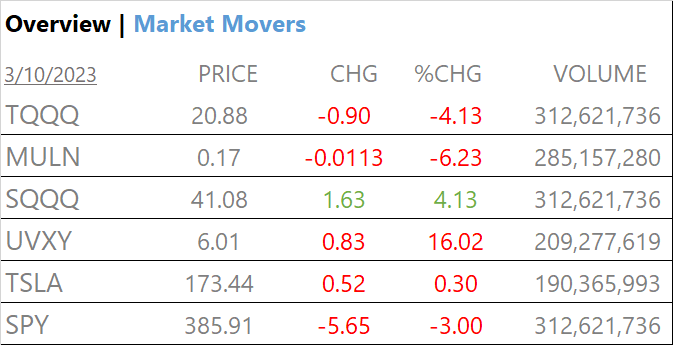

MARKETS TODAY March 10 (Vica Partners)

Overview

A ‘good Friday to all,

Yesterday Founders Fund, tech billionaire Peter Thiel, advised companies to withdraw holdings from SVB Financial (SIVB) due to concerns about financial stability. By early afternoon the news sent major indices lower by >2% and exposing a systemic Financial Sector issue as a result of higher interest rates.

Overnight the S&P futures were down about 1% but turned positive following Friday mornings employment report however SVB stock fell by as much as 69% premarket and trading was shortly halted.

Favorable economic data out this morning showed that headline nonfarm payrolls came in high 311k (vs.215k), the unemployment rate rose from 3.4 to 3.6% and hourly earnings were below, act 0.2%mm/ 4.6% y/y, forecast of 0.4%/ 4.7%. As an aside note the US federal government’s budget deficit widened in February by $262 billion.

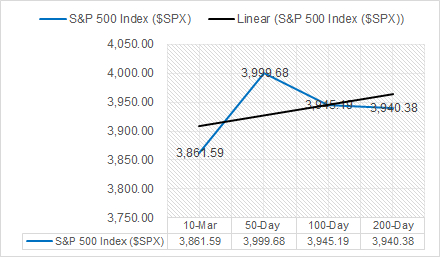

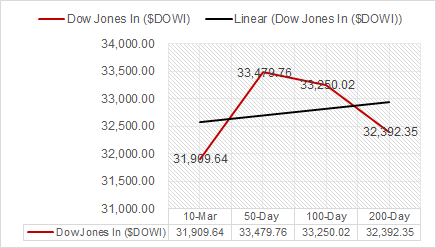

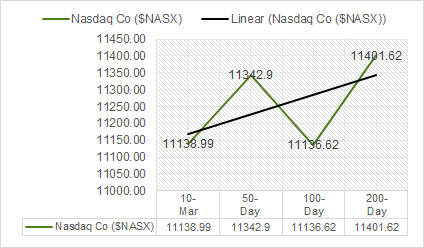

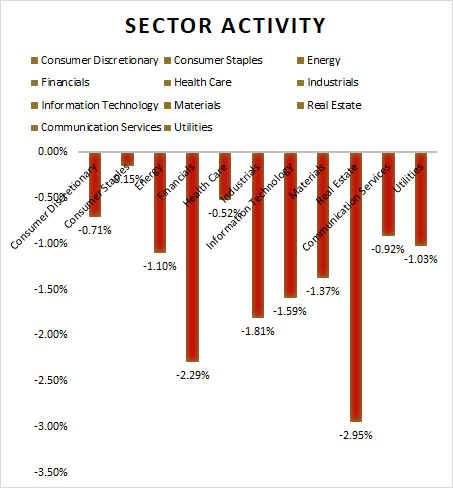

By midday SVB became the first FDIC-insured financial institution to fail this year. At market close, Key Indexes all declined sharply, DOW dropped 345 points. All 11 S&P Sectors lower: Defensive Sectors, Consumer Staples and Healthcare outperformed.

Key Takeaways

- SVB became the first FDIC-insured financial institution to fail this year

- Headline payrolls high, unemployment up, hourly earnings decline “Perfect”

- Indexes fell sharply for 2nd consecutive day, DOW drops 900p since Thursday

- All 11 S&P Sectors lower: Defensive Sectors, Consumer Staples and Health Care outperform

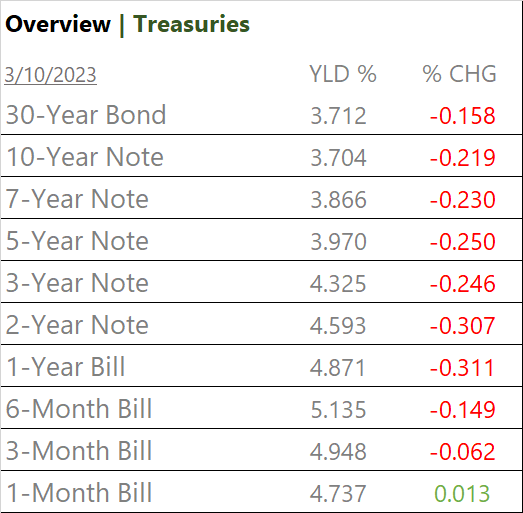

- Yields decline, except 1 Month

- Fear & Greed index rating, Extreme Fear

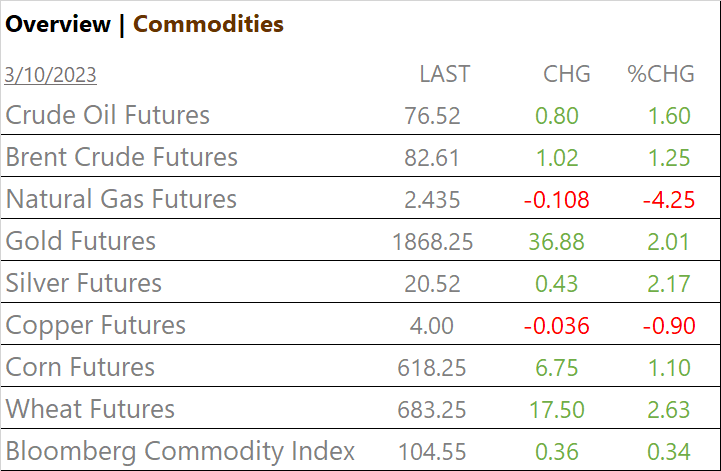

- Bloomberg Commodity Index, +up

- Crude Oil Futures, +up, Gold, +up

- Bitcoin, – down

- USD Index, -down

My last word. Keep in mind that Yellen will be guiding Fed on looming Bank liquidity failures while insisting on rate hike restraints

Sectors/ Commodities/ Treasuries

Key Indexes (50d, 100d, 200d)

S&P Sectors

- All 11 S&P Sectors lower: Defensive Sectors, Consumer Staples -0.15% and Health Care -0.52% outperform/ Real Estate – 2.95% and Financials -2.29% underperform.

Commodities

US Treasuries

Economic Data

US

- Employment report; period Feb., act 311,000, fc 225,000, prev. 504,000

- U.S. unemployment rate; period Feb., act 3.6%, fc 3.4%, prev. 3.4%

- Average hourly wages; period Feb., act 0.2%, fc 0.4%, prev. 0.3%

- Average hourly wages (yy), period Feb., act 4.6%, fc 4.8%, prev. 4.4%

- Federal budget; period Feb., act -$262B, fc -$265.5B, prev. -$217B

News

Company News

- SVB Races to Prevent Bank Run as Funds Advise Pulling Cash – Bloomberg

- Silicon Valley Bank shut by California regulator – Reuters

- First Republic, Western Alliance seek to calm contagion worries from SVB meltdown – Reuters

Central Banks/Inflation/Labor Market

- Singapore’s Central Bank Boosted Gold Reserves 30% in January – Bloomberg

- Fed Chair Powell Provides Update on US Central Bank Digital Currency – Bitcoin,com

Energy

- Biden’s clean energy czar Podesta says Chinese companies will be ‘big players’ in future US energy production – Foxnews

China

- Chinese city Xi’an draws backlash with flu lockdown proposal – BBC

Market Outlook and updates posted at vicapartners.com