By VICA Partners | June 2025

Every few years, financial headlines rediscover U.S. government debt. The tone is always urgent. Yields are rising. Debt-to-GDP is unsustainable. The dollar is at risk. And yet, if you look at how long-term capital — Buffett, pensions, family offices — is actually behaving, the message is clear:

This isn’t panic. This is positioning.

As investors, we don’t need to react to noise. We need to understand the signal underneath it. And the signal right now is flashing green — for opportunity, discipline, and durable yield.

The Headlines vs. the Reality

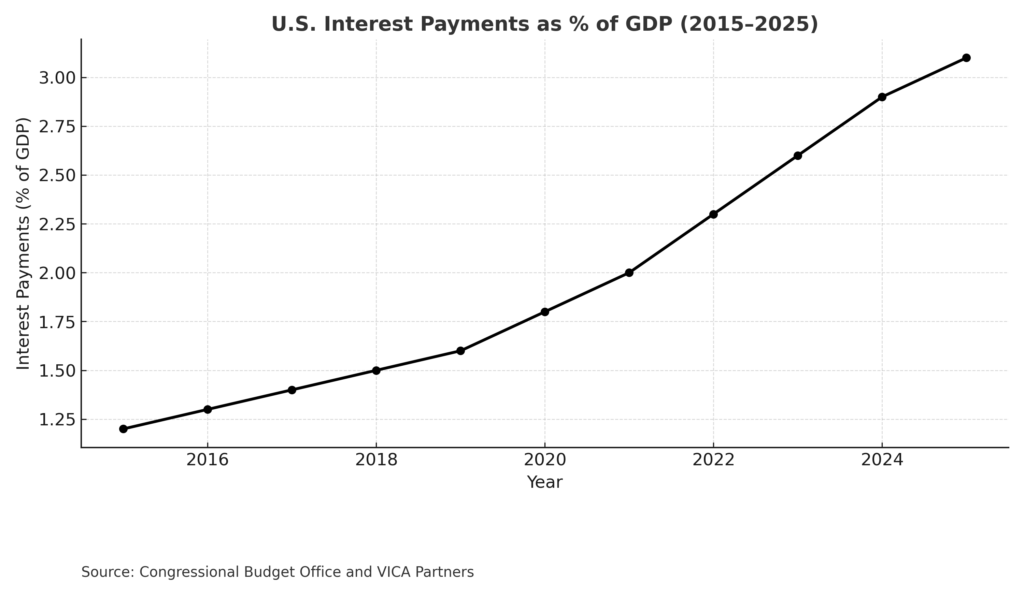

The U.S. is running larger deficits. Treasury is issuing more bonds. Interest costs are rising.

That’s true. But it’s not new.

- We’ve seen versions of this story in 1987 (bond vigilantes), 2011 (debt ceiling), and again today.

- Every time, markets adapt. Long-term capital compounds.

Debt headlines are cyclical. Wealth-building is structural.

What Smart Capital Is Actually Doing

- Buffett Isn’t Selling Treasurys — He’s Buying Them

Berkshire Hathaway holds over $150B in short-term T-bills. This isn’t about fear. It’s about optionality: 5% risk-free yield while waiting for dislocations.

- Institutions Are Rebalancing, Not Retreating

Pensions and endowments are extending duration and re-allocating toward fixed income. For the first time in a decade, core bonds are competitive.

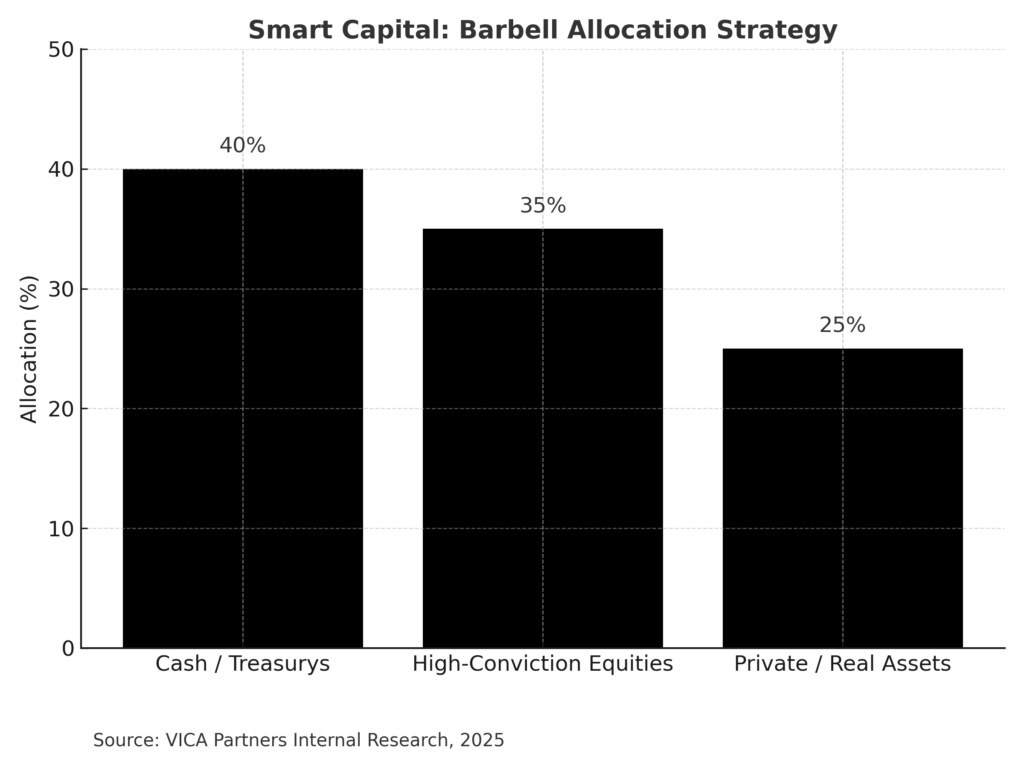

- Family Offices Are Barbell-Positioned

Yield on one end. High-conviction equities and real assets on the other. Cash is no longer sidelined — it’s strategic.

This chart shows how institutional and high-net-worth investors are applying a barbell strategy—anchoring portfolios with yield while maintaining growth exposure.

Valuation Meets Opportunity

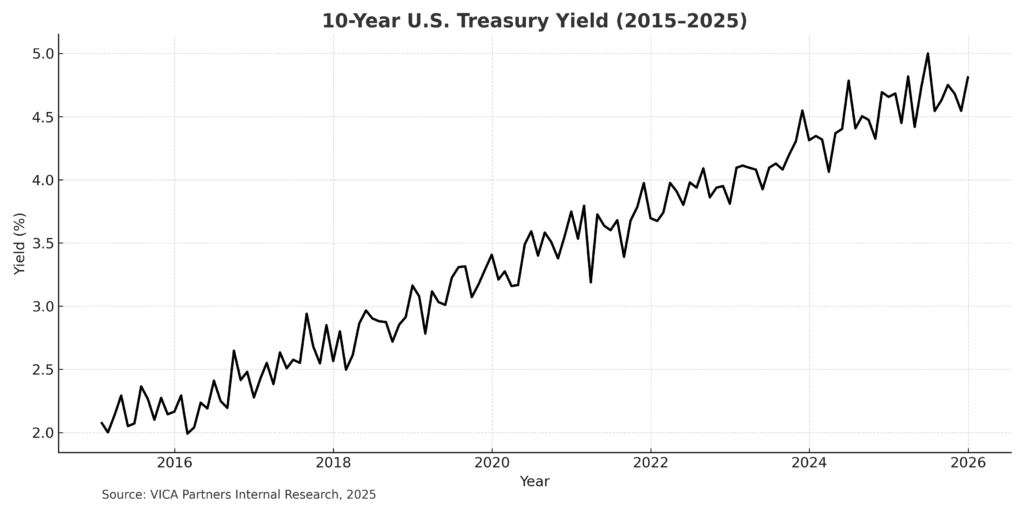

- 10-year Treasury yields above 4.5% offer real returns.

- Equity valuations have reset — multiples are more attractive.

- Corporate credit is pricing in discipline, not dysfunction.

This is a healthy repricing, not a breakdown.

Media Noise Is a Cyclical Phenomenon

Every cycle needs a villain. In the 1980s, it was inflation. In the 2010s, it was central banks. Today, it’s debt.

- These narratives drive news cycles, not portfolio results.

- Institutional capital understands that risk premiums are adapting — not exploding.

- The dollar remains resilient. Treasury markets remain liquid. The U.S. still leads global flows.

This chart puts the rising interest cost into long-term perspective, showing it as a manageable share of GDP that supports rather than undermines market structure.

VICA Partners View: This Isn’t a Warning. It’s a Window.

We believe this moment should be met with clarity, not caution.

- Yield is back — use it.

- Volatility creates selectivity.

- Market structure remains intact.

- It’s time to reposition, not retreat.

Buffett doesn’t trade headlines. Neither should you.

Now is the time to position for the next decade, not the next headline.

Source: VICA Partners Internal Research, 2025