By Matthew Krumholz | VICA Partners

The Core Error

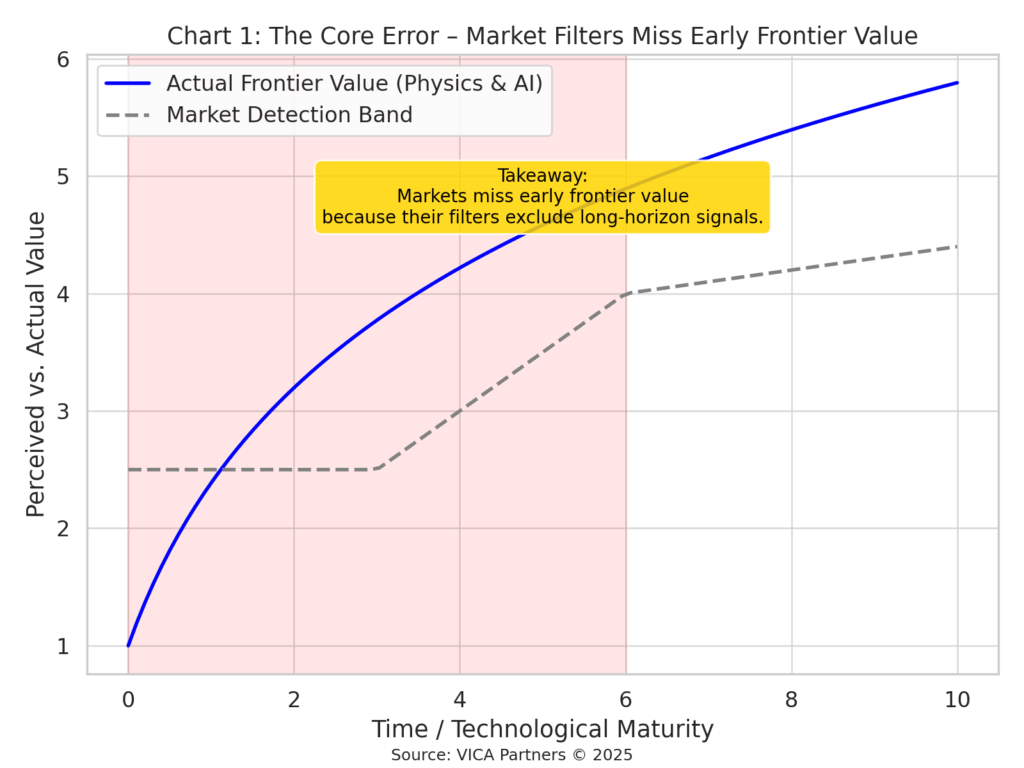

Markets, even at their most sophisticated, remain anchored in what is familiar and backtestable. High-net-worth allocators and institutional funds alike prize clarity over possibility. Capital follows confidence intervals, not catalytic change.

Markets allocate capital based on visible, historical, and quantifiable signals. Financial models optimize for near-term certainty. What cannot be benchmarked is often ignored.

Chart: The Core Error – Market Filters Miss Early Frontier Value

What’s Being Missed

To markets, breakthroughs in physics and AI-native science look like friction — not momentum. These systems defy categorization. They show no clean comps, no short-term yield. But they reshape the frontier.

Breakthroughs in physics and AI-native science produce unfamiliar, delayed signals. These technologies begin with high friction, but yield compounding returns — misread as risk.

The Consequence

The most consequential technologies of our time are underfunded. Not because they’re unimportant — but because they don’t fit the spreadsheets. For the discerning allocator, this isn’t a risk — it’s a premium-priced entry point.

Markets consistently misprice long-horizon technologies with transformational potential. Not due to malice — but due to cognitive and institutional limits.

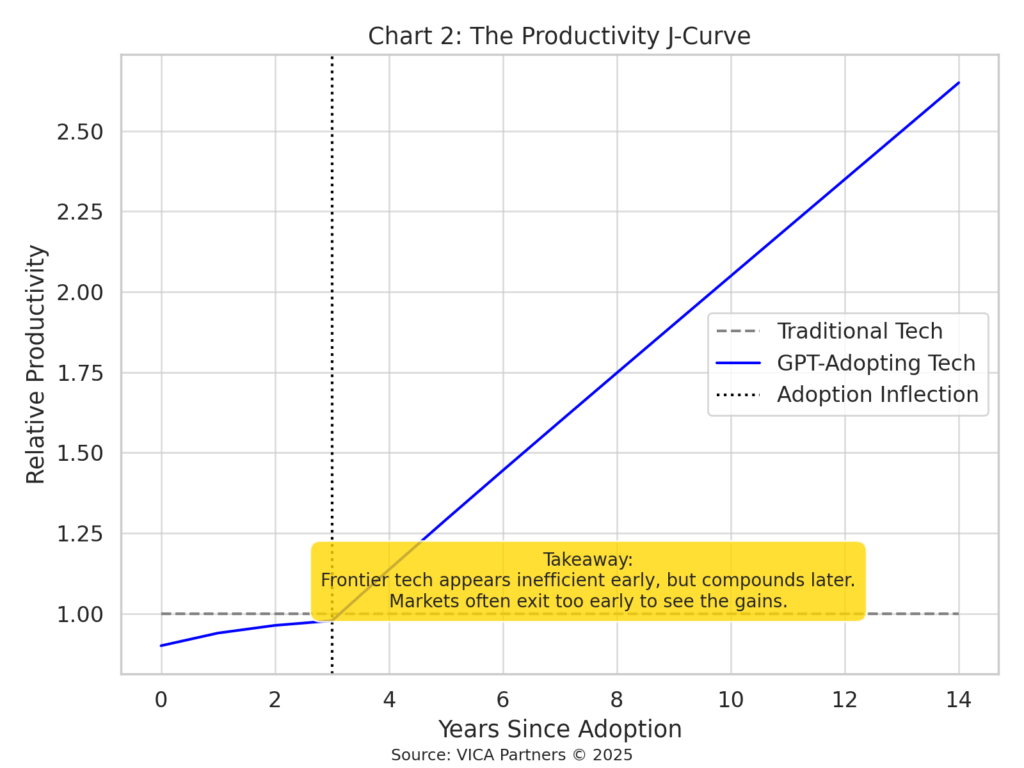

Historical Pattern of Blindness

– Electricity (1870s): Scientifically sound, capital-ignored

– Semiconductors (1950s): Treated as military tools, not economic levers

– Internet (1990s): Valued for novelty, not infrastructure

– Deep Learning (2010s): Considered niche until monetizable

Each followed the same arc: Signal → Dismissal → Overcorrection

Chart : The Productivity J-Curve

Why Today’s Markets Still Miss It

Quant systems and capital allocators:

– Filter based on backtestable trends

– Miss fat-tailed, infrequent but seismic outcomes

– Fail to value scientific acceleration or physical constraint-breaking

They read velocity, not trajectory.

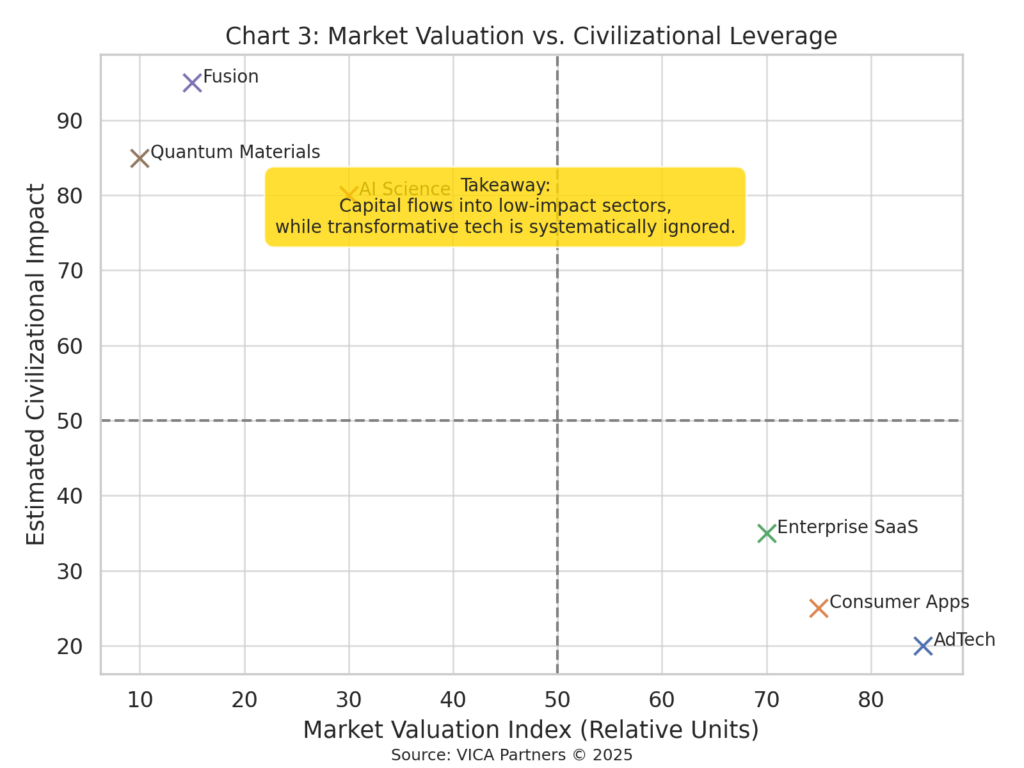

Chart: Market Valuation vs. Civilizational Leverage

Toward a Better Value Lens

True value = Ability to remove physical constraints × Speed of discovery

Physics expands what’s possible.

AI collapses the time to get there.

Together, they form the next great productivity engine. But markets still price adtech.

VMSI: A Framework to Correct the Blindness

VICA’s VMSI model reframes capital movement as a physics system:

– Mass: Capital base density

– Acceleration: Change in conviction

– Force: Momentum of investment

– ƒₜ (Time Friction): How close the payoff must be to justify action

What VMSI Solves Institutionally

Most institutional allocators rely on models that reward liquidity, near-term returns, and backward-tested confidence. These models filter out technologies that show up late, scale nonlinearly, or lack early comps.

VMSI adjusts for this by recognizing when capital should move — not based on volatility or quarterly yield, but on directional force. It reframes delayed payoff as strategic advantage.

And in the future, those who control mass — the sheer volume of deployable assets — will not just influence the market. They will skew it. Large-scale allocators using physics-aligned models like VMSI will shape directional pricing itself.

VMSI Proof Snapshot (As of Aug 1, 2025):

Capital momentum is high, but deployment is filtered by time-value constraints.

That’s why deep technologies with delayed yield — like fusion, quantum, and AI science — remain structurally underfunded.

VMSI identifies this friction early and reroutes allocation.

Final Synthesis for Capital Stewards

If you manage long-duration capital, the opportunity isn’t to react faster — it’s to see farther. Markets will price these technologies eventually. The edge belongs to those who price them now.

Markets are not irrational — they’re constrained by the tools they use. Those constraints are your opportunity.

Physics and AI are not speculative — they’re under-recognized.

VMSI is not theory — it’s a compass for where the real economy is going.

“The future is not priced by confidence intervals. It is built by those who act where physical laws and machine intelligence converge — before the pricing models catch up.”

© 2025 VICA Partners. All rights reserved.