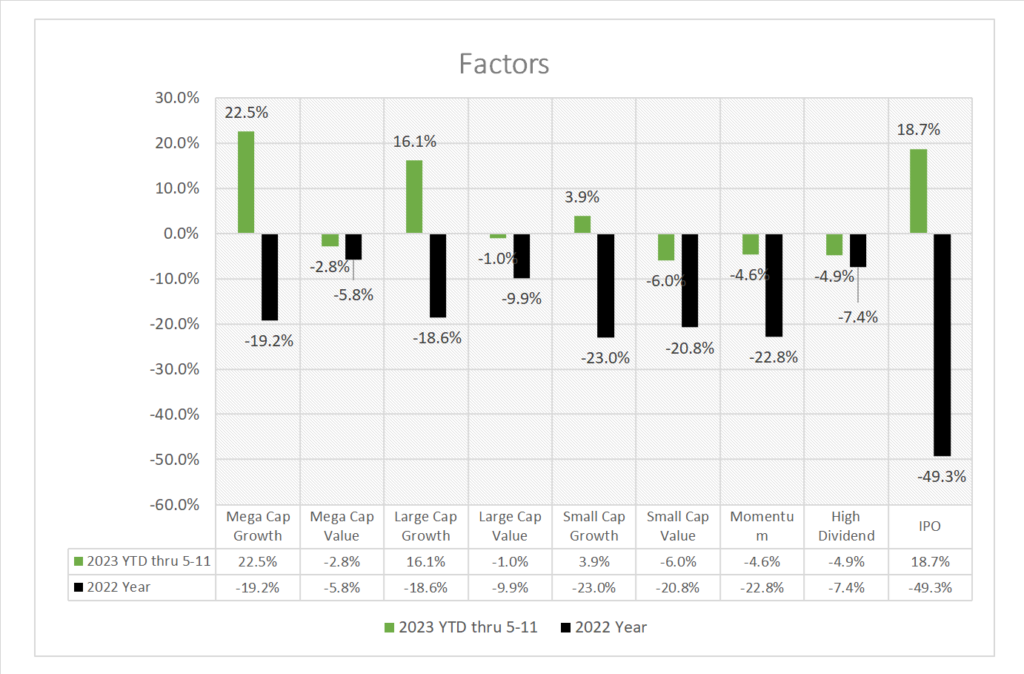

- Mega cap growth continue to trend up, Nasdaq gains

- 8 of 11 of the S&P 500 sectors finished lower: Communication Services outperforms/ Materials lags

- Regional Banking SPDR S&P Banking ETF (KR) <2.48%>

- Merck ADR (MKKGY) misses, JD.com Inc Adr (JD) beats earnings

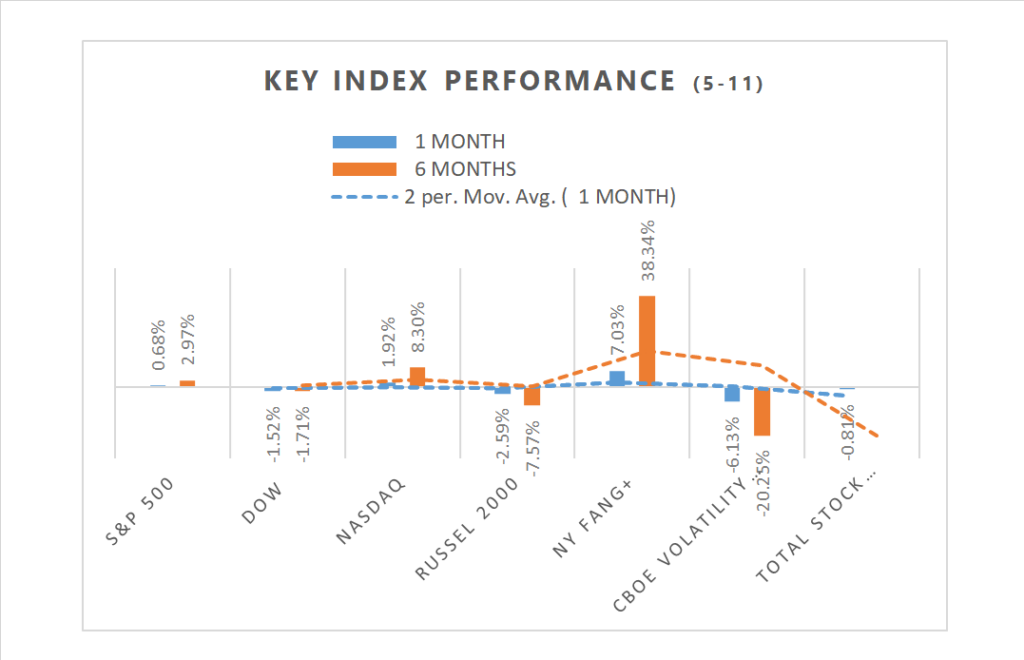

Pro Tip: Key Indices Analysis / Short-Term (1-Month) a) assess volatility b) review indices performance c) examine sectors d) consider macroeconomic events. Medium-Term (6-Month) a) topline general trends b) evaluate market breadth c) compare indices+ sectors d) consider fundamental factors, indicators and company earnings.

Sectors/ Commodities/ Treasuries

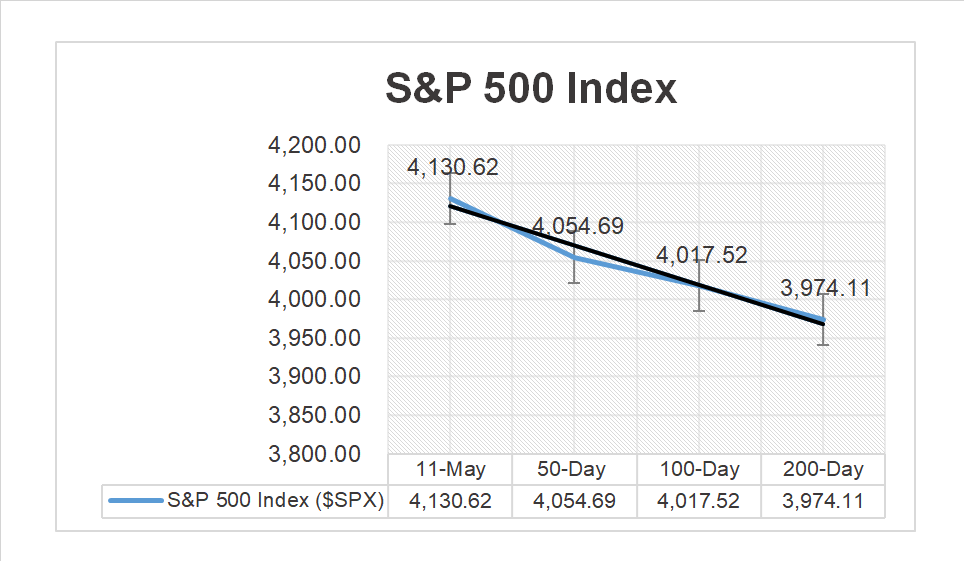

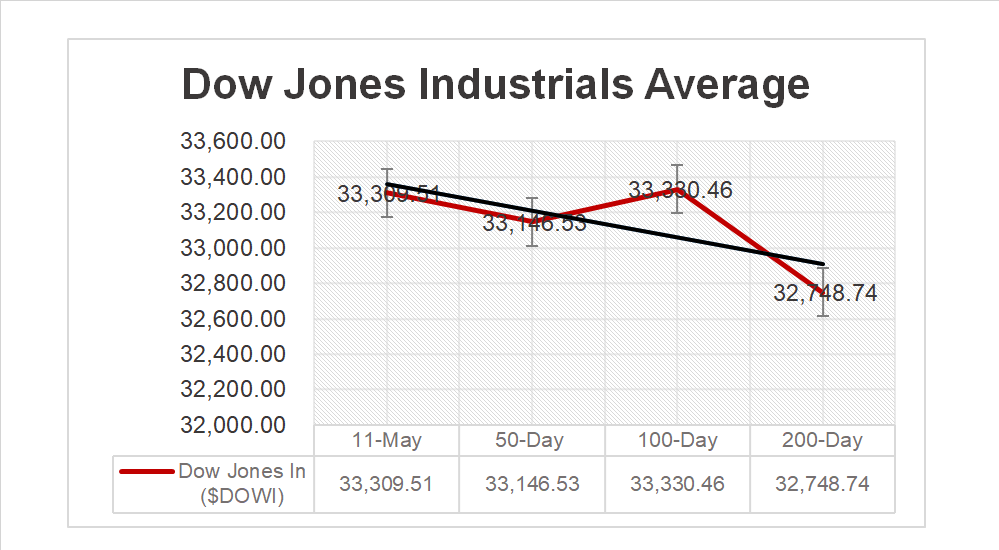

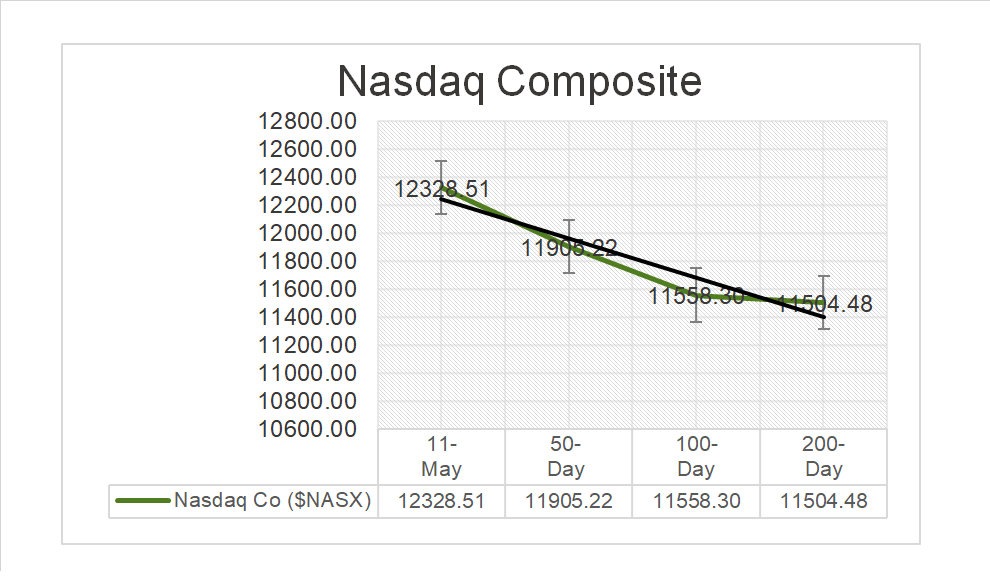

Key Indexes (50d, 100d, 200d)

S&P Sectors

- 8 of 11 of the S&P 500 sectors finish lower: Communication Services +1.09% outperforms/ Materials -1.36% land Energy -1.18% lag

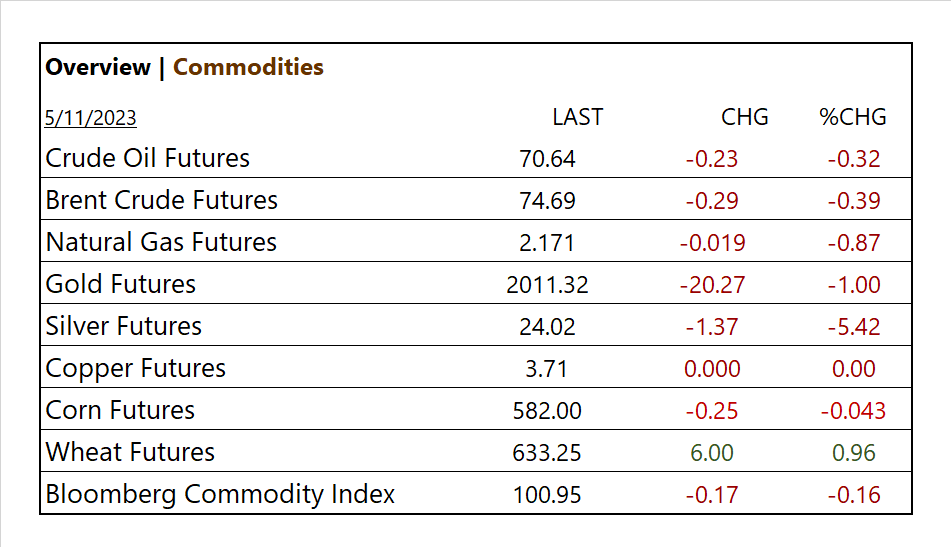

Commodities

Factors (YTD)

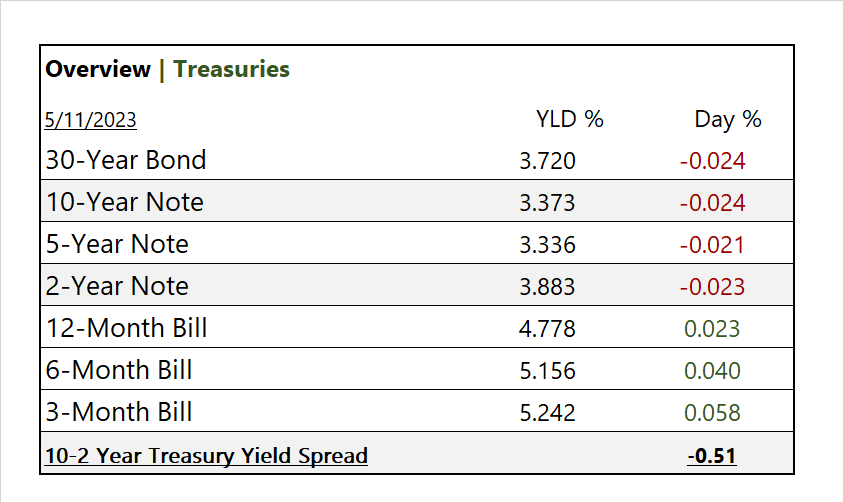

US Treasuries

Notable Earnings Today

- +Beat: Deutsche Telekom ADR (DTEGY), Bayer AG PK (BAYRY), SoftBank Group Corp. (SFTBF), Tokyo Electron Ltd PK (TOELY), JD.com Inc Adr (JD), ING ADR (ING), Suntory Beverage & Food (STBFY), Tapestry (TPR), US Foods (USFD), Dillards (DDS)

- – Miss: Merck ADR (MKKGY), KDDI Corp PK (KDDIY), Takeda Pharma ADR (TAK), Honda Motor ADR (HMC), Nissan Motor ADR (NSANY), Kirin Holdings Co (KNBWY), Polestar Automotive Holding A (PSNY), Pharming Group (PHAR), Hannover Re (HVRRY)

- * Strong support – NVIDIA (NVDA), Analog Devices (ADI), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), Alpha Metallurgical Resources (AMR), DaVita (DVA)

Economic Data

US

- Producer price index; period April, act 0.2, fc 0.3, prev. -0.4%

- Core PPI; period April, act 0.2%, fc 0.2%, prev. 0.2%

- PPI year over year; period April. Act 2.3%, prev. 2.7%

- Core PPI year over year; period April, act 3.4% , prev. 3.7%

- Initial jobless claims; period May6, act 264K, fc 245K, prev. 242K

- Continuing jobless claims; period April 29, act 1.81m, prev. 1.80m

News

Company News/ Other

- EU decision clearing $69 billion Microsoft, Activision deal expected May 15, sources say – Reuters

Central Banks/Inflation/Labor Market

- Bank of England Raises Interest Rates to Highest Level in 15 Years – NY Times

China