MARKETS TODAY May 23rd, 2023 (Vica Partners)

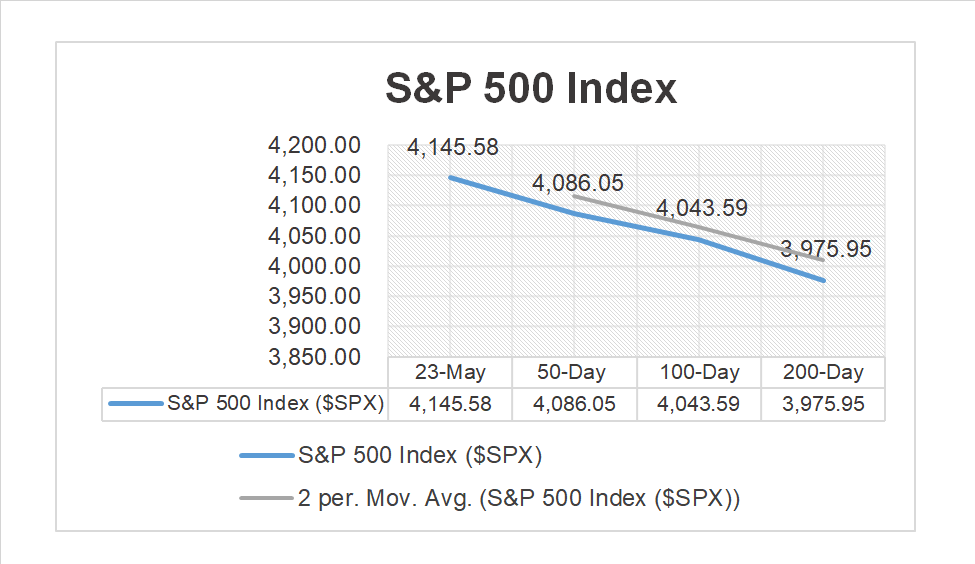

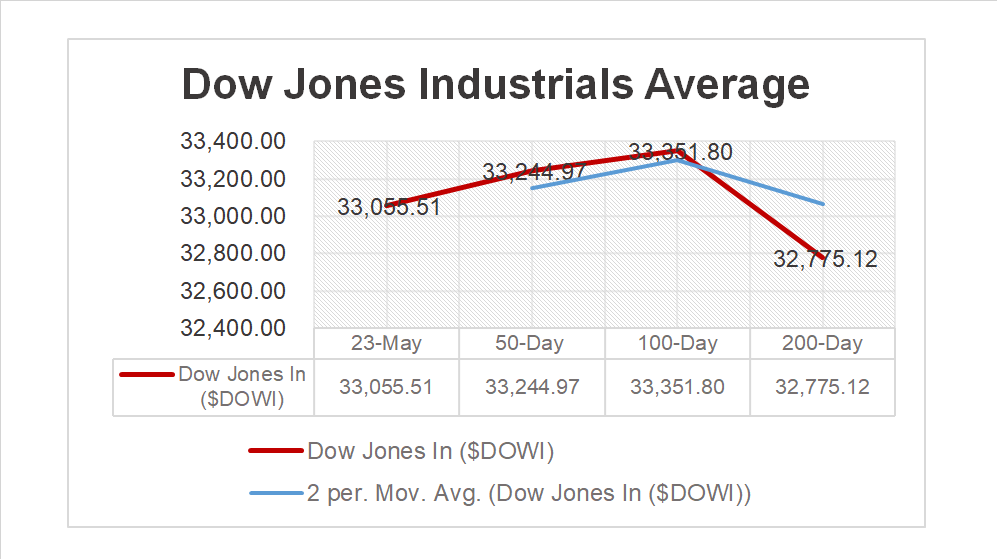

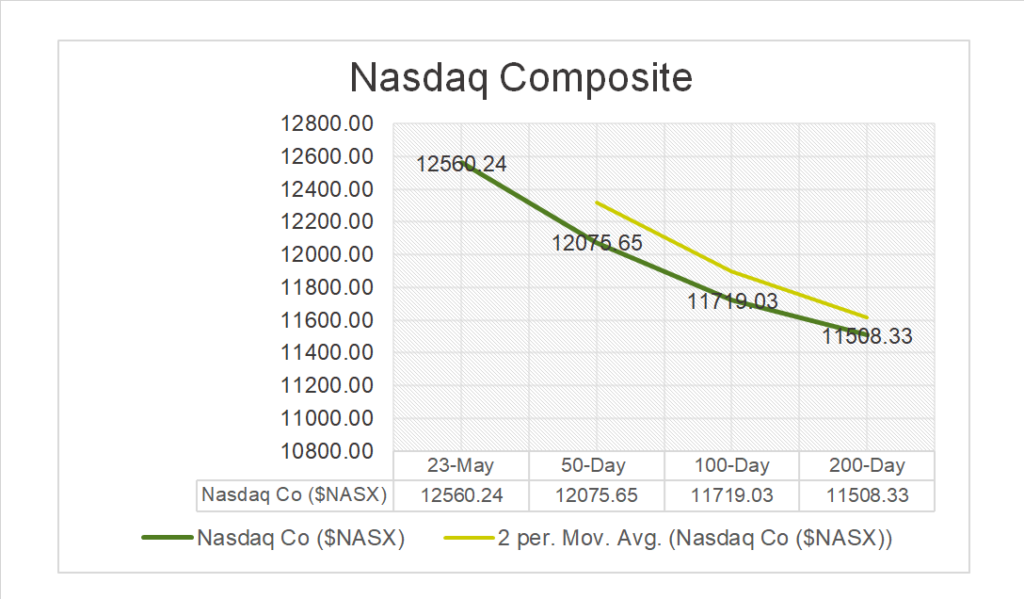

On Monday, US Markets finished mixed, S&P 500 +0.02%, DOW -0.42% and the Nasdaq +0.50%. The Russell 2k outperformed +1.22% as SPDR S&P Banking ETF (KRE) was up 3.19%. 7 of 11 of the S&P 500 sectors higher: Communication Services +1.17% outperformed/ Consumer Staples -1.47% lagged. Treasury Yields, Oil, Bitcoin and USD Index all gained. No US economic data only Fed “hawkish” commentary.

Overnight/US Premarket, Asian markets finished lower, Shanghai Composite -1.52%, Hong Kong’s Hang Seng -1.25% and Japan’s Nikkei 225 -0.42%. European markets finished lower, France’s CAC 40 -1.33%, Germany’s DAX -0.44% and London’s FTSE 100 -0.10%. US futures were trading at 0.4% below fair value.

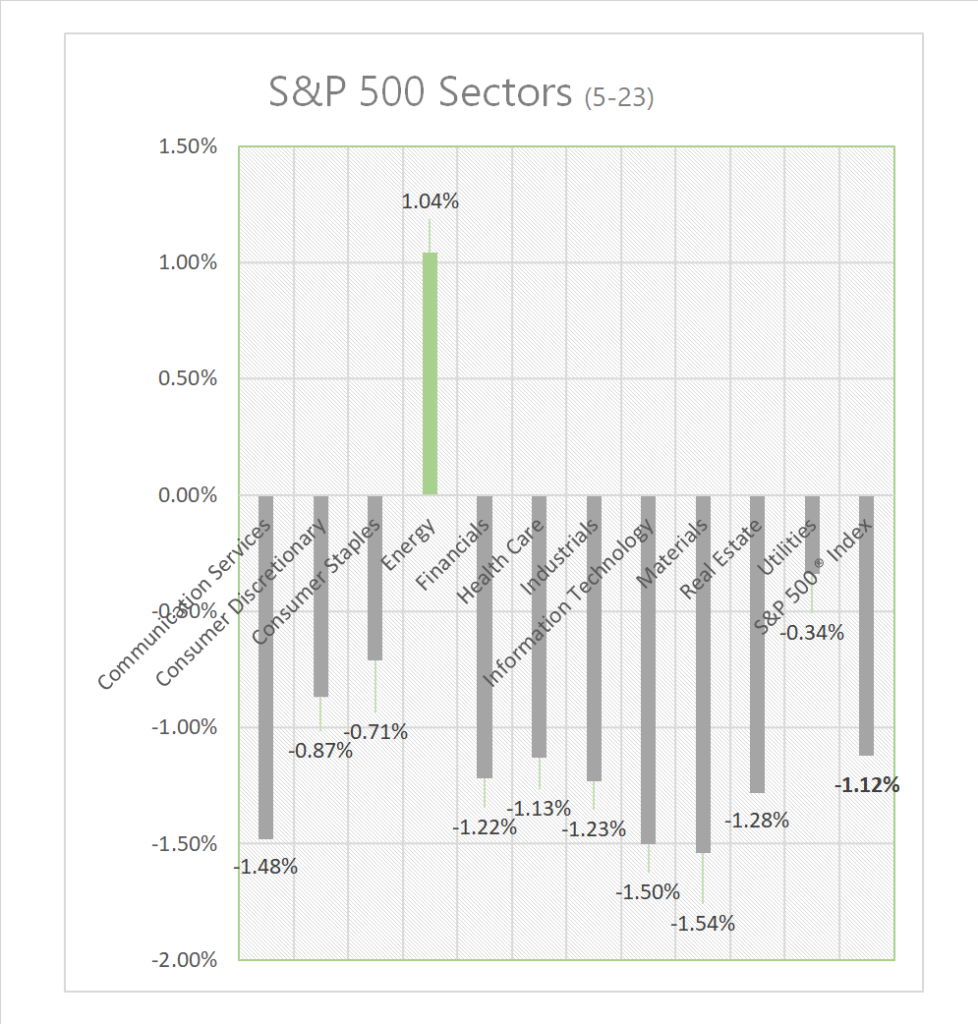

Today US Markets finished lower, S&P 500 -1.12%, DOW -0.69% and the Nasdaq -1.26%. 10 of 11 of the S&P 500 sectors lower: Materials -1.54% underperforms/ Energy +1.04% outperforms. On the upside, Oil, Gold, Bitcoin and USD Index all gain. In economic news, S&P flash U.S. services PMI came in hot while manufacturing PMI missed, new home sales exceeded consensus.

Takeaways

- Debt ceiling

- Economic data mixed, Mfg. in contraction/ Services remain strong

- SPDR S&P Banking ETF (KRE) +8% over the last 5 days

- 10 of 11 of the S&P 500 sectors lower: Energy outperforms

- Intuit (INTU) misses, Palo Alto Networks (PANW) beats on earnings

Pro Tip: Company earnings guidance given to investors by company executives is inaccurate >66% of the time. Source: Vica datametrics

Sectors/ Commodities/ Treasuries

Key Indexes (50d, 100d, 200d)

S&P Sectors

- 10 of 11 of the S&P 500 sectors lower: Materials -1.54% and Information Technology -1.50% lagged/ Energy +1.04% outperforms.

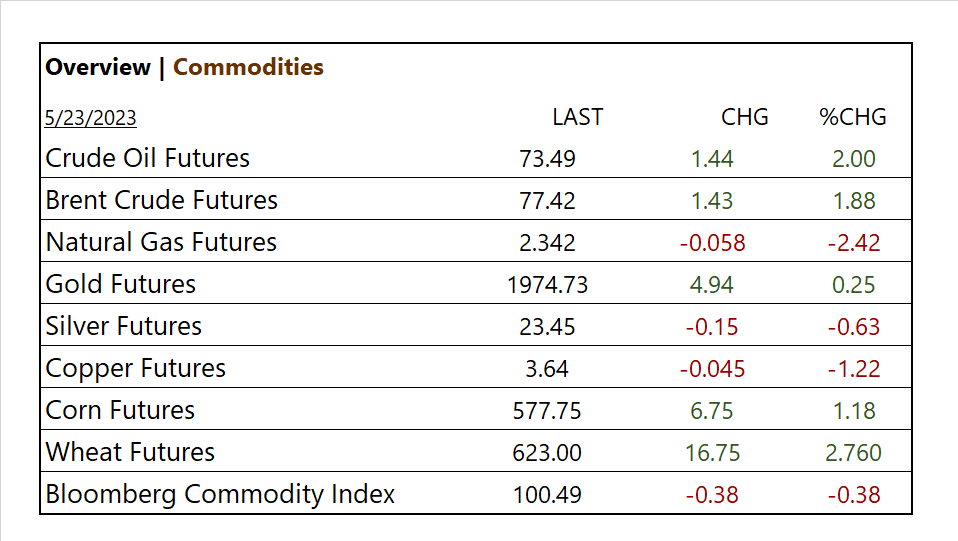

Commodities

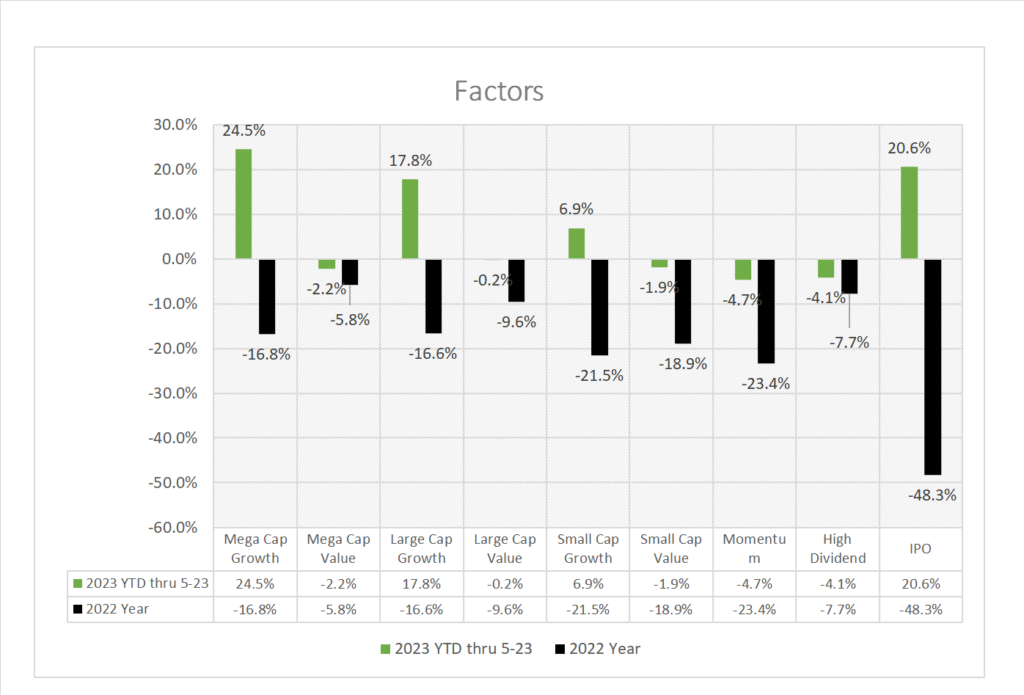

Factors (YTD)

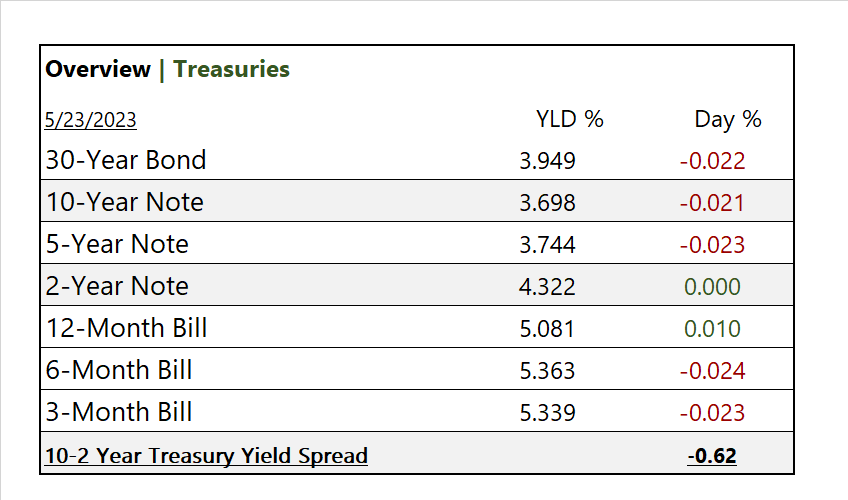

US Treasuries

Notable Earnings Today

- +Beat: Palo Alto Networks (PANW)Lowe’s (LOW), Dick’s Sporting Goods (DKS), Endava (DAVA)

- – Miss: : Intuit (INTU), AutoZone (AZO), BJs Wholesale Club (BJ),Williams-Sonoma (WSM)

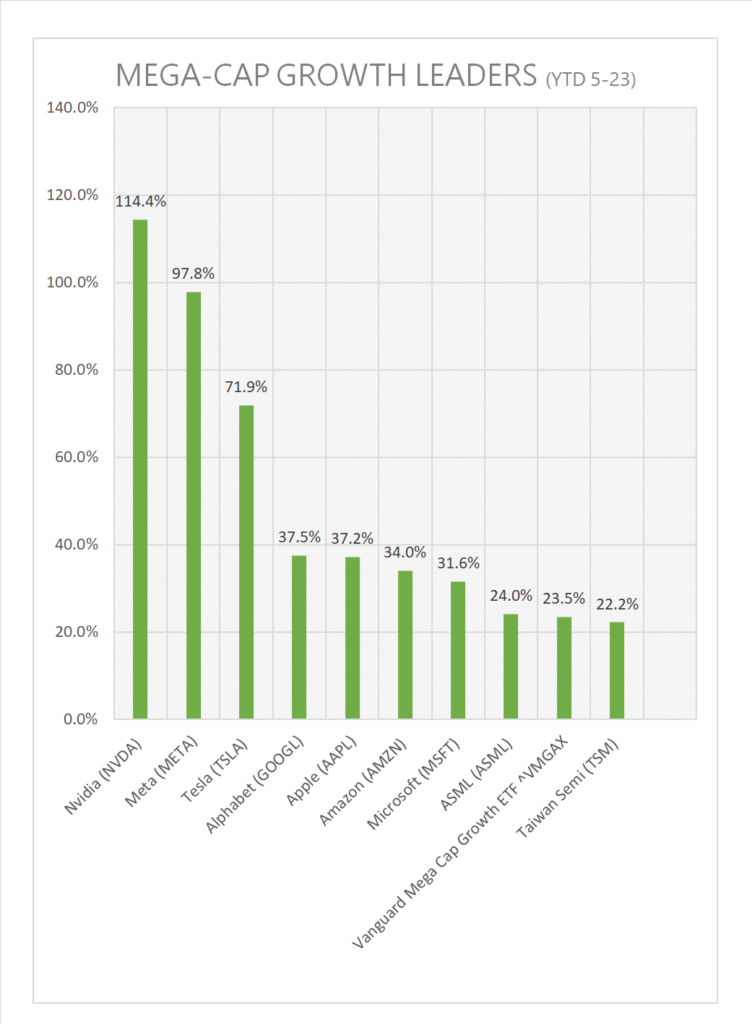

- * Strong support – NVIDIA (NVDA), Analog Devices (ADI), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), Baidu (BIDU), Nu Holdings (NU)

Economic Data

US

- S&P flash U.S. services PMI; period May, act 55.1, fc 52.6, prev. 53.6 Topline/ New orders rose at the fastest rate since April 2022 and new export orders grew for the first time in a year.

- S&P flash U.S. manufacturing PMI; period May, act 48.5, fc 50.0, prev. 50.2 Topline/ the reading pointed to the biggest contraction in the manufacturing sector in three months and a renewed deterioration in operating conditions.

- New home sales; period April, act 683,000, fc 669,000, prev. 656,000 Topline/ sales of new U.S. single-family homes reached a 13-month high in April, boosted by a shortage of previously owned houses on the market and a sharp decline in prices from last year.

News

Company News/ Other

- Wyndham Hotels Stock Rises After Report of Choice Hotels Acquisition Interest – WSJ

- Apple Strikes Multibillion-Dollar Supply Deal With Broadcom – WSJ

- Gas Stocks Set to Trounce Oil Shares, Says Bank of America – WSJ

Central Banks/Inflation/Labor Market

- Fed Needs to Cool Off Hot Job Market, Ex-Chair Bernanke Says – Bloomberg

- United States Services PMI – com

- United States Manufacturing PMI – com

- US new home sales, business activity rise to 13-month highs – Reuters

- US homebuilder sentiment rises to 10-month high in May – Reuters

China

- China Vows to Stabilize Growth, Curb Risks by Boosting Audits – Bloomberg

- Banks Are Roaring Back in Xi’s New China – Bloomberg

Education

- A Golden Cross is a basic technical indicator used in financial markets, particularly in the analysis of stock prices. It is formed when a shorter-term moving average crosses above a longer-term moving average, signaling a potential bullish trend reversal or continuation. Here’s a step-by-step explanation of how a Golden Cross is formed and interpreted.