MARKETS TODAY March 15th, 2023 (Vica Partners)

A good Wednesday to all!

Yesterday the US Market moved higher, boosted by Nasdaq >2% and recovery financial sector +1.5% rally.

Overnight in Asia, S&P futures were trading higher but turned negative as Europe opened. Renewed banking sector worries i.e. Credit Suisse, sent European Indices down.

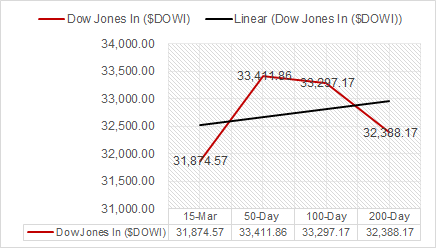

US Indices opening negative following Europe. US economic pricing data out this morning was positive with headline and core PPI in-line or better than estimates. However, retail sales declined February following a strong Jan and March Empire State Manufacturing Index dropped more than expected. US crude oil inventories rose but gasoline and heating reserves declined, the most since the end of 2022.

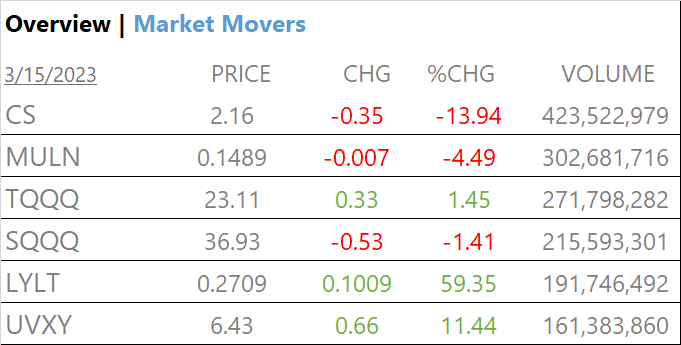

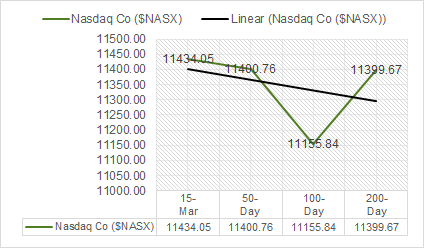

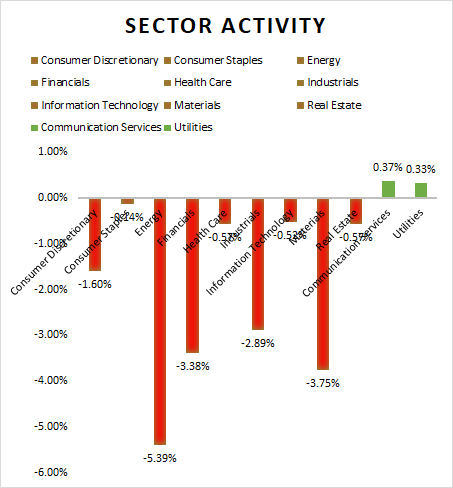

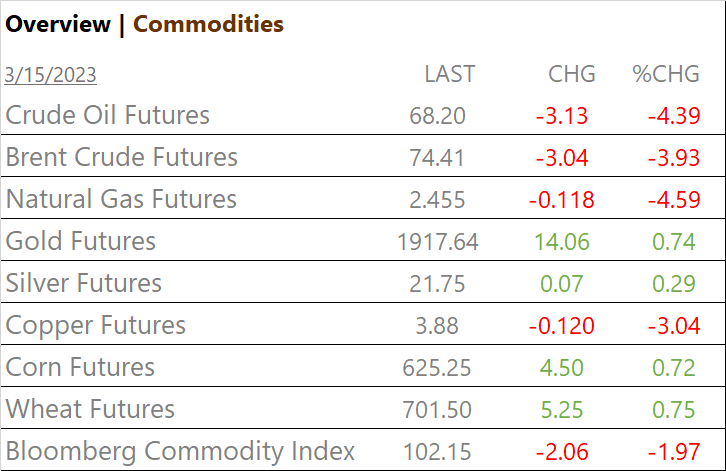

Major Indices closed mixed, the Nasdaq +0.05% and NYSE FANG+1.22% led. 9 of 11 of the S&P 500 sectors ended lower, Communication Services and Utilities outperformed/ Energy, Materials and Financials underperformed. Yields were lower while the USD Index was up. Crude Oil futures down >4% on Banking fears. Credit Suisse was top most active in market trading volume finishing down, 13.9%.

Takeaways

- Credit Suisse renews global market banking concerns

- PPI’s in-line or better than estimates

- Indexes finished mixed, Nasdaq and NYSE FANG lead

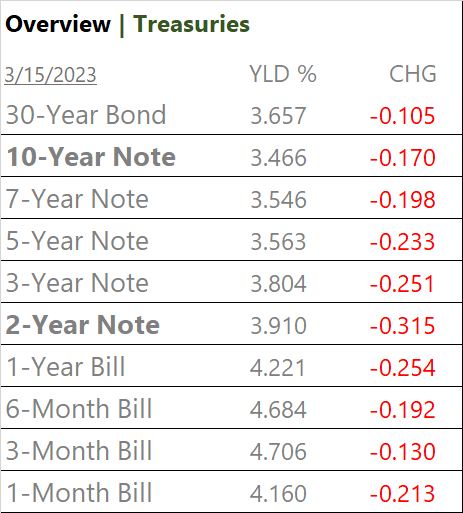

- Yields decline

- 9 of 11 of the S&P 500 sectors were lower, Communication Services and Utilities outperformed

- Energy and Material sectors fell sharply on global banking concerns

- Fear & Greed index rating = Extreme Fear

- Bloomberg Commodity Index down >2%

- Crude Oil Futures down, >4%

- USD Index, up

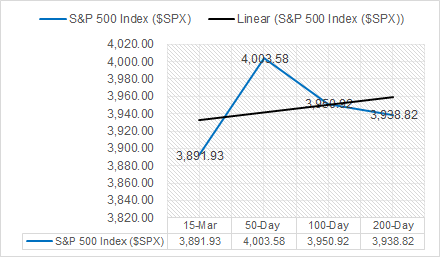

Last word, it appears that Investors are flocking to Tech this week for safety from the Banking contagion, reflected in the fact that the Nasdaq is up over its 50d, 100d and 200d moving averages. Defensive sectors Consumer Staples, Utilities and Health Care should also see growth into next Quarter.

Sectors/ Commodities/ Treasuries

Key Indexes (50d, 100d, 200d)

S&P Sectors

- 9 of 11 S&P 500 Sectors lower, Energy -5.39%, Materials -3.75% underperform/ Communication Services +0.37% and Utilities +0.33%, outperform.

Commodities

US Treasuries

Economic Data

US

- Mortgage apps; period March, act 6.5%, prev. 6.9%,

- Retail sales; period Feb., act -0.4%, fc -0.4%, prev. 3.2%

- Retail sales ex autos; period Feb., act -0.1%, fc 0.0%, prev. 2.4%

- Producer price index; period Feb.; act -0.1%, fc 0.3%, prev. 0.3%

- Core PPI; period Feb., act 0.2%, fc 0.4%, prev. 0.5%

- PPI (year over year); period Feb., act 4.6%, fc 5.4%, prev. 5.7%

- Core PPI (year over year); period Feb., act 4.4%, fc -, prev. 4.4%

- Empire State manufacturing; period March, act -24.6, fc -7.8, prev. -5.8

- Mortgage apps; period March, act 6.5%, prev. 6.9%,

- US crude oil inventories; period March, act +1.55m barrels, fc 1.18m

Summary – Producer price increases slowed to an annual pace of 4.6% last month, down from 6% in January, while prices declined by 0.1% after rising 0.7% in January. Retail sales declined 0.4% in February following a strong Jan. 0.1%. Mortgage apps +7% for the week, down 38% for comp week LY. US crude oil inventories rose by 1.6m barrels in March beatings expectations however gasoline and heating oil stocks declined the most since the end of 2022.

Tomorrow; Initial Job Claims, Import Price Index, Housing Starts/ Permits, Philadelphia Fed manufacturing

News

Company News

- Swiss Government Holds Talks on Options to Stabilize Credit Suisse – Bloomberg

- Tech stocks emerge as haven in sell-off fueled by bank worries – Reuters

Central Banks/Inflation/Labor Market

- U.S. banking behemoths attract flood of deposits after SVB collapse –sources – Reuters

- Fed to Consider Tougher Rules for Midsize Banks After SVB, Signature Failures – WSJ

- Failed Bank List FDIC – FDIC

Energy

- Oil slumps $5/bbl to lowest in more than a year as banking fears mount Reuters

- Weekly Petroleum Status Report – eia.gov pdf

China

- China, Russia, Iran conduct four-day naval exercises in Gulf of Oman – Reuters

- U.S. officials project calm as China stuns world with Iran-Saudi deal – Politico

Market Outlook and updates posted at vicapartners.com