MARKETS TODAY May 16th, 2023 (Vica Partners)

Yesterday US Markets finished moderately higher, S&P 500 +0.30%, DOW +0.14% and the Nasdaq +0.66%. 9 of 11 of the S&P 500 sectors advanced: Financials +1.25% outperformed/ Utilities -0.74% lagged. Treasury Yields, Gold, Bitcoin, Oil and the Bloomberg Commodity Index all gained. In economic news, the Empire State Manufacturing Survey Index declined sharply and missed estimates for May.

Overnight/Premarket Asian markets finished mixed, Japan’s Nikkei 225 +073%, Shanghai Composite -0.60% and Hong Kong’s Hang Seng -0.02%. European markets finished lower, the London FTSE 100 -0.34%, France’s CAC 40 -0.16% and Germany’s DAX -0.12%. US futures were trading at 0.3% below fair-value.

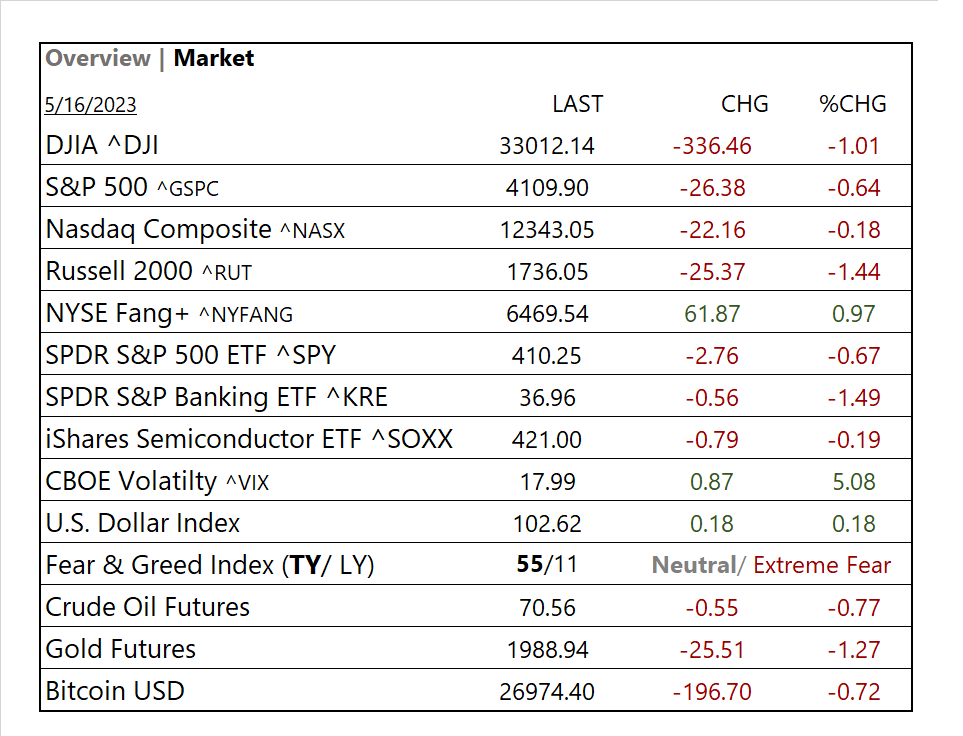

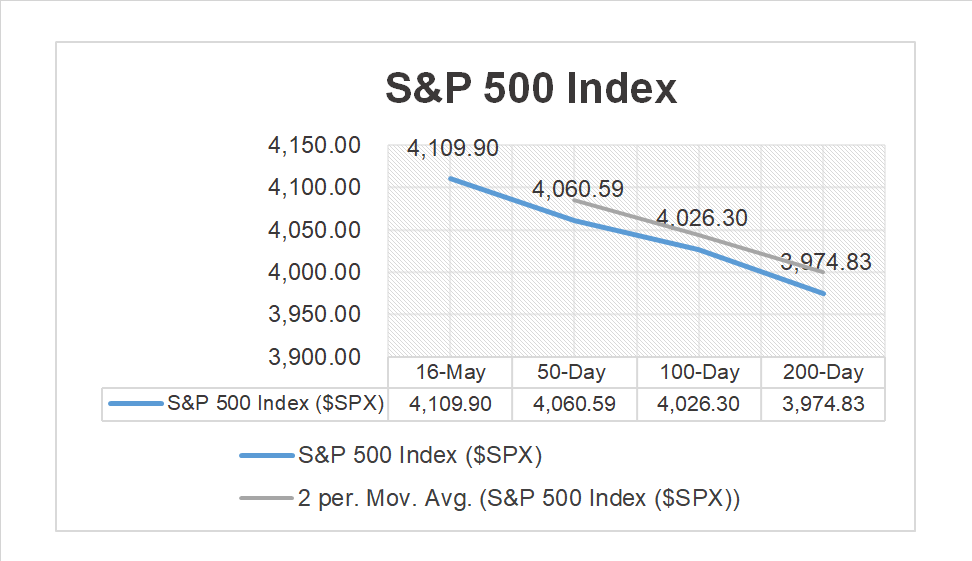

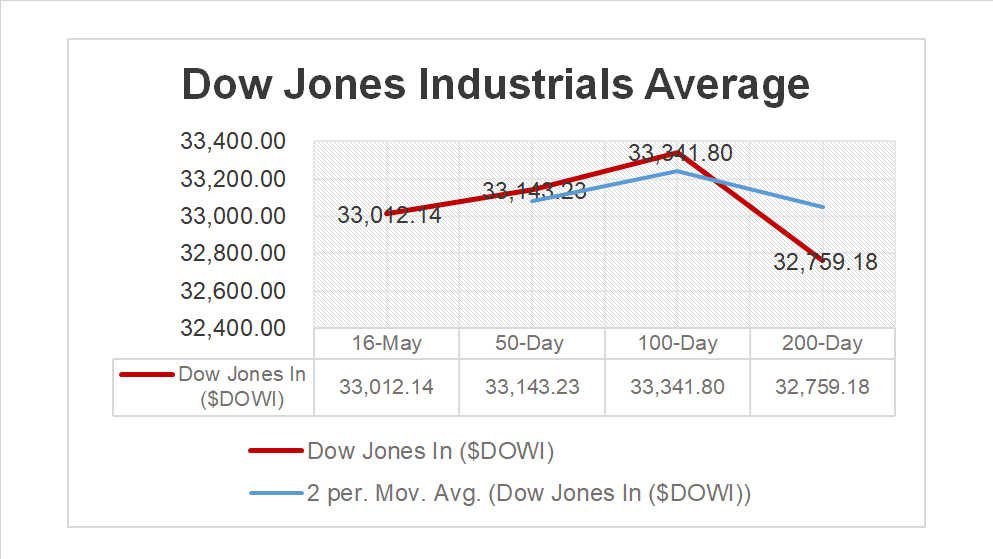

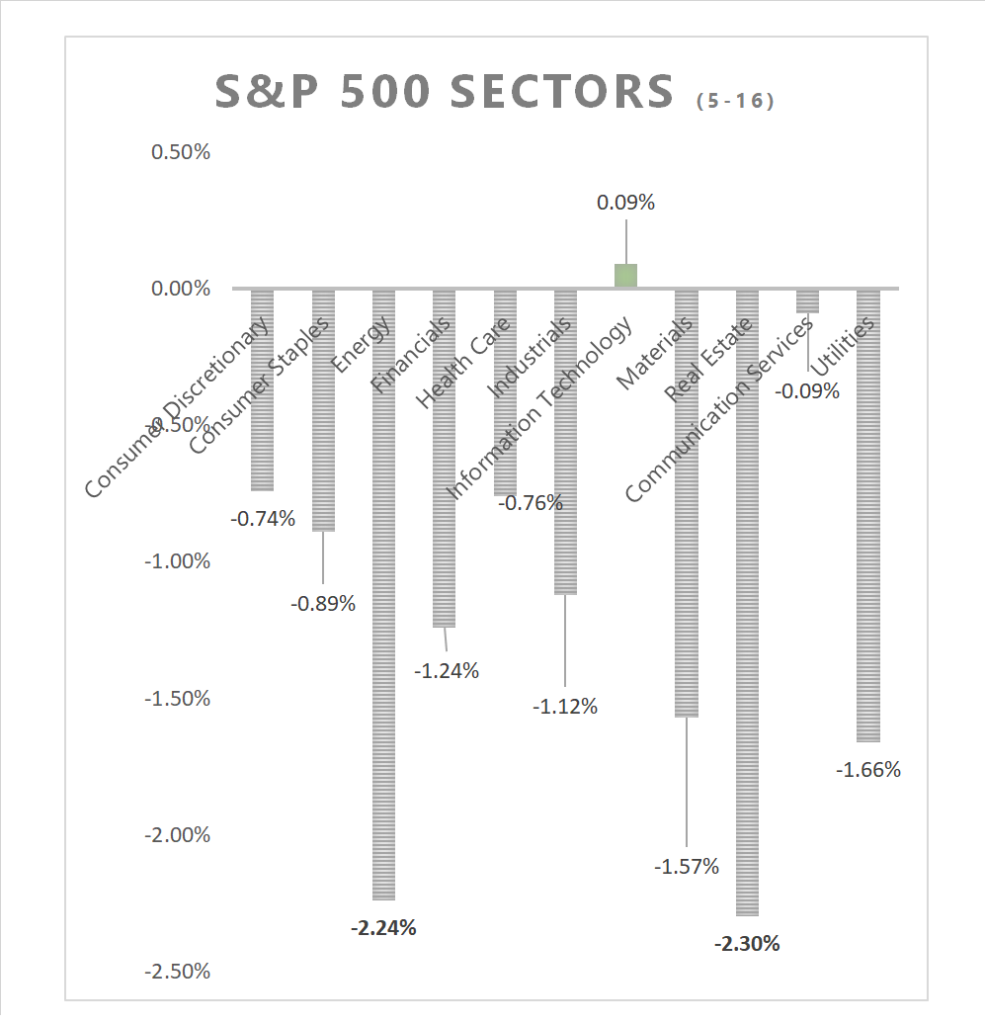

Today US Markets finished broadly lower, S&P 500 -0.64%, DOW -1.01% and the Nasdaq -0.18%. 10 of 11 of the S&P 500 sectors lower, Real Estate -2.30% and Energy -2.24% underperformed/ Information Technology +0.09% outperformed. On the upside, NYFANG+, Treasury Yields and the USD Index gained. In economic news, Retail Sales increased by 0.4% in April but below the 0.8% analyst estimates. Home Builder Confidence Index with surprise beat.

Takeaways

- Retail Sales miss forecast

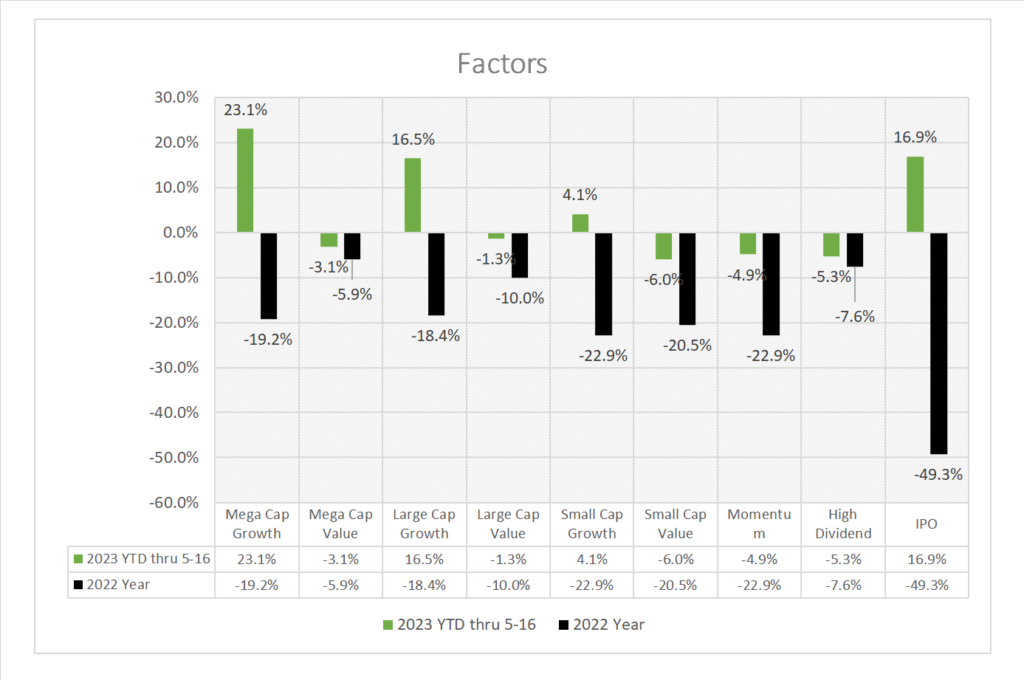

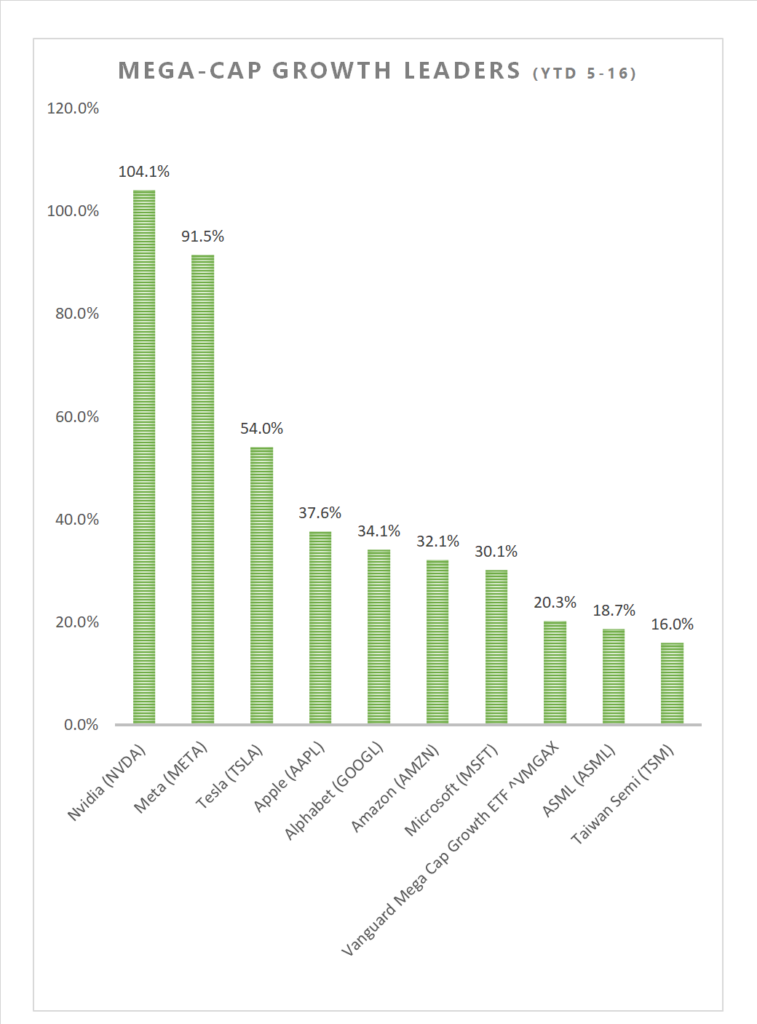

- NYFANG+, up 0.97% as Mega Cap Tech continues higher

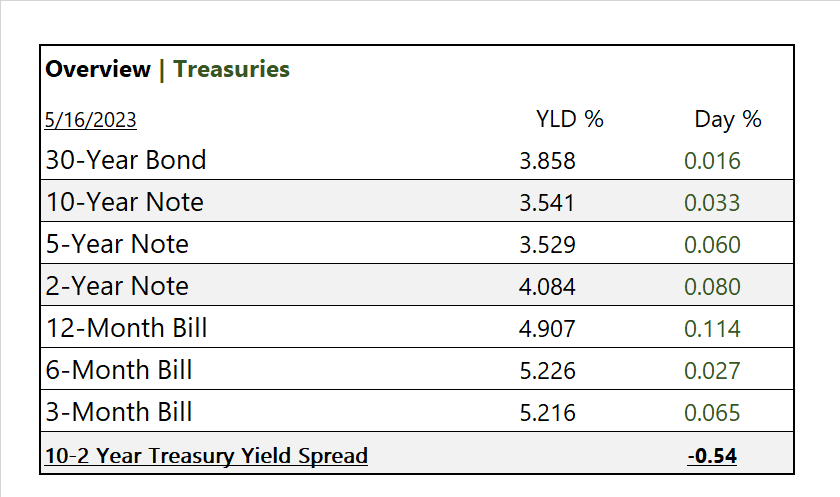

- Yields rise

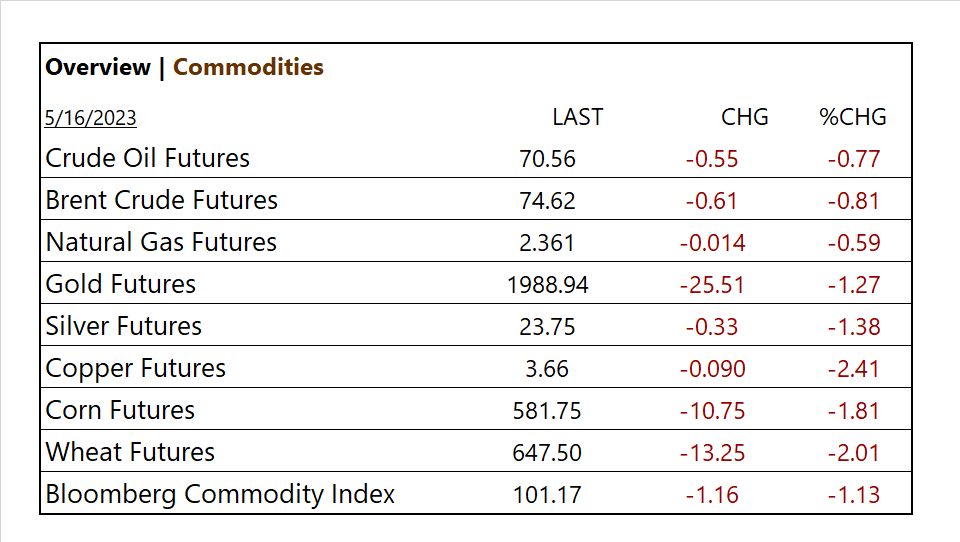

- Energy and Materials mostly pullback on recessionary concerns

- Greed Index shifts from greed to neutral

- CBOE Volatility Index (VIX) +>5%

- Home Depot (HD) misses, Baidu (BIDU) beats on earnings

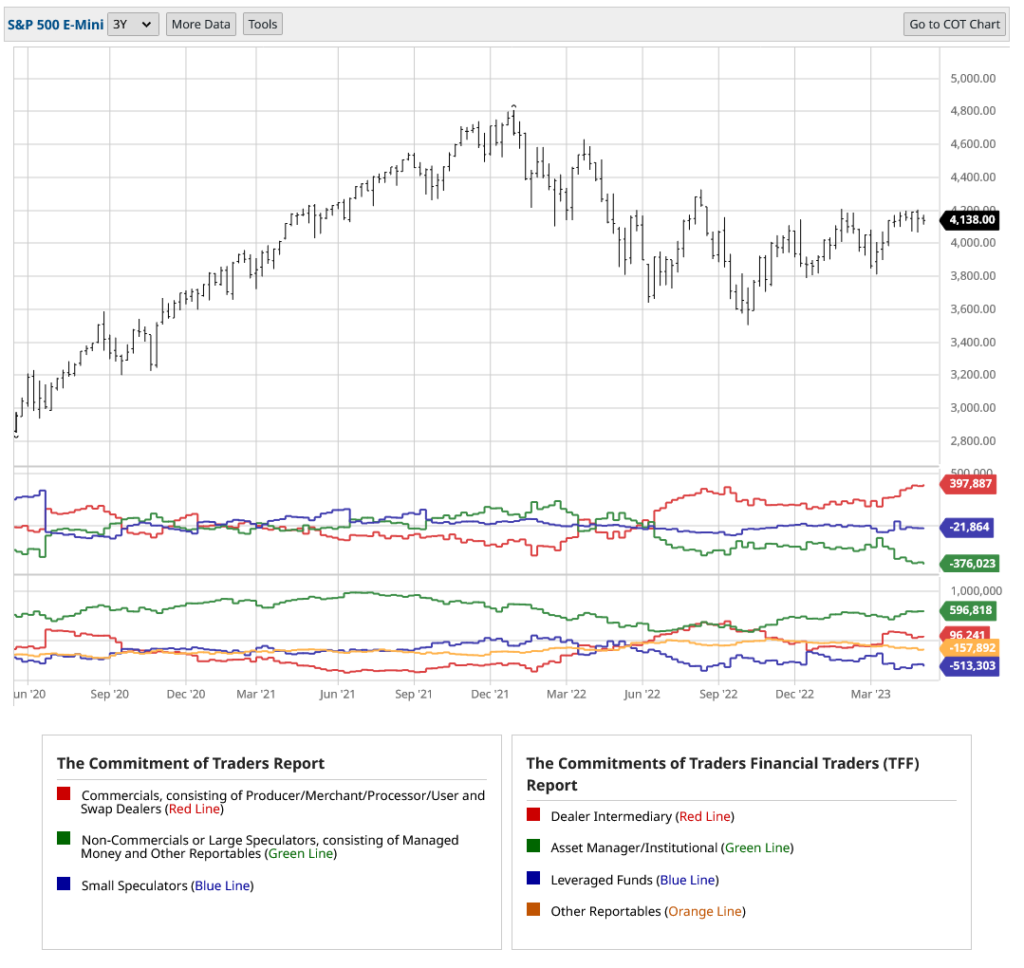

Pro Tip: The Commitment of Traders (COT) reports show futures traders’ positions and it’s a strong indicator for analyzing market sentiment. Traders are grouped into categories and their holdings are aggregated. There are 3 categories: Commercial Traders, Non-Commercial Traders (large speculators) and Nonreportable (small speculators).

Sectors/ Commodities/ Treasuries

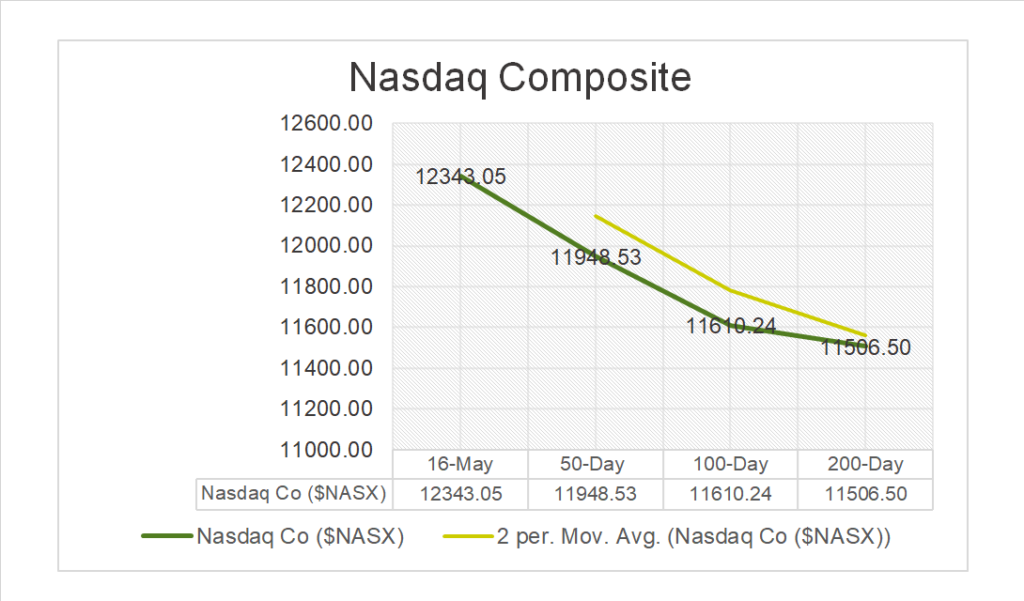

Key Indexes (50d, 100d, 200d)

S&P Sectors

- 10 of 11 of the S&P 500 sectors finished lower: Real Estate -2.30% and Energy -2.24% underperform/ Information Technology +0.09% outperforms

Commodities

Factors (YTD)

US Treasuries

Notable Earnings Today

- +Beat: Baidu (BIDU), iQIYI (IQ), Miniso (MNSO), Keysight Technologies (KEYS), Tencent Music Entertainment Group (TME), Nu Holdings (NU),

- – Miss: Home Depot (HD), Sea (SE),Tencent Music Entertainment Group (TME)

- * Strong support – NVIDIA (NVDA), Analog Devices (ADI), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), Baidu (BIDU), Nu Holdings (NU)

Economic Data

US

- US. retail sales; period April, act 0.4%, fc 0.8%, prev. -0.7%

- Retail sales minus autos; period April, act 0.4%, fc 0.4%, prev. -0.5%

- Industrial production; period April, act 0.5%, fc 4%. prev. 0.4%

- Capacity utilization; period April, act 79.7%, fc 79.7%, prev. 79.4%

- Business inventories; period March, act -0.1%, fc 0.1%, prev. 2%

- Home builder confidence index; period May, act 50, fc 45, prev. 45

News

Company News/ Other

- FTC Poised to Block Amgen’s $27.8 Billion Deal for Horizon Therapeutics – WSJ

- Home Depot Projects First Annual Sales Decline Since 2009 – WSJ

- Capital One shares up after billionaire investor Buffett’s near $1 bln bet on bank – Reuters

- Investors Most Pessimistic So Far This Year, BofA Survey Shows – Bloomberg

Central Banks/Inflation/Labor Market

- US retail sales increase moderately; core sales strong – Reuters

- Fed’s Barkin Says He’s Willing to Raise Interest Rates Again If Needed – Bloomberg

- Production at US Manufacturers Rebounds After March Slump – Bloomberg

China