MARKETS TODAY June 6th, 2023 (Vica Partners)

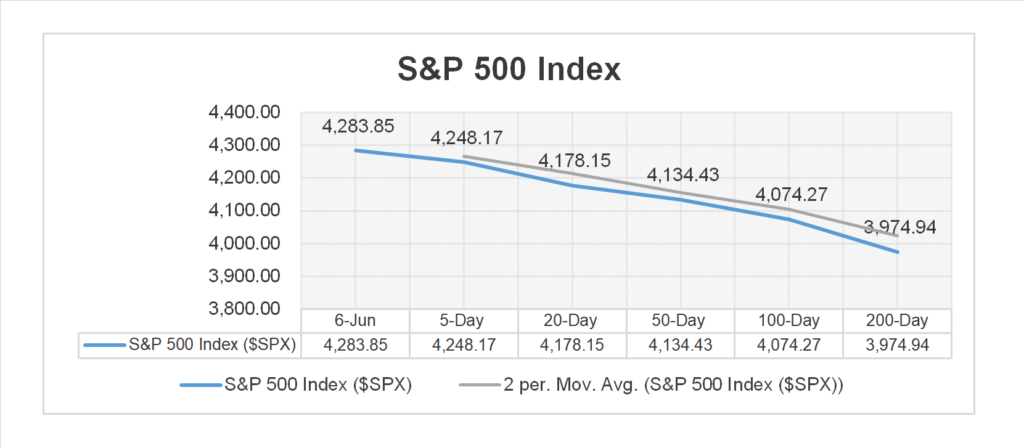

Yesterday, US markets finished lower, S&P 500 -0.20%, DOW -0.59% and the Nasdaq -0.09%. 8 of 11 of the S&P 500 sectors declined: Communication Services +0.58% outperforms/ Industrials -0.71% lags. On the upside, FANG+, Gold and Brent Crude In economic news, S&P Global US Composite PMI for May in line with expectations, S&P Global US Services PMI came in light and ISM Services PMI misses.

Overnight/US Premarket, Asian markets finished higher, Japan’s Nikkei 225 +2.20% Hong Kong’s Hang Seng +0.84% and China’s Shanghai Composite +0.07%. US S&P futures were trading at 0.1% above fair value. European markets finished lower, France’s CAC 40 -0.96%, Germany’s DAX -0.54% and London’s FTSE 100 -0.10%.

Today US Markets finished higher, S&P 500 +0.24%, DOW +0.03% and the Nasdaq +0.36%. 7 of 11 of the S&P 500 sectors advance: Financials +1.33% outperforms/ Health Care -0.88% lags. On the upside, Russel 2k, USD Index, Gold, Bitcoin and the Bloomberg Commodity Index. In economic news, no domestic report releases, the ECB European Consumer Expectations Survey beat inflation expectations.

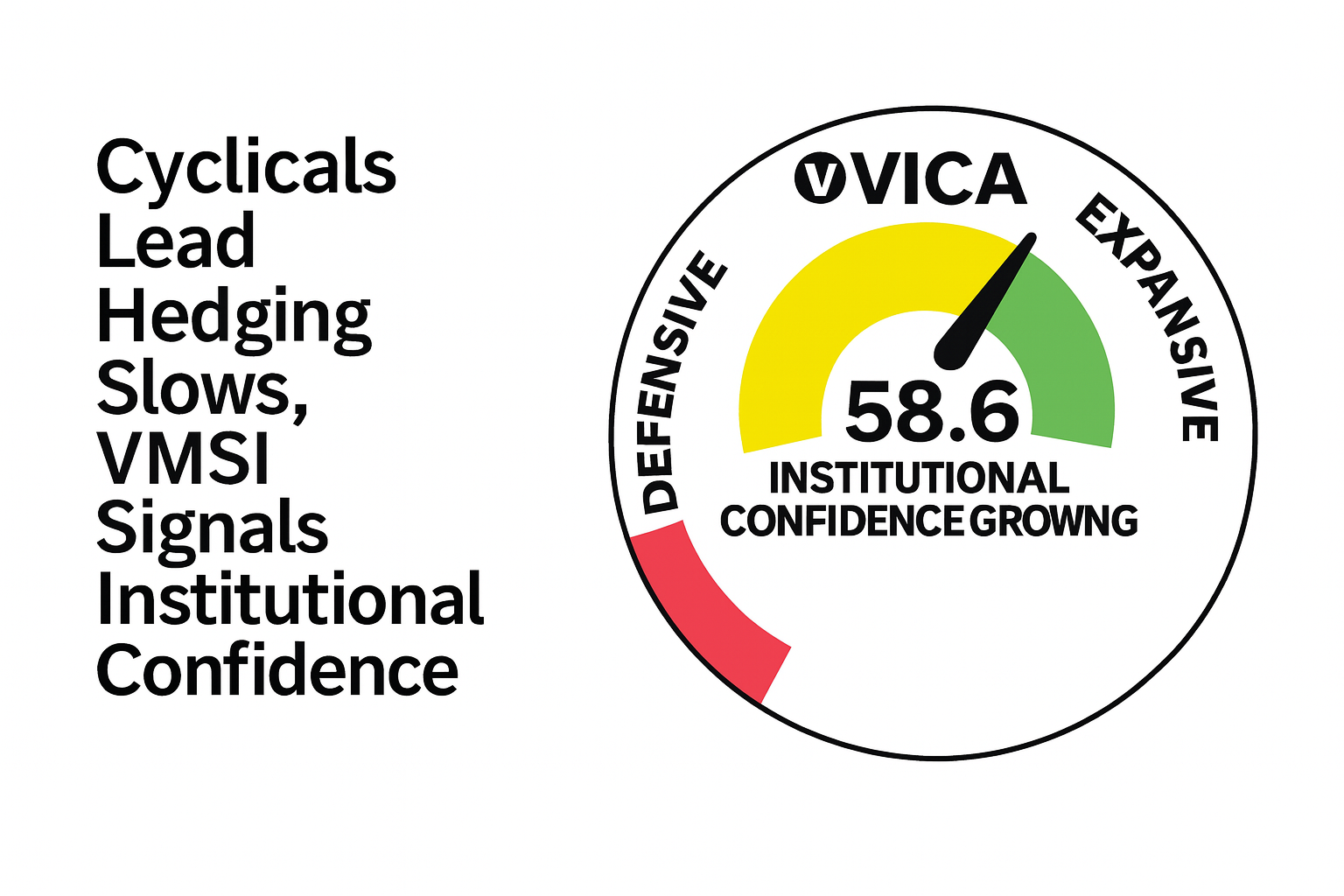

Takeaways

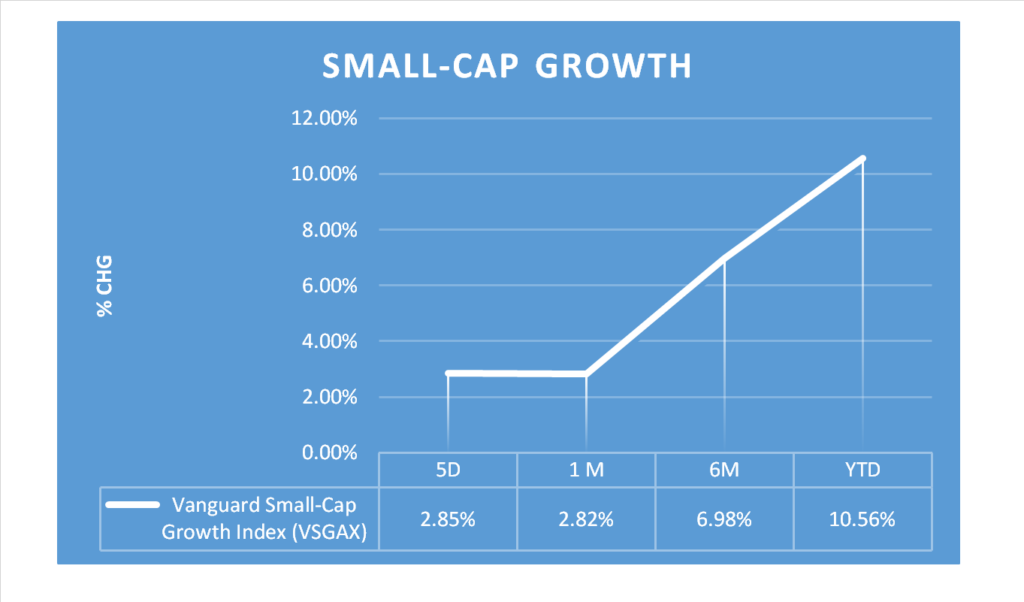

- Russell 2000 (RUT) up >2.6% as Financials rally

- SPDR S&P Banking ETF (KRE) +2.2%

- 7 of 11 of the S&P 500 sectors higher: Financials +1.33% outperforms/ Health Care -0.88% lags.

- Energy rises +.069% today off the Financial sector rally

- Bitcoin jumps +>5%

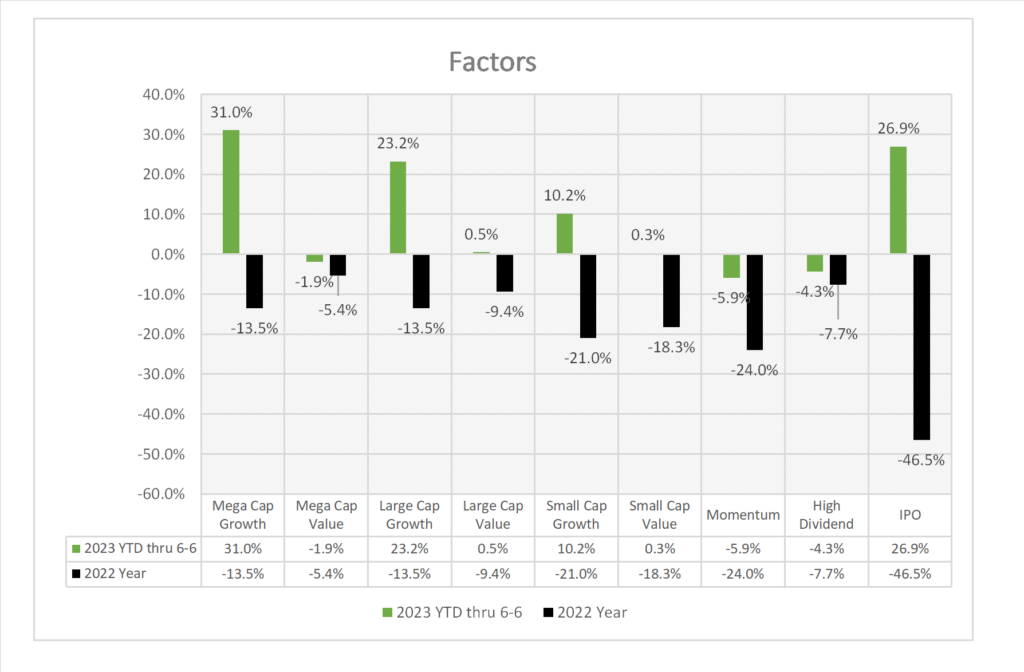

- Vanguard Mega Cap Growth Index muted today <0.04%>

- Ferguson (FERG) and JM Smucker (SJM) with solid earnings beats

- Fed rate decision next week

Pro Tip: During a recession, small-cap stocks can see larger declines in price, whereas during economic recoveries, they can rise in price more quickly than large-caps.

Sectors/ Commodities/ Treasuries

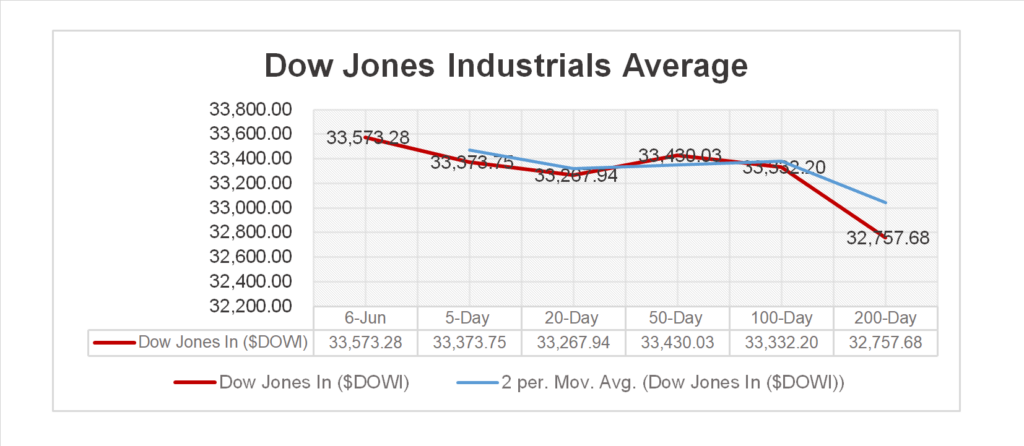

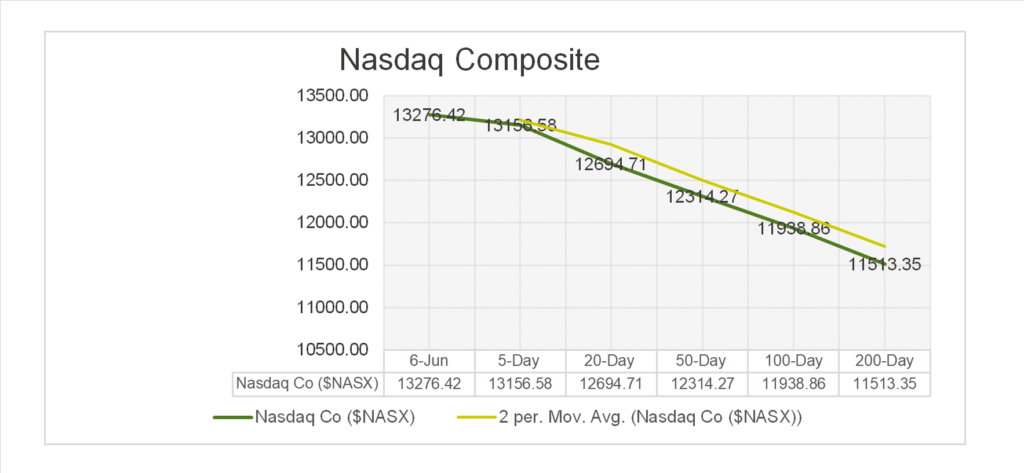

Key Indexes (50d, 100d, 200d)

S&P Sectors

- 7 of 11 of the S&P 500 sectors higher: Financials +1.33%, Consumer Discretionary +0.99% outperform/ Health Care -0.88%, Consumer Staples -0.47% lag.

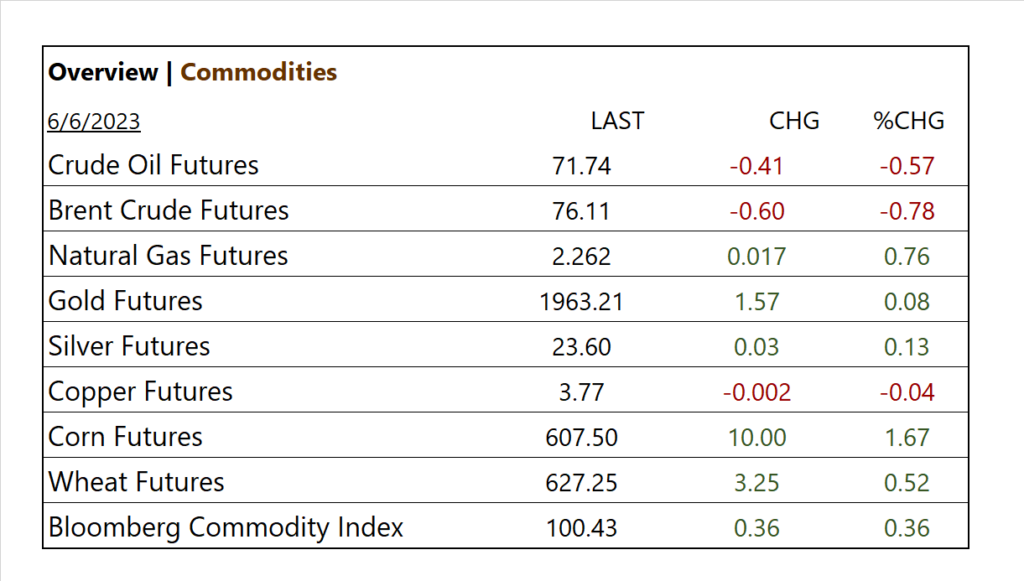

Commodities

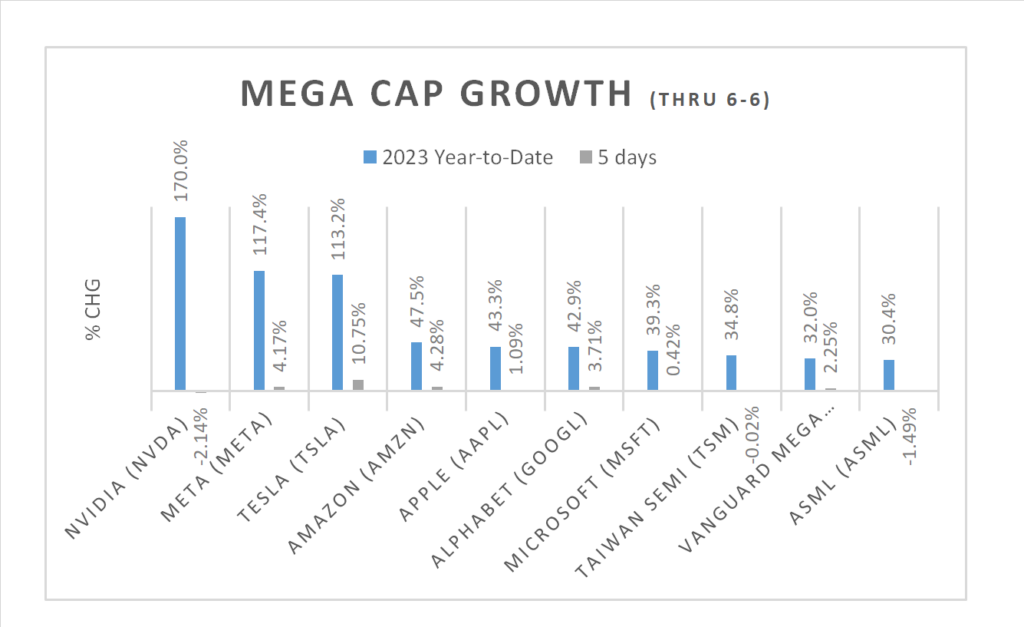

Factor/ Mega Cap Growth Chart (YTD)

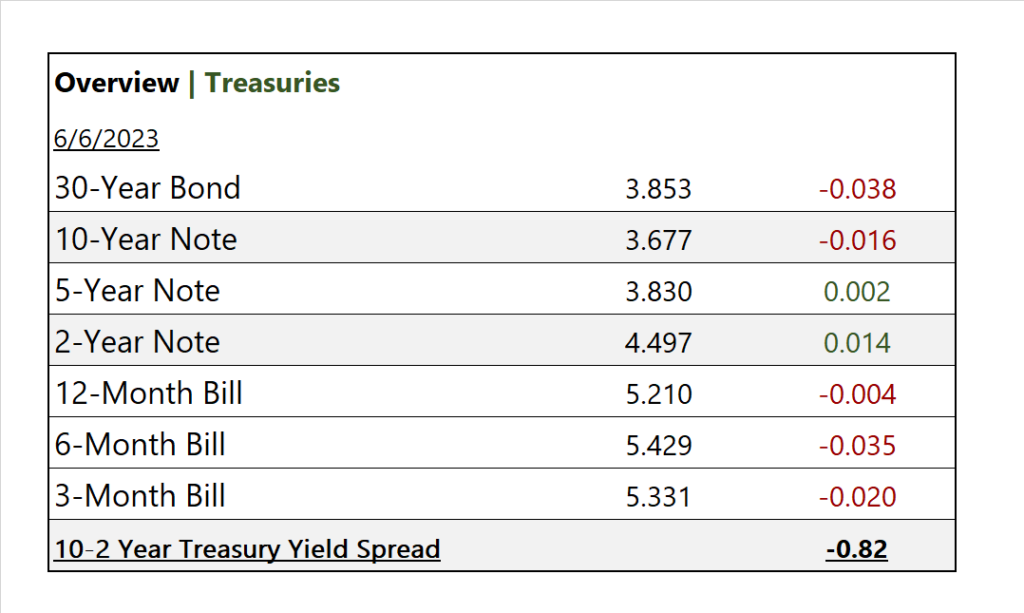

US Treasuries

Notable Earnings Today

- +Beat: Ferguson (FERG), JM Smucker (SJM), Ciena Corp (CIEN), Thor Industries (THO), Hello Group (MOMO)

- – Miss: Core Main (CNM), Academy Sports (ASO), ABM Industries (ABM), Cracker Barrel Old (CBRL)

- * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), UI Path (PATH)

Economic Data

US

- No economic report releases today

News

Company News

- Merck Challenges U.S. Government’s New Powers to Negotiate Drug Prices – WSJ

- SEC’s Coinbase Lawsuit Heralds Deepening US Crypto Crackdown – Bloomberg

- Apple Takes On Meta in Race to Make Headsets the Next Big Thing – WSJ

Energy/ Materials

- Underground Hydrogen Could Supercharge Green Energy. First, Scientists Have to Find It. – WSJ

- Commodities Slide as Investors Bet on Economic Slowdown – WSJ

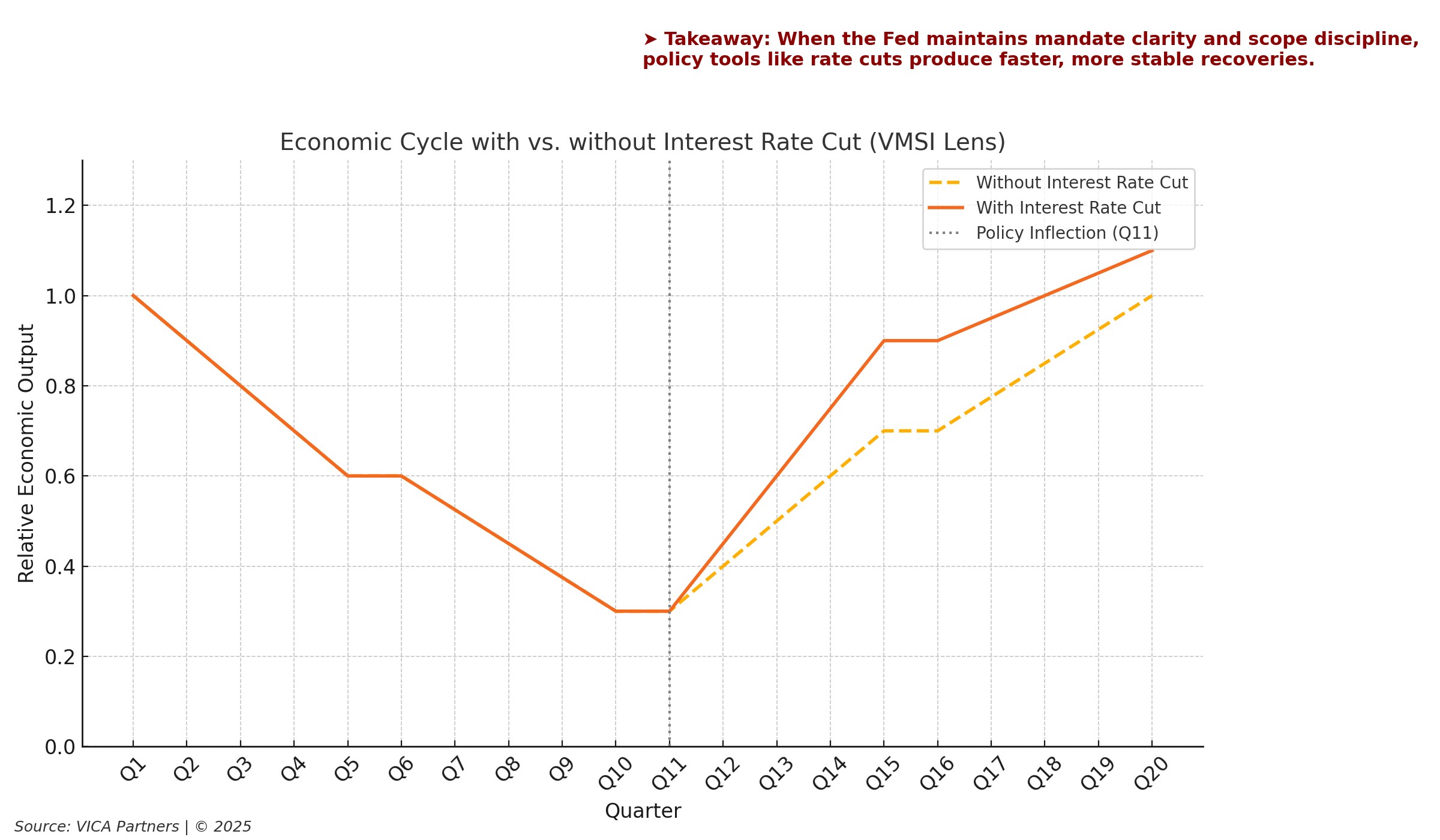

Central Banks/Inflation/Labor Market

- Wall Street Backs Off Bets on Fed Rate Cuts – WSJ

- Debt-Limit Deal Has Low Impact on US Credit Profile, Moody’s Says – Bloomberg

China

- China’s Targeted Stimulus Steps Raise Doubts About Rate Cuts – Bloomberg