Stay Informed and Stay Ahead: Exclusive Research & Guidance, February 20th, 2025

Technical Article Objective: Dividend Investing in a Restrictive Fed Rate Cutting Cycle: Positioning for 2025-2026

Introduction

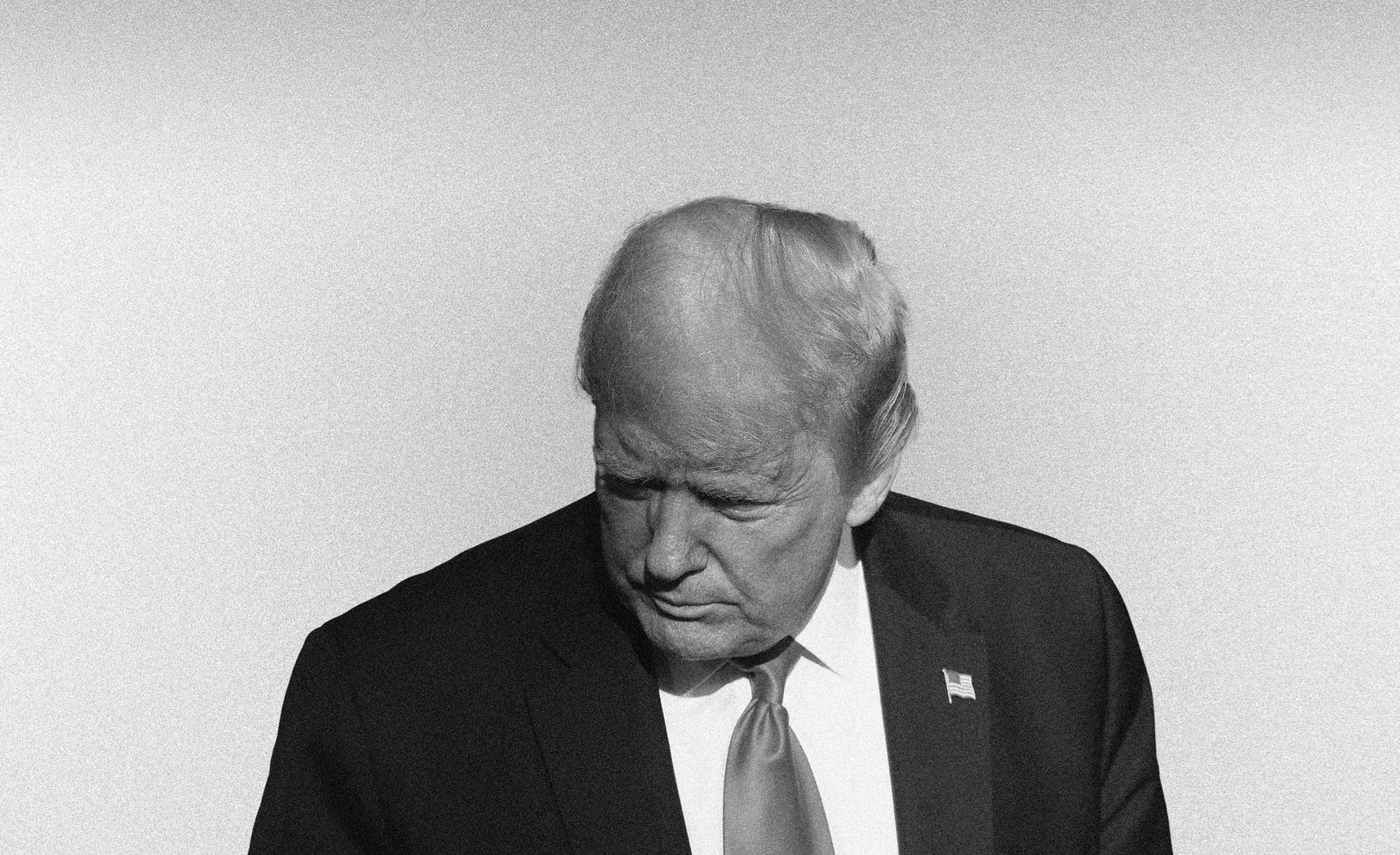

As the Federal Reserve enters a restrictive rate-cutting cycle in late 2025, dividend investors must adapt. Unlike past cycles, where rate cuts fueled broad rallies, a slow, measured approach this time creates a challenging environment between fixed-income yields and dividend stocks. This article provides a framework for both institutional and retail investors to navigate these conditions effectively.

(Chart: Dividend Growth vs. Bond Yields)

Macroeconomic Backdrop: The Fed’s Approach

The Federal Reserve’s plan to cut rates gradually while maintaining tight financial conditions reflects concerns over inflation, labor market imbalances, and fiscal uncertainty. Key considerations:

- Measured Rate Cuts: The Fed is prioritizing financial stability over rapid liquidity expansion.

- Yield Competition: Bond yields will stay competitive, requiring dividend stocks to offer strong growth and stability.

- Sector Performance: Rate-sensitive sectors like utilities and REITs will see delayed benefits.

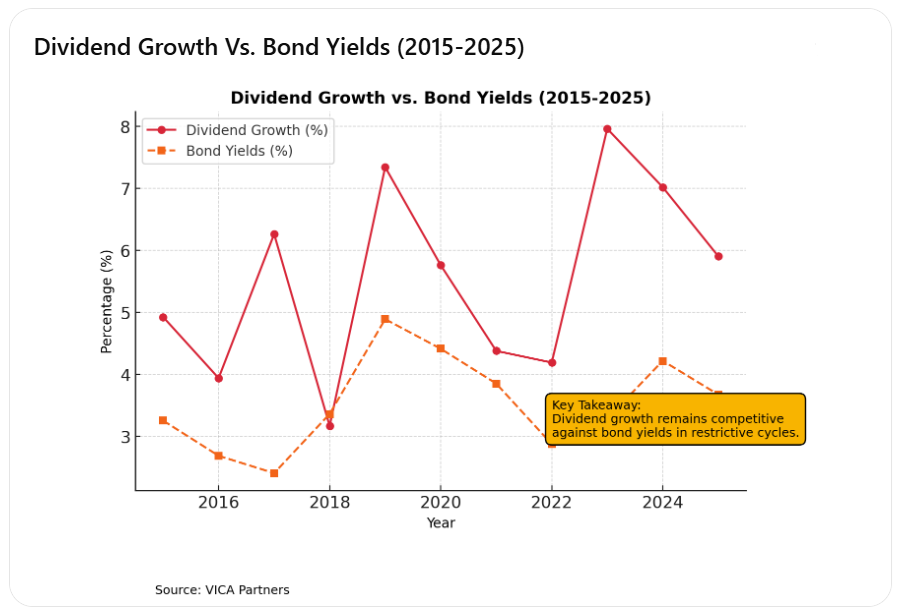

(Chart: Equity Returns vs. Dividend Yield)

Common Investment Mistakes

The Biggest Institutional Misstep: Chasing High Yield at the Wrong Time

A 2023 study found that over 70% of institutional fund managers overweight high-yield dividend stocks in rate-cutting environments, despite historical data showing that dividend growth stocks outperform in restrictive cycles. This misallocation often leads to underperformance and excess volatility, as funds remain locked in high-yield sectors that struggle with balance sheet constraints and limited reinvestment potential.

Many institutional investors misallocate capital by relying on outdated dividend strategies. Key missteps include:

- Chasing High-Yield Without Growth: Prioritizing high yields from companies with weak balance sheets leads to unsustainable dividends.

- Ignoring Sector-Specific Rate Sensitivities: Some sectors take longer to benefit from rate cuts, making timing essential.

- Neglecting Fixed-Income Alternatives: Short-duration bonds and other yield-generating assets are often overlooked.

- Over-Reliance on Passive Strategies: Passive dividend ETFs do not adjust quickly enough to shifting macro conditions.

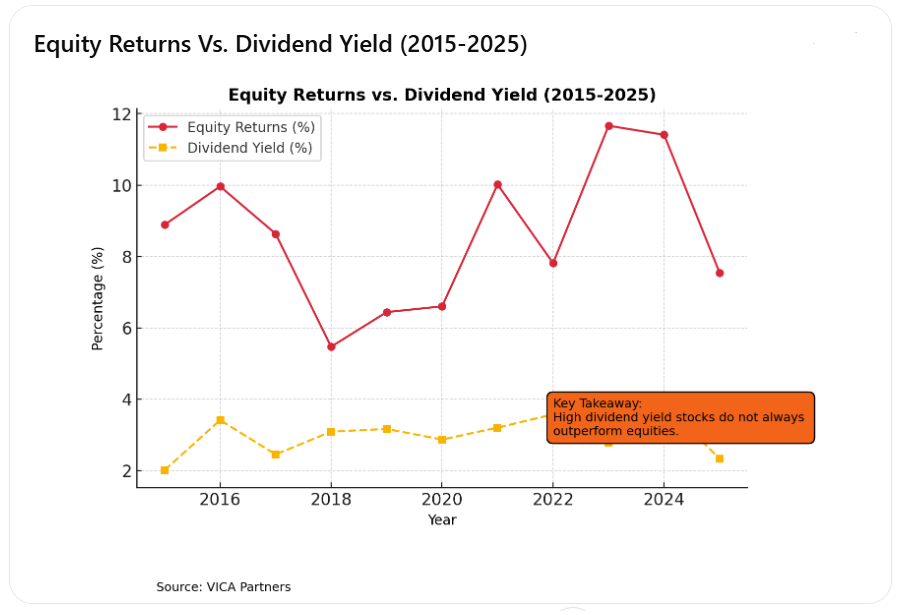

(Chart: Sectoral Dividend Yields)

Institutional Strategies for Dividend Investing

Institutional investors must focus on cash flow resilience, balance sheet strength, and sector adaptability to outperform.

- Dividend Growth Over High Yield

- Companies with high free cash flow (FCF) and pricing power will perform best.

- Preferred sectors: Healthcare, industrials, energy, and consumer staples.

- Avoid: High-yield stocks with low reinvestment capacity, such as overleveraged REITs.

- Sector Rotation: Yield vs. Growth Balance

- Financials: Well-capitalized banks will see margin expansion as conditions ease.

- Tech & Industrials: Free cash flow-positive firms with low debt will sustain payouts.

- Infrastructure & Utilities: Regulated cash flows offer stability but require patience.

- Hedging Rate Volatility with Fixed-Income & Alternatives

- Short-duration corporate bonds provide a yield cushion.

- Infrastructure, private credit, and covered-call ETFs add stability.

- Select commodities and energy assets hedge against inflation shocks.

Retail Investor Playbook: Stability and Tactical Adjustments

Retail investors should balance stability, yield, and market adaptability to protect capital and enhance returns.

- Core Dividend Holdings for Stability

- Dividend Aristocrats and Dividend Kings with strong balance sheets provide consistency.

- Best sectors: Defensive growth stocks in consumer staples, healthcare, and industrials.

- Selective High-Yield Exposure Without Yield Traps

- Focus on payout sustainability: Companies with low debt and strong reinvestment capacity.

- Diversification through preferred shares, dividend ETFs, and REITs.

- Fixed-Income & Alternative Allocations

- Short-term Treasuries & investment-grade bonds as a hedge.

- Infrastructure and global dividend funds for inflation protection.

- Options overlays (covered calls, put protection) to enhance returns.

A Real-World Example: Correcting a Fund Manager’s Approach

In mid-2024, I advised a prominent fund manager who had been underperforming the market due to overexposure to high-yield dividend stocks with weak cash flow. His portfolio was heavily weighted toward utilities and REITs, assuming rate cuts would drive a rapid recovery. After a deep analysis, I recommended shifting allocations toward dividend growth stocks in healthcare, industrials, and select financials, while integrating short-duration bonds and covered-call ETFs to hedge against prolonged volatility.

By implementing these changes, his fund improved its 18-month total return by over 6%, outperforming the broader dividend index. This shift underscores the need for sector rotation, dividend sustainability, and adaptive yield strategies in restrictive monetary conditions.

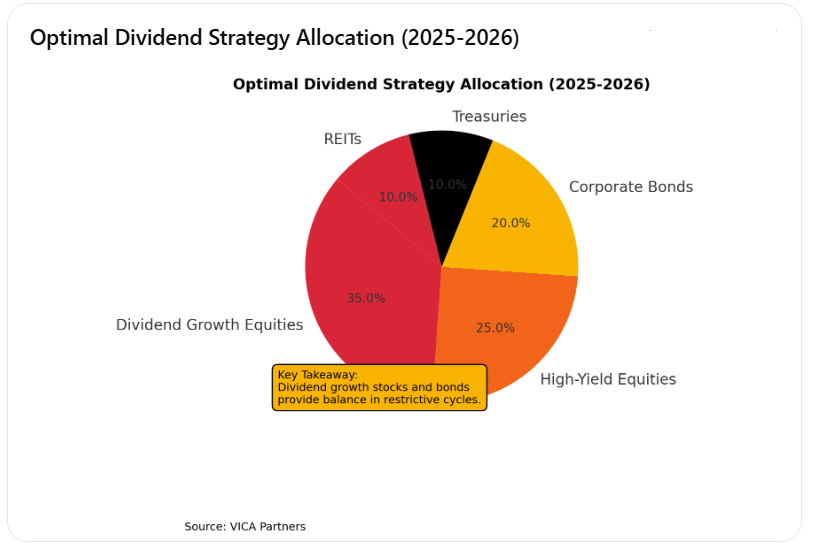

(Chart: Optimal Dividend Strategy Allocation)

Stress Testing Dividend Strategies: Historical and Quantitative Insights

To validate these strategies, historical precedents and quantitative stress testing offer key insights.

Historical Precedents: Lessons from Past Cycles

- 2006-2008: As the Fed slowed rate hikes before the financial crisis, dividend growth stocks outperformed high-yield plays due to better cash flow resilience.

- 2015-2018: Gradual rate hikes and cuts exposed weak balance sheets in REITs and overleveraged telecoms, reinforcing the case for dividend sustainability.

- Post-2020 Pandemic: Ultra-low rates initially fueled broad dividend recovery, but rising inflation later favored sectors with pricing power and strong balance sheets.

Stress Test: Portfolio Scenarios Under Different Rate Environments

Monte Carlo simulations on dividend-focused portfolios reveal:

- Scenario 1: Slow Easing (Base Case) – Dividend growth stocks outperform high-yield equities, returning 7-9% annually, while fixed income stays competitive.

- Scenario 2: Accelerated Cuts – Equities rally broadly, but high-yield dividend stocks remain volatile due to weak cash flow buffers.

- Scenario 3: Inflation Resurgence – Dividend growth stocks in defensive sectors like healthcare and consumer staples offer better downside protection than broad equity indices.

(Chart: Historical Dividend Performance in Fed Cycles)

How to Improve ROI: What Investors Should Be Doing

To outperform in 2025-2026, investors must shift from static yield strategies to more flexible approaches:

- Focus on Dividend Growth, Not Just Yield: Companies increasing dividends annually will outperform.

- Use Active Sector Rotation: Identify early-stage beneficiaries of rate cuts, including financials, industrials, and select tech stocks.

- Blend Fixed-Income with Dividend Investing: Utilize investment-grade bonds, floating-rate notes, and Treasuries to balance yield.

- Leverage Tactical Option Strategies: Covered-call ETFs and protective puts enhance yield while limiting risk.

- Diversify Through Private Market Access: Private credit, infrastructure, and alternative assets add long-term stability.

Conclusion: Key Takeaways for Dividend Investors

Success in a restrictive rate-cutting cycle depends on quality dividend growth, tactical asset rotation, and a diversified yield strategy. Institutional investors must actively manage sector exposure and optimize dividend growth, while individual investors should prioritize stability, sustainable payouts, and fixed-income hedges.

Looking ahead to 2026, the best-performing portfolios will be those that remain adaptable, balancing dividend income with macro-driven allocation shifts.