MARKETS TODAY June 14th, 2023 (Vica Partners)

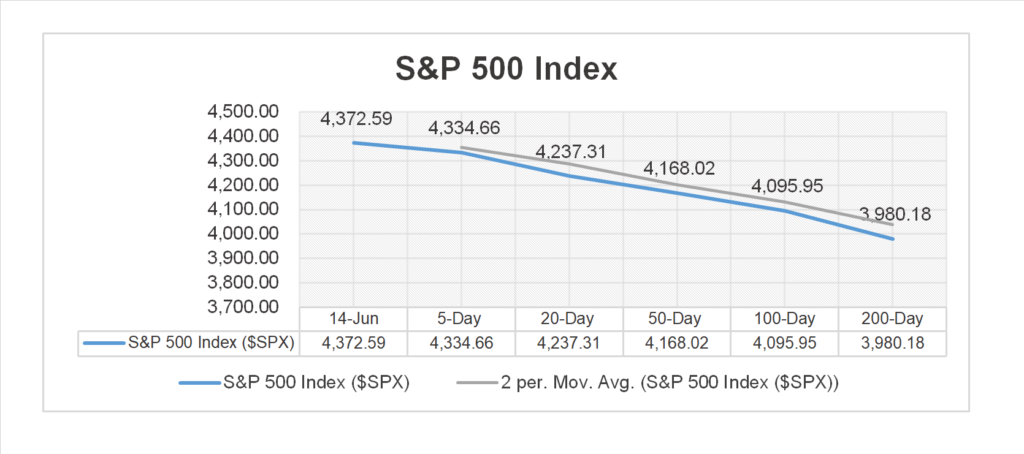

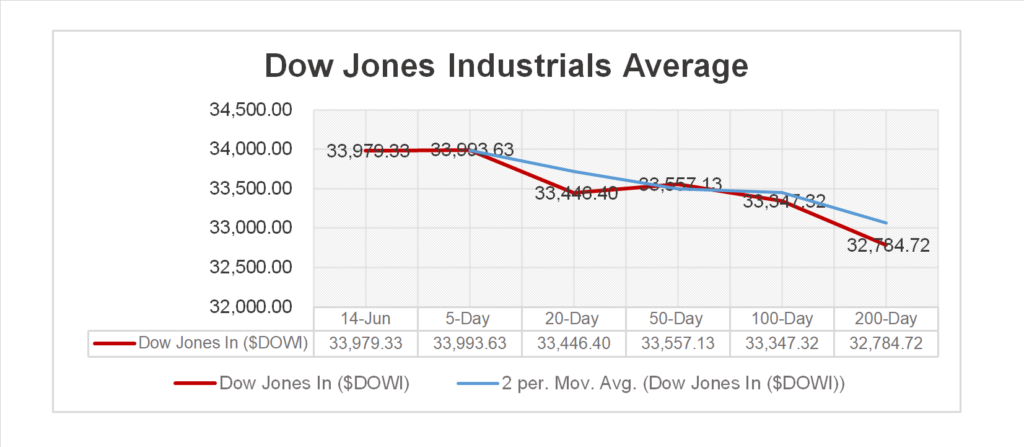

On Tuesday, US markets finished higher, S&P 500 +0.69%, DOW +0.43% and the Nasdaq +0.83%. 10 of 11 of the S&P 500 sectors advancing: Materials +2.33% outperforms/ Utilities -0.06% lags. On the upside, Russell 2k, SPDR S&P Banking ETF (KRE), Treasury Yields, Oil and the Bloomberg Commodity Index. In economic news, Headline CPI showed significant deceleration on both a monthly and annual basis while Core-CPI was inline with estimates.

Overnight/US Premarket, Asian markets finished mixed, Japan’s Nikkei 225 +1.47%, Hong Kong’s Hang Seng -0.58% and China’s Shanghai Composite -0.14%. European markets finished higher, France’s CAC 40 +0.52%, Germany’s DAX +0.49% and London’s FTSE 100 +0.10%. S&P futures were trading at 0.1% above fair value.

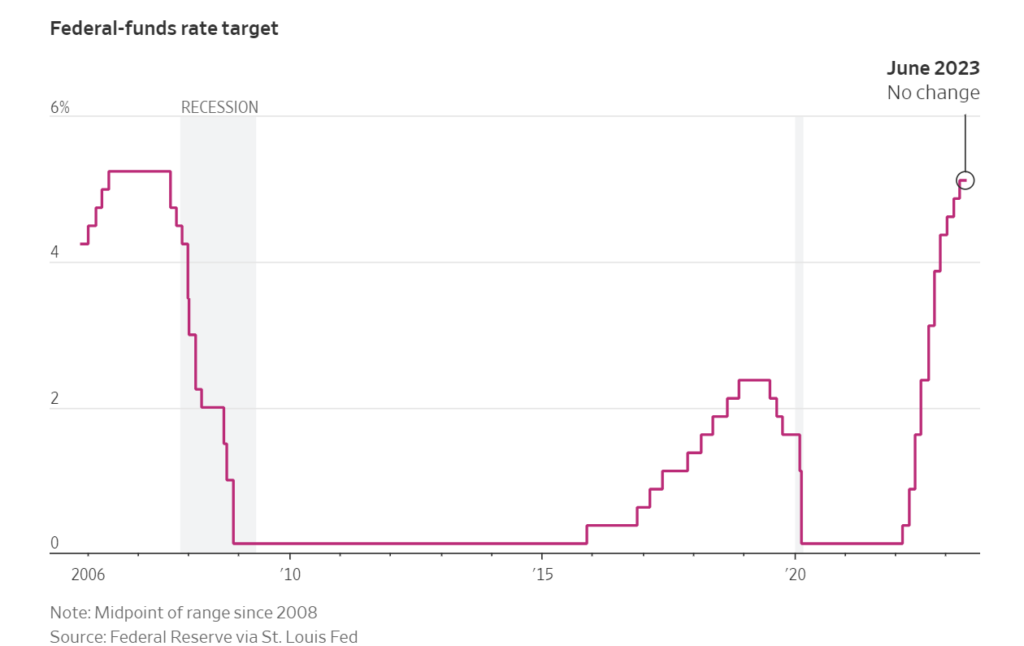

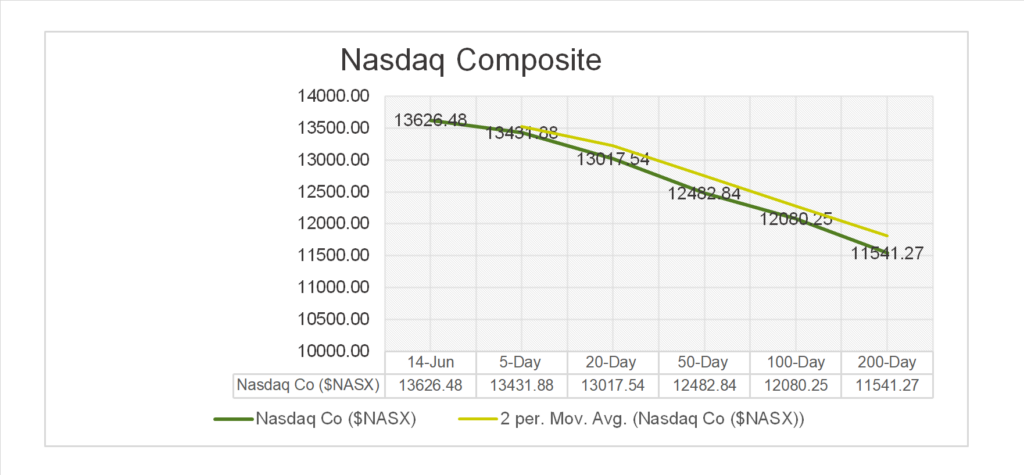

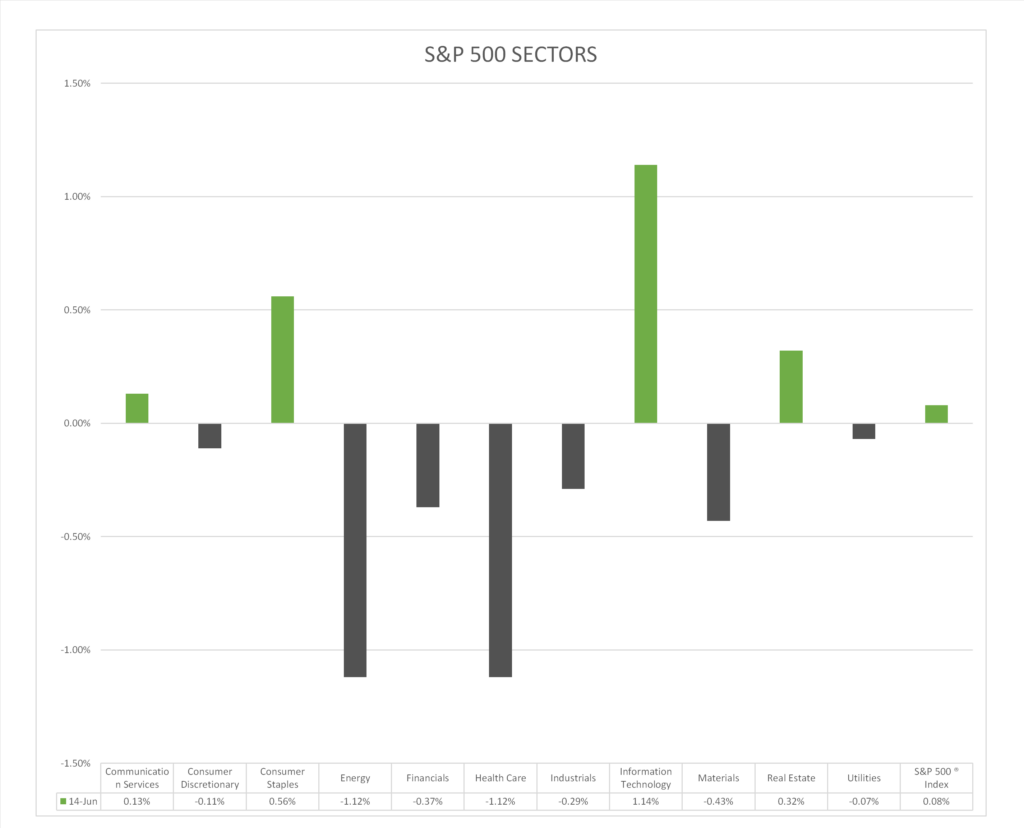

Today US Markets finished mixed, S&P 500 +0.12%, DOW -0.68% and the Nasdaq +0.39%. 7 of 11 of the S&P 500 sectors lower: Information Technology +1.14% outperforms/ Health Care and Energy both respectively -1.12% lag. On the upside, FANG+, Semiconductor ETF (SOXX), Mega Cap Growth and the Bloomberg Commodity Index. In economic news, US headline PPI easily beat estimates and Core-PPI was in line. No Fed June interest rate hike!

Takeaways

- PPI easily beats consensus

- Fed holds rates in June

- FANG+, up >1.4%

- 7 of 11 of the S&P 500 sectors lower: Information Technology +1.14% outperforms/ Health Care -1.12% and Energy -1.12%, lag

- Semiconductor ETF (SOXX) +1.42%

- SPDR S&P Banking ETF (KRE) declines <2.92%>

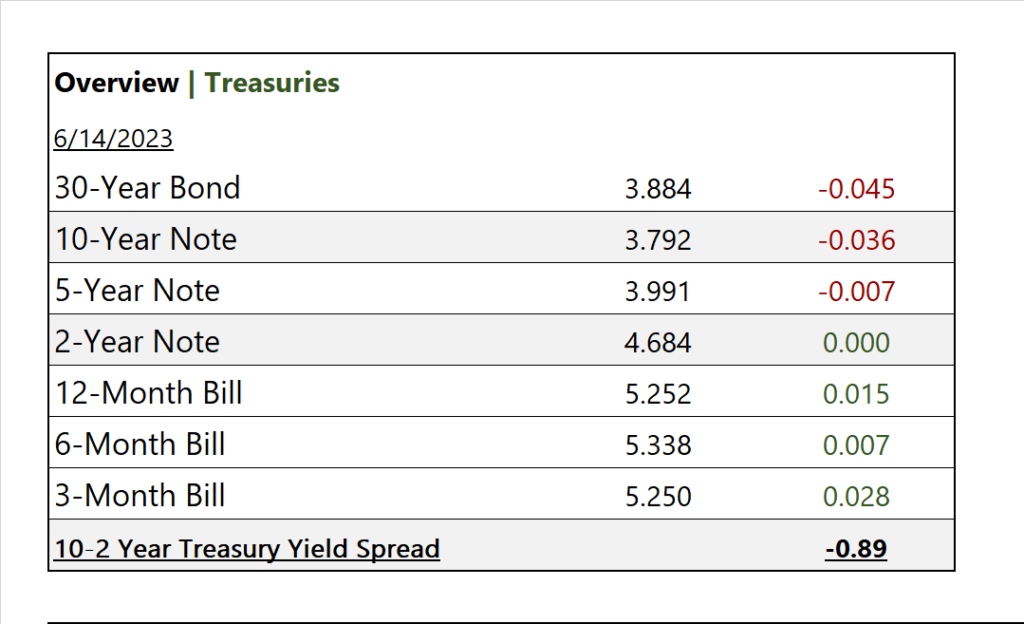

- Inversion increasing/ 10-2 Year Treasury Yield spread -0.89

- Lennar (LEN) BIG earnings beat

Pro Tip: During an economic downturn, credit markets to tighten, as borrowing becomes more expensive. Investors like “Ken Griffin” who anticipate a recession might choose to “ramp up credit bets” by taking positions that benefit from an increase in credit risk. For example, they may short-sell bonds or engage in credit default swaps (CDS) to profit from the decline in the creditworthiness of specific companies or sectors.

Sectors/ Commodities/ Treasuries

Key Indexes (50d, 100d, 200d)

S&P Sectors

- 7 of 11 of the S&P 500 sectors lower: Information Technology +1.14%, Consumer Staples +0.56%, outperform/ Health Care -1.12%, Energy 1.12% lag.

Commodities

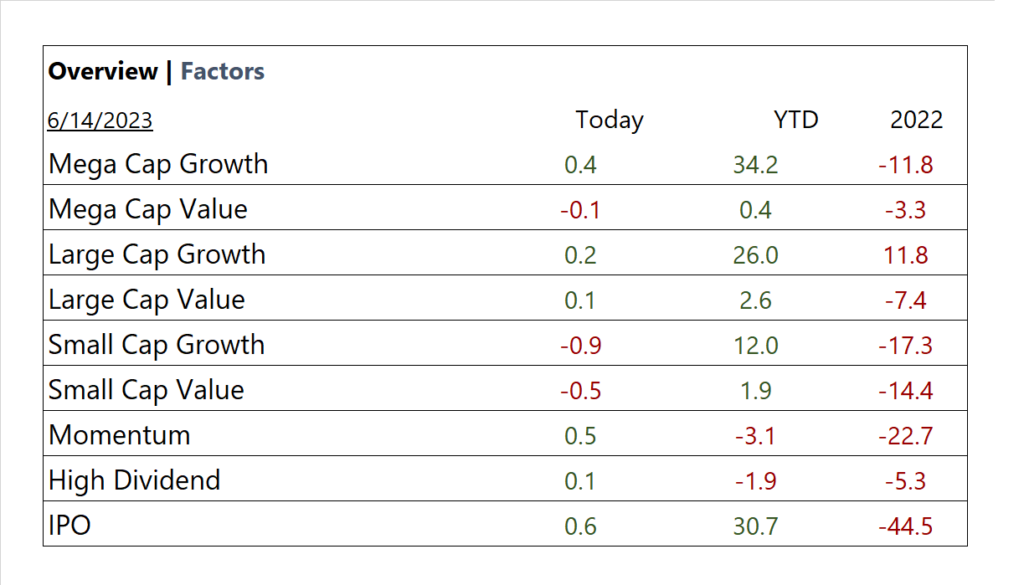

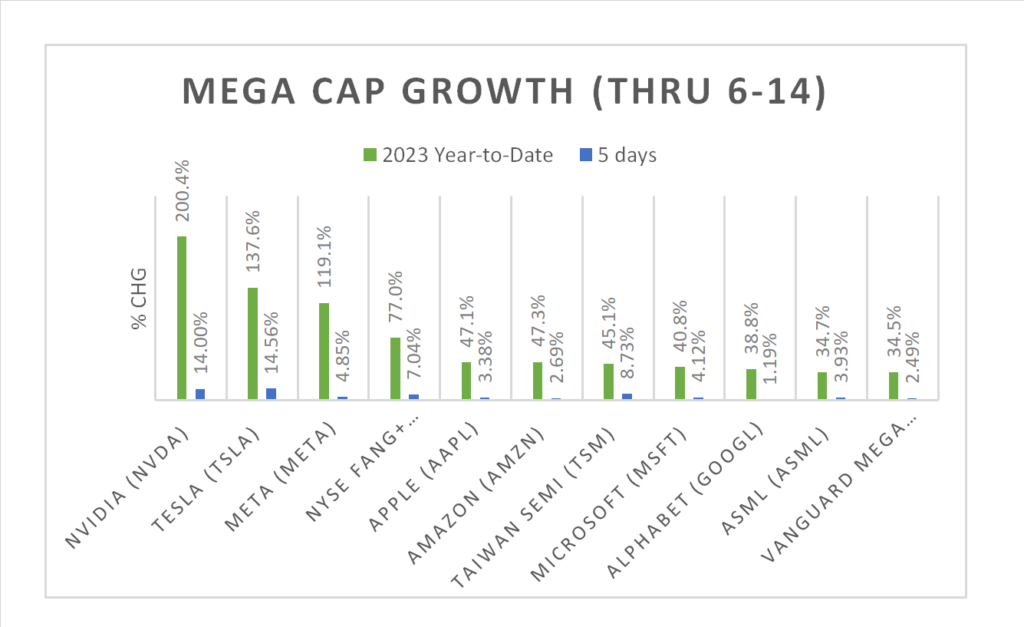

Factor/ Mega Cap Growth Chart (YTD)

US Treasuries

Notable Earnings Today

- +Beat: Lennar (LEN),

- – Miss: Ashtead Gro (ASHTY)

- * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), UI Path Inc. (PATH), Broadcom Inc (AVGO)

Economic Data

US

- Producer price index; act-0.3%, fc -0.1%, prior 0.2%

- Core PPI; act 0.2%, fc 0.2%, prior 0.2%

- PPI year over year; act 1.1%, fc 1.5%, prior 2.3%

- Core PPI year over year; act 8%, fc 2.9%, prior 3.3%

- Fed decision on interest-rate policy; Fed no June interest rate hike.

News

Company News

- A Once-Obscure Chinese Startup Overtakes Shein In US – Bloomberg

- Quantum Computing Advance Begins New Era, IBM Says – NY Times

- AI Regulation Is Here. Almost. – WSJ

Energy/ Materials

- Macron to Meet Elon Musk in Paris on Friday to Discuss Batteries – Bloomberg

- Tax Rules to Kick Off New Clean-Energy Market – WSJ

Central Banks/Inflation/Labor Market

- What to Watch For at the Fed’s Meeting – NY Times

- Fed Holds Rates Steady but Expects More Increases – WSJ

- Ken Griffin Ramps Up Credit Bets, Anticipating US Recession – Bloomberg

- Traders Now Expect Fed Policy Rate to Peak in September Not July – Bloomberg

China/ Asia