MARKETS TODAY May 2nd, 2023 (Vica Partners)

Yesterday, US Markets finished lower S&P 500 -0.14%, DOW -0.14%, Nasdaq -0.11%. 6 of 11 of the S&P 500 sectors declined on the day, Energy -1.04% and Real Estate -0.86% underperformed/ Healthcare outperformed. Yields rose across the curve. In economic news, S&P 500 Global Manufacturing PMI increased (MOM) and the ISM Manufacturing PMI improved beating analyst consensus.

Overnight/Premarket, Asian markets finished higher, Shanghai Composite +1.14%, Hong Kong’s Hang Seng +0.22%, Japan’s Nikkei 225 +0.12%. European markets finished lower, France’s CAC 40 -1.45%, Germany’s DAX -1.23%, London’s FTSE 100 -1.22%. S&P 500 US futures were trading at 0.25% below fair-value.

Today, US Markets finished lower for a 2nd consecutive day, the S&P 500 -1.16%, DOW -1.08%, Nasdaq -1.08% and Yields fell. All 11 of the S&P 500 sectors finished lower on the day, Energy -4.19% sharply led decliners. On the upside, the Defensives/ Healthcare and Consumer Staples outperformed, Gold +1.74% and Bitcoin +2.09%. In economic news, March Job Openings and Factory Orders missed analysts forecast.

Takeaways

- Economic data points to weaker economic outlook ahead

- Watch VIX, over +20 could indicate Market pullback

- Regional Banking down, SPDR S&P Banking ETF (KRE) -6.27%

- Energy Sector falls sharply -4.19%, Oil Stocks get hammered

- Defensives/ Healthcare and Consumer Staples outperform

- Pfizer (PFE), AMD (AMD), Ford (F) with earnings beat

- March Job Openings greater than expected, misses analyst consensus

- Fed set to raise rates with 25bps hike on Wednesday

Pro Tip: a double bottom pattern is a technical analysis charting formation showing a major change in trend from a prior down move. Its bullish reversal pattern, because it signifies the end of a downtrend and a shift towards an uptrend. The double bottom pattern looks like the letter “W.” The twice-touched low is considered a support level. (learn more).

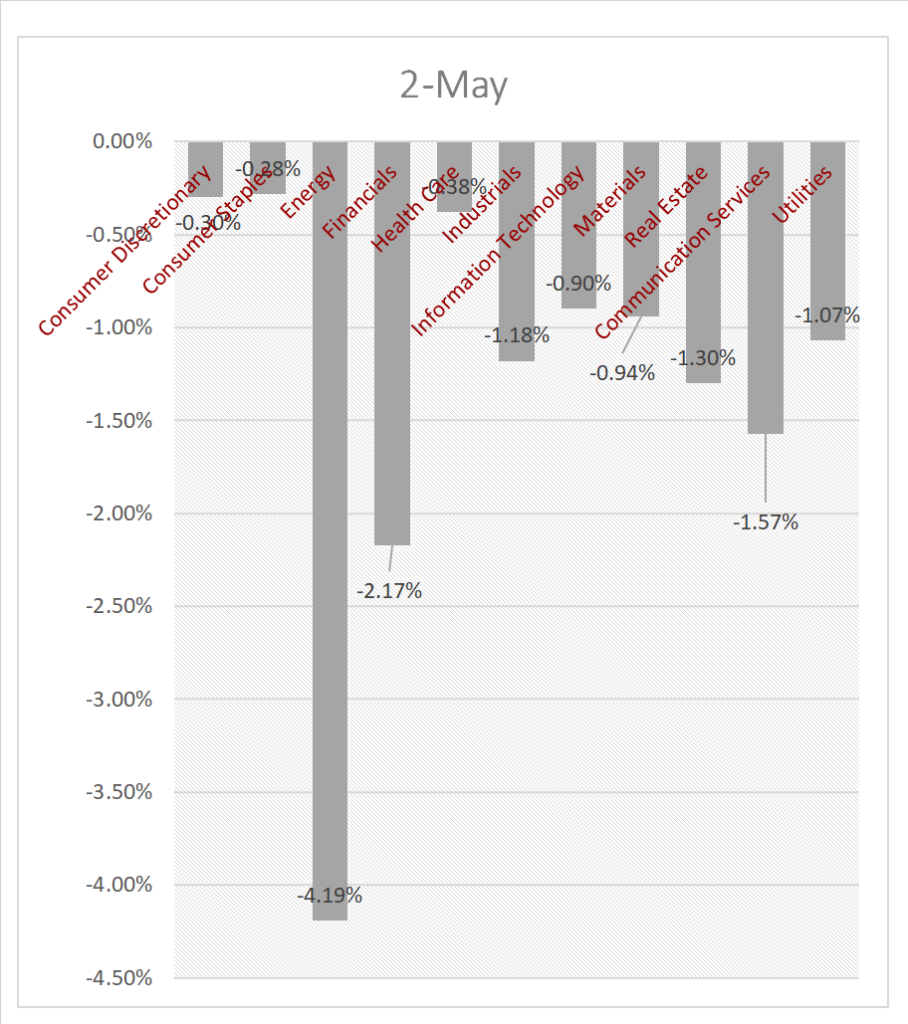

Sectors/ Commodities/ Treasuries

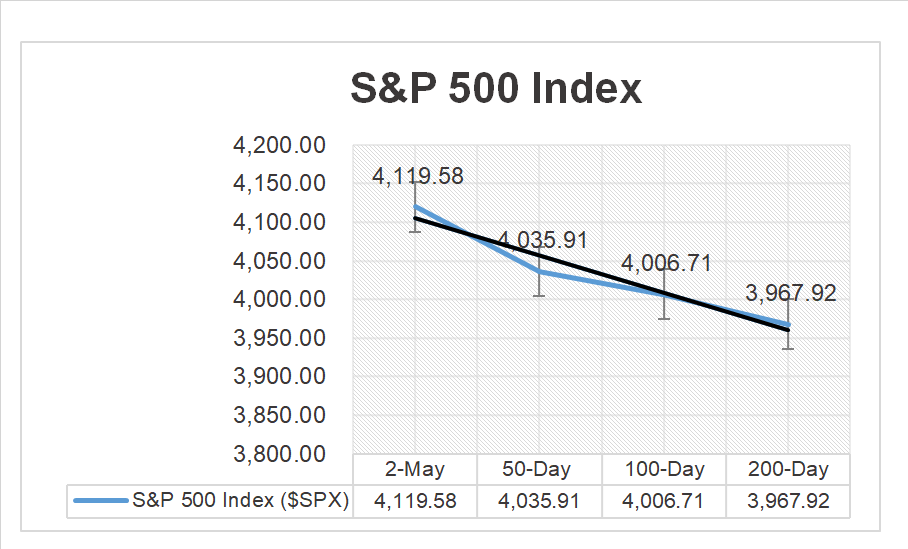

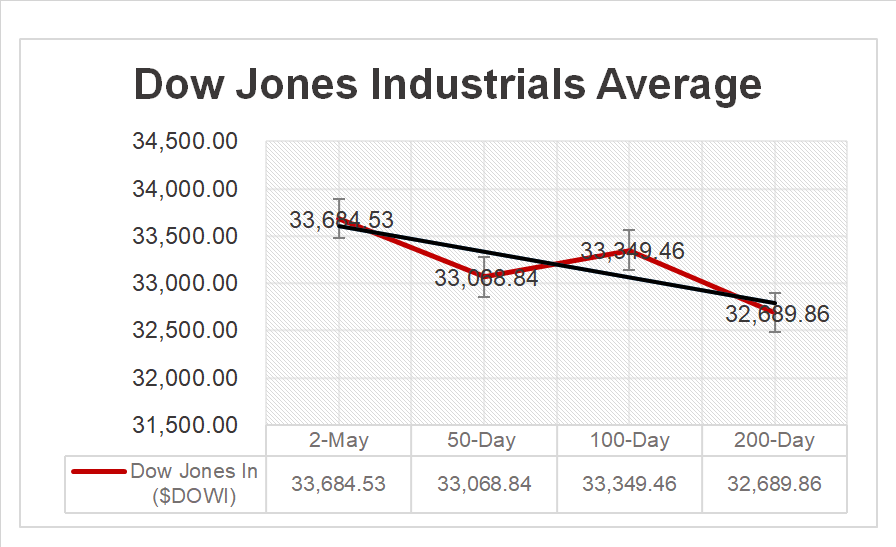

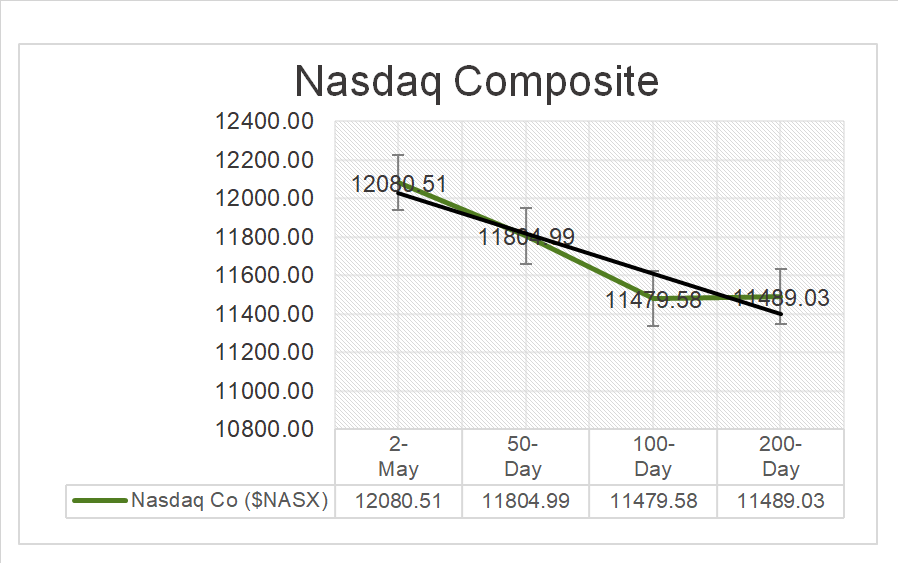

Key Indexes (50d, 100d, 200d)

S&P Sectors

- All 11 of the S&P 500 sectors finish lower, Energy -4.19% and Financials -2.17% led decliners/Consumer Staples -0.28% and Health Care -0.38% outperformed

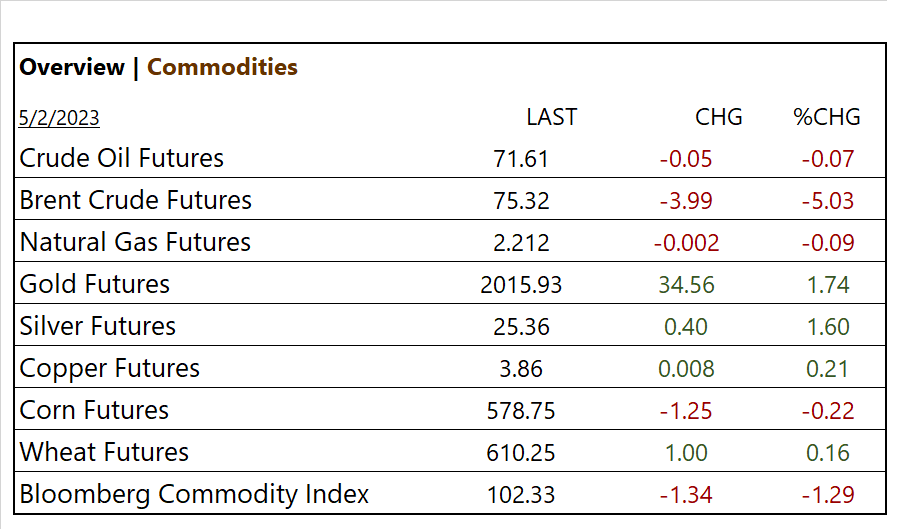

Commodities

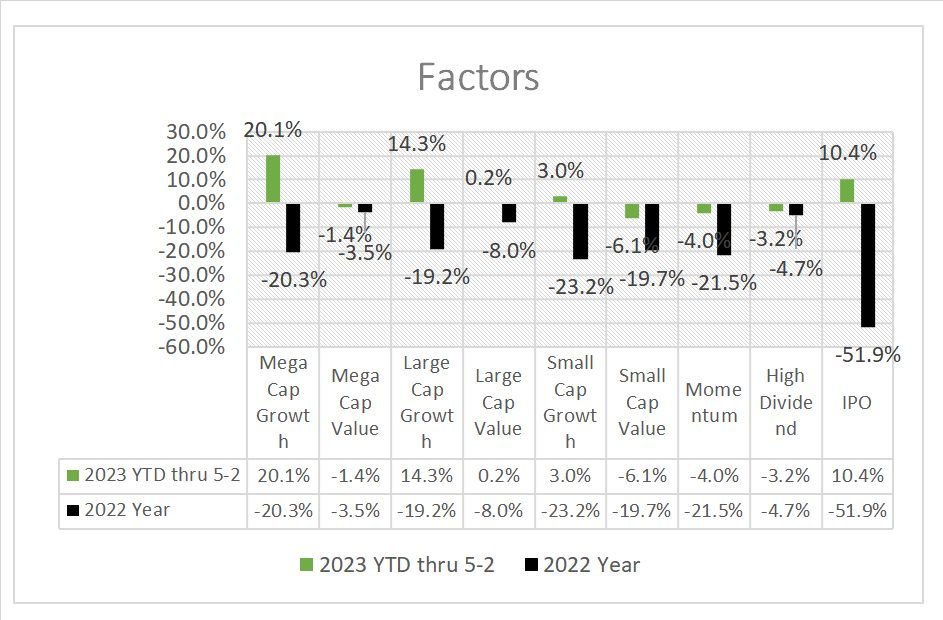

Factors (YTD)

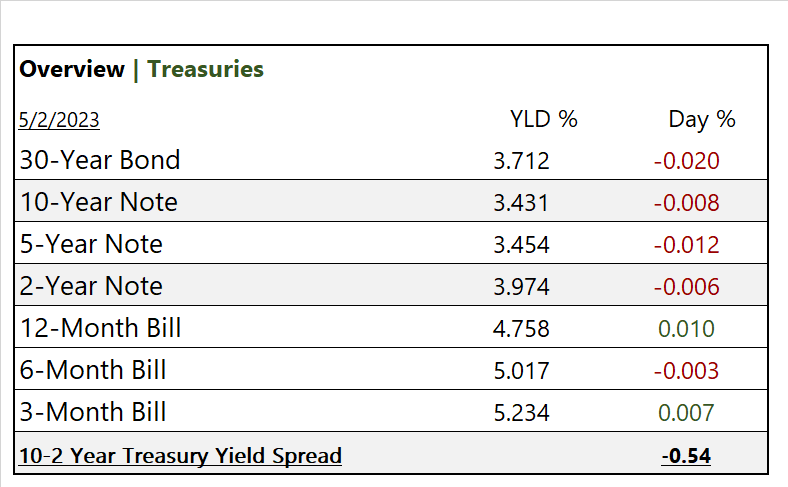

US Treasuries

Notable Earnings Today

Notable Earnings Today

- +Beat: Pfizer (PFE), AMD (AMD), Starbucks (SBUX), Uber Tech (UBER), Illinois Tool Works (ITW), Eaton (ETN), Marriott Int (MAR), Marathon Petroleum (MPC), Ford Motor (F), Cummins (CMI), DuPont De Nemours (DD), Molson Coors Brewing B (TAP), Clorox (CLX)

- – Miss: HSBC ADR (HSBC), BP ADR (BP), Enterprise Products Partners LP (EPD), Mitsui & Company (MITSY), Energy Transfer (ET), Prudential Financial (PRU), Cheniere Energy (LNG), Sysco (SYY), Welltower (WELL)

- * Strong support – NVIDIA (NVDA), Analog Devices (ADI), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Broadcom (AVGO), Citigroup (C), BlackRock (BLK), Morgan Stanley (MS), Coca-Cola (KO)

Economic Data

US

- S. job openings; period March, act 9.6m, fc 9.7m, prev. 10m

- Factory orders; period March, act 0.9%, fc 1.3%, prev. -1.1%

News

Company News/ Other

- The First Republic Deal Is a Big One for JPMorgan Chase. Take a Look at the Math- Barrons

- Edtech Chegg tumbles as ChatGPT threat prompts revenue warning – Reuters

- HSBC soothes shareholders by restoring dividend as profit triples – Reuters

Central Banks/Inflation/Labor Market

- Fed Will Decide Next Rate Move After Bank Jitters – NYT

- US labor market softens as job openings drop, layoffs at highest level in over 2 years – Reuters

China