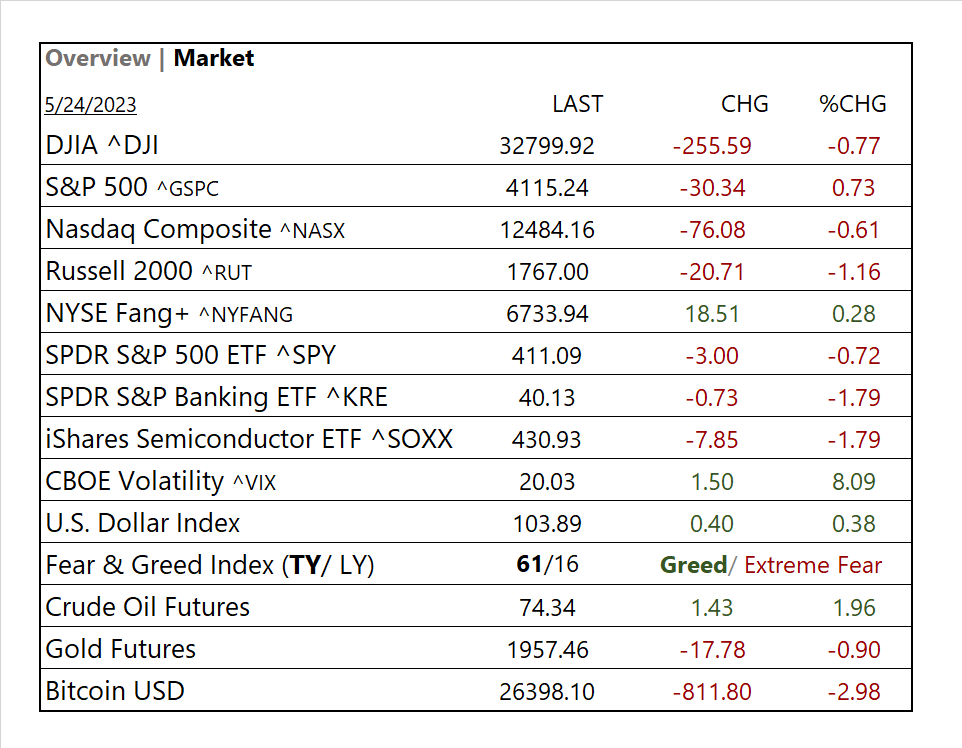

MARKETS TODAY May 24th, 2023 (Vica Partners)

On Tuesday, US Markets finished lower, S&P 500 -1.12%, DOW -0.69% and the Nasdaq -1.26%. 10 of 11 of the S&P 500 sectors lower: Materials -1.54% underperforms/ Energy +1.04% outperforms Oil, Gold, Bitcoin and USD Index all gained. In economic news, S&P flash U.S. services PMI came in hot, manufacturing PMI missed, new home sales beat.

Overnight/US Premarket, Asian markets finished lower, Hong Kong’s Hang Seng -1.62%, Shanghai Composite -1.28% and Japan’s Nikkei 225 -0.89%. US futures were trading at 0.5% below fair value. European markets finished lower, Germany’s DAX –1.92%, London’s FTSE 100 -1.75%.

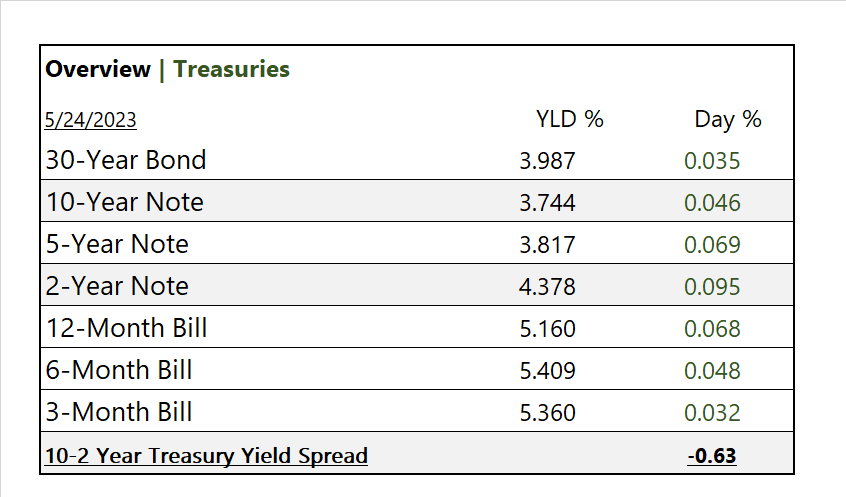

Today US Markets finished lower, S&P 500 -0.73%, DOW -0.77% and the Nasdaq -0.61%. 10 of 11 of the S&P 500 sectors lower: Real Estate -2.21% underperforms/ Energy +0.52% outperforms. On the upside, Treasury Yields, USD Index and Oil all gain. In economic news, mortgage applications decrease 2nd consecutive week, crude oil inventories had biggest decline since November.

Takeaways

- Jamie Dimon Op-Ed “more defaults & higher rates” sparks market selloff

- NYSE FANG+ up 0.28%, mega cap growth continues to pull ahead

- CBOE Volatility Index (VIX) +>8%

- 10 of 11 of the S&P 500 sectors lower: Real Estate lags/ Energy outperforms

- SPDR S&P Banking ETF (KRE) declines 1.79%

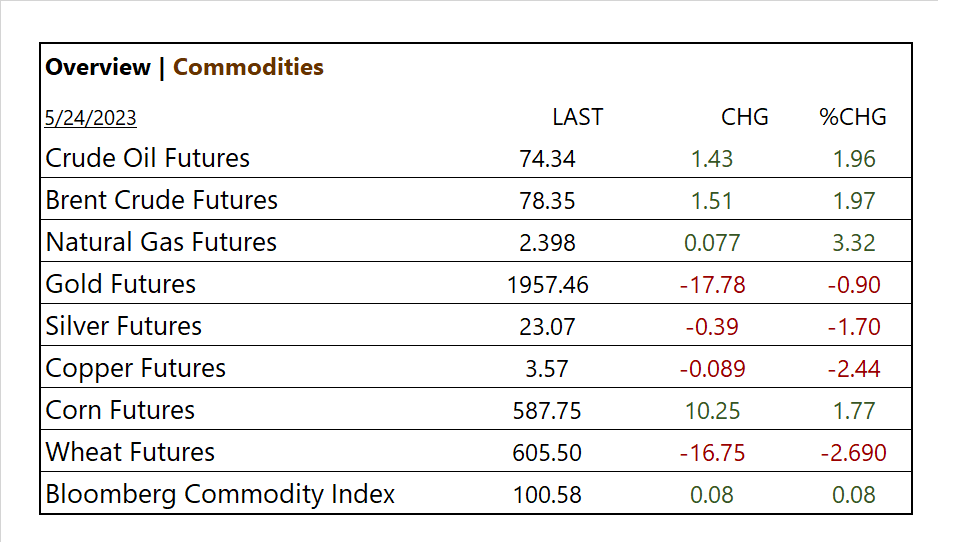

- Oil rises, Saudi Arabia’s top energy official warns oil short-sellers

- NVIDIA (NVDA) important BIG earnings beat in afterhours

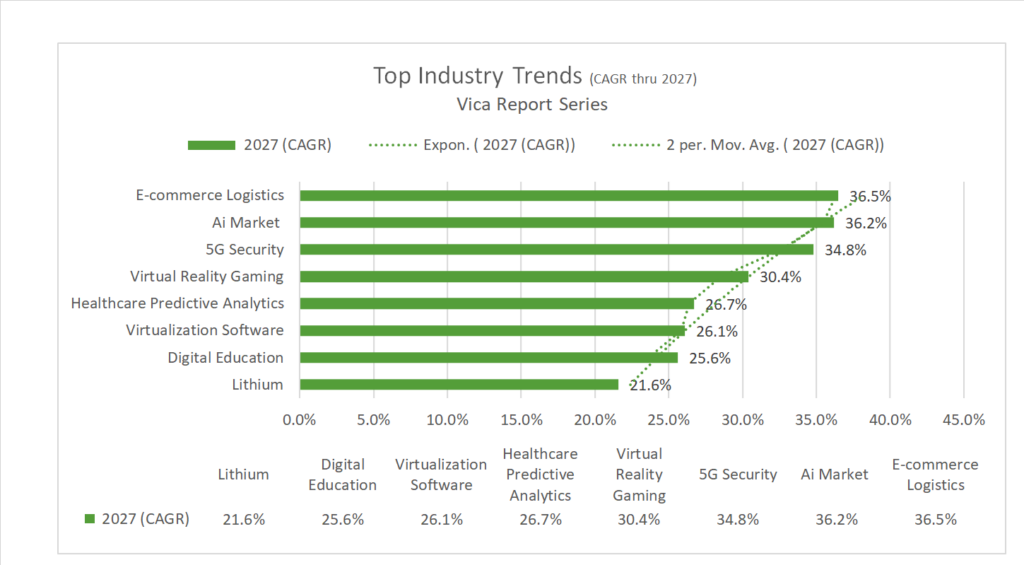

- Watch Lithium!

Pro Tip: China is spending billions today to secure the world’s lithium reserves (see WSJ article below), A Vica top CAGR growth category.

Sectors/ Commodities/ Treasuries

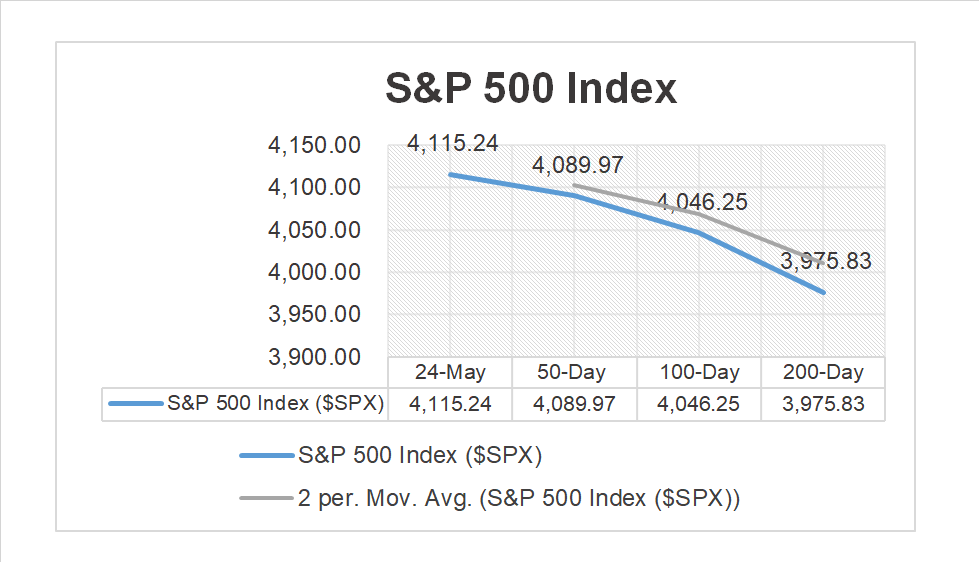

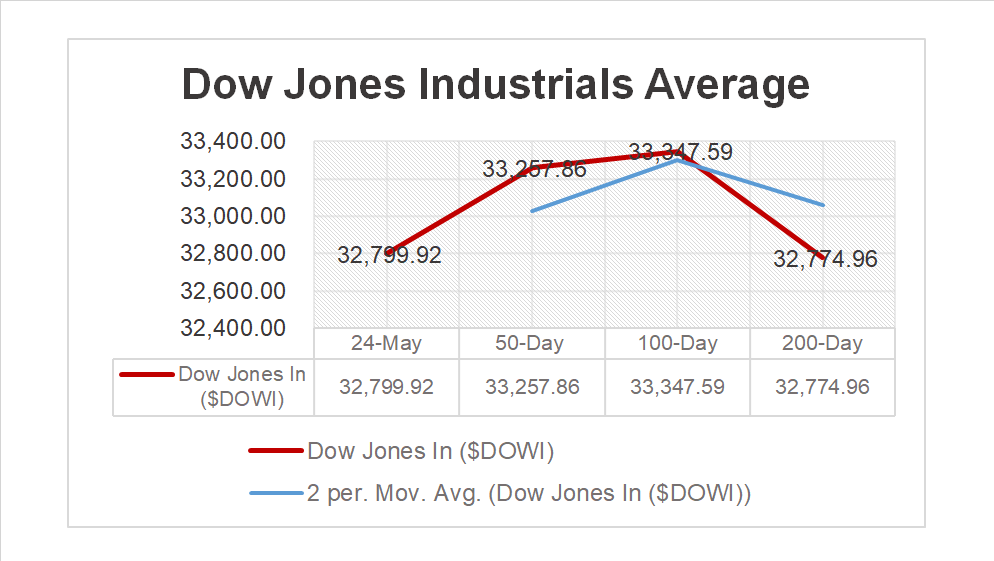

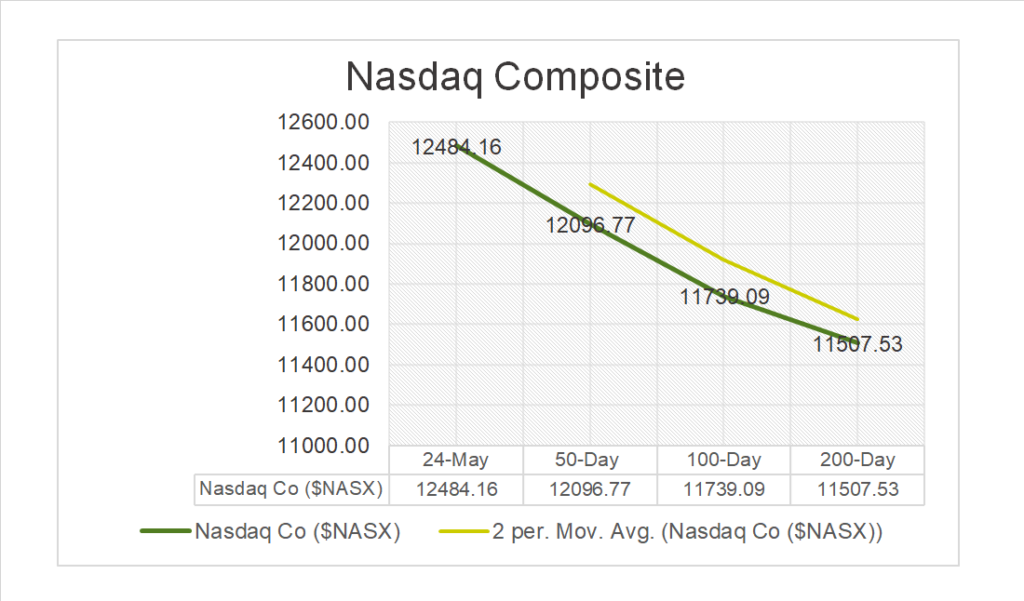

Key Indexes (50d, 100d, 200d)

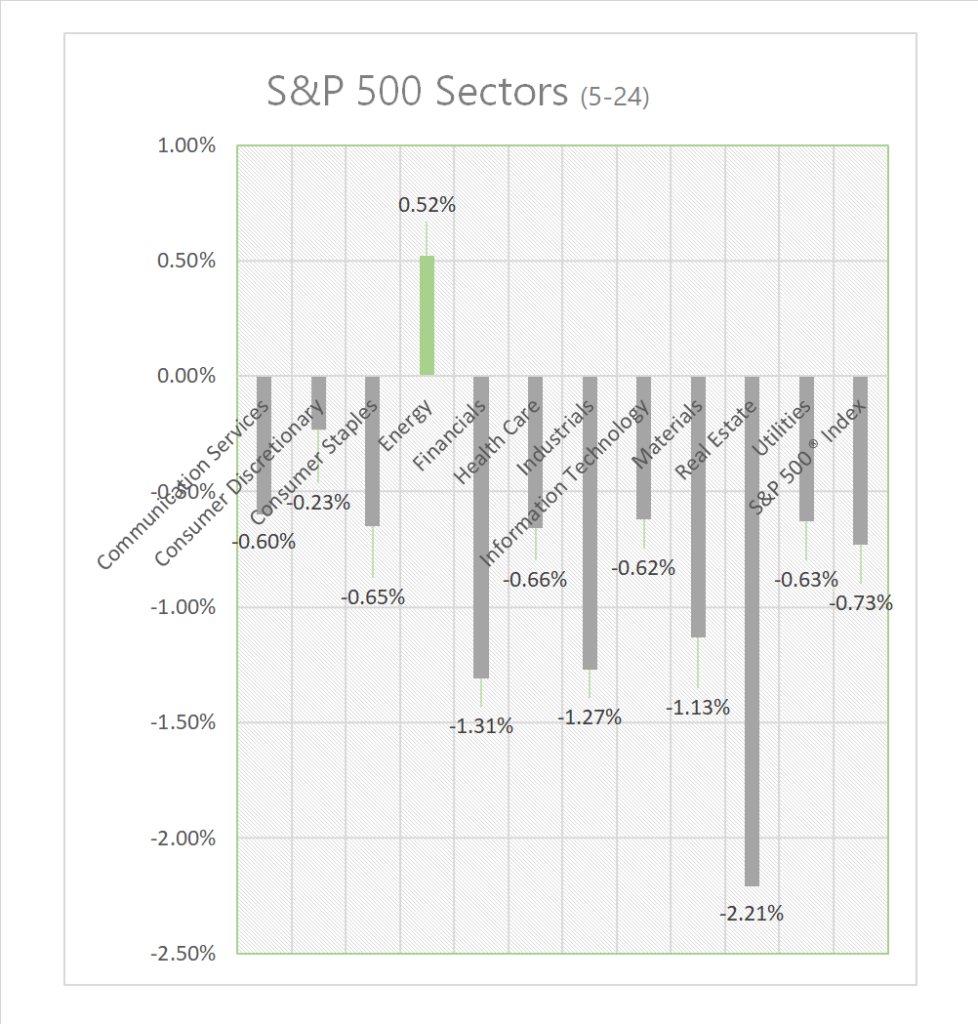

S&P Sectors

- 10 of 11 of the S&P 500 sectors lower: Real Estate -2.21% and Financials -1.31% lag/ Energy +0.52% outperforms.

Commodities

Factors (YTD)

US Treasuries

Notable Earnings Today

- +Beat: NVIDIA (NVDA), Analog Devices (ADI), Snowflake (SNOW), Splunk (SPLK), Uipath (PATH), Nutanix (NTNX), Futu (FUTU), ELF Beauty (ELF), Dycom Industries (DY), Enersys (ENS), Kohl’s Corp (KSS)

- – Miss: : Bank of Montreal (BMO), Bank of Nova Scotia (BNS), Lenovo Group (LNVGF), Xpeng (XPEV),

- * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML)

Economic Data

US

- Mortgage apps; period May 19, act -4.6%, refi -5.0%, updated 30yr rate: 6.7% Summary/ mortgage applications decrease 2nd consecutive week among volatile rates and thin inventories.

- Oil inventories; period May 19, Crude <12.5m> fc +700k , Gasoline act <2.1m>, fc <1.3m> Summary/ S. inventories of crude oil saw their biggest decline last week since late November.

News

Company News

- Elon Musk Wants to Challenge Google and Microsoft in AI – WSJ

- Chipmaker Analog Devices’ weak forecast sparks share selloff – Reuters

Energy/ Materials

- An American Oil Hub Is Pivoting to Offshore Wind – Bloomberg

- Oil Rises for Third Day After Saudi Warning to Speculators – Bloomberg

Central Banks/Inflation/Labor Market

- US Default Scenarios Span From Localized Pain to Dimon’s ‘Panic’ – Bloomberg

- Why Inflation Erupted: Two Top Economists Have the Answer – WSJ

- Who’s afraid of the big, bad debt ceiling from Jurrien Timmer opinion – LinkedIn Post

China

- China Spends Billions on Risky Bets to Lock Down World’s Lithium – WSJ

Education

- In technical analysis, a death cross is a term used to describe a bearish signal that occurs on a price chart when a shorter-term moving average crosses below a longer-term moving average. The interpretation of a death cross depends on the specific moving averages being used and the context in which it occurs. Here’s a general interpretation of a technical death cross: