MARKETS TODAY May 1st, 2023 (Vica Partners)

Last Friday, US Markets finished higher with the 3 major Indices all returning a Weekly gain. The Nasdaq was up 1.3% over the past 5 days as Big Tech reported solid Q1 earnings while the S&P 500 was up 3% in the final two days with Exxon and Chevron reporting earning beats. The Volatility Index dropped to >16, an 18 month low. In economic news, Core PCE was in-line with analyst’s estimates.

Overnight, Asian and European markets mostly closed, Japan’s Nikkei 225 +0.92%. S&P 500 US futures were trading unchanged

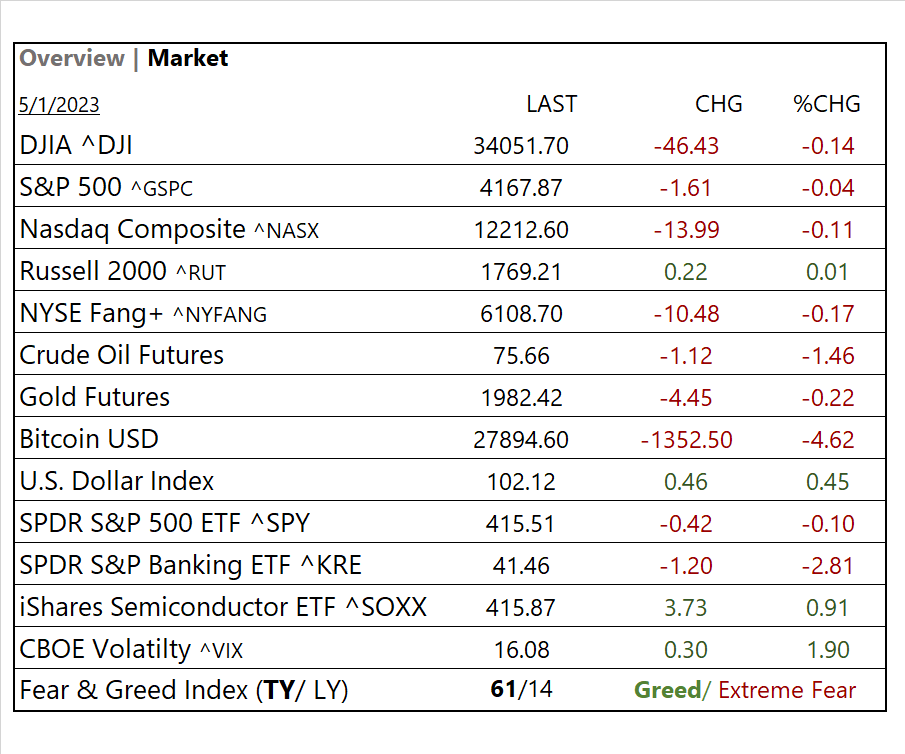

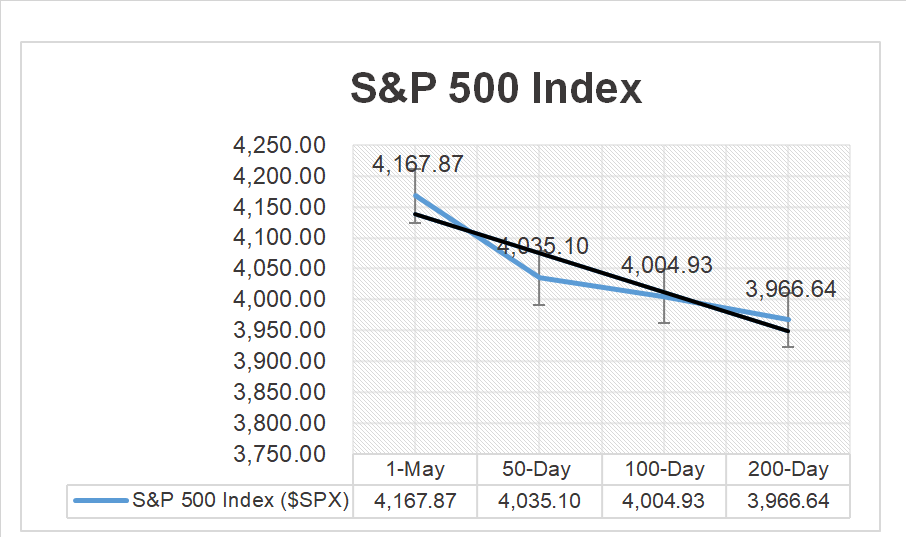

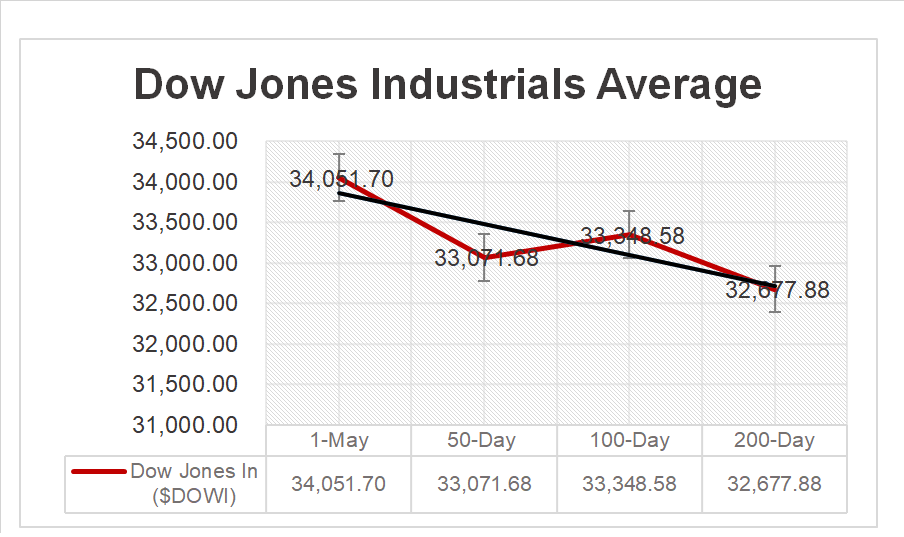

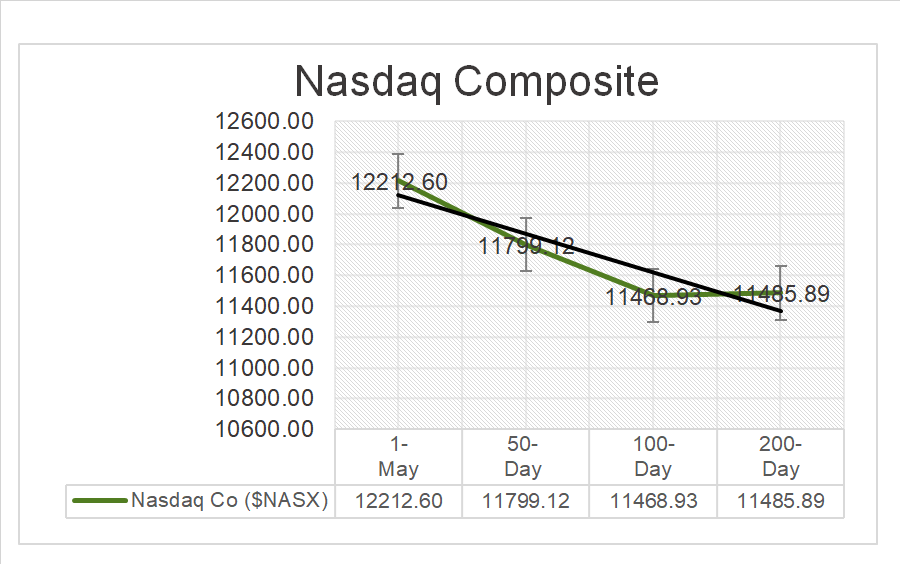

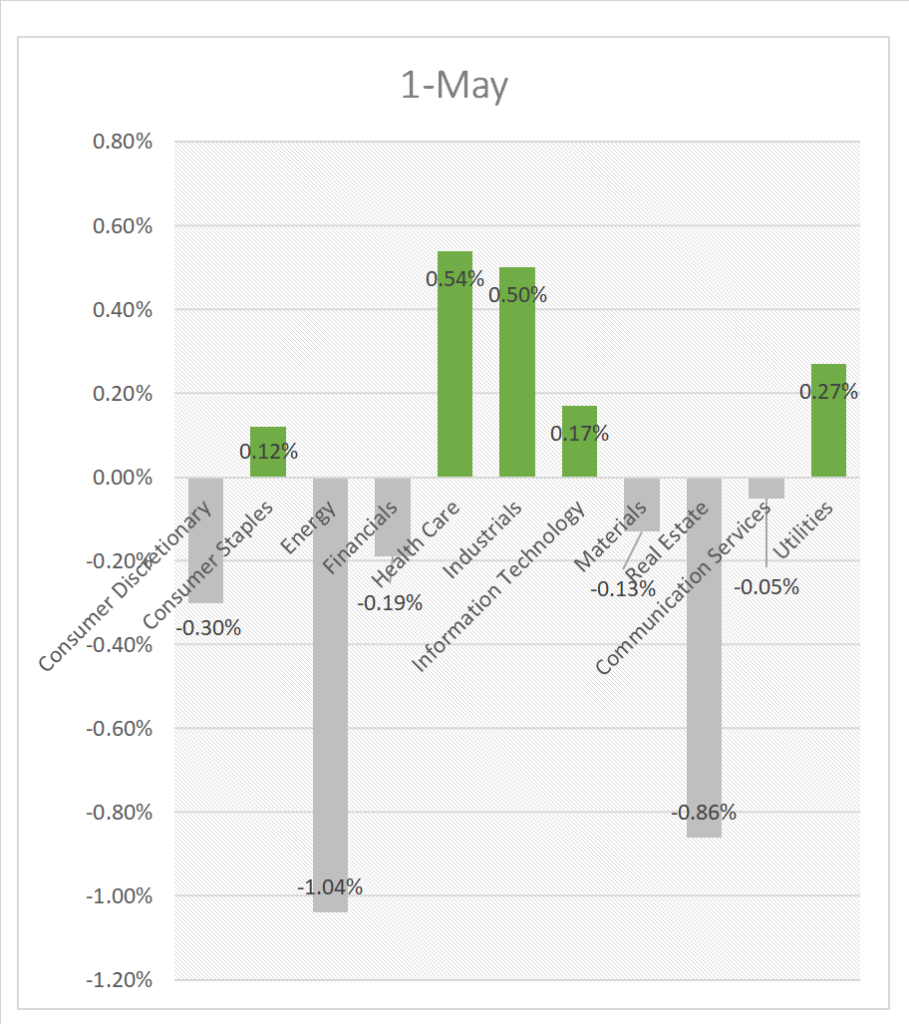

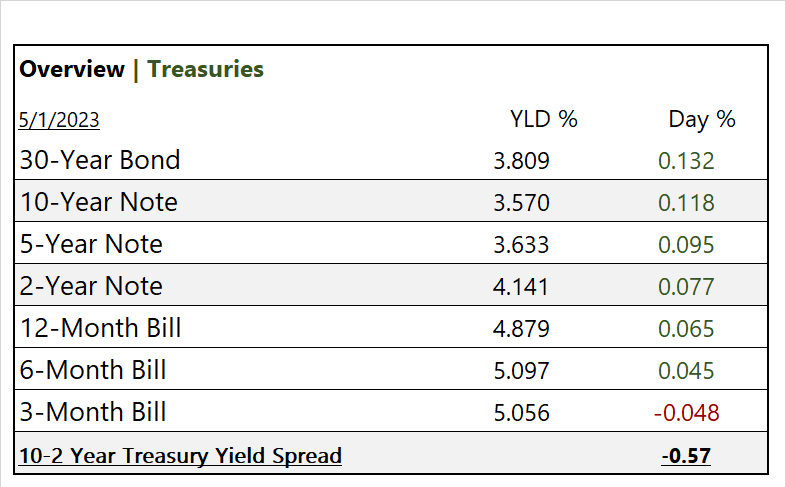

Today, US Markets finished lower S&P 500 -0.14%, DOW -0.14%, Nasdaq -0.11%. 6 of 11 of the S&P 500 sectors finished lower on the day, Energy -1.04% and Real Estate -0.86% led decliners On the upside, the Healthcare sector outperformed, Semiconductor ETF (SOXX)+0.91% / ON Semiconductor (ON) earnings beat, Yields rose across the curve. In economic news, S&P 500 Global Manufacturing PMI increased (MOM) and the ISM Manufacturing PMI improved beating analyst consensus.

Takeaways

- Global markets closed for holiday

- Indices pause as regulators seize First Republic Bank

- Regional Banking down, SPDR S&P Banking ETF (KRE) -2.81%

- Defensives/ Healthcare outperforms

- ON Semiconductor (ON) earnings beat

- ISM Manufacturing PMI beat analyst consensus

- Fed’s expected to take 25bps hike on Wednesday

Pro Tip: A double top is a bearish technical reversal pattern that forms after an asset reaches a high price two consecutive times with a moderate decline between the two highs. Often, an asset’s price will experience a peak, before retracing back to a level of support. It usually climbs before reversing back and regressing to mean average (learn more here).

Sectors/ Commodities/ Treasuries

Key Indexes (50d, 100d, 200d)

S&P Sectors

- 6 of 11 of the S&P 500 sectors finish lower, Energy -1.04% and Real Estate -0.86% led decliners/ Health Care +0.53% outperformed

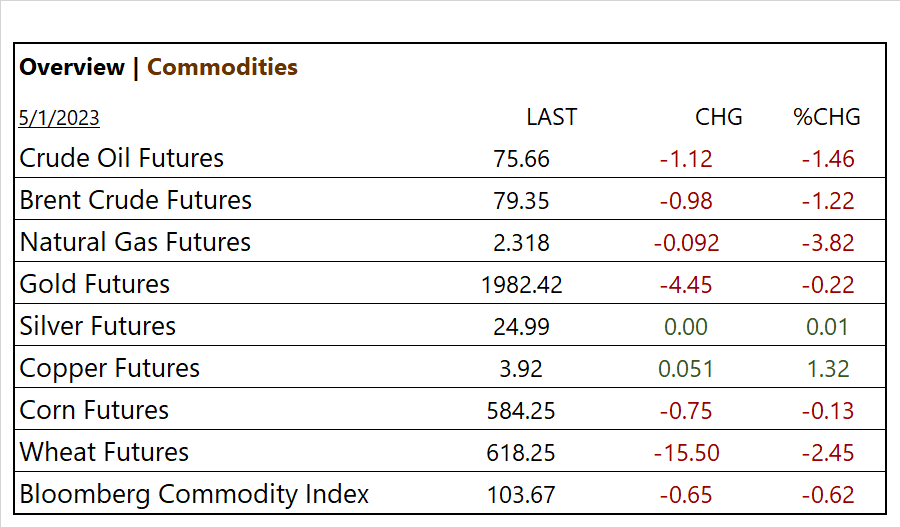

Commodities

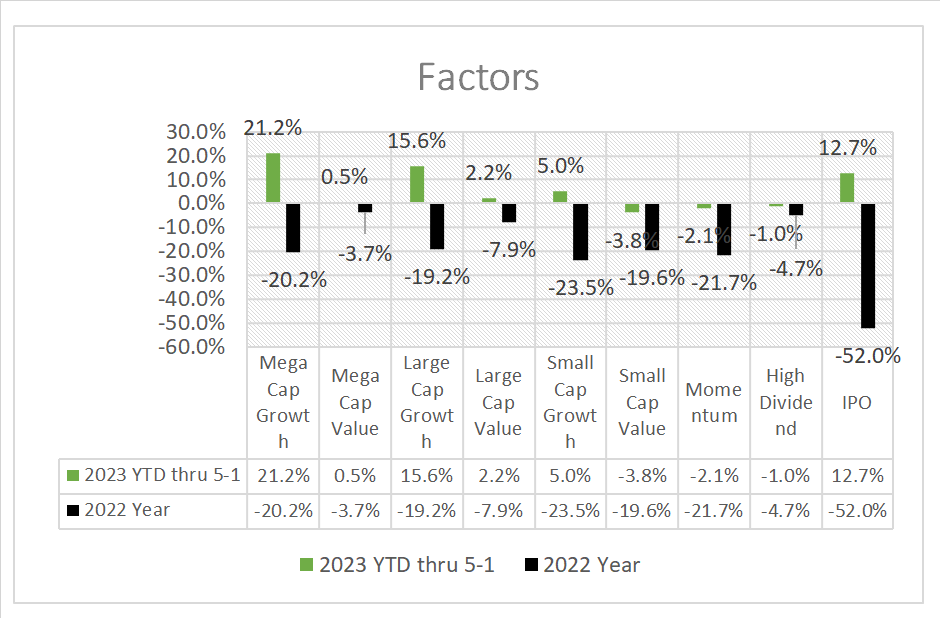

Factors (YTD)

US Treasuries

Notable Earnings Today

- +Beat: Stryker (SYK), Vertex (VRTX), Arista Networks (ANET), NXP (NXPI), ON Semiconductor (ON), Global Payments (GPN), WEC Energy (WEC), Global Payments (GPN), Hologic (HOLX), MGM (MGM), Norwegian Cruise Line (NCLH)

- – Miss: VICI Properties (VICI), Diamondback (FANG), Everest (RE), CNA Financial (CNA), Credit Acceptance (CACC), Sonoco Products (SON), Amkor (AMKR)

- * Strong support – NVIDIA (NVDA), Analog Devices (ADI), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Broadcom (AVGO), Citigroup (C), BlackRock (BLK), Morgan Stanley (MS), Coca-Cola (KO)

Economic Data

US

- S&P U.S. manufacturing PMI; period April, act 50.2, fc 50.4. prev. 49.2

- ISM manufacturing; period April, act 47.1, fc 46.7%, prev. 46.3%

- Construction spending; period March, act 0.3%, fc 0.0%, prev. -0.3%

News

Company News/ Other

- Explainer: Why First Republic Bank failed and what JPMorgan’s deal means – Reuters

- Meta to raise $8.5 billion in second bond offering – Reuters

Central Banks/Inflation/Labor Market

- Fed Restrictions on Employee Stock Trading Not Strict Enough, Says Watchdog – WSJ

- The Building Boom Is Prolonging Market Pain – WSJ

China

- Why Chinese Banks Aren’t Worried About Depositors Fleeing – Bloomberg